Alpha-Methylstyrene Market Size

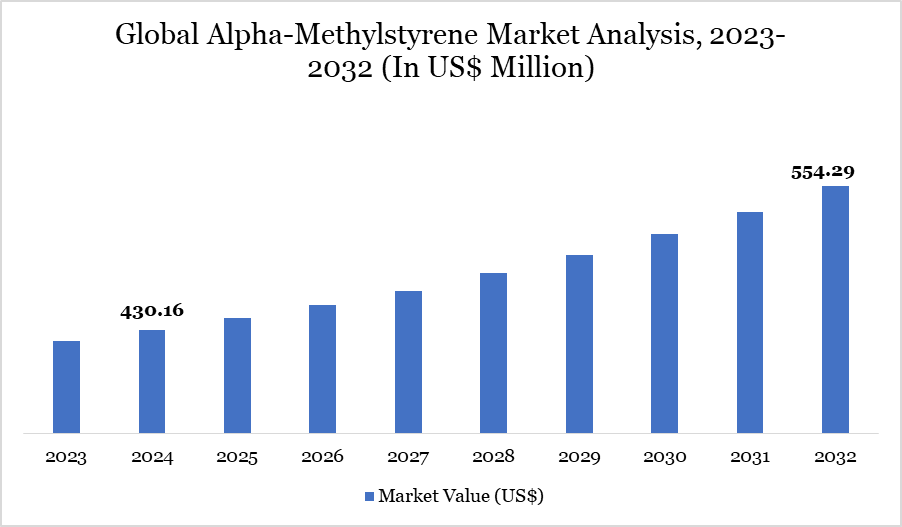

Alpha-Methylstyrene Market Size reached US$ 430.16 million in 2024 and is expected to reach US$ 554.29 million by 2032, growing with a CAGR of 3.22% during the forecast period 2025-2032.

The increasing demand for Alpha-Methylstyrene (AMS) has emerged as a significant market driver. AMS resins are utilized in the manufacture of car exterior frames, electronic appliance housings and protective coatings. The global automobile sector has grown significantly in recent years, driven by rising consumption in emerging markets such as India and Brazil.

For example, the Indian Brand Equity Foundation predicts that by 2022, the country will be one of the world's major automobile markets, producing 22.93 million vehicles per year. The rise of the electric vehicle market is likely to drive the global automotive market in the coming years. Increased demand for consumer goods from emerging economies contributes to market expansion.

In 2023, North America is expected to be the second-dominant region with over 20% of the global alpha-methylstyrene market. Leading AMS producers in North America are investing in capacity expansions, facility modernization and R&D projects to accommodate the growing demand for AMS-based products. Strategic investments boost production capacities, product quality and market competitiveness in the region.

Alpha-Methylstyrene Market Trend

A significant trend influencing the alpha-methylstyrene (AMS) industry is its growing application in the production of high-performance materials, including para-cumyl phenol, adhesives, and coatings. AMS has gained prominence, especially in China and the US, owing to its chemical diversity and compatibility with a wide array of formulations.

The demand for it is increasing in end-use industries such as construction, automotive, and consumer goods, propelled by the compound's capacity to improve product performance, stability, and durability. Manufacturers are progressively utilizing AMS in the production of specialty intermediates for polymers and resins, hence expanding its industrial presence.

The increase in para-cumyl phenol synthesis, utilized in antioxidant formulations, has highlighted the compound's importance in downstream chemical applications. Emerging applications, bolstered by increasing industrial activity and consumer demand in Asia-Pacific and North America, are establishing AMS as an essential raw material across several production industries.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Purity | >99.5%, 95%-99% |

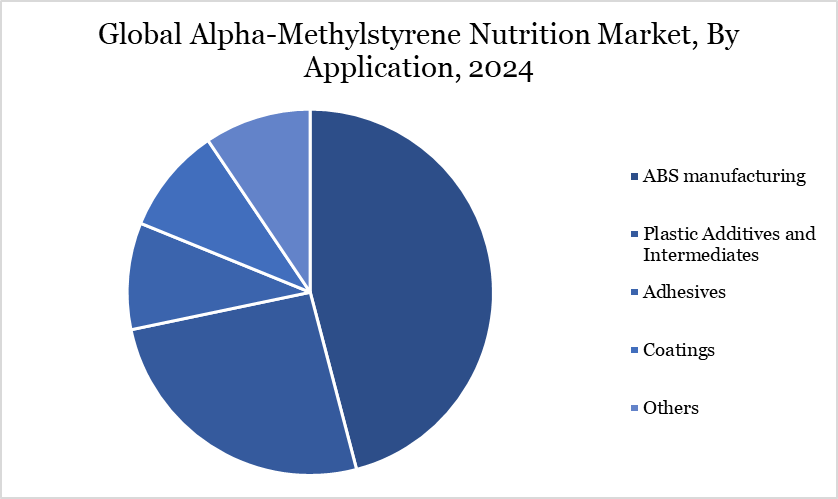

| By Application | ABS manufacturing, Plastic Additives and Intermediates, Adhesives, Coatings, Others |

| By End-user | Automotive, Electronics, Chemical Manufacturing, Personal Care & Cosmetics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Alpha-Methylstyrene Market Dynamics

Expansion of the Automotive Sector Fuels Global Demand for Alpha-Methylstyrene

The substantial growth of the automotive industry is a key factor propelling the global alpha-methylstyrene (AMS) market. The molecule is essential in the synthesis of Acrylonitrile Butadiene Styrene (ABS), a prevalent thermoplastic utilized in vehicle exterior frames, protective casings, and coatings.

Countries like India and Brazil are experiencing a rise in car production, propelled by increasing incomes and heightened mobility demands. The Indian Brand Equity Foundation reports that India manufactured more than 22.93 million automobiles in 2022, highlighting the region's expanding automotive presence.

The rising usage of electric vehicles (EVs) is anticipated to heighten the need for ABS resin, with AMS acting as a crucial intermediate. EV Volumes indicated that worldwide sales of battery electric and plug-in hybrid vehicles increased by 55% in 2022. As original equipment manufacturers increase manufacturing capacity, particularly in Germany, the consumption of AMS is expected to rise alongside the growing need for high-performance polymer components.

Environmental Regulations and Price Volatility Impede Market Advancement

The expansion of the alpha-methylstyrene (AMS) business is hindered by rigorous environmental restrictions and fluctuations in raw material prices. Global governments are implementing stricter regulations on volatile organic compounds (VOCs) and air quality, which directly affect AMS production and utilization. Adherence to environmental regulations frequently requires significant expenditures in emission control systems, thereby elevating operational expenses for firms.

AMS production is significantly reliant on raw materials such as cumene and styrene, which are extracted from crude oil. These feedstocks experience price volatility influenced by global oil market dynamics, resulting in cost risks throughout the AMS supply chain. This unpredictability might diminish profit margins and deter long-term investments in manufacturing infrastructure.

The presence of inexpensive alternative compounds exhibiting comparable performance attributes presents a competitive challenge, especially in price-sensitive sectors. These constraints may collectively hinder the market's growth trajectory despite robust demand from developing applications.

Alpha-Methylstyrene Market Segment Analysis

The global Alpha-Methylstyrene market is segmented based on purity, application, end-user and region.

Rising Demand for Alpha-Methylstyrene in ABS Production for Automotive Applications

Alpha-Methylstyrene (AMS) is essential in the synthesis of Acrylonitrile Butadiene Styrene (ABS) resin, a material progressively utilized in the automotive industry as a feasible substitute for metal. Its incorporation markedly enhances the impact resistance and thermal stability of ABS, beyond the performance attainable with styrene alone. AMS-enhanced ABS is optimal for producing lightweight and robust car components, including dashboards, seat backs, handles, and instrument panels.

The expansion of the global automotive sector, demonstrated by the production of 85.01 million vehicles in 2022, a 6% increase from 2021, has resulted in a corresponding rise in AMS demand. The swift growth of electric vehicle (EV) production, evidenced by the delivery of 10.5 million BEVs and PHEVs in 2022, has intensified this tendency. Initiatives such as Ford’s sophisticated Cologne Electric Vehicle Center further emphasize the industry's progress. The tire manufacturing industry continues to enhance AMS utilization, particularly in high-demand areas like India.

Alpha-Methylstyrene Market Geographical Share

Rising Demand for Tires in Asia-Pacific

The Asia-Pacific region, especially China and India, is experiencing significant growth in the alpha-methylstyrene (AMS) market, propelled by the swift development of essential end-use sectors including automotive, plastics, and manufacturing. The National Bureau of Statistics of China reports that the nation generates almost 6 million metric tons of plastic products monthly, highlighting its supremacy in global plastic production.

This robust production capability facilitates substantial utilization of AMS as a crucial intermediary in plastic and resin compositions. The increasing need for tires, propelled by domestic and overseas markets, is generating more demand for AMS-based polymers and additives.

Statistics from the Indian Brand Equity Foundation (IBEF) indicates a 32.3% year-on-year rise in plastic raw material exports from India from April to September 2022. The region's export-driven expansion and developing industrial sector persist in strengthening the AMS market, establishing Asia-Pacific as a crucial center for both consumption and production.

Sustainability Analysis

The Alpha-Methylstyrene (AMS) market is experiencing a transition towards sustainability, propelled by the changing requirements of the electronics and semiconductor sector, which attained a production value of US$ 3,436.8 billion in 2022. As electronic devices increase in complexity, the demand for high-performance, environmentally sustainable materials is escalating. Manufacturers are implementing innovative production technologies that improve efficiency and minimize environmental effect.

Established companies are progressively engaging in sustainable practices to adhere to rigorous environmental standards and sustain competitive advantage. The focus on digital transformation and automation enhances operational efficiency while advancing sustainability objectives through resource optimization. Smaller entrants, despite encountering significant entry obstacles, can achieve momentum by concentrating on particular applications and establishing robust connections with end-users.

Ultimately, sustained growth in the AMS industry hinges on the equilibrium of innovation, regulatory adherence, and cost-effectiveness. Sustainability has emerged as a vital cornerstone for success, providing both competitive distinction and alignment with global environmental imperatives.

Alpha-Methylstyrene Market Major Players

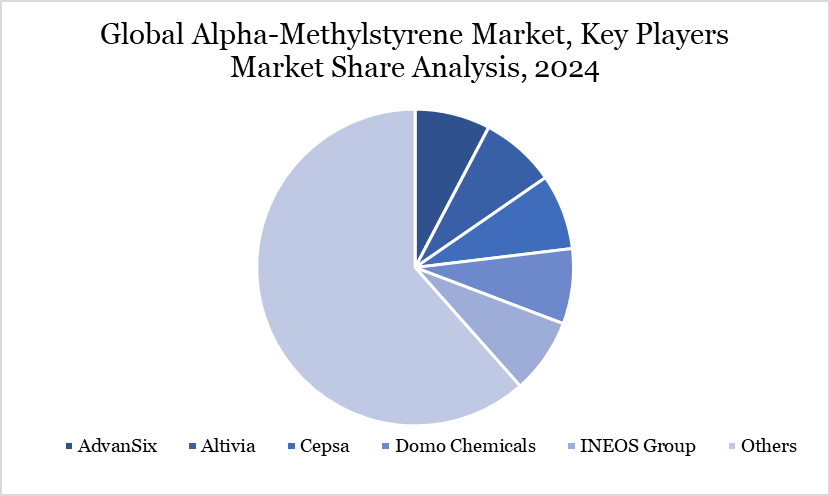

The major global players in the market include AdvanSix, Altivia, Cepsa, Domo Chemicals, INEOS Group, Kraton Corporation, KUMHO P&B CHEMICALS, Mitsubishi Chemical Corporation, Prasol Chemicals Limited and Solvay and among others.

Key Developments

In April 2023, INEOS Phenol announced the acquisition of Mitsui Phenol Singapore Ltd for a sum of US$ 330 million. The acquisition included Mitsui Phenols production facility based on Jurong Island in Singapore which produces 20 kilotons of alpha methylstyrene per year apart from phenol, cumene, acetone and bisphenol A. The acquisition is expected to help INEOS expand its asset portfolio and expand production capacity to cater its clients in Southeast Asian nations

In April 2023, INEOS Phenol announced the completion of its acquisition of Mitsui Phenols Singapore Ltd for a total of US$ 330 million. Through the acquisition, the firm has acquired more than 1 million tons of capacity each year, which includes alpha-methyl styrene, among other goods, which will further allow the company to support its clients more efficiently across the Asian region.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies