Autonomous Freight & Logistics Market Overview

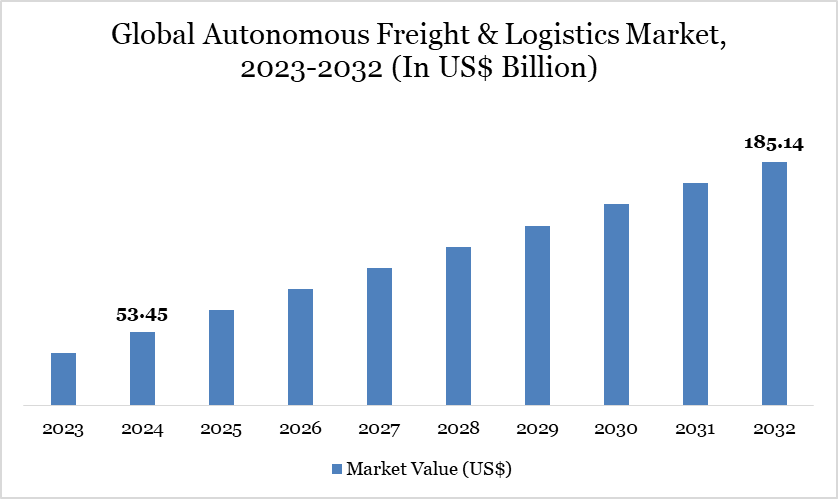

Global Autonomous Freight & Logistics Market reached US$ 53.45 billion in 2024 and is expected to reach US$ 185.14 billion by 2032, growing with a CAGR of 16.80% during the forecast period 2025-2032.

Autonomous trucks, utilizing AI, LiDAR, radar, and sensor fusion technologies, signify a transformative advancement in freight transportation through the facilitation of self-driving commercial vehicles. These vehicles automate intricate activities, including long-haul deliveries and yard operations, with the objective of enhancing safety, operational efficiency, and cost-effectiveness.

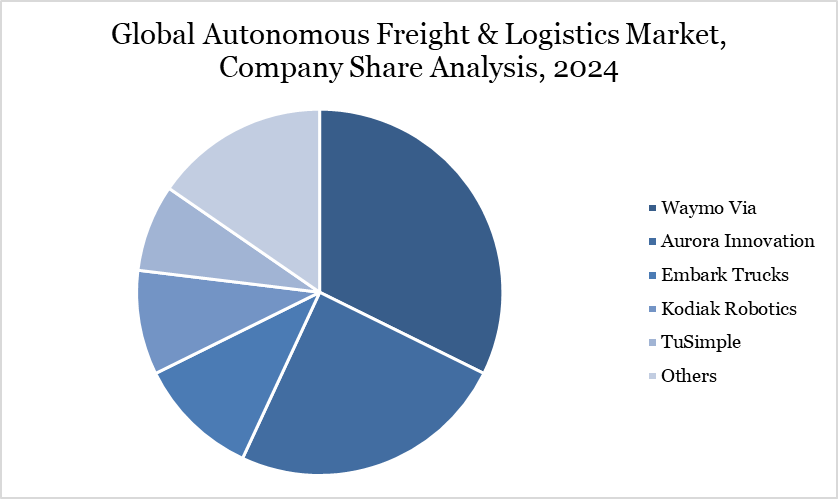

The industry is experiencing swift expansion propelled by advancements in artificial intelligence, sensor technologies, and high-performance computers. Prominent industry participants including as Waymo, Aurora Innovation, TuSimple, and Volvo are actively partnering with technology companies and logistics providers to address technological and regulatory obstacles.

The collaboration between Aurora, Nvidia, and Continental, aiming for mass production by 2027, illustrates the rapid acceptance of autonomous trucks. The incorporation of electric power and rigorous emission regulations, such as the EU's Euro VII, bolsters industry growth, highlighting emission-free autonomous fleets. Due to increasing logistics needs and ongoing driver shortages worldwide, autonomous trucks are set to transform freight transportation by improving productivity and lowering operational expenses.

Autonomous Freight & Logistics Market Trend

The autonomous freight industry is marked by growing partnerships among technology developers, original equipment manufacturers, and logistics companies to enhance the deployment of self-driving trucks. Aurora Innovation's cooperation with Nvidia and Continental in January 2025 aims to utilize Nvidia's DRIVE Thor platform and DriveOS operating system for SAE Level 4 autonomous trucks, with mass production anticipated by 2027.

Waabi's partnership with Volvo's autonomous division to include its virtual driver system onto Volvo VNL Autonomous trucks exemplifies the movement towards commercial pilot initiatives, particularly in the Texas logistics corridor. The global megatrend of automobile electrification, bolstered by rigorous emission regulations in key economies, is propelling the amalgamation of electric propulsion with autonomous technologies. Logistics automation, augmented by AI and IoT, is extensively implemented to optimize warehouse management, last-mile delivery, and supply chain visibility, particularly in the e-commerce sector, which necessitates swift, cost-effective, and transparent delivery services.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

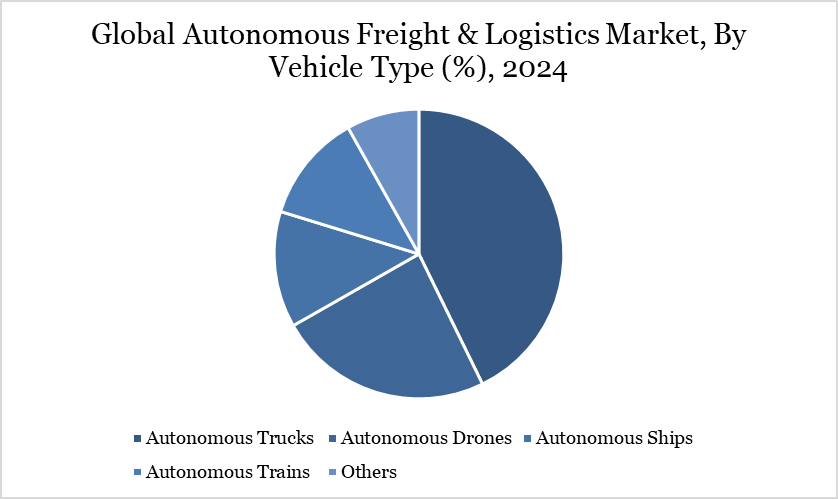

By Vehicle Type | Autonomous Trucks, Autonomous Drones, Autonomous Ships, Autonomous Trains, Others |

By Mode of Transport | Road, Rail, Air, Sea |

By Autonomy Level | Level 1, Level 2, Level 3, Level 4, Level 5 |

By Solution Type | Hardware, Software, Services |

By End-user | E-commerce, Retail & FMCG, Automotive, Healthcare & Pharmaceuticals, Industrial Manufacturing, Food & Beverage, Oil & Gas, Construction, Others |

By Application | Long-Haul Freight, Last-Mile Delivery, Port Operations, Warehouse Logistics, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Autonomous Freight & Logistics Market Dynamics

Fuel Efficiency and Cost Minimization Drive Adoption

A primary driver for the expansion of autonomous trucks is their demonstrated capacity to improve fuel efficiency and decrease operational expenses. Advanced AI algorithms facilitate autonomous trucks in optimizing acceleration, braking, and speed control, resulting in smoother driving and at least a 10% reduction in fuel consumption, as evidenced by the study conducted by the University of California San Diego and TuSimple.

The efficiency improvement is especially notable in urban, stop-and-go traffic scenarios, resulting in considerable cost reductions for fleet operators. Moreover, the predictive maintenance features integrated into autonomous trucks minimize vehicle downtime and prolong component longevity, resulting in reduced maintenance costs.

The aggregate savings from fuel and maintenance constitute a significant economic incentive, projected to save the US trucking sector around 4 billion gallons of fuel per year, valued at around US$ 10 billion. These cost advantages closely correspond with sustainability objectives by substantially reducing greenhouse gas emissions.

Regulatory and Infrastructure Obstacles

The autonomous trucking sector encounters substantial limitations due to inadequate regulatory frameworks and insufficient infrastructural development. Existing legislation in numerous jurisdictions inadequately addresses advanced autonomous operations, resulting in ambiguities around legal culpability, safety regulations, and operational authorization.

Infrastructure constraints, including variable road quality, absence of designated lanes, and inadequate connectivity, complicate large-scale implementation. Public skepticism about the safety of autonomous vehicles and ethical issues around job displacement further complicate market acceptance.

Cybersecurity threats and data privacy concerns necessitate comprehensive mitigation techniques. These factors cumulatively impede the integration of autonomous vehicles into mainstream freight transportation, necessitating coordinated efforts from governments, industry stakeholders, and technology suppliers to set definitive legislation, enhance infrastructure, and cultivate public trust.

Autonomous Freight & Logistics Market Segment Analysis

The global cosmetic ingredients market is segmented based on vehicle type, mode of transport, autonomy level, solution type, end-user, application, and region.

Strategic Differentiation of Autonomous Trucks by Operational Terrain

The autonomous truck sector, encompassing long-haul trucks, yard trucks, and specialty delivery vehicles. Long-haul autonomous trucks prevail because they can enhance extended freight routes by minimizing driver tiredness and facilitating uninterrupted operation. Yard trucks prioritize the automation of loading, unloading, and container transportation inside ports and distribution hubs, enhancing operational efficiency and diminishing reliance on manual labor.

Specialized delivery vehicles, engineered for last-mile logistics, integrate sophisticated navigation systems to navigate intricate urban landscapes and guarantee prompt deliveries. Each vehicle category utilizes customized sensor configurations and degrees of autonomy to tackle specific operating issues.

Market leaders emphasize long-haul trucks because of their substantial fuel consumption and labor expenses, where automation yields the greatest economic and environmental benefits. The segmentation facilitates tailored technology development and implementation techniques that correspond with certain logistics requirements.

Autonomous Freight & Logistics Market Geographical Share

North America Leads Autonomous Trucking Driven by Evolving Freight Infrastructure

North America leads in the adoption of autonomous trucks, propelled by a developed logistics sector, a sophisticated technological framework, and favorable legislative measures. Texas is becoming as a crucial area due to its massive highway systems, strategic location as a freight route, and favorable regulatory framework. Aurora Innovation and Waabi's intentions to initiate commercial pilot projects in Texas by 2025 underscore the state's significance as a testing site for autonomous freight operations.

The US government's emphasis on infrastructure renovation and emissions reduction programs bolsters industry expansion. Furthermore, North America reaps significant advantages from considerable investments made by prominent autonomous truck developers, including Waymo Via, TuSimple, and Volvo. The extensive logistical activities and increasing e-commerce penetration in the region generate significant demand for efficient, safe, and economical freight solutions, establishing it as a pivotal market for autonomous trucking technologies.

Technological Analysis

The autonomous freight and logistics sector is primarily propelled by advanced technology including artificial intelligence, sensor fusion, high-performance computing, and enhanced networking. Autonomous trucks utilize a synthesis of cameras, LiDAR, radar, and ultrasonic sensors to interpret their surroundings and execute real-time choices. AI algorithms analyze extensive data sets to enhance route optimization, collision prevention, and fuel-efficient navigation. The use of Nvidia’s DRIVE Thor platform illustrates the movement towards robust, scalable computer systems adept at handling intricate autonomous driving functions.

Predictive maintenance systems utilize IoT and machine learning to assess vehicle condition, minimize failures, and arrange prompt repairs. Moreover, advancements in cybersecurity frameworks guarantee secure and dependable functioning, safeguarding cars and cargo from cyber assaults. The integration of these technologies facilitates the shift from limited driver assistance to complete autonomy, fostering the global acceptance of autonomous freight systems.

Autonomous Freight & Logistics Market Major Players

The major global players in the market include Waymo Via, Aurora Innovation, Embark Trucks, Kodiak Robotics, TuSimple, Plus, Einride, Gatik, Motional, Inceptio Technology.

Key Developments

In February 2025, Volvo Group Venture Capital AB invested in the Canadian firm Waabi Innovation Inc. to advance the next generation of autonomous trucking technology. Waabi is advancing cutting-edge artificial intelligence technology to address autonomy on a large scale. The company recently introduced the Waabi Driver, their primary autonomous trucking technology, intended for extensive commercialization and secure implementation.

In January 2025, Aurora, Continental, and NVIDIA collaborate to deploy autonomous trucks throughout the US, representing the inaugural cooperation in the nation to scale these vehicles inside the automotive sector. Continental intends to expedite the advancement and implementation of autonomous trucks throughout the US.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies