Anticoccidial Drugs Market Size & Industry Outlook

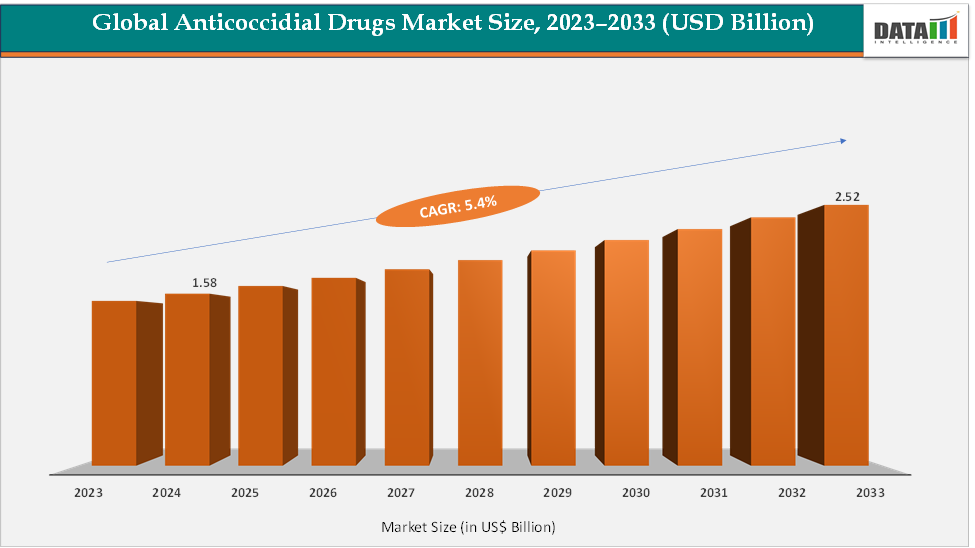

The global anticoccidial drugs market size reached US$ 1.58 Billion in 2024 from US$ 1.51 Billion in 2023 and is expected to reach US$ 2.52 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033. Rising vaccine adoption and biological alternatives (live attenuated/recombinant vaccines, phytogenics) reflect efforts to manage drug resistance and meet stricter residue/animal-welfare requirements. Market dynamics are being reshaped by concerns over antimicrobial resistance and consumer pressure for “antibiotic-free” products, which accelerate the uptake of live vaccines, phytogenic supplements, probiotics, and tailored vaccination programs. Competitive dynamics feature large animal-health multinationals and specialist feed-additive firms supplying ionophores, synthetics, vaccines, and functional-feed alternatives, driving consolidation, premix partnerships, and innovation around non-chemical control strategies.

Key Market Highlights

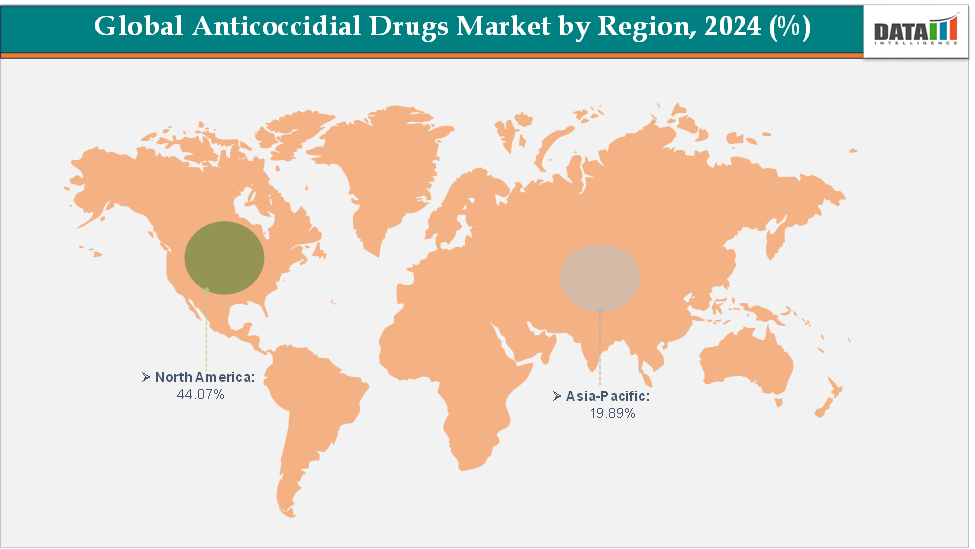

North America dominates the anticoccidial drugs market with the largest revenue share of 44.07% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.7% over the forecast period.

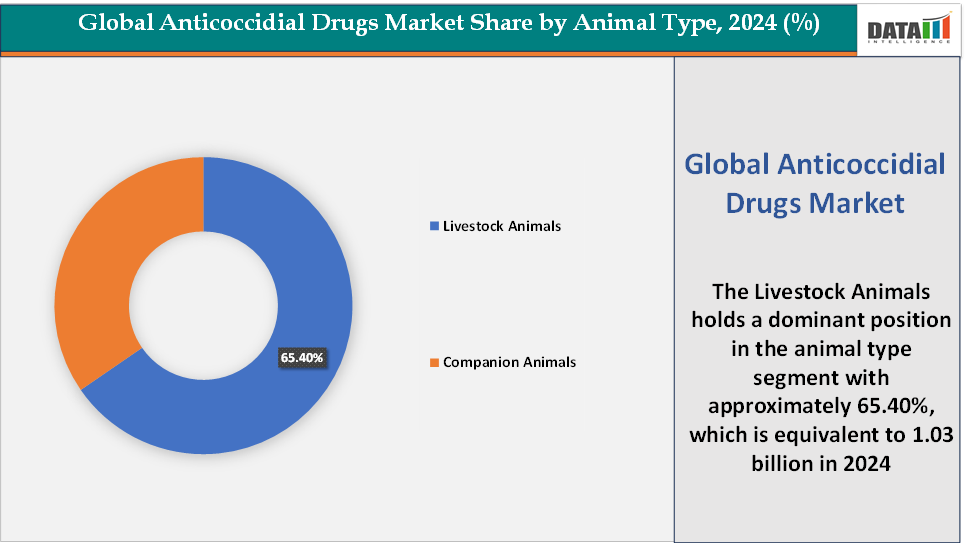

Based on animal type, the livestock animals segment led the market with the largest revenue share of 65.40% in 2024.

The major market players in the anticoccidial drugs market are Merck & Co., Inc., Boehringer Ingelheim Animal Health USA Inc., Elanco, Ceva, Huvepharma, Vetoquinol, Virbac, and Zoetis Inc., among others

Market Dynamics

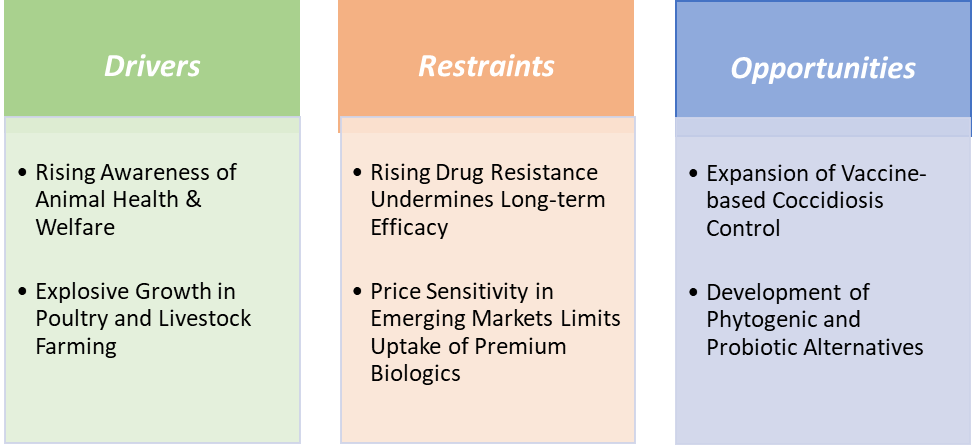

Drivers:Rising awareness of animal health & welfare is significantly driving the anticoccidial drugs market growth

Rising awareness of animal health and welfare is playing a pivotal role in driving the growth of the anticoccidial drugs market, particularly as producers, regulators, and consumers increasingly prioritize disease prevention, food safety, and ethical farming practices. Coccidiosis remains one of the most economically devastating parasitic diseases in poultry and livestock. As consumers demand higher standards of welfare and antibiotic-free meat, producers are under pressure to adopt reliable, safe, and residue-free solutions to maintain flock health. This shift is boosting the adoption of coccidiosis vaccines such as HIPRACOX (HIPRA) and Zoetis’s Poulvac Eimeria, which provide preventive protection without contributing to antimicrobial resistance, aligning with both welfare and regulatory goals.

At the same time, precision delivery technologies, such as automated in-ovo vaccination systems capable of inoculating up to 60,000 chicks per hour, ensure consistent protection at scale while reducing animal stress and handling risks. Welfare-focused certifications and retailer-driven antibiotic-free programs further reinforce this demand, as integrators must implement robust coccidiosis control to safeguard both flock well-being and product marketability.

Moreover, emerging economies in Asia-Pacific and Latin America, where poultry consumption is rising rapidly, are also witnessing increasing uptake of vaccines and biologics, supported by government and industry campaigns promoting animal welfare. This convergence of consumer awareness, welfare regulations, and corporate sustainability commitments is transforming anticoccidial strategies from purely productivity-driven interventions to holistic welfare-centered health programs, thereby significantly accelerating the market’s growth trajectory.

Restraints:Rising drug resistance undermines long-term efficacy is hampering the growth of the market

Rising drug resistance in Eimeria parasites is a major restraint hampering the long-term growth of the anticoccidial drugs market, as it directly undermines the efficacy of widely used ionophores and synthetic chemicals. Continuous and repeated use of these drugs in feed programs has led to the emergence of resistant strains, reducing their effectiveness in preventing coccidiosis outbreaks. For instance, resistance to monensin and salinomycin, two of the most commonly used ionophores, has been documented in commercial poultry operations worldwide, forcing producers to rotate or combine products more frequently to maintain flock protection.

Similarly, resistance to synthetic compounds such as diclazuril and nicarbazin has been reported, limiting their long-term viability and prompting a need for integrated control programs. This escalating resistance not only increases the cost of disease management but also shortens the commercial lifespan of established drugs, discouraging investment in new molecule development, given the high R&D and regulatory costs involved.

Producers are compelled to adopt shuttle or rotation programs, alternating between different drug classes or combining them with vaccines, but even these strategies provide only temporary relief as resistance continues to evolve. The result is a cycle where farmers face recurring outbreaks despite prophylaxis, reducing confidence in traditional drug solutions and shifting demand toward non-chemical alternatives such as vaccines and phytogenic feed additives. Consequently, while the market is still dependent on conventional anticoccidials for volume, resistance issues are eroding their effectiveness, straining profitability for manufacturers, and acting as a significant brake on overall market expansion.

For more details on this report – Request for Sample

Anticoccidial Drugs Market, Segment Analysis

The global anticoccidial drugs market is segmented based on animal type, product type, route of administration, distribution channel, and region.

Animal Type:The livestock animals segment is dominating the anticoccidial drugs market with a 65.40% share in 2024

The livestock animals segment, particularly poultry, dominates the global anticoccidial drugs market because coccidiosis is one of the most common and economically damaging parasitic diseases in food-producing animals. Poultry farming alone accounts for billions of birds globally, and outbreaks of Eimeria can cause high mortality, poor feed conversion, and significant financial losses if untreated. As a result, anticoccidials are routinely incorporated into feed or water as prophylaxis in commercial broiler and layer operations, making poultry the single largest end-user of these drugs. Ionophores such as monensin, lasalocid, and salinomycin remain standard in-feed additives, while synthetic drugs like nicarbazin, diclazuril, and toltrazuril are used in shuttle programs to delay resistance.

Recent launches highlight the emphasis on livestock health. For instance, in January 2024, Boehringer Ingelheim launched Vaxxilive Cocci 3, a poultry coccidiosis vaccine previously known as Hatchpak Cocci III. VAXXILIVE COCCI 3 is a tool for the prevention of coccidiosis and a biological alternative to in-feed anticoccidial drugs. The vaccine works to stimulate the bird’s natural immune response while minimizing tissue damage. VAXXILIVE COCCI 3 is tough on coccidiosis and gentle on birds. The vaccine contains the same proven formula producers have come to rely on, including three genetically stable precocious strains of the important Eimeria species that affects broilers. With shortened life cycles, precocious strains can achieve immunity earlier than non-precocious strains.

Beyond poultry, cattle and swine also contribute to livestock dominance, with products like amprolium-based therapies widely used for calves. The segment’s strength is further reinforced by intensification in emerging economies, where governments and producers are investing in modern veterinary practices to meet rising protein demand. In contrast, the companion animal segment remains niche, limited to treatments for pets and small mammals, and lacks the scale and consistent prophylactic use seen in livestock. This structural reliance on anticoccidials for food security and farm profitability ensures that livestock animals remain the dominant segment, driving innovation and shaping product portfolios in the market.

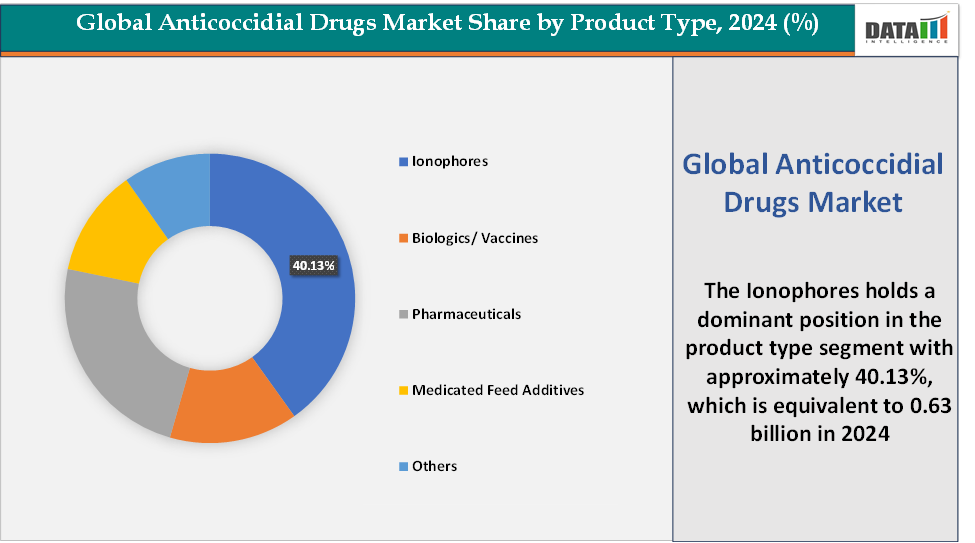

Product Type:The ionophores segment is dominating the anticoccidial drugs market with a 40.13% share in 2024

The ionophores segment dominates the anticoccidial drugs market because these compounds have long been the cornerstone of coccidiosis prevention in intensive poultry and livestock production. Ionophores such as monensin, salinomycin, narasin, and lasalocid are widely used as in-feed additives due to their proven efficacy, cost-effectiveness, and ability to improve feed conversion ratios alongside parasite control. They are especially valuable in large-scale poultry farming, where continuous prophylactic use is essential to prevent outbreaks in high-density housing environments.

Unlike many synthetic anticoccidials, ionophores are less prone to rapid resistance development when used in shuttle or rotation programs, making them reliable tools for long-term management. Their dual role in enhancing growth performance and disease control has entrenched their use in regions like North America and Asia-Pacific, where poultry production is most intensive. Even as vaccines and phytogenic alternatives grow, ionophores remain the largest product class by market share, contributing over half of global anticoccidial drug sales in recent years. Their scalability, cost advantage, and regulatory acceptance in key poultry-producing regions ensure that ionophores will continue to dominate the market in the near term, though complemented increasingly by biologics and natural feed additives as part of integrated coccidiosis control programs.

Geographical Analysis

North America is expected to dominate the global anticoccidial drugs market with a 44.07% in 2024

North America holds a dominant position in the global anticoccidial drugs market, primarily driven by its large-scale, industrialized poultry and livestock industries, stringent animal health standards, and high per-animal healthcare spending. Supportive regulatory frameworks, a well-developed veterinary infrastructure, and high awareness among producers reinforce North America’s dominance.

US Anticoccidial Drugs Market Trends

The region also leads in the adoption of coccidiosis vaccines, with products such as Zoetis’s Poulvac Eimeria and Merck’s Coccivac widely used by integrators aiming to meet consumer and retailer demand for antibiotic-free and welfare-friendly meat products. Recent innovations, including automated in-ovo vaccination technologies that immunize chicks before hatching, have seen strong uptake in the US, improving efficiency and coverage while reducing handling stress. Furthermore, US feed companies are at the forefront of launching phytogenic and probiotic-based anticoccidial alternatives, reflecting the region’s rapid pivot toward sustainable and residue-free approaches.

The Asia Pacific region is the fastest-growing region in the global anticoccidial drugs market, with a CAGR of 5.7% in 2024

The Asia-Pacific region is the fastest-growing market for anticoccidial drugs, fueled by rapid urbanization, rising disposable incomes, and increasing demand for affordable animal protein, especially poultry and swine. Countries such as China, India, and Japan are experiencing sharp growth in commercial poultry production, where high stocking densities make coccidiosis prevention a critical priority. This has led to widespread use of ionophores like salinomycin and monensin in feed, alongside synthetic options such as diclazuril and nicarbazin, which remain essential tools for large-scale broiler operations.

At the same time, the region is witnessing rapid adoption of coccidiosis vaccines, with companies like HIPRA expanding access to HIPRACOX and Zoetis introducing its Poulvac Eimeria vaccine portfolio in Asian markets to support the shift toward antibiotic-free poultry production. Local feed manufacturers are also investing in phytogenic feed additives and probiotics, with recent launches in India and China targeting gut health and parasite resistance management, highlighting the growing demand for sustainable alternatives.

Europe Anticoccidial Drugs Market Trends

The anticoccidial drugs market in Europe is witnessing strong momentum, primarily driven by a combination of stringent regulatory frameworks, rising consumer preference for antibiotic-free protein, and the rapid adoption of innovative prevention technologies. Unlike other regions, Europe enforces some of the world’s strictest restrictions on antibiotic usage in livestock, which has accelerated the transition from traditional chemoprophylaxis toward vaccines and biologics. A notable example is HIPRA’s launch of the in-ovo vaccine Evanovo, specifically designed for European poultry producers seeking residue-free and welfare-friendly solutions.

Adoption of in-ovo and spray vaccination technologies has further gained traction, allowing hatcheries to immunize thousands of chicks efficiently while improving uniformity and reducing stress compared to post-hatch treatments. At the same time, demand for phytogenic and probiotic feed additives is surging, with the European phytogenic feed market, as producers increasingly integrate essential oils, saponins, and direct-fed microbials to control coccidiosis and promote gut health naturally. The region’s strong feed production base, coupled with modernization efforts in poultry farming, has created scalable distribution channels for medicated feed additives, vaccines, and natural products alike.

Competitive Landscape

Top companies in the anticoccidial drugs market include Merck & Co., Inc., Boehringer Ingelheim Animal Health USA Inc., Elanco, Ceva, Huvepharma, Vetoquinol, Virbac, Zoetis Inc., and HIPRA, among others.

Market Scope

Metrics | Details | |

CAGR | 5.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Animal Type | Livestock Animals and Companion Animals |

Product Type | Ionophores, Biologics/ Vaccines, Pharmaceuticals, Medicated Feed Additives, and Others | |

Route of Administration | Oral, Injectable, and Others | |

Distribution Channel | Veterinary Hospitals & Clinics, E-commerce, Retail Stores, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global anticoccidial drugs market report delivers a detailed analysis with 67 key tables, more than 63 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more veterinary health-related reports, please click here