Market Size

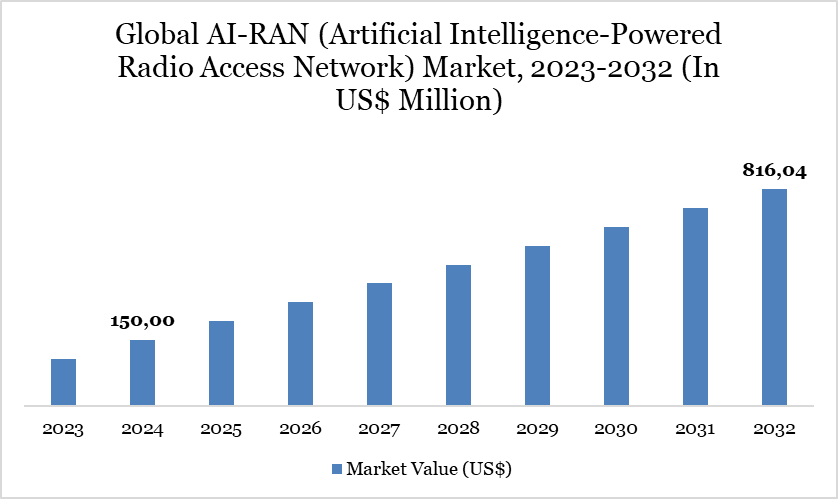

Global AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market reached US$ 150,00 million in 2024 and is expected to reach US$ 816,04 million by 2032, growing with a CAGR of 23.75% during the forecast period 2025-2032.

The The AI-RAN market is gaining strong traction as telecom operators and enterprises accelerate 5G deployments and prepare for 6G adoption. The integration of AI into RAN architectures enhances traffic prediction, resource optimization, energy efficiency, and network automation, enabling telecom providers to meet the surging demand for low-latency, high-capacity, and intelligent wireless connectivity.

Rising data traffic from AI-driven applications, IoT ecosystems, cloud gaming, and autonomous systems is fueling the adoption of AI-RAN across industries. Meanwhile, operators are embracing Open RAN (O-RAN) and Virtualized RAN (vRAN) architectures to reduce costs, increase interoperability, and gain network agility. However, challenges such as high implementation costs, interoperability issues, and security risks remain key restraints.

On the other hand, advancements in AI algorithms, edge computing, cloud-native architectures, and digital twin simulations are driving new opportunities, helping operators accelerate network automation and reduce operational expenditure. These innovations are positioning AI-RAN as a cornerstone of next-generation wireless infrastructure.

Global AI-RAN (Artificial Intelligence-Powered Radio Access Network) Market Trend

The global AI-RAN market is being shaped by several transformative trends. One of the most significant is the shift from traditional hardware-centric RANs to virtualized, software-defined, and cloud-native deployments. This transition is enabling telecom operators to achieve greater scalability, automation, and agility while reducing their reliance on proprietary hardware. At the same time, the integration of artificial intelligence (AI), the Internet of Things (IoT), and digital twin technologies is revolutionizing network planning and optimization. By virtually simulating real-world network conditions, telecom providers can test, refine, and optimize configurations without the need for costly and time-consuming physical trials, resulting in improved efficiency, faster deployments, and more predictable performance outcomes.

Another key trend driving the AI-RAN market is the growing emphasis on energy-efficient networks. With telecom infrastructure accounting for a significant share of global energy consumption, operators are increasingly adopting AI-powered solutions to dynamically manage power usage, reduce idle energy consumption, and support sustainability initiatives. Collectively, these trends are fueling the digital transformation of RAN systems, creating faster, smarter, and more reliable wireless connectivity while aligning with the industry’s broader push toward intelligent, autonomous, and environmentally sustainable networks.

Market Scope

Metrics | Details |

By Component | Software, Hardware, Services |

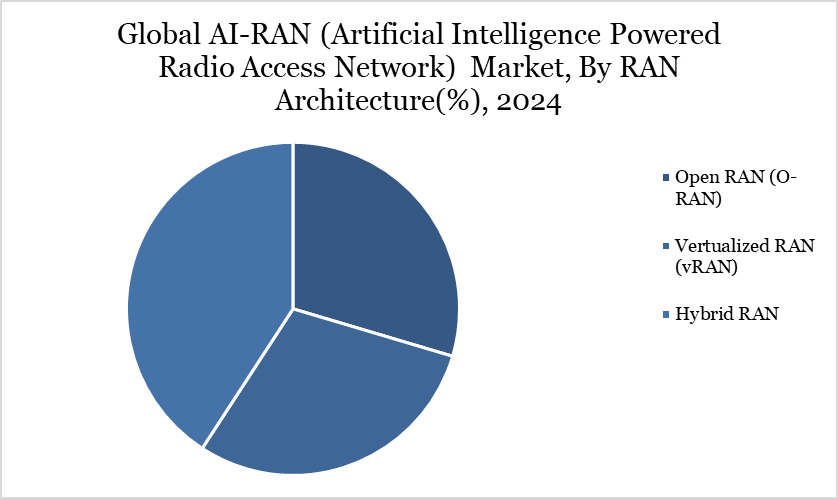

By RAN Architecture | Open RAN (O-RAN), Virtualized RAN (vRAN), Hybrid RAN |

By Deployment | On-premises, Cloud based |

By End-Users | Telecom Operators, Enterprises, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More detailed information Request free sample

Market Dynamics

Expanding 5G and 6G Networks Fueling AI-RAN Growth

The global acceleration of 5G rollouts and groundwork for 6G infrastructure are key forces propelling the AI-RAN market. Unlike conventional RAN, AI-RAN employs artificial intelligence to enhance spectrum efficiency, automate network operations, and support ultra-low-latency connectivity essential for advanced use cases such as autonomous mobility, smart manufacturing, cloud gaming, and immersiveAR/VR.

In North America and Europe, operators are adopting AI-enabled Open RAN (O-RAN) to cut costs and boost flexibility, while Asian telecom leaders are turning to AI-driven vRAN solutions to address surging data traffic. As demand for intelligent, adaptive, and energy-efficient networks intensifies, AI-RAN is becoming a cornerstone of next-generation connectivity.

Interoperability Challenges and High Costs as Market Restraints

Although the AI-RAN market holds strong potential, it faces significant restraints due to interoperability issues, high deployment costs, and security concerns. Telecom operators often operate with a mix of legacy hardware and modern software-defined systems, making the integration of AI-driven RAN architectures complex.

For instance, while the O-RAN Alliance promotes vendor interoperability, real-world deployments still demand extensive customization and integration. Moreover, shifting to AI-enabled and virtualized architectures requires substantial upfront investments in edge computing, cloud infrastructure, and AI models—costs that may be prohibitive for smaller operators. Cybersecurity risks further add to the challenge, as AI-driven RAN expands the attack surface of critical telecom infrastructure.

Segmentation Analysis

The global AI-RAN (Artificial Intelligence Powered Radio Access Network) Market is segmented based on Component, RAN architecture, deployment, end-users and region.

Open RAN (O-RAN) as the Core Driver of AI-RAN Market Demand

Open RAN (O-RAN) is a major driver of the AI-RAN market, accounting for the largest share of deployments as telecom operators worldwide push toward network openness, flexibility, and cost efficiency. With rising demand for advanced connectivity, especially in regions like Asia Pacific, North America, and Europe, O-RAN adoption has accelerated to reduce reliance on proprietary hardware and enable multi-vendor ecosystems.

For instance, the O-RAN Alliance, supported by leading operators such as AT&T, Vodafone, NTT DoCoMo, and China Mobile, has established global standards for interoperability and modular architectures, enabling faster integration of AI-driven RAN solutions. In the United States, major carriers are deploying AI-enabled O-RAN platforms to improve spectrum utilization, reduce operational costs, and enhance network agility. Similarly, in Europe, regulatory push for vendor diversification has boosted O-RAN adoption, with operators investing in AI-powered network optimization.

In Asia Pacific, countries like Japan and India are aggressively adopting O-RAN architectures to accelerate 5G rollouts, improve energy efficiency, and handle surging data traffic. This shift is also encouraging local ecosystem development, with new players entering the market for software, hardware, and AI integration.

The growing global adoption of cloud-native O-RAN deployments further strengthens its role, as operators look for scalable and adaptive networks to support use cases such as autonomous mobility, industrial automation, and immersive AR/VR experiences. Moreover, with AI integration, O-RAN is enabling real-time traffic management, predictive maintenance, and power optimization, making it a cornerstone of intelligent and sustainable telecom networks.

Overall, Open RAN (O-RAN) continues to dominate AI-RAN demand, establishing itself as a central growth engine for the market by driving openness, innovation, and cost competitiveness.

Geographical Penetration

Asia Pacific Emerging as the Global Growth Hub for AI-RAN Market

Asia Pacific (APAC) is emerging as the fastest-growing hub for the AI-RAN market, driven by large-scale 5G deployments, government-led digital infrastructure programs, and the strong presence of telecom giants in the region. Countries like China, Japan, South Korea, and India are leading in both telecom investments and AI adoption, creating massive opportunities for AI-powered Radio Access Networks.

China is spearheading the rollout of 5G and early 6G pilots, with operators like China Mobile and Huawei driving innovation in AI-powered Open RAN (O-RAN) and virtualized RAN (vRAN) solutions. Japan, backed by initiatives from NTT DoCoMo and Rakuten, is advancing in cloud-native and software-defined network deployments, focusing heavily on AI-based network optimization and energy efficiency. South Korea remains at the forefront of ultra-low latency use cases such as AR/VR, cloud gaming, and autonomous mobility, accelerating demand for AI-enabled RAN intelligence.

India is rapidly scaling its 5G infrastructure with operators like Reliance Jio and Bharti Airtel, supported by government-backed digitalization initiatives. The region’s massive mobile user base and rising data consumption are fueling investments in AI-integrated RAN solutions for spectrum management, traffic balancing, and customer experience enhancement.

Additionally, APAC’s position as a manufacturing and innovation hub for telecom hardware and AI software ecosystems further strengthens its dominance. With strong government backing, increasing urbanization, and an expanding user base demanding next-gen connectivity, Asia Pacific is set to remain the central growth engine of the global AI-RAN market, outpacing North America and Europe in both adoption speed and scale..

Technological Analysis

Technological advancements are reshaping the robotics market by enabling higher efficiency, precision, and versatility across industries. Artificial Intelligence (AI) and Machine Learning (ML) are powering smarter robots capable of adaptive learning, predictive maintenance, and autonomous decision-making. Collaborative robots (cobots) are gaining traction with advanced sensors and safety systems that allow seamless human–machine interaction. Integration of the Internet of Things (IoT) is enhancing connectivity, enabling real-time monitoring, predictive analytics, and remote operations.

Advances in vision systems, haptics, and motion control are driving innovations in handling, assembling, welding, and cleanroom applications. The rise of lightweight materials and energy-efficient actuators is making robots more sustainable and cost-effective. Cloud robotics and edge computing are further optimizing data processing and reducing latency in robotic operations. With increasing adoption of electric and autonomous systems, robotics technologies are accelerating automation across automotive, electronics, and healthcare sectors while supporting the transition toward intelligent, connected manufacturing.

Competitive Landscape

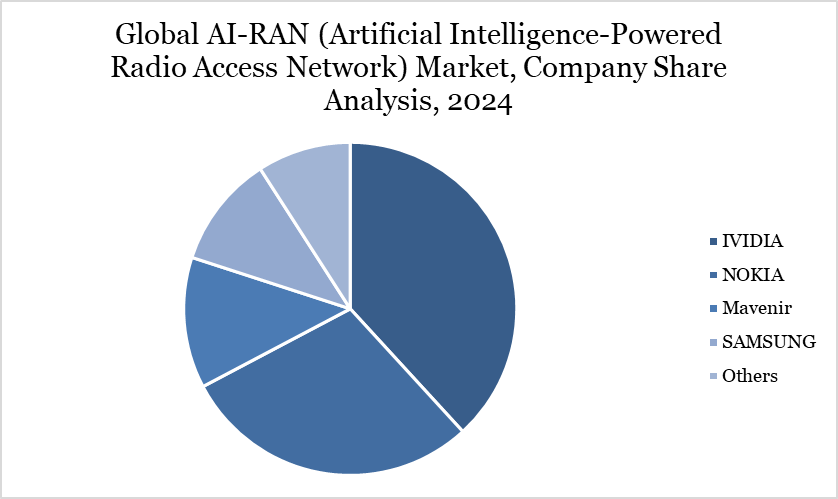

The major global players in the market include NVIDIA, NOKIA, Mavenir, SAMSUNG, NEC Corporation, FUJITSU, ZTE Corporation, VIAVI SOLUTIONS INC., Radisys, Telefonaktiebolaget LM Ericsson and among others.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies