Ambulatory Blood Pressure Monitoring Devices Market Size & Industry Outlook

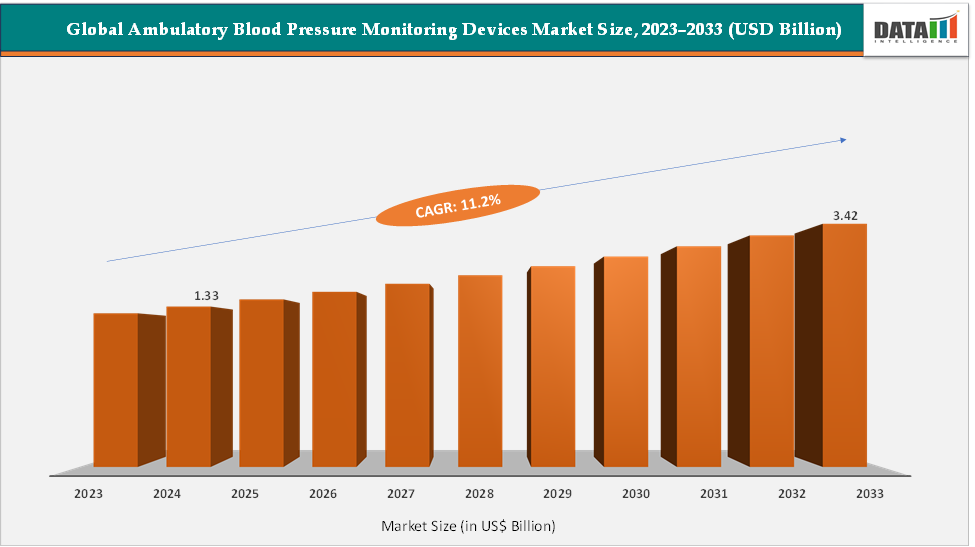

The global ambulatory blood pressure monitoring (ABPM) devices market size reached US$ 1.33 Billion in 2024 from US$ 1.21 Billion in 2023 and is expected to reach US$ 3.42 Billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025-2033. The market is experiencing strong growth driven by the rising global prevalence of hypertension, the clinical shift toward out-of-office BP monitoring, and increasing guideline-mandated use of ABPM to diagnose white-coat and masked hypertension.

Advances in validated, compact, and connected devices such as the Spacelabs OnTrak 90227, SunTech Oscar 2, and Mobil-O-Graph NG have enhanced accuracy, comfort, and remote data transmission, boosting adoption by hospitals and primary care clinics. Furthermore, FDA/CE-approved innovations like Omron’s connected monitors are expanding remote-patient-monitoring programs, supporting better cardiovascular management and sustained market expansion.

Key Market Highlights

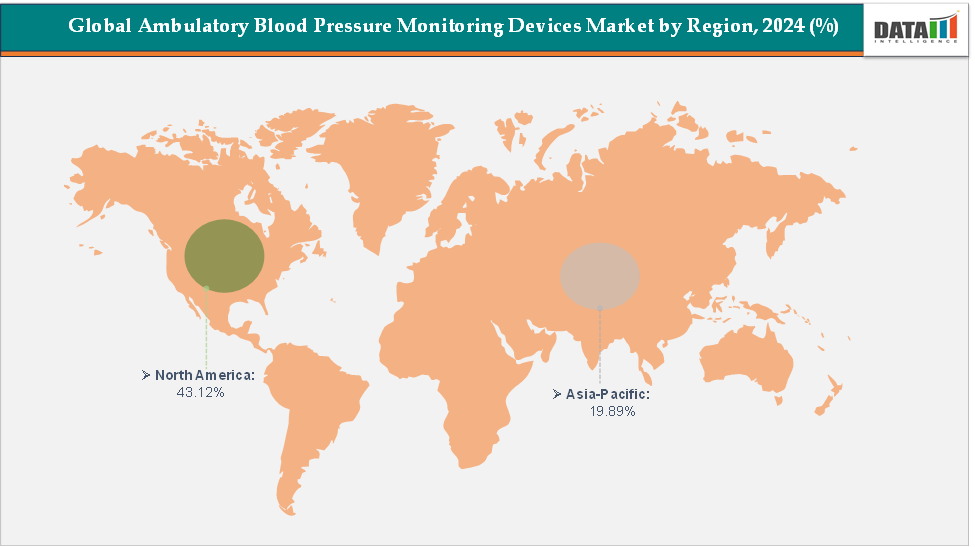

- North America dominates the ambulatory blood pressure monitoring devices market with the largest revenue share of 43.12% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 11.7% over the forecast period.

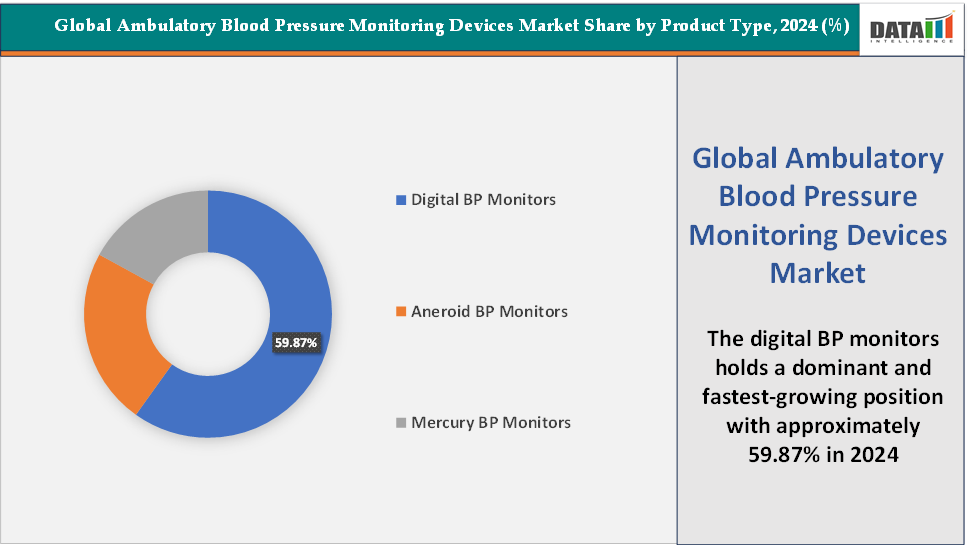

- Based on product type, the digital BP monitors segment led the market with the largest revenue share of 59.87% in 2024.

- The major market players in the ambulatory blood pressure monitoring devices market are OMRON Healthcare, Inc., Hill-Rom Holdings, Inc., Spacelabs Healthcare, A&D Company, SCHILLER AG, Nihon Kohden Corporation, CONTEC MEDICAL SYSTEMS CO., LTD, Withings, SunTech Medical, Inc., and Numed Holdings Ltd, among others

Market Dynamics

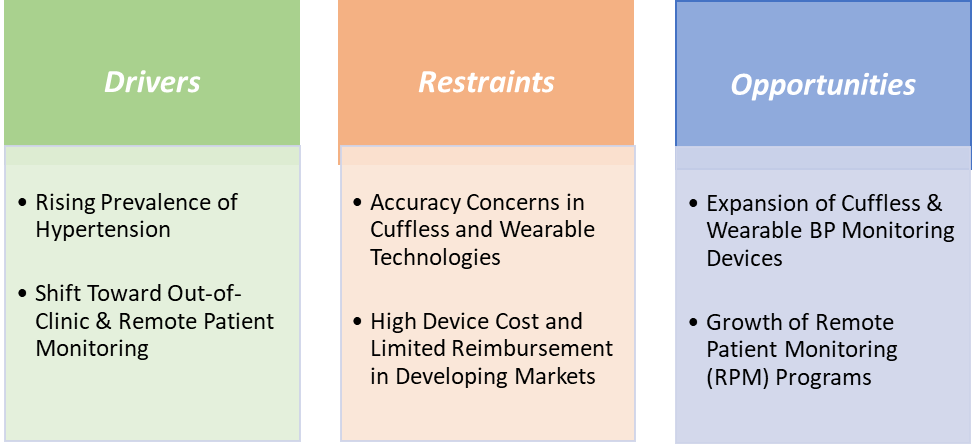

Drivers: Rising prevalence of hypertension is significantly driving the ambulatory blood pressure monitoring devices market growth

The rising prevalence of hypertension is one of the most significant drivers of the ambulatory blood pressure monitoring (ABPM) devices market. Hypertension is a major risk factor for cardiovascular diseases, stroke, and kidney failure, making accurate diagnosis and continuous monitoring critical for preventing complications. Traditional in-clinic measurements are often insufficient due to white-coat hypertension or masked hypertension, which can lead to misdiagnosis or suboptimal treatment. ABPM devices, which provide 24-hour blood pressure profiles, allow clinicians to capture fluctuations throughout the day and night, giving a more reliable picture of a patient’s cardiovascular health.

According to the World Health Organization (WHO), an estimated 1.4 billion adults aged 30–79 years worldwide had hypertension in 2024; this represents 33% of the popluation in this age range. Two-thirds of adults aged 30–79 years who have hypertension live in low- and middle-income countries. An estimated 600 million adults with hypertension (44%) are unaware that they have the condition. Approximately 630 million adults with hypertension (44%) are diagnosed and treated. Approximately 320 million adults with hypertension (23%) have it under control. Hypertension is a major cause of premature death worldwide. One of the global targets for noncommunicable diseases is to reduce the prevalence of uncontrolled hypertension by 25% between 2010 and 2025.

Restraints: Accuracy concerns in cuffless and wearable technologies is hampering the growth of the market

The accuracy concerns in cuffless and wearable blood pressure monitoring technologies are a significant restraint on the growth of the market. Unlike traditional cuff-based ABPM devices, which have long been clinically validated against mercury sphygmomanometers, cuffless devices rely on optical sensors, photoplethysmography (PPG), ECG, or algorithmic estimations to measure blood pressure continuously. These measurements can be influenced by factors such as skin tone, wrist or arm position, motion artifacts, ambient light, and vascular stiffness, leading to variability in readings and potential clinical inaccuracy. For instance, devices like Aktiia Bracelet and Withings ScanWatch have received CE approval for consumer use, but their accuracy in clinical hypertensive populations remains a concern, limiting adoption in hospital and primary care settings.

As a result, clinicians often prefer traditional oscillometric ABPM devices, such as Spacelabs OnTrak 90227 or SunTech Oscar 2, which offer validated 24-hour readings, reducing the market penetration of cuffless alternatives. Furthermore, inconsistent accuracy across different patient demographics and activity levels undermines confidence in wearable devices for chronic disease management, slowing their integration into remote patient monitoring programs. This technological limitation also affects insurance reimbursement and institutional adoption, as payers and hospitals require validated, reliable measurements for diagnostic and therapeutic decision-making. Therefore, despite the convenience and growing consumer interest in wearables, accuracy concerns remain a critical barrier, restraining the adoption of next-generation ABPM technologies and slowing overall market growth.

For more details on this report – Request for Sample

Segmentation Analysis

The global ambulatory blood pressure monitoring devices market is segmented based on product type, operation, and region.

Product Type: The digital BP monitors segment is dominating and fastest-growing in the ambulatory blood pressure monitoring devices market with a 59.87% share in 2024

The digital blood pressure (BP) monitors segment is both the dominant and fastest-growing segment in the ambulatory blood pressure monitoring (ABPM) devices market due to a combination of ease of use, clinical validation, technological advancements, and expanding home healthcare adoption. Unlike mercury or aneroid devices, digital monitors offer automatic inflation and deflation, memory storage, and sometimes wireless connectivity, making them convenient for both clinical and home settings.

Moreover, innovations in cuffless digital devices and AI-enabled analytics are further attracting attention, though traditional validated digital monitors remain the backbone of the market. For instance, in September 2025, Sky Labs announced the official launch of CART BP, a ring-type cuffless blood pressure monitor designed for everyday use. Worn on the finger, CART BP enables 24-hour blood pressure monitoring, including during sleep. The device has been approved by Korea's Ministry of Food and Drug Safety (MFDS) and was developed based on the clinically validated technology of CART BP pro, Sky Labs' professional model adopted by hospitals as an ambulatory blood pressure monitoring (ABPM) device.

Additionally, in October 2025, Huawei launched a smartwatch equipped with blood pressure monitoring in India, with industry watchers expecting the device to be the HUAWEI Watch D2 or a similar model. The device employs a method closer to clinical cuff-based monitors, allowing users to perform both single-time checks and 24-hour ambulatory blood pressure tracking. This dual advantage of wide acceptance in clinical practice and fast adoption in home and remote monitoring explains why digital BP monitors dominate the ABPM market and exhibit the highest CAGR compared to aneroid and mercury segments.

Geographical Analysis

North America is expected to dominate the global ambulatory blood pressure monitoring devices market with a 43.12% in 2024

North America is expected to dominate the global ambulatory blood pressure monitoring (ABPM) devices market due to a combination of high healthcare expenditure, advanced healthcare infrastructure, favorable reimbursement policies, and strong regulatory frameworks. The region has widespread adoption of guideline-recommended BP monitoring, with the American Heart Association (AHA) and other professional bodies advocating the use of ABPM for accurate diagnosis and management of hypertension.

US Ambulatory Blood Pressure Monitoring Devices Market Trends

The presence of major ABPM players such as Spacelabs Healthcare (OnTrak 90227), SunTech Medical (Oscar 2), Omron Healthcare (VitalSight), and A&D Medical (TM-2441 series), all with FDA 510(k) clearance, ensures availability of validated and clinically trusted devices. Moreover, the Medicare reimbursement for 24-hour ABPM (CPT 93784/93786) incentivizes hospitals, primary care clinics, and cardiology practices to adopt these devices. Integration with remote patient monitoring platforms further drives adoption, as digital ABPM devices allow clinicians to manage hypertensive patients outside traditional hospital settings.

High patient awareness and growing demand for home-based and connected monitoring solutions also support market growth. Additionally, continuous innovation in wearable and connected ABPM devices by companies such as Omron and Spacelabs reinforces the US leadership in both unit sales and technological adoption. Consequently, the combination of clinical guidelines, reimbursement policies, technological innovation, and patient-centric healthcare models positions US as the largest and most influential market for ABPM devices worldwide.

The Asia Pacific region is the fastest-growing region in the global ambulatory blood pressure monitoring devices market, with a CAGR of 11.7% in 2024

The Asia Pacific (APAC) region is emerging as the fastest-growing market for ambulatory blood pressure monitoring (ABPM) devices, driven by a combination of rising hypertension prevalence, increasing healthcare investments, and growing adoption of advanced medical technologies. The region faces a substantial burden of hypertension, with prevalence rates ranging from 10.6% to 48.3% across different countries, and localized studies, such as in Mizoram, India, reporting rates as high as 33.6% in males and 23.4% in females, surpassing national averages. This escalating prevalence is coupled with growing awareness of cardiovascular risks, prompting a heightened demand for accurate and continuous blood pressure monitoring solutions.

Despite this need, ABPM and home BP monitor usage remains relatively low in several countries, with penetration rates around 6%, though adoption has been gradually increasing due to awareness campaigns and improved healthcare accessibility. The growth is further supported by government initiatives and public health programs aimed at early detection and management of hypertension, as well as by the rising adoption of digital health platforms and telemedicine solutions that enable remote patient monitoring and real-time data analysis.

Europe Ambulatory Blood Pressure Monitoring Devices Market Trends

The European ambulatory blood pressure monitoring (ABPM) devices market is experiencing robust growth, driven by a combination of increasing hypertension prevalence, technological advancements, and supportive healthcare policies. Europe faces a rising burden of hypertension, with many countries reporting prevalence rates above 30% among adults, creating a strong need for accurate, continuous blood pressure monitoring to prevent cardiovascular complications. Technological innovation has significantly contributed to market expansion, with devices such as Meditech ABPM-06, which is CE-certified and FDA-approved, offering advanced features like SleepWell technology, voice recording, and customizable programming, enhancing patient comfort and diagnostic accuracy.

Moreover, the expansion of remote patient monitoring (RPM) programs and telemedicine platforms has accelerated the uptake of portable, connected ABPM devices, enabling patients to monitor their blood pressure at home and transmit data to clinicians in real-time, thereby improving treatment adherence and outcomes. The combined impact of rising hypertension prevalence, innovations in digital and wearable ABPM technologies, increasing physician awareness, and supportive regulatory and reimbursement frameworks positions Europe as a key driver of global ABPM market growth, with the region poised to maintain leadership in both technological adoption and clinical utilization.

Competitive Landscape

Top companies in the ambulatory blood pressure monitoring devices market include OMRON Healthcare, Inc., Hill-Rom Holdings, Inc., Spacelabs Healthcare, A&D Company, SCHILLER AG, Nihon Kohden Corporation, CONTEC MEDICAL SYSTEMS CO., LTD, Withings, SunTech Medical, Inc., and Numed Holdings Ltd, among others.

Market Scope

| Metrics | Details | |

| CAGR | 11.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Digital BP Monitors, Aneroid BP Monitors, and Mercury BP Monitors |

| Operation | Automatic, Semi-Automatic, and Manual | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global ambulatory blood pressure monitoring devices market report delivers a detailed analysis with 54 key tables, more than 42 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here