Market Size

Global Automotive VOC Testing Market reached US$ 2,050.12 million in 2024 and is expected to reach US$ 3,656.34 billion by 2032, growing with a CAGR of 7.5% during the forecast period 2025-2032.

The global automotive Volatile Organic Compound (VOC) testing market is experiencing significant growth, driven by stringent environmental regulations and the automotive industry's commitment to sustainability. In the United States, the Environmental Protection Agency (EPA) has established various methods for VOC analysis, such as EPA Method 18, which is used to determine the concentration of VOCs in emissions from stationary sources.

Additionally, the California Air Resources Board (CARB) has developed Method 310, a standard test method for determining the VOC content in consumer products, including automotive coatings. These regulatory frameworks ensure that automotive manufacturers adhere to emission standards, thereby promoting the adoption of advanced VOC testing technologies. Furthermore, the increasing consumer demand for low-emission vehicles is prompting manufacturers to invest in VOC testing to meet environmental standards and enhance product quality. This convergence of regulatory pressure and market demand is propelling the growth of the automotive VOC testing market.

Automotive VOC Testing Market Trend

A notable trend in the automotive VOC testing market is the increasing adoption of advanced testing methods, such as thermal desorption and solid-phase microextraction (SPME), to meet stringent emission standards. Additionally, there is a growing emphasis on indoor air quality testing, driven by consumer awareness and demand for safer vehicles. The integration of mobile testing units is also gaining traction, allowing for on-site testing and reducing turnaround times.

Furthermore, the development of new testing technologies, including automated and miniaturized systems, is enhancing testing efficiency and accuracy. These trends reflect the industry's commitment to improving air quality and meeting evolving regulatory requirements.

Market Scope

Metrics | Details |

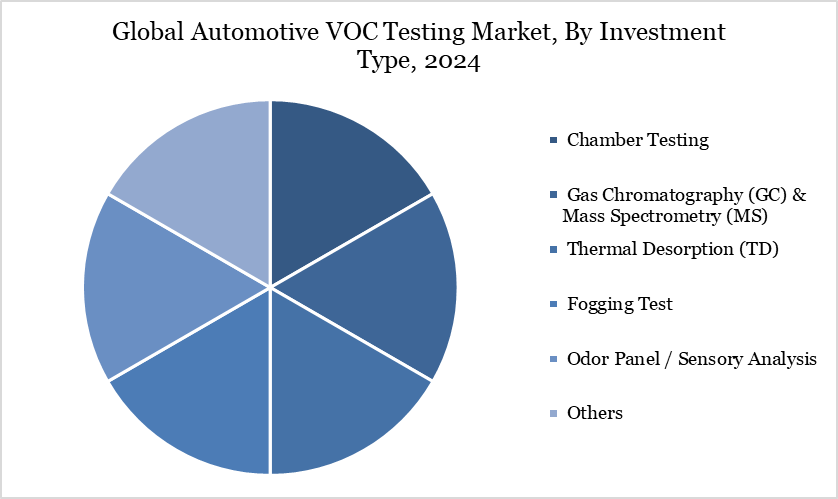

By Testing Method | Chamber Testing, Gas Chromatography (GC) & Mass Spectrometry (MS), Thermal Desorption (TD), Fogging Test, Odor Panel, Others |

By Vehicle Type | Passenger Vehicles, Commercial Vehicles |

By Emission Type | Methane, Formaldehyde, Benzene, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More detailed information Request free sample

Market Dynamics

Integration of Climate Stress Testing into Financial Risk Assessment Frameworks

The integration of climate stress testing into financial risk assessment frameworks is significantly influencing the global automotive Volatile Organic Compound (VOC) testing market. A 2024 report by the United Nations Environment Programme Finance Initiative indicates that 33 out of 58 vendors have the capability to conduct forward-looking climate analyses, highlighting the growing emphasis on assessing climate-related financial risks. This shift towards incorporating climate risk assessments is prompting automotive manufacturers and suppliers to invest in advanced VOC testing technologies to ensure compliance with emerging environmental regulations. For instance, the U.S. Environmental Protection Agency's stringent standards on VOC emissions are pushing companies to adopt more rigorous testing methods.

Lack of Unified Global Taxonomy for Sustainable Financial Products

The absence of a standardized global taxonomy for sustainable financial products poses a significant challenge to the advancement of automotive Volatile Organic Compound (VOC) testing. Without a unified classification system, investors and stakeholders face difficulties in identifying and supporting initiatives that aim to reduce VOC emissions in the automotive sector.

For instance, the European Union's Taxonomy Regulation, which provides a classification system for environmentally sustainable economic activities, has yet to fully integrate automotive VOC reduction measures, leading to a gap in sustainable investment flows into this area. This lack of clarity and consistency in classification hinders the mobilization of capital necessary for the development and implementation of advanced VOC testing technologies.

Segmentation Analysis

The global automotive VOC testing market is segmented based on testing method, vehicle type, emission type and region.

Thermal Desorption (TD) Testing Segment Driving Automotive VOC Testing Market

Thermal Desorption (TD) testing has become a pivotal method in the global automotive VOC testing market, driven by stringent environmental regulations and the industry's commitment to sustainability. The U.S. Environmental Protection Agency (EPA) has developed various methods utilizing TD for VOC analysis, such as EPA Method 5035A, which employs closed-system purge-and-trap and thermal desorption techniques to analyze volatile compounds in soil and water samples. This method has been instrumental in assessing VOC emissions from automotive components, ensuring compliance with air quality standards.

Similarly, the California Air Resources Board (CARB) has established Standard Operating Procedure SOP259 for in-situ measurements of atmospheric volatile organic compounds using thermal desorption gas chromatography. This procedure is crucial for monitoring VOC emissions from automotive sources, contributing to the development of emission inventories and the implementation of air quality management strategies. The adoption of TD testing methods by regulatory bodies underscores their effectiveness in providing accurate and reliable data, thereby driving the growth of the automotive VOC testing market.

Geographical Penetration

Europe Drives the Global Automotive VOC Testing Market

The European automotive volatile organic compound (VOC) testing market is expanding steadily, driven by strict regulatory frameworks, growing consumer expectations, and the region’s leadership in sustainable mobility. Europe’s automotive sector, anchored by Germany, France, and the UK, places significant emphasis on vehicle interior air quality (VIAQ), requiring manufacturers and suppliers to test materials and components for emissions of VOCs, aldehydes, and others.

A major driver of demand is the EU’s regulatory environment. Under REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), the European Chemicals Agency requires detailed reporting and limits on substances used in automotive materials. Complementing this, the European Commission’s Industrial Emissions Directive enforces restrictions on pollutants released during production, indirectly shaping automotive supply chains to adopt VOC-compliant materials. Additionally, standards such as VDA 278 and ISO 12219 set testing methods for VOC and odor emissions, ensuring consistency across manufacturers operating in Europe.

According to the German Federal Motor Transport Authority (Kraftfahrt-Bundesamt, KBA), the country produced over 1.2 million battery electric and plug-in hybrid vehicles in 2023, making it Europe’s top EV producer. These vehicles rely heavily on lightweight polymers, flame-retardant coatings, and adhesives, many of which release VOCs that require rigorous testing to meet both safety and consumer comfort standards. This shift toward electrification has amplified the demand for VOC testing services and facilities. From a consumer perspective, there is heightened sensitivity toward cabin wellness.

The German Environment Agency (Umweltbundesamt, UBA) has published multiple studies highlighting the health impacts of VOC exposure, including irritation and potential long-term respiratory effects. Such findings align with rising public demand for safer, odor-free, and allergen-minimized interiors, particularly in premium and EV segments where comfort is a key selling point.

Sustainability Analysis

The global automotive industry is increasingly focusing on reducing volatile organic compound (VOC) emissions to enhance sustainability and comply with stringent environmental regulations. For instance, the U.S. Environmental Protection Agency (EPA) has established national VOC emission standards for aerosol coatings under the Clean Air Act, aiming to reduce VOC emissions contributing to ozone formation and nonattainment areas.

Similarly, California's Air Resources Board (CARB) proposed a Suggested Control Measure (SCM) for automotive coatings, estimating a reduction of about 13.4 tons per day in VOC emissions statewide, equating to a 63% reduction in total VOC emissions from the coating categories. These regulatory measures underscore the automotive sector's commitment to sustainability by minimizing VOC emissions through stringent testing and compliance with environmental standards.

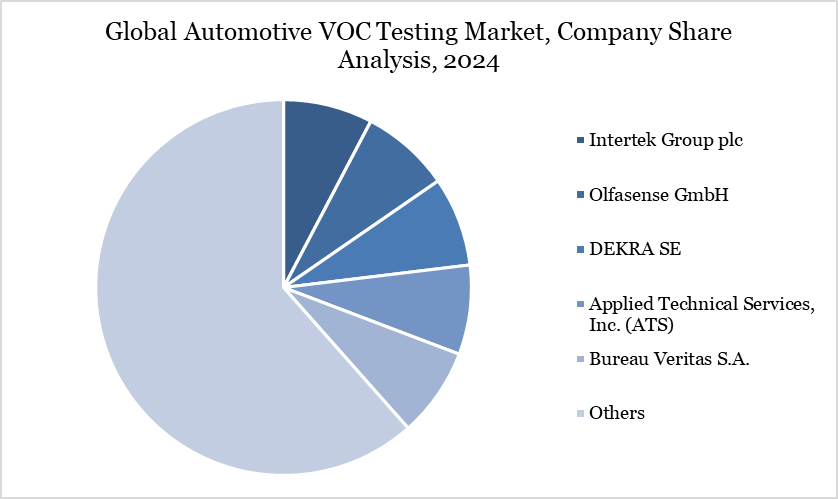

Competitive Landscape

The major global players in the market include Intertek Group plc, Olfasense GmbH, DEKRA SE, Applied Technical Services, Inc. (ATS), Bureau Veritas S.A., TÜV SÜD AG, SGS S.A., UL Solutions Inc., Applus+ Servicios Tecnológicos, S.L., and Gasera Ltd.

Key Developments

In February 2025, SGS officially launched our first Volatile Organic Compounds (VOC) testing lab in Naucalpan, State of Mexico, supporting the country’s automotive sector. The lab offers comprehensive VOC and SVOC testing to meet strict local and international vehicle interior air quality (VIAQ) standards. It can analyze materials like plastics, paints, adhesives, and textiles, which may release harmful VOCs affecting driver and passenger health. Equipped with climatic chambers and ovens, the facility ensures precise testing under controlled conditions.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies