Atherectomy Devices Market Size & Industry Outlook

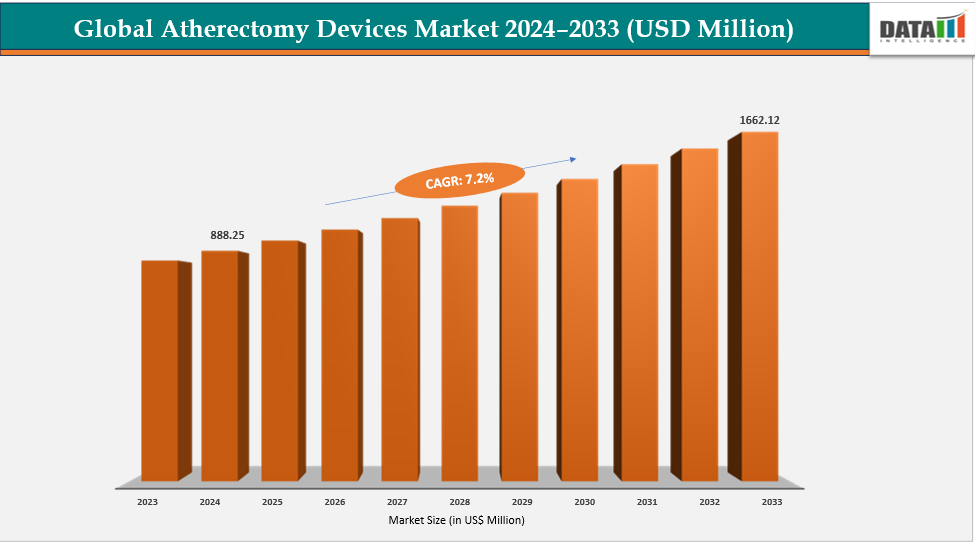

The global atherectomy devices market size reached US$ 832.47 Million in 2023 with a rise of US$ 888.25 Million in 2024 and is expected to reach US$ 1,662.12 Million by 2033, growing at a CAGR of 7.2% during the forecast period 2025-2033.

The growth of the atherectomy devices market is being significantly accelerated by the preference for minimally invasive procedures and continuous technological advancements. Patients and doctors are increasingly choosing minimally invasive atherectomy procedures because they enable clinicians to remove artery plaque without open surgery, which leads to shorter hospital stays, quicker recovery, fewer complications, and less discomfort for patients. At the same time, technology advancements including better imaging guidance, directional and rotating cutting mechanisms, and sophisticated catheter designs improve the accuracy, safety, and efficacy of procedures. These developments make it possible to treat previously difficult complex lesions like calcified or chronic complete occlusions.

Key Highlights

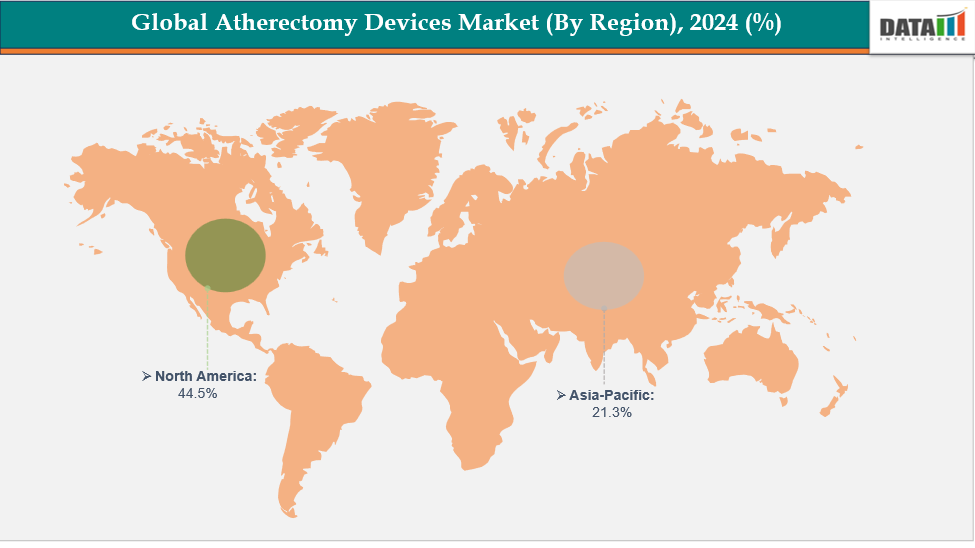

- North America is dominating the global atherectomy devices market with the largest revenue share of a 44.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

- The peripheral vascular applications segment form application is dominating the atherectomy devices market with a 52.3% share in 2024

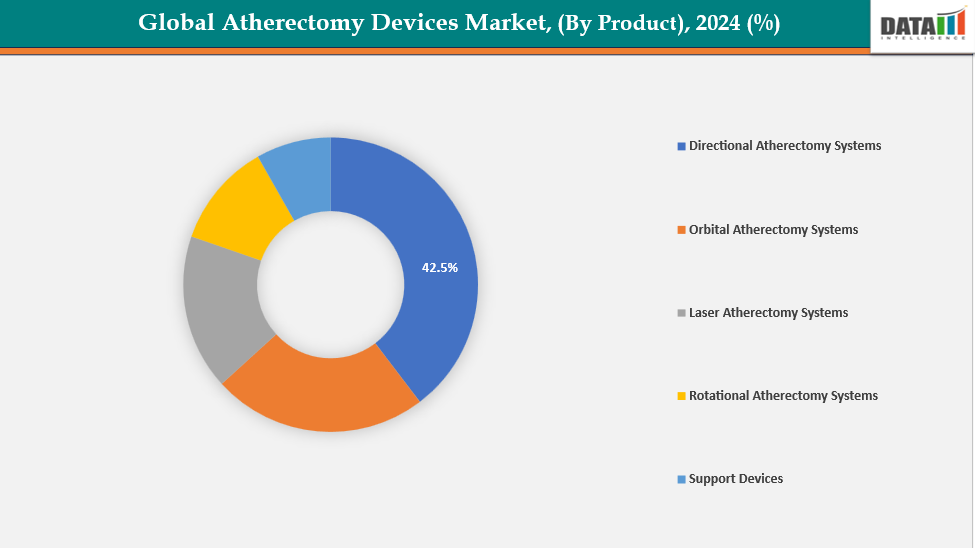

- The directional atherectomy systems segment from product is dominating the atherectomy devices market with a 42.5% share in 2024

- Top companies in the atherectomy devices market include Medtronic, Boston Scientific Corporation, Koninklijke Philips N.V., BD, Abbott, Veryan Medical, AngioDynamics, NIPRO, plusmedica.de, and Rex Medical, among others.

Market Dynamics

Drivers: Rising prevalence of cardiovascular diseases are accelerating the growth of the atherectomy devices market

The rising prevalence of cardiovascular diseases (CVDs), including coronary artery disease (CAD) and peripheral artery disease (PAD), is a major driver of the atherectomy devices market. Atherosclerotic plaques build up in arteries due to aging populations, sedentary lifestyles, obesity, and diabetes. This results in decreased blood flow and an elevated risk of heart attacks and strokes. By manually eliminating these plaques, restoring vascular patency, and enhancing patient outcomes, atherectomy devices serve a critical role.

Owing to these factors, like cardiovascular diseases, for instance, according to recent WHO and CDC data, cardiovascular diseases (CVDs) remain the leading global cause of death, with an estimated 19.8 million deaths in 2022, accounting for 32% of all deaths worldwide. Of these, 85% were due to heart attacks and strokes. In the United States alone, about 805,000 people experience a heart attack each year, including 605,000 first-time cases and 200,000 recurrent cases, underscoring the urgent need for effective prevention and treatment strategies for cardiac arrest and related conditions.

Restraints: The risk of procedural complications are hampering the growth of the atherectomy devices market

The risk of procedural complications is significantly hampering the growth of the atherectomy devices market. Even though atherectomy provides a less intrusive way to remove atherosclerotic plaque, there are still hazards involved, including the possibility of arterial dissection, perforation, distal embolization, and restenosis. The entire cost of treatment may rise as a result of these complications, which may also result in prolonged recovery periods, poor clinical outcomes, and the need for additional therapies.

Moreover, these risks may also be increased by procedural technique variance and a lack of operator experience. Alternative therapies like stenting or angioplasty may be preferred by hospitals and physicians because they are seen to be safer and more reliable.

For more details on this report, see Request for Sample

Segmentation Analysis

The global atherectomy devices market is segmented based on product, application, end user and region

By-Product: The directional atherectomy systems segment from product is dominating the atherectomy devices market with a 42.5% share in 2024

The directional atherectomy systems segment dominates the atherectomy devices market due to its high precision, effectiveness, and versatility in plaque removal. These devices are perfect for treating complicated and calcified lesions because they minimize vascular stress while selectively removing specific plaque using a cutting blade and collection chamber. Procedure results and patient safety are improved by their capacity to restore blood flow without the need for stents and to gather debris for analysis.

Moreover, the efficiency and deliverability of devices have been enhanced by technological breakthroughs made by major players like BD and Medtronic. The dominance of directed atherectomy systems in the global market is further supported by expanding use of minimally invasive endovascular procedures, new product innovations and clinical trials. For instance,

By Application: The peripheral vascular applications segment form application is dominating the atherectomy devices market with a 52.3% share in 2024

The peripheral vascular applications segment dominates the atherectomy devices market due to the high prevalence of peripheral artery disease (PAD), which affects over 200 million people globally, particularly older adults and individuals with diabetes or obesity. According to the MSD manual, the global prevalence of peripheral artery disease (PAD) is between 2 and 6% overall; prevalence increases to 15 to 20% after age 80.

Additionally, in order to restore blood flow and lessen symptoms like claudication, atherectomy devices are very effective at removing atherosclerotic plaques from peripheral arteries in the arms and legs. Because atherectomy offers faster recovery periods, fewer complication rates, and a lesser requirement for stents than traditional surgery, the preference for minimally invasive methods further propels acceptance.

Geographical Analysis

North America is dominating the global atherectomy devices market with a 44.5% in 2024

North America is expected to lead the global atherectomy devices market due to its advanced healthcare infrastructure, high prevalence of peripheral artery and cardiovascular diseases, and strong adoption of minimally invasive endovascular procedures. Increased need for safe, accurate, and efficient plaque-removal technologies fuels the region's market growth.

In the USA, the atherectomy devices market grows due to robust healthcare infrastructure, rising peripheral artery disease prevalence, and increasing regulatory approvals for endovascular and catheter-based procedures. For instance, in October 2023, Cardio Flow, Inc., a medical device company specializing in minimally invasive treatments for peripheral artery disease (PAD), received FDA 510(k) clearance for its FreedomFlow Orbital Atherectomy Peripheral Platform, enabling its clinical use in modifying and removing arterial plaque to restore blood flow in affected patients.

Europe is the second region after North America which is expected to dominate the global atherectomy devices market with a 33.5% in 2024

Europe’s atherectomy device market is expanding due to high disease awareness, advanced healthcare infrastructure, and widespread access to hospitals and clinics. Growth is further driven by company collaborations, strategic partnerships, and EU regulatory approvals, facilitating adoption of innovative atherectomy systems for peripheral, cardiovascular, and neurovascular applications. For instance, in September 2024, AngioDynamics, Inc. received European CE Mark approval for its Auryon Atherectomy System, enabling its use in treating peripheral artery disease (PAD), including critical limb ischemia (CLI) and in-stent restenosis (ISR), marking a significant advancement in minimally invasive vascular intervention in Europe.

Germany’s atherectomy devices market is driven by advanced healthcare infrastructure, robust regulatory support, and high public awareness. Widespread access through hospitals, clinics, and digital platforms, alongside government initiatives, ongoing research, and continuous technological innovation, is boosting adoption of atherectomy systems and supporting sustained market growth nationwide.

The Asia Pacific region is the fastest-growing region in the global with a CAGR of 7.7% in 2024

The Asia-Pacific including Japan, China, India, and South Korea, is growing due to rising peripheral artery disease awareness, urbanization, and improved healthcare access. Early intervention, treatment uptake, and improved management of vascular disorders are being propelled by government programs, public health campaigns, and developments in minimally invasive vascular devices.

China is a rapidly growing region in the global driven by increasing prevalence of peripheral and coronary artery diseases, rising physician awareness, and expanding healthcare infrastructure. Regulatory approvals from the National Medical Products Administration (NMPA), strategic partnerships, and adoption of advanced minimally invasive technologies are accelerating market growth nationwide. For instance, in January 2025, MicroPort RotaPace received market approval in China for its FireRaptor Integrated Coronary Rotational Atherectomy System, including the console, catheter, and guidewire, enabling clinical use for treating complex coronary artery lesions nationwide.

Competitive Landscape

Top companies in the atherectomy devices market include Medtronic, Boston Scientific Corporation, Koninklijke Philips N.V., BD, Abbott, Veryan Medical, AngioDynamics, NIPRO, plusmedica.de, and Rex Medical, among others.

Medtronic: Medtronic is a global medical technology leader, specializing in atherectomy devices for treating peripheral artery disease (PAD). Its directional systems, including SilverHawk, TurboHawk, and HawkOne, effectively remove plaque from blocked arteries, restoring blood flow while preserving vessel integrity. Widely used in above- and below-the-knee procedures, these devices address various plaque types, including severe calcification, reflecting Medtronic’s commitment to innovation and vascular care.

Key Developments:

- In January 2024, AngioDynamics, Inc. received FDA 510(k) clearance for its Auryon XL Catheter, a 225-cm radial access catheter, for use with the Auryon Atherectomy System, enabling minimally invasive treatment of peripheral arterial disease (PAD) and expanding clinical options for vascular intervention.

- In April 2023, Abbott completed the acquisition of Cardiovascular Systems, Inc. (CSI), making CSI a wholly owned subsidiary. CSI’s atherectomy systems, used to treat peripheral and coronary artery disease and prepare vessels for angioplasty or stenting, provided Abbott with a complementary solution for expanding its vascular disease treatment portfolio.

Market Scope

| Metrics | Details | |

| CAGR | 7.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | By-Product | Directional Atherectomy Systems, Orbital Atherectomy Systems, Laser Atherectomy Systems, Rotational Atherectomy Systems and Support Devices |

| By Application | Peripheral Vascular Applications, Cardiovascular Applications, Neurovascular Applications | |

| By End User | Hospitals, Surgical Centers, Ambulatory Care Centers, Research Laboratories and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global atherectomy devices market report delivers a detailed analysis with 56 key tables, more than 62 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here