Market Overview

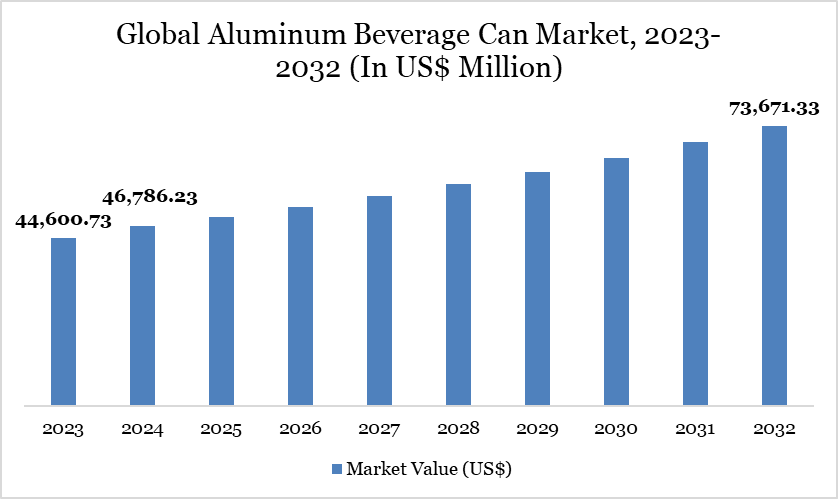

The global aluminum beverage can market reached US$46,786.23 million in 2024 and is expected to reach US$73,671.33 million by 2032, growing at a CAGR of 5.95% during the forecast period 2025-2032.

The global aluminum beverage can market is witnessing strong growth driven by the rising consumption of carbonated soft drinks, energy drinks, and ready-to-drink beverages worldwide. Lightweight, durable, and sustainable aluminum packaging is increasingly preferred over plastics, aligning with consumer demand for eco-friendly products.

According to the International Aluminium Institute, global demand for beverage cans is expected to grow from 420 billion units in 2020 to 630 billion by 2030, demonstrating significant market expansion. Recycling initiatives are also a key driver, as recycling all cans by 2030 could prevent approximately 60 million tonnes of greenhouse gas emissions annually, reinforcing both environmental sustainability and the market’s long-term growth potential.

Aluminum Beverage Can Market Trend

The aluminum beverage can market is trending toward increased sustainability and innovation, driven by growing consumer preference for recyclable and lightweight packaging. Demand is rising globally due to the popularity of soft drinks, energy drinks, and ready-to-drink beverages. Manufacturers are adopting advanced can designs and coating technologies to enhance durability and appeal, while recycling initiatives are further boosting market growth and environmental impact.

Market Scope

Metrics | Details |

By Type | Standard Cans, Slim Cans, Specialty Cans, Sleek Cans, Others |

By Structure | 2-Piece Cans, 3-Piece Cans |

By Capacity | Upto 200 ml, 200 ml – 330 ml, 330 ml – 500 ml, Above 500 ml |

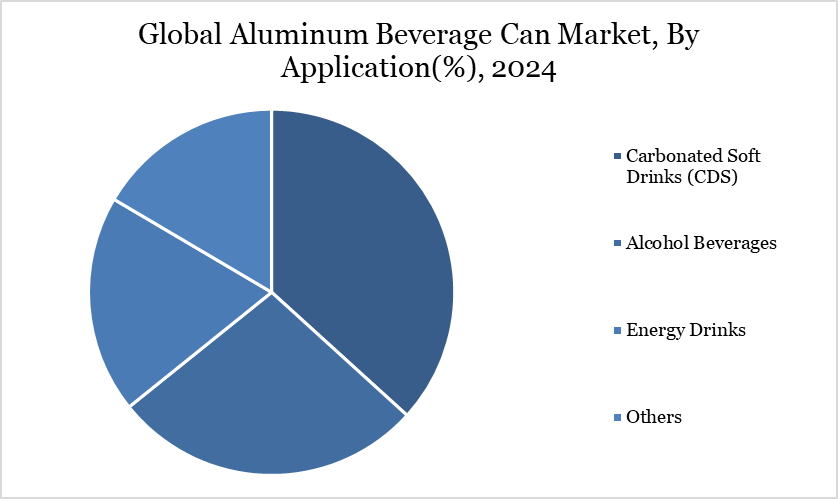

By Application | Carbonated Soft Drinks (CDS), Alcohol Beverages, Energy Drinks, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details request a free sample

Market Dynamics

Growing Consumer Demand for Carbonated Soft Drinks (CSDs) Ready-to-Drink (RTD) Beverages

The growing consumer demand for Carbonated Soft Drinks (CSDs) and Ready-to-Drink (RTD) beverages is significantly driving the aluminum beverage can market. CSDs, which accounted for over 44% of global beverage revenue in 2023 according to the India Council for Research on International Economic Relations (ICRIER), are a key component of the processed food and beverages industry. Meanwhile, RTD beverages such as energy drinks, iced teas, and flavored drinks are gaining popularity due to convenience and portability, further increasing demand for cans.

Aluminum cans offer lightweight, stackable, and tamper-evident packaging, preserving flavor and freshness for both CSDs and RTDs. In India, despite the relatively small CSD market generating US$18.25 billion in 2022, the shift toward convenient and recyclable packaging is evident. As consumer preference for on-the-go beverages rises, manufacturers are increasingly adopting aluminum cans, driving market expansion globally and regionally.

Fluctuating Raw Material Prices

Fluctuating raw material prices, particularly aluminum, directly impact the production cost of beverage cans. Sudden price hikes can squeeze profit margins for manufacturers, forcing some to delay expansion or limit production volumes. Additionally, these cost uncertainties make long-term pricing strategies difficult, leading companies to either absorb higher costs or pass them onto consumers. This volatility can slow market growth as manufacturers become cautious in investment and supply planning.

Segmentation Analysis

The global aluminum beverage can market is segmented based on type, structure, capacity, application and region

Carbonated Soft Drinks (CSD) Dominate the Aluminum Beverage Can Market Due to High Consumption and Convenience Packaging.

Carbonated soft drinks (CSDs) hold a significant share in the aluminum beverage can market due to their high global consumption and the convenience offered by cans. The demand for visually appealing, customized packaging has further boosted this segment, as consumers increasingly prefer unique designs and branding.

In line with this trend, Orora’s August 2025 launch of Helio, a high-speed digital can decorator at its Dandenong facility, allows the production of digitally printed, customized cans for soft drinks and other beverages. This innovation not only enhances consumer appeal but also supports sustainability by using recycled aluminum, reinforcing the strong position of CSDs in the market.

Geographical Penetration

North America Holds a Significant Share in the Aluminum Beverage Can Market Due to High Beverage Consumption and Advanced Manufacturing Infrastructure

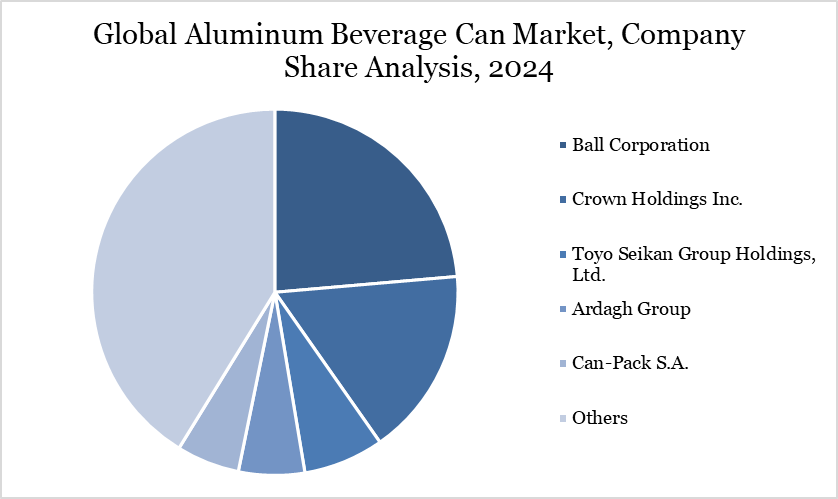

North America holds a substantial share in the aluminum beverage can market due to the region’s high consumption of carbonated soft drinks, energy drinks, and alcoholic beverages packaged in cans. Strong recycling infrastructure and consumer preference for eco-friendly packaging further support the adoption of aluminum cans.

Additionally, the presence of major manufacturers like Ball Corporation, Crown Holdings, and Ardagh Group in the region ensures efficient production and distribution. Continuous innovations in can design, digital decoration, and lightweighting also drive market growth in North America.

Sustainability Analysis

The aluminum beverage can industry is increasingly embracing sustainability due to the material’s high recyclability, which significantly reduces energy consumption and greenhouse gas emissions compared to producing new aluminum. Companies are investing in lightweighting technology to reduce raw material usage while maintaining can strength and durability.

Moreover, the sector is integrating circular economy practices, such as closed-loop recycling and using post-consumer recycled (PCR) aluminum, to lower environmental impact. Several major players are committing to carbon-neutral production and renewable energy-powered manufacturing, enhancing the overall eco-friendliness of aluminum cans.

Competitive Landscape

The major global players in the market include Ball Corporation, Crown Holdings Inc., Toyo Seikan Group Holdings, Ltd., Ardagh Group, Can-Pack S.A., Silgan Holdings Inc., CPMC Holdings Limited, Kian Joo Can Factory Berhad, Nampak Ltd., and Orora Limited.

Key Developments

In September 2023, Thai Beverage Can (TBC) inaugurated its 5th production line at the TBC 2 factory in WHA Industrial Estate. The new line will produce 500 ml aluminum cans and lightweight DWI aluminum bottles in 310 ml and 510 ml designs to meet growing customer demand.

In September 2022, Novelis announced its new laminated aluminum surfaces for beverage can ends, designed to improve appearance, production efficiency, and reduce CO₂ emissions by 33% compared to conventional coatings. The BPA- and PFAS-free laminated sheets, applied at Novelis’ Göttingen site, maintain color stability for premium beverage cans, support recyclability, and help brands meet sustainability goals while advancing circular economy practices.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies