Overview

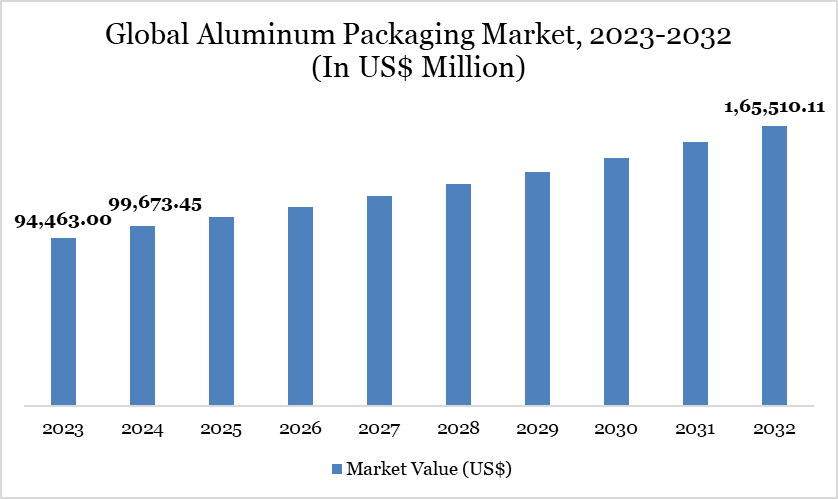

The global aluminum packaging market reached US$99,673.45 million in 2024 and is expected to reach US$1,65,510.11 million by 2032, growing at a CAGR of 6.66% during the forecast period 2025-2032.

The aluminum packaging market is primarily driven by the growing demand for sustainable and recyclable packaging solutions across industries such as food & beverages, pharmaceuticals, and personal care. Aluminum’s lightweight, durable, and corrosion-resistant properties make it ideal for cans, foils, and containers, while consumer preference for ready-to-eat and convenience products is boosting adoption. According to Metal Packaging Europe (MPE), the global demand for aluminum beverage cans is projected to rise from 420 billion units in 2020 to 630 billion by 2030, reflecting this growing market need.

The market is witnessing steady growth, with recycling initiatives playing a key role in its expansion. Recycling all cans by 2030 could save 60 million tonnes of greenhouse gas emissions annually, highlighting aluminum’s environmental advantages. Industry and governments are being urged to increase recycling rates to at least 80% by 2030 and strive for nearly 100% by 2050, reinforcing the market’s sustainability focus. Technological advancements in aluminum packaging design and production further enhance product appeal, enabling the market to grow both in volume and value while addressing environmental concerns.

Aluminum Packaging Market Trend

The aluminum packaging market is increasingly shaped by the demand for sustainable and recyclable solutions, as manufacturers and consumers prioritize eco-friendly materials. Growing consumer preference for convenience foods and beverages is driving innovation in can and foil designs, while technological advancements are enhancing both functionality and aesthetic appeal. Additionally, global initiatives to increase recycling rates and reduce greenhouse gas emissions are reinforcing aluminum’s position as a preferred packaging material across industries.

Market Scope

Metrics | Details |

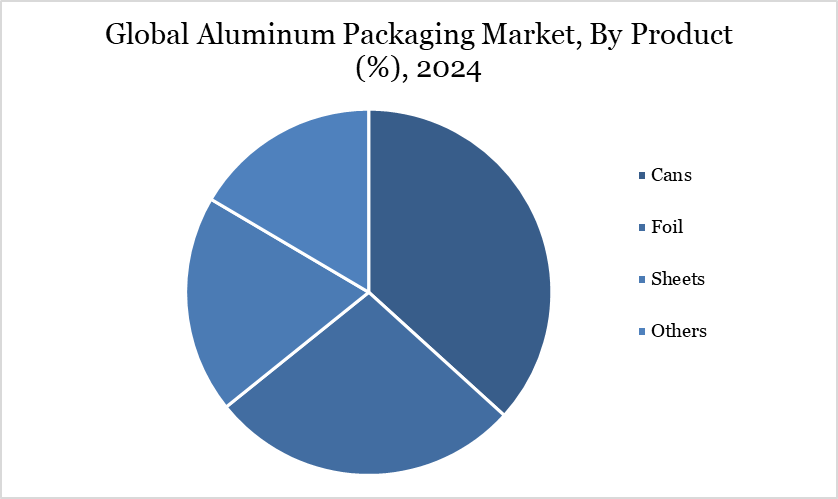

By Product | Cans, Foil, Sheets, Others |

By Type | Rigid Packaging, Flexible Packaging |

By End-User | Food & Beverage, Pharmaceuticals, Cosmetics, Consumer Goods, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Sustainability and Recycling Driving the Aluminum Packaging Market

Aluminum’s infinite recyclability without quality loss makes it a highly preferred material for sustainable packaging solutions. Companies are increasingly using recycled aluminum to reduce energy consumption and carbon footprint, supporting global sustainability goals. Rising consumer demand for eco-friendly products is encouraging brands across the food, beverage, and personal care sectors to expand aluminum packaging usage.

In August 2025, Ball Corp., a leading global producer of beverage cans, reported a 4.1% year-on-year increase in aluminum packaging shipments for Q2, highlighting the growing adoption of sustainable aluminum solutions. The company’s net earnings rose 34% to US$212 million, and sales reached $3.34 billion, reflecting strong market demand. CEO Daniel W. Fisher emphasized that sustainability initiatives, coupled with effective management of aluminum price volatility, are driving both financial performance and broader industry growth.

Energy-Intensive Production Process

The energy-intensive production process of aluminum significantly restrains the aluminum packaging market. Manufacturing aluminum requires large amounts of electricity, often derived from non-renewable sources, leading to high production costs and a substantial carbon footprint. These environmental concerns have prompted stricter regulations and sustainability requirements, which can increase operational expenses for manufacturers. Additionally, regions with limited access to affordable, clean energy face challenges in producing aluminum competitively, slowing market expansion. As a result, the high energy demand acts as a barrier to faster growth in the aluminum packaging industry.

Segment Analysis

The global aluminum packaging market is segmented based on product, type, application and region

Aluminum Cans Dominate the Packaging Market Due to Durability, Recycling, and Rising RTD Beverage Demand

Aluminum cans maintain a significant share in the global aluminum packaging market due to their durability, lightweight nature, and recyclability, which appeal to both manufacturers and environmentally conscious consumers. They provide excellent product protection and extend shelf life, making them ideal for beverages and other liquid products. The growing demand for ready-to-drink (RTD) beverages, soft drinks, and alcoholic drinks further reinforces their market dominance.

In August 2025, Ball Corporation partnered with CavinKare to launch retort aluminium cans for milkshakes in India, tapping into the country’s expanding RTD beverage market. This move highlights the versatility of aluminum cans in adapting to diverse product types and flavors. With innovations enhancing convenience, sustainability, and aesthetic appeal, aluminum cans continue to strengthen their position as a preferred packaging solution worldwide.

Geographical Penetration

Asia-Pacific Leads Global Aluminum Packaging Market Due to Rapid Industrialization, Rising Consumer Demand, and Strong Manufacturing Capabilities

The Asia-Pacific region accounts for a major share of the global aluminum packaging market, fueled by rapid industrialization, urbanization, and growing demand for packaged food and beverages. Countries like China, Japan, and India are key contributors, supported by strong manufacturing capabilities and cost-effective production.

According to the Packaging Industry Association of India (PIAI), the Indian packaging market is projected to reach USD 204.81 billion by 2025, growing at a CAGR of 26.7% from 2020 to 2025. As one of India’s high-growth industries, expanding at 22–25% annually, it reinforces the region’s dominance in aluminum packaging. The sector’s steady growth and potential for further expansion, especially in exports, further strengthen Asia-Pacific’s leading position in the market.

Sustainability Analysis

The global aluminum packaging market is increasingly focusing on sustainability due to its high recyclability and lower carbon footprint compared to other packaging materials. Manufacturers are adopting recycled aluminum in production, reducing energy consumption and minimizing greenhouse gas emissions. Innovations in lightweighting and eco-friendly coatings further enhance the environmental performance of aluminum packaging.

Regulatory pressures and consumer demand for sustainable packaging are driving companies to adopt circular economy practices, such as collection and reuse programs. Partnerships between beverage and food brands with recycling initiatives are growing globally. Overall, aluminum’s closed-loop recycling potential positions it as a key material for sustainable packaging solutions.

Competitive Landscape

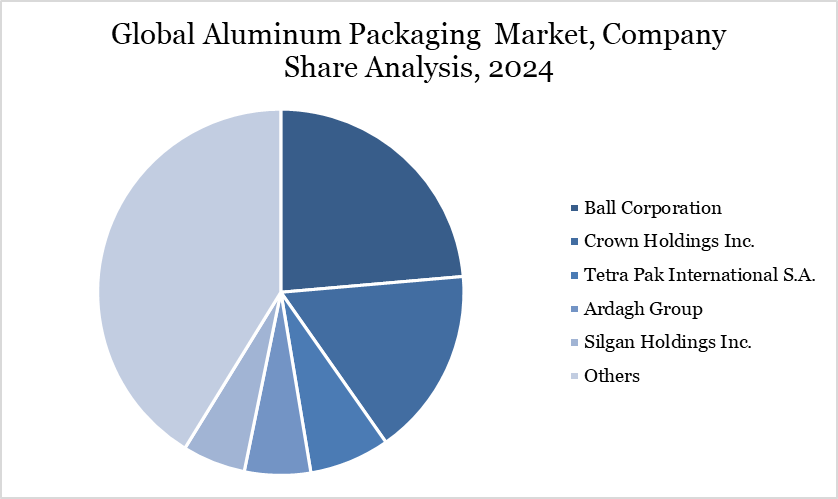

The major global players in the market include Ball Corporation, Crown Holdings Inc., Tetra Pak International S.A., Ardagh Group, Silgan Holdings Inc., Can-Pack S.A., Toyoseikan Group Holdings, Ltd., Constellium SE, Orora Packaging Australia Pty Ltd, Ajanta Bottle.

Key Developments

On April 15, 2025, Steelforce Packaging, a global leader in metal trading and packaging solutions, announced the launch of a dedicated Aluminium Division. This expansion reflects the company’s focus on sustainability and strategic diversification in key global markets.

In July 2025, SIG launched the world’s first 1-liter aseptic cartons made from its Terra Alu-free + Full barrier material, eliminating the aluminum layer and further reducing the carbon footprint of standard SIG cartons. Building on prior single-serve success, the alu-free option is now available in multi-serve juice formats.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies