Atopic Dermatitis Market - Industry Trends & Overview

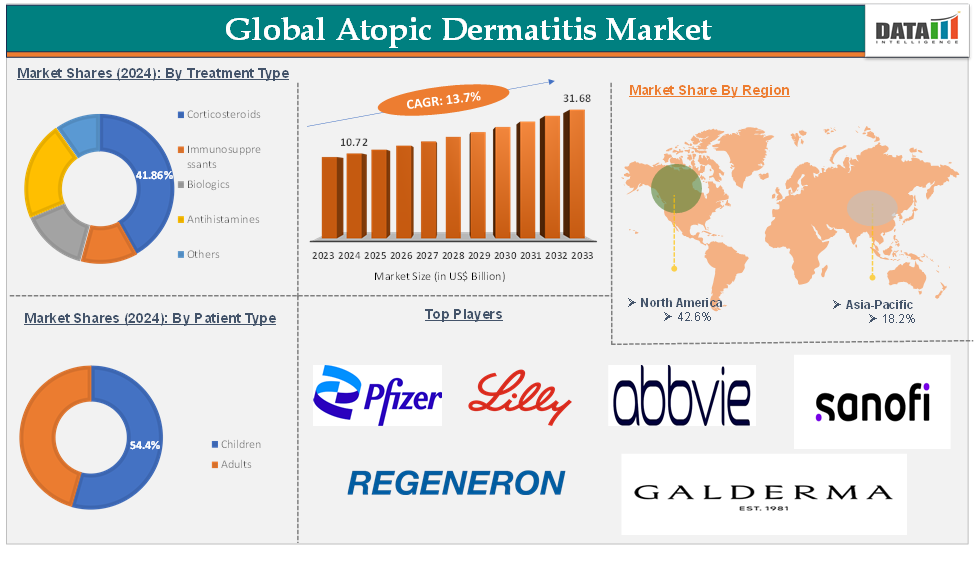

Atopic Dermatitis Market reached US$10.72 billion in 2024 and is expected to reach US$31.68 billion by 2033, growing at a CAGR of 13.7% during the forecast period 2025-2033, according to DataM Intelligence research.

Atopic dermatitis, commonly referred to as eczema, is a chronic inflammatory skin condition characterized by itchy, red, and swollen skin. It’s part of a group of conditions known as the "atopic triad," which also includes allergic rhinitis (hay fever) and asthma. Atopic dermatitis often starts in childhood and may continue into adulthood, though the severity and symptoms can fluctuate over time. Chronic atopic dermatitis can lead to xerosis (dry, scaly skin), skin cracking, and even open sores. During "flares," symptoms worsen significantly, while at other times, symptoms may subside or enter remission.

This chronic inflammatory skin condition, characterized by intense itching, redness, and dry, flaky patches, impacts millions globally and presents a substantial burden on healthcare systems and patients' quality of life. The global atopic dermatitis (AD) market is experiencing a significant surge, poised for robust growth driven by a confluence of factors, including increasing disease prevalence worldwide, groundbreaking advancements in biologic therapies, and strategic collaborations among leading pharmaceutical companies.

This surge is propelled by the rising global burden of the disease, the emergence of advanced biologic and small-molecule therapies, and a new wave of digital healthcare solutions and industry partnerships.

Executive Summary

For more details on this report - Request for Sample

Atopic Dermatitis Market Dynamics: Drivers

Rising prevalence of atopic dermatitis

Atopic dermatitis is a chronic condition that mainly affects the skin of an individual. The condition is usually diagnosed in younger children between 0 to 4 years. The prevalence and incidence of atopic dermatitis are constantly rising and have become a global burden in recent years. For instance, according to the latest global report on Atopic Dermatitis published in 2022, approximately 223 million people across the globe suffer from atopic dermatitis, and among these, children (1-4 years of age) accounted for 43 million.

According to the National Eczema Association, nearly 9.6 million children (below 18 years of age) in the United States have atopic dermatitis, and approximately one-third of the population has moderate to severe disease. Moreover, nearly 16.5 million adults (above 18 years of age) are diagnosed with the condition, and approximately 40% of the population has moderate to severe disease.

Moreover, several epidemiology studies have reported an increasing trend in the incidence of atopic dermatitis. With the expanding healthcare industry, the diagnosis and treatment rate is anticipated to increase, combined with the rising number of cases, propelling the market positively in the forecast period.

For instance, an epidemiology study published in the Frontiers in Microbiology Journal among the Chinese population has stated that the prevalence is steadily growing among the 10-19 age group. With the growing population, this increasing trend may create a huge burden of cases in the future.

Atopic Dermatitis Market Dynamics: Restraints

Patient adherence and compliance concerns

Patient adherence and compliance are critical concerns in the atopic dermatitis market, as the chronic, relapsing nature of the disease often requires long-term, consistent treatment for symptom management. However, poor adherence is common, particularly due to the time-intensive and sometimes uncomfortable nature of current treatment regimens.

Many patients, especially those with moderate-to-severe atopic dermatitis, are prescribed topical treatments that need multiple daily applications. This can be cumbersome and challenging to maintain consistently, especially if the treatment irritates or feels greasy on the skin. For instance, according to the National Institute of Health (NIH), in dermatological diseases, non-adherence to treatment is problematic and related to negative therapeutic outcomes. About 50% of patients diagnosed with chronic skin diseases were not adherent to the treatments prescribed by their dermatologists.

Atopic Dermatitis Market Segment Analysis

The global atopic dermatitis market is segmented based on treatment type, patient type, distribution channel, and region.

Treatment Type:

The corticosteroids treatment type segment is expected to hold 41.86% of the global atopic dermatitis market in 2024

Corticosteroids are essential medications for the treatment of atopic dermatitis (AD) and especially so when it comes to the management of flare-ups and inflammation. As anti-inflammatory agents, these drugs markedly alleviate the signs of cutaneous reddening, papules, and pus-filled blisters, pruritus, and discomfort caused by the AD condition.

Corticosteroids come in several formulations: topical creams, ointments, lacquers, which come in various ‘strengths’, from low to super potent, depending on the weight of the condition. For mild-to-moderate-severity cases, low to medium-potency corticosteroid agents are commonly prescribed, but for severe exacerbations, higher potency options are given, or those thick, dense skin areas such as palms and soles.

The administration of these medications decreases the reactivity of certain parts of the immune system and inflammation of the skin, and allows a patient to recover from chronic and acute forms of the disease. For instance, in July of 2024, ZORYVE (roflumilast) cream 0.15% was commercially launched in the United States to treat mild to moderate atopic dermatitis in adults and children aged 6 and up by Arcutis Biotherapeutics, Inc. which is a commercial-stage biotechnology firm dedicated to the development of significant innovations in the field of immuno-dermatology.

ZORYVE is a cream that can be applied once daily to treat afflicted skin without the need for steroids. It acts fast to reduce itching and resolve impacted skin while also helping to control the condition over the long term.

Moreover, some of the factors that need to be considered when selecting a topical corticosteroid include the age of the patient, the area being treated, and the rate of absorption. In general, infants may need a less potent preparation for the management of atopic dermatitis flares. In contrast, teenagers may use a medium or a high-potency drug. Peripheral absorption of these corticosteroids is maximum in thin areas such as the face and perineum and minimal in thicker regions like the palms and soles. Such cases may require mid-potency or high-potency topical drugs for effective management.

Atopic Dermatitis Market Geographical Analysis

North America is expected to hold 42.6% of the global atopic dermatitis market in 2024

North America holds the largest market share, driven by high disease prevalence, early adoption of biologics, and strong reimbursement systems. In 2025, over 28 million people in the U.S. were affected by atopic dermatitis. Companies like Sanofi and Pfizer are leading innovation, with digital companion apps and advanced immunotherapies enhancing treatment access and patient engagement.

The healthcare system in North America, especially in the USA, is robust with equipped hospitals, research organizations, and dermatology clinics. This system also aids in diagnosis, treatment, and management of Atopic Dermatitis, thus influencing the growth of the market. The healthcare services offered are of good quality because there are professionals such as dermatologists and allergists available.

The region leads other regions of the world in the adoption and implementation of modern technologies in the health sector. Most of its countries, particularly the United States, where attention to R&D is very high, have been able to come up with new therapies and diagnostic technologies for atopic dermatitis.

For instance, in September 2024, Eli Lilly revealed that Ebglyss an IL-13 targeting inhibitor, has been accepted by USFDA for the treatment of moderate to severe atopic dermatitis (AD). The drug has been approved for use by Adults as well as teens with a 12-year-old or older with a minimum body weight of 40kg who have inadequate AD disease control despite the use of topical prescription therapies.

Asia-Pacific is expected to hold 18.2% of the global atopic dermatitis market in 2024

The Asia Pacific region is experiencing the fastest growth in the atopic dermatitis market, driven by a combination of rising prevalence, increased healthcare spending, improved access to advanced therapies, and greater awareness of dermatological health.

Asia-Pacific (India and Japan) is witnessing fast growth due to rising awareness, better diagnosis, and expanding access to biologics. India benefits from growing e-pharmacy networks and urban healthcare outreach, while Japan leads in biologic adoption, supported by favorable policies and active clinical trials. Both countries are integrating AI tools in dermatology for better disease management.

For instance, according to Sanofi. Anil Raina, General Manager, Sanofi, declared that more public awareness is required for innovative treatments for difficult-to-treat illnesses like atopic dermatitis to know more about the advancements in the management of atopic dermatitis in India, which impacts more than 28 million lives.

Atopic Dermatitis Market Major Players

The major global players in the atopic dermatitis market include Pfizer Inc., Regeneron Pharmaceuticals Inc., Sanofi S.A., AbbVie Inc., Eli Lilly and Company, Galderma Inc., LEO Pharma Inc., Incyte Corporation, Arcutis Biotherapeutics, Inc., Otsuka Pharmaceutical Co., Ltd, and others.

Atopic Dermatitis Market Emerging Players

The emerging players in the atopic dermatitis market include Almirall, S.A, Aclaris Therapeutics Inc, Kiniksa Pharmaceuticals, Cara Therapeutics, VYNE Therapeutic and among others.

Recent Industry Trends (2025)

Gilead & LEO Pharma (Jan 2025): Strategic alliance for the STAT6 oral small molecule program, targeting inflammatory skin diseases.

Eli Lilly & Dice Therapeutics (Mar 2025): Acquisition expands Lilly’s dermatology pipeline with oral IL-17 inhibitors for AD.

AI-Powered Skin Scanners: Integrated into dermatology apps for real-time monitoring, widely adopted in U.S. and Japan clinics.

Decentralized Clinical Trials: Gaining traction in 2025 for atopic dermatitis, with remote monitoring and virtual patient visits increasing recruitment and retention rates.

Atopic Dermatitis Market Key Developments

In April 2025, Galderma unveiled “Scratch Resistance,” its first Direct-to-Consumer (DTC) multichannel campaign and new broadcast advertisement for NEMLUVIO (nemolizumab-ilto), an innovative therapy for atopic dermatitis, also known as eczema. The campaign highlights the significant burden of atopic dermatitis beyond just the physical itch, focusing on the emotional and daily life impacts of the disease.

In March 2025, Amgen and Kyowa Kirin Co., Ltd. reported new findings from the ongoing ROCKET Phase 3 clinical trial program assessing rocatinlimab, an investigational therapy that rebalances T-cells by targeting the OX40 receptor, in patients with moderate to severe atopic dermatitis (AD).

In January 2025, the U.S. Food and Drug Administration (FDA) approved Nemluvio (nemolizumab-ilto), a novel biologic therapy developed by Galderma. Nemluvio is an IL-31 inhibitor indicated for patients aged 12 and older with moderate to severe atopic dermatitis whose condition is not adequately managed with topical prescription treatments.

In September 2024, Eli Lilly and Company cleared that the U.S. Food and Drug Administration (FDA) approved EBGLYSS (lebrikizumab-lbkz), a targeted IL-13 inhibitor, for the treatment of adults and children 12 years of age and older who weigh at least 88 pounds (40 kg) with moderate-to-severe atopic dermatitis (eczema) that is not well controlled despite treatment with topical prescription therapies. EBGLYSS works by targeting eczema inflammation throughout the body that can lead to dry, itchy, and irritated skin.

In April 2024, Dermavant Sciences released that the U.S. Food and Drug Administration (FDA) accepted the company’s Supplemental New Drug Application (sNDA) for VTAMA (tapinarof) cream, 1%, for the topical treatment of atopic dermatitis (AD) in adults and children 2 years of age and older. The Prescription Drug User Fee Act (“PDUFA”) action date assigned by the Agency is in Q4 2024.

In July 2024, Arcutis Biotherapeutics, Inc. cleared that the U.S. Food and Drug Administration (FDA) has approved the supplemental new drug application (sNDA) for ZORYVE (roflumilast) cream, 0.15%, for the treatment of mild to moderate atopic dermatitis in adult and pediatric patients 6 years of age and older. ZORYVE is a once-daily, steroid-free cream that provides rapid disease clearance and significant reduction in itch and has been specifically developed to be a treatment option for long-term disease control.

Market Scope

Metrics | Details | |

CAGR | 13.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Treatment Type | Corticosteroids, Immunosuppressants, Biologics, Antihistamines, Others |

Patient Type | Children and Adults | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |