Anaphylaxis Treatment Market Size & Industry Outlook

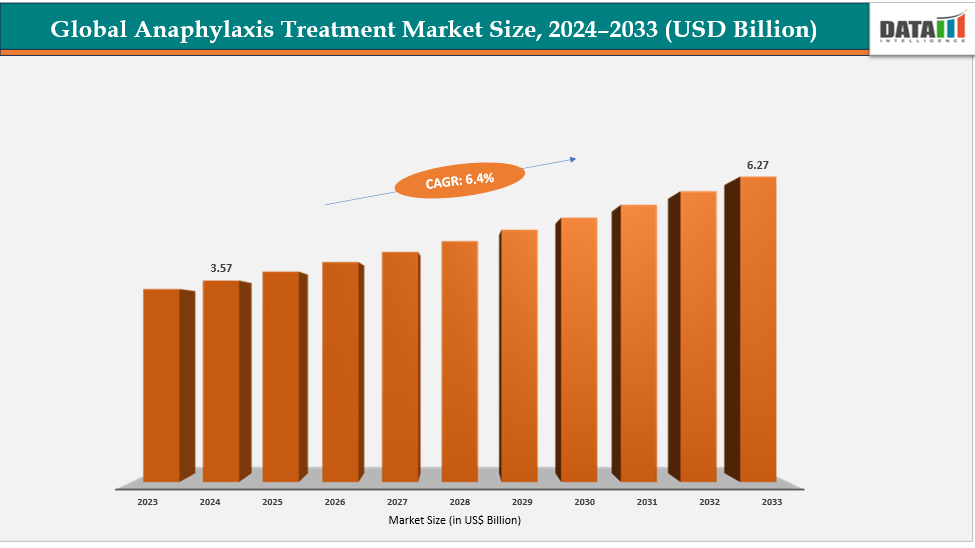

The global anaphylaxis treatment market size reached US$ 3.37 Billion with rise of US$ 3.57 Billion in 2024 is expected to reach US$ 6.27 Billion by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033. The rising awareness about the life-saving potential of epinephrine auto-injectors is another major driver for the global anaphylaxis treatment market. Educational campaigns by healthcare organizations, schools, and patient advocacy groups have encouraged patients, caregivers, and medical professionals to adopt these devices for emergency use. For instance, in Europe, initiatives like the European Academy of Allergy and Clinical Immunology (EAACI) guidelines have promoted the use of auto-injectors in schools and public spaces, significantly increasing their adoption.

Key Highlights

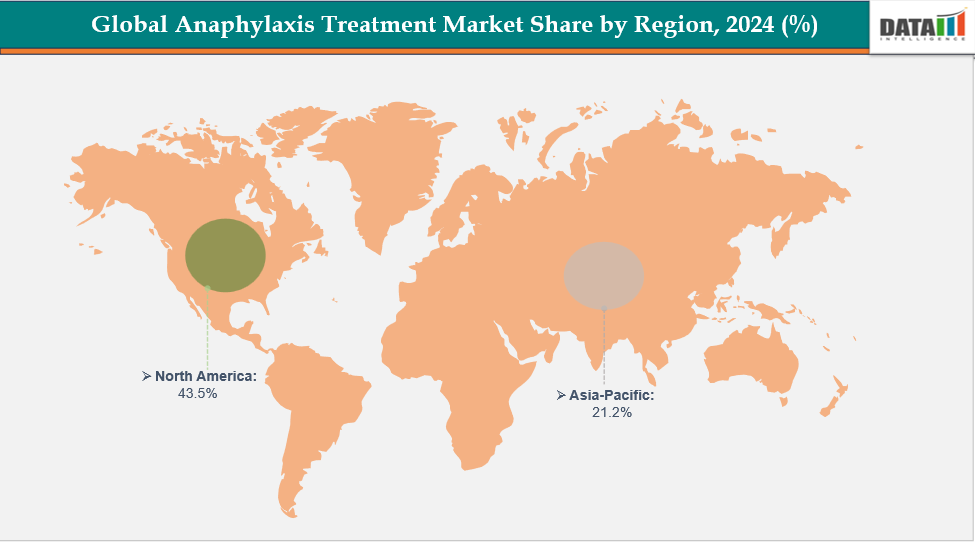

North America dominates the anaphylaxis treatment market with the largest revenue share of 43.5% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.1% over the forecast period.

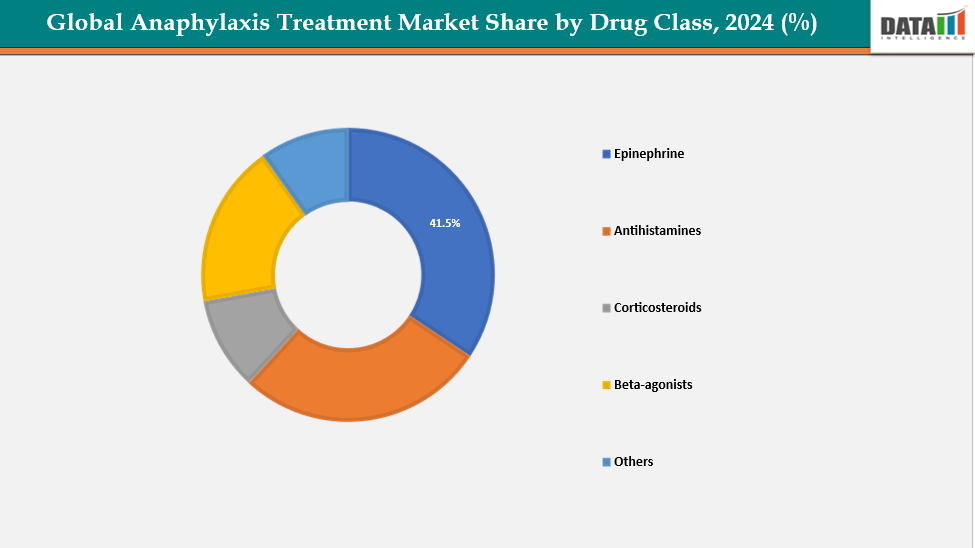

Based on drug class, epinephrine segment led the market with the largest revenue share of 41.5% in 2024.

The major market players in the Viatris Inc., GlaxoSmithKline Plc, Amneal Pharmaceuticals Inc., Teva Pharmaceutical Industries Ltd, Adamis Pharmaceutical Corporation, Aquestive Therapeutics Inc., ALK-Abelló A/S, Amphastar Pharmaceuticals Inc., Hikma Pharmaceuticals and among others.

Market Dynamics

Drivers:The increasing prevalence of severe allergic reactions globally is significantly driving the anaphylaxis treatment market growth

The rising prevalence of severe allergic reactions is a major driver for the global anaphylaxis treatment market. Allergic reactions, triggered by food, drugs, or insect stings, are becoming more frequent due to changing lifestyles, environmental factors, and genetic predisposition. This increase directly fuels the demand for effective emergency treatments like epinephrine and other anaphylaxis therapies.

For instance, globally, it is estimated that over 220 million people suffer from food allergies, with around 1–2% of the population experiencing drug-induced anaphylaxis. Countries such as the United States, Germany, and Australia report increasing hospital admissions for severe allergic reactions each year, reflecting the urgent need for rapid-response treatment options.

Restraints:Stringent regulatory approvals and long clinical trial timelines are hampering the growth of the anaphylaxis treatment market

One of the major challenges in the global anaphylaxis treatment market is the stringent regulatory framework and lengthy clinical trial processes required for new therapies. Developing and bringing anaphylaxis treatments to market involves multiple phases of clinical testing, rigorous safety evaluations, and compliance with regulations from authorities such as the FDA, EMA, and other national health agencies. These processes are often time-consuming and expensive, delaying the launch of innovative drugs or devices.

For more insights - Download the Sample

Anaphylaxis Treatment Market, Segment Analysis

The global anaphylaxis treatment market is segmented based on drug class, route of administration, distribution channel, and region.

Drug Class:The epinephrine from drug class segment is expected to dominate the anaphylaxis treatment market with a 41.5% share in 2024

The epinephrine segment is driving the global anaphylaxis treatment market due to several factors. Rapid onset of action allows immediate reversal of life-threatening allergic reactions, making it the first-line therapy. Ease of administration through auto-injectors enables patients, caregivers, and healthcare providers to deliver the drug quickly without medical supervision. Strong clinical recommendations from organizations like the World Allergy Organization (WAO) support its universal use.

For instance, in June 2025, Aquestive Therapeutics, Inc., a pharmaceutical company focused on advancing medicines through innovative science and delivery technologies, announced that the U.S. Food and Drug Administration (FDA) has accepted its New Drug Application (NDA) for Anaphylm, targeting Type 1 allergic reactions, including anaphylaxis. The FDA has set a Prescription Drug User Fee Act (PDUFA) target action date of January 31, 2026, and noted that it may hold an Advisory Committee meeting regarding the approval. If approved, Anaphylm would become the first and only orally delivered epinephrine treatment for severe allergic reactions in the United States.

Route of Administration:The Injectable segment is estimated to have a 54.1% of the anaphylaxis treatment market share in 2024

The injectable segment, which includes epinephrine administered via syringes or auto-injectors, is a key driver of the anaphylaxis treatment market due to several factors. Rapid and effective symptom reversal during severe allergic reactions makes injectables the preferred emergency treatment. Ease of use, particularly with auto-injectors, allows patients, caregivers, and healthcare professionals to administer the dose quickly without specialized medical training. Strong clinical guidelines globally recommend injectables as the first-line therapy for anaphylaxis.

Geographical Analysis

North America is expected to dominate the global anaphylaxis treatment market with a 43.5% in 2024

North America is one of the largest markets for anaphylaxis treatments, driven primarily by the high prevalence of severe allergic reactions in the United States and Canada. Millions of individuals suffer from food, drug, and insect-sting allergies, creating significant demand for emergency treatments like epinephrine injectables. The market is further supported by widespread awareness campaigns, such as educational programs in schools and workplaces, encouraging the use of auto-injectors.

The United States is a leading market for anaphylaxis treatments, driven primarily by the high prevalence of severe allergic reactions, including food, drug, and insect-sting allergies. According to the CDC, millions of Americans experience life-threatening allergic responses every year, which has created a large patient base requiring immediate treatment. Widespread awareness and education campaigns about the importance of carrying epinephrine auto-injectors in schools, workplaces, and homes have further boosted adoption.

For instance, in July 2025, The U.S. Food and Drug Administration (FDA) has accepted Aquestive Therapeutics’ New Drug Application (NDA) for Anaphylm, an innovative postage stamp–sized sublingual film that delivers adrenaline during severe allergic reactions. This milestone follows positive clinical trial outcomes in both pediatric and adult patients.

Europe is the second region after North America which is expected to dominate the global anaphylaxis treatment market with a 34.5% in 2024

Europe, led by countries such as Germany, the UK, and France, shows robust growth in the anaphylaxis treatment market. Key drivers include advanced healthcare systems, well-established hospital networks, and high adoption rates of epinephrine injectables. Regulatory support and guidelines from organizations like the European Academy of Allergy and Clinical Immunology (EAACI) emphasize the immediate treatment of severe allergic reactions, further driving demand.

Germany represents one of the largest markets for anaphylaxis treatments in Europe. The market is driven by advanced healthcare infrastructure, which supports early diagnosis and rapid treatment of allergic reactions. There is a high adoption rate of epinephrine auto-injectors both in hospitals and among patients for home use, driven by strong recommendations from healthcare authorities and organizations like the European Academy of Allergy and Clinical Immunology (EAACI).

For instance, in June 2025, ALK-Abelló has introduced an alternative to epinephrine auto-injectors in Germany with the launch of its nasal spray treatment, Eurneffy. Originally developed by ARS Pharma, Eurneffy received European Commission approval in August 2024 for the emergency treatment of allergic reactions, including anaphylaxis. This marks the first needle-free option available for patients in the EU market.

The Asia Pacific region is the fastest-growing region in the global anaphylaxis treatment market, with a CAGR of 7.1% in 2024

The Asia-Pacific region, including countries like Japan, China, India, and South Korea, is witnessing substantial growth due to the rising incidence of allergic reactions and growing urban populations with increased access to healthcare. In Japan, public awareness campaigns and government initiatives promoting epinephrine use in schools and public institutions are key drivers. China and India are experiencing increasing prevalence of food and drug allergies, coupled with improved healthcare infrastructure and growing adoption of emergency treatment options.

Japan’s anaphylaxis treatment market is expanding due to a rising prevalence of severe food and drug allergies, particularly among children and young adults. Public education and awareness programs led by medical societies and schools emphasize the importance of timely treatment with epinephrine, which has increased the adoption of auto-injectors.

Competitive Landscape

Top companies in the anaphylaxis treatment market include Viatris Inc., GlaxoSmithKline Plc, Amneal Pharmaceuticals Inc, Teva Pharmaceutical Industries Ltd., Adamis Pharmaceutical Corporation, Aquestive Therapeutics Inc., ALK-Abelló A/S, Amphastar Pharmaceuticals Inc., Hikma Pharmaceuticals and among others.

GlaxoSmithKline: GlaxoSmithKline plc plays a significant role in the global anaphylaxis treatment market through its product Emerade, an epinephrine auto-injector designed for the emergency treatment of severe allergic reactions. GSK’s strong presence in Europe, combined with its reputation for high-quality pharmaceutical products and extensive distribution networks, ensures broad patient access to life-saving treatments. By focusing on innovation, safety, and accessibility, GSK continues to support the growing demand for effective anaphylaxis management, positioning itself as a key player in this critical therapeutic area.

Key Developments:

In August 2025, preclinical research conducted by Northwestern University revealed that Zileuton, an existing asthma medication, has the potential to block allergic reactions, including anaphylaxis, in mice. The study showed a dramatic reduction in susceptibility to allergic reactions, dropping from 95% to just 5%. Building on these promising findings, a human clinical trial has now commenced, marking a significant step toward developing a novel prophylactic option in allergy management.

Market Scope

Metrics | Details | |

CAGR | 6.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Epinephrine, Antihistamines, Corticosteroids, Beta-agonists, Others |

Route of Administration | Injectable, Oral | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global anaphylaxis treatment market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here