Automotive Aluminum Market Size

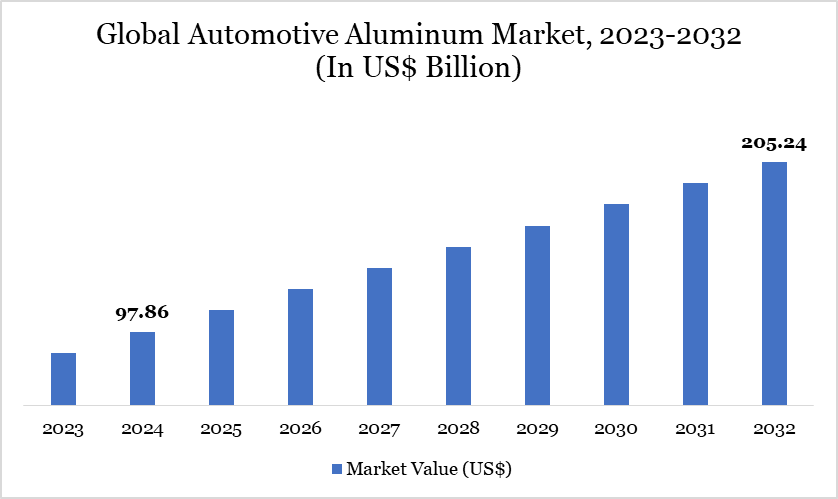

Automotive Aluminum Market Size reached US$ 97.86 billion in 2024 and is expected to reach US$ 205.24 billion by 2032, growing with a CAGR of 9.7% during the forecast period 2025-2032.

The global automotive aluminum market has witnessed significant growth due to the increasing demand for lightweight materials in vehicles. Aluminum, known for its lightweight properties, is a critical material in reducing vehicle weight, improving fuel efficiency, and enhancing overall performance. This trend is primarily driven by stricter fuel efficiency regulations and the growing demand for electric vehicles (EVs), where lightweighting plays a crucial role in extending battery life and range.

The market is also seeing increased adoption of aluminum in vehicle body panels, engine components, transmission systems, and wheels, as automakers focus on enhancing fuel economy and meeting environmental standards. The demand for lightweight, high-strength aluminum is expected to rise as automakers and consumers prioritize sustainability and performance. With major players like Alcoa Corporation, Novelis Inc., and Constellium leading the way, the market is set to witness innovations that will further drive aluminum's dominance in the automotive sector.

Automotive Aluminum Market Trend

The global automotive aluminum market is experiencing several transformative trends, primarily driven by the automotive industry's shift towards lightweighting, electrification, and sustainability. A key trend is the increased adoption of aluminum in electric vehicles (EVs), as manufacturers strive to extend vehicle range and reduce battery load. For example, Tesla uses aluminum extensively in its Model S and Model X for chassis and body structures, reducing vehicle weight without compromising safety.

Another strong trend is the use of high-strength aluminum alloys in structural components such as crash management systems and battery enclosures, as seen in the Audi e-tron, which uses more than 40% aluminum in its structure. There is also a notable rise in aluminum recycling initiatives, driven by environmental regulations and cost advantages aluminum recycling consumes up to 95% less energy compared to primary production.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Product Type | Wrought Aluminum, Cast Aluminum, Extruded Aluminum, Others | |

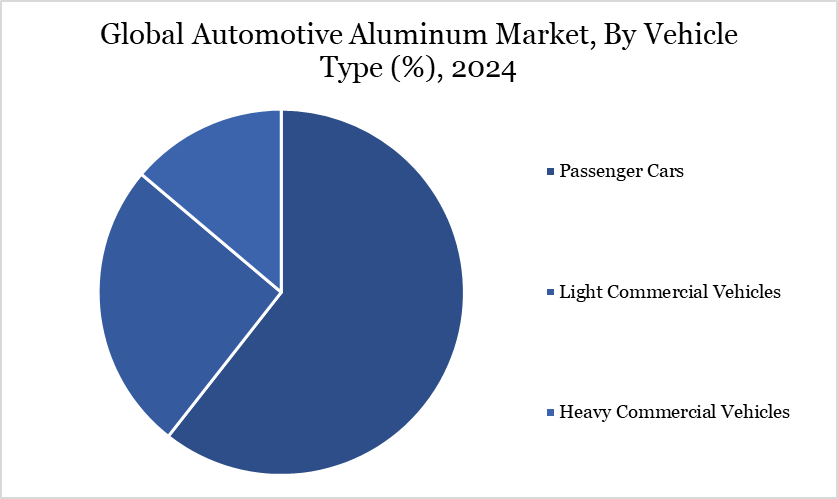

| By Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles | |

| By Application | Body and Chassis, Powertrain, Suspension Components, Wheels and Tires, Interior Components, Others | |

| By End User | OEMs (Original Equipment Manufacturers), Aftermarket | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Automotive Aluminum Market Dynamics

Vehicle Lightweighting for Fuel Efficiency and Emission Reduction

Vehicle lightweighting for fuel efficiency and emission reduction is one of the strongest drivers of the Global Automotive Aluminum Market, as governments and regulatory bodies across the world impose stricter emission norms to combat climate change and reduce dependency on fossil fuels. Automakers are under immense pressure to meet standards such as the Corporate Average Fuel Economy (CAFÉ) norms in the US and the European Union’s CO₂ emission targets, which limit the average emissions a car manufacturer’s fleet can produce. To comply, manufacturers are increasingly using aluminum to reduce vehicle weight, as a 10% reduction in vehicle weight can improve fuel efficiency by 6% to 8%.

Aluminum offers a unique advantage it is about 60% lighter than steel but still provides high strength and crash resistance, making it ideal for structural and exterior vehicle components. For instance, General Motors and BMW have adopted aluminum in various models to optimize weight without compromising safety or luxury. This trend is only accelerating with the rise of electric vehicles (EVs), where lighter materials like aluminum help improve battery efficiency and vehicle range critical competitive advantages in the EV market.

High Cost of Aluminum Compared to Steel

The high cost of aluminum compared to steel is a significant restraining factor for the Global Automotive Aluminum Market, limiting its widespread adoption, especially in cost-sensitive segments like compact and economy vehicles. Aluminum production particularly primary aluminum requires energy-intensive processes such as electrolysis in smelters, leading to higher raw material and processing costs compared to steel.

While aluminum offers superior weight reduction benefits, it can be up to 2 to 3 times more expensive than high-strength steel, making it economically unviable for many automakers targeting mass-market consumers in emerging economies like India, Brazil, or Southeast Asia. Therefore, despite aluminum’s benefits, its high upfront costs and production investments act as a major barrier, slowing down its penetration into lower and mid-tier vehicle segments and restraining overall market growth.

Automotive Aluminum Market Segment Analysis

The global automotive aluminum market is segmented based on product type, vehicle type, application, end user and region.

Rising Demand for Lightweight and Efficient Light Commercial Vehicles Boosts Aluminum Adoption

Light Commercial Vehicles (LCVs) are a key driver in the automotive aluminum market, primarily due to the rising need for fuel-efficient, lightweight, and high-performing delivery and utility vehicles. LCVs, which include vans, pickups, and small trucks, are widely used for urban logistics, e-commerce deliveries, and last-mile transportation. Aluminum plays a vital role here by offering significant weight reduction without compromising durability, allowing LCVs to carry more cargo while consuming less fuel.

For instance, Mercedes-Benz Sprinter vans incorporate aluminum body structures and roof frames, enhancing load capacity while lowering emissions—an important factor for fleet buyers in Europe adhering to Euro 6 standards. Moreover, the push toward electric LCVs (e-LCVs) is intensifying demand for lightweight materials to compensate for heavy battery systems. Given the booming e-commerce sector and increasing environmental compliance in logistics, aluminum’s role in enhancing LCV performance and cost efficiency makes this vehicle type a major growth contributor to the global automotive aluminum market.

Automotive Aluminum Market Geographical Share

North America Leads the Charge in Automotive Aluminum Adoption through Innovation and Regulatory Push

North America dominates the global automotive aluminum market, primarily due to a strong combination of regulatory mandates, advanced automotive manufacturing infrastructure, and a high penetration of pickup trucks and SUVs—which benefit greatly from aluminum integration. The region has witnessed a robust shift toward lightweighting in response to Corporate Average Fuel Economy (CAFÉ) standards, which require automakers to improve fleet-wide fuel efficiency and reduce emissions.

Moreover, North America is home to leading aluminum producers like Alcoa Corporation and Novelis Inc., which provide advanced aluminum products and support the development of closed-loop recycling systems that enhance sustainability and reduce material costs for automakers. The presence of such an integrated supply chain ecosystem further cements the region’s leadership. With a combination of regulatory pressure, technological leadership, and consumer demand for high-performance vehicles, North America continues to drive innovation and scale in the automotive aluminum market.

Sustainability Analysis

A major pillar of sustainability in the aluminum market is its closed-loop recycling potential. Unlike many materials, aluminum does not degrade during recycling and retains 100% of its original properties. Leading producers like Novelis and Constellium have implemented partnerships with OEMs such as Jaguar Land Rover, BMW, and Ford to recycle aluminum scrap directly from manufacturing lines. This not only reduces raw material demand but also saves 95% of the energy required for producing primary aluminum.

Aluminum also supports design for sustainability by enabling modular, multi-material vehicle platforms that improve assembly, disassembly, and recyclability. For example, EV manufacturers like Lucid Motors and Polestar design frames using a mix of recycled aluminum and other lightweight composites to meet both performance and sustainability benchmarks. These innovations are pivotal as automakers set internal goals to become carbon neutral by 2030–2040.

Automotive Aluminum Market Major Players

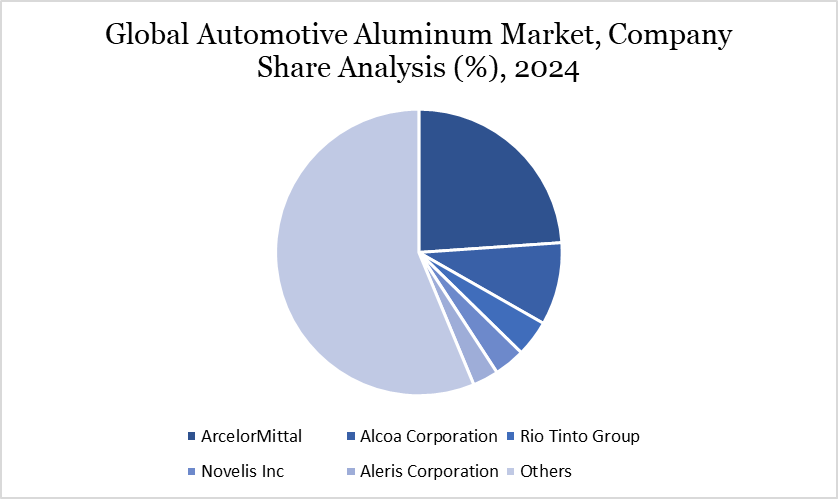

The major global players in the market include ArcelorMittal, Alcoa Corporation, Rio Tinto Group, Novelis Inc, Aleris Corporation, Constellium, UACJ Corporation, Kaiser Aluminum Corporation, CHALCO, Norsk Hydro ASA and among others.

Key Developments

- In 2025, Novelis Inc., stated the production of the world's first-ever aluminum coil made entirely from 100% recycled, end-of-life automotive scrap. Developed and produced for the European automotive market, this breakthrough marks a significant step toward greater circularity and sustainability in the automotive industry.

- In 2025, Hydro and Nemak, the two old allies, have reportedly formed another strategic partnership to develop low-carbon aluminum casting products for the automotive industry to decarbonise the car manufacturing sector and help automakers reach their sustainability goals.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies