Market Overview and Growth Outlook

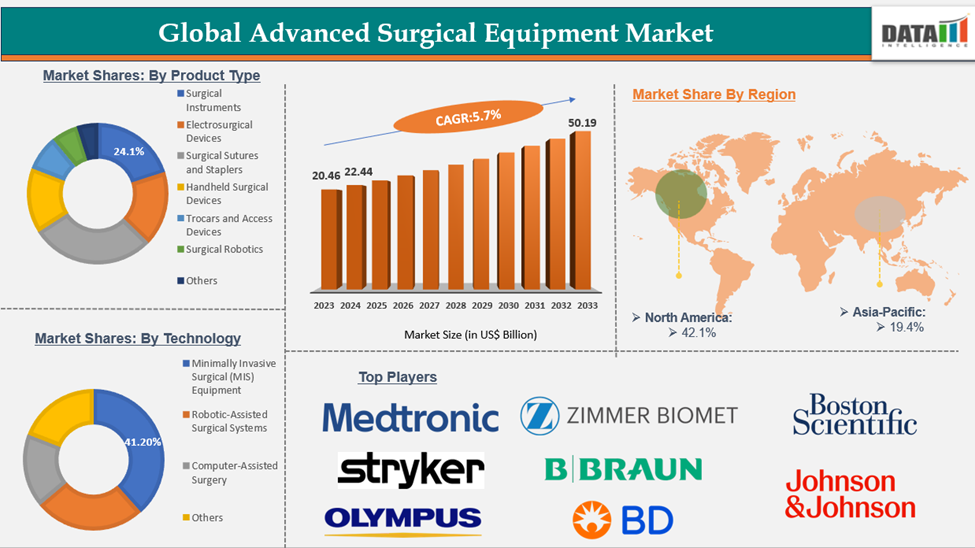

The global advanced surgical equipment market reached US$ 20.46 billion in 2023, with a rise of US$ 22.44 billion in 2024, and is expected to reach US$ 50.19 billion by 2033, growing at a CAGR of 9.6% during the forecast period 2025-2033.

The advanced surgical equipment market is rapidly evolving, driven by cutting-edge advancements in robotics, imaging, and digital technologies. These innovations are making minimally invasive procedures more common, helping patients recover faster with fewer complications.

At the same time, technologies like real-time data analytics, IoT-connected devices, and augmented reality (AR) are changing how surgeons plan and perform operations. Surgeons can now see more clearly, make better decisions on the spot, and track outcomes more effectively. All of this is leading to a more connected and intelligent surgical environment; it’s smarter, faster, and centered around better patient outcomes.

Executive Summary

Advanced Surgical Equipment Market Dynamics

Driver: Technological innovation

Minimally Invasive Surgical (MIS) Equipment holds a significant share of the Advanced Surgical Equipment Market due to its transformative impact on patient care and clinical outcomes. MIS techniques require specialized tools that allow surgeons to operate through small incisions with enhanced precision, reduced trauma, and faster recovery times. These benefits have driven widespread adoption across specialties like orthopedics, gynecology, urology, and general surgery, especially in high-volume hospital settings and ambulatory surgical centers.

In 2024, MIS equipment accounted for a substantial portion of the total advanced surgical equipment market, fueled by strong demand for robotic systems, energy-based devices, and advanced endoscopic instruments. The surge is also supported by favorable reimbursement policies, growing patient preference for low-risk procedures, and rising surgical volumes globally.

Recent product innovations further highlight the trend. For instance, the FDA clearance of the da Vinci 5 system and SureForm 45 robotic stapler in the U.S. in 2025 reinforced the dominance of MIS platforms in robotic surgery. Similarly, companies like Medtronic and Stryker continue to expand their MIS portfolios with energy-efficient hand instruments, intelligent laparoscopic tools, and AI-powered visualization systems.

Restraint: High costs of medical devices

High costs of medical devices remain a major barrier to the growth of the Advanced Surgical Equipment Market, particularly in low- and middle-income regions. Advanced tools like robotic-assisted surgery systems, AI-powered imaging platforms, and precision-guided instruments often come with high price tags, not just in terms of acquisition, but also maintenance, software upgrades, training, and consumables. For example, robotic surgical systems can cost anywhere from $1 million to $2.5 million, with annual maintenance fees adding several hundred thousand dollars more.

For more details on this report, Request for Sample

Segmentation Analysis

The global advanced surgical equipment market is segmented based on product type, technology, application, end-user, and region.

Segment Analysis by Technology

The minimally invasive surgical (MIS) equipment segment is estimated to have 44.4% of the advanced surgical equipment market share.

Minimally Invasive Surgical (MIS) Equipment holds a significant share of the Advanced Surgical Equipment Market due to its transformative impact on patient care and clinical outcomes. MIS techniques—such as laparoscopy, endoscopy, and robotic-assisted surgeries—require specialized tools that allow surgeons to operate through small incisions with enhanced precision, reduced trauma, and faster recovery times. These benefits have driven widespread adoption across specialties like orthopedics, gynecology, urology, and general surgery, especially in high-volume hospital settings and ambulatory surgical centers.

In 2024, MIS equipment accounted for a substantial portion—over 35%—of the total advanced surgical equipment market, fueled by strong demand for robotic systems, energy-based devices, and advanced endoscopic instruments. The surge is also supported by favorable reimbursement policies, growing patient preference for low-risk procedures, and rising surgical volumes globally.

Recent product innovations further highlight the trend. For example, the FDA clearance of the da Vinci 5 system and SureForm 45 robotic stapler in the U.S. in 2024–2025 reinforced the dominance of MIS platforms in robotic surgery. Similarly, companies like Medtronic and Stryker continue to expand their MIS portfolios with energy-efficient hand instruments, intelligent laparoscopic tools, and AI-powered visualization systems—all of which contribute to the segment’s strong performance in the market.

MIS is not just a product category—it's become a standard of care. Its role in reducing hospital stays, lowering infection risks, and improving patient satisfaction continues to make it a cornerstone of surgical innovation worldwide.

Geographical Analysis

The North America advanced surgical equipment market was valued at 42.1% market share in 2024

North America stands at the forefront of the global Advanced Surgical Equipment Market, contributing over 50% of the total revenue share in 2024, making it the dominant region by a significant margin. This leadership reflects the region’s robust healthcare infrastructure, strong R&D ecosystems, and fast-track regulatory pathways that encourage innovation and rapid market access.

Recent FDA approvals and product launches underscore this trend. In March 2024, Intuitive Surgical secured FDA clearance for its next-generation da Vinci 5 robotic system, which is now being rolled out across the U.S. The following year, in April 2025, the company gained clearance for its SureForm 45 stapler, enhancing the capabilities of its da Vinci SP system in urologic, thoracic, and colorectal surgeries. Meanwhile, ZEISS Medical earned FDA approval in April 2025 for its INTRABEAM 700, a precise intraoperative radiotherapy device tailored for neuro-oncology and breast cancer procedures.

Adding to the momentum, Zimmer Biomet recently announced its acquisition of Monogram Technologies (July 2025), along with integration plans for its semi- and fully autonomous surgical systems.

Together, these developments illustrate how North America’s combination of technological innovation, favorable regulation, and active investment continues to shape and propel the advanced surgical equipment market forward.

Competitive Landscape and Key Players

The major players in the advanced surgical equipment market include Stryker Corporation, Zimmer Biomet, Medtronic, Johnson & Johnson, B. Braun, Boston Scientific Corporation, BD, Abbott, Intuitive Surgical Operations, Inc., Electro Surgical Instrument Company, MicroPort Scientific Corporation, among others.

Recent Developments and Innovations in Advanced Surgical Equipment

In June 2025, Johnson & Johnson MedTech, a global frontrunner in surgical technology and solutions, announced the U.S. launch of the ETHICON 4000 Stapler. This state-of-the-art surgical stapler is engineered to handle complex tissue challenges while ensuring outstanding staple line strength, aiming to reduce the risk of surgical leaks and bleeding complications across a wide range of specialties.

Report Scope

Metrics | Details | |

CAGR | 9.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Surgical Instruments, Electrosurgical Devices, Surgical Sutures and Staplers, Handheld Surgical Devices, Trocars and Access Devices, Surgical Robotics, Others |

Technology | Minimally Invasive Surgical (MIS) Equipment, Robotic-Assisted Surgical Systems, Computer-Assisted Surgery, Others | |

| Application | Cardiovascular Surgery, Neurosurgery, Orthopedic Surgery, Gynecology & Obstetrics, General Surgery, ENT Surgery, Urology, Plastic & Reconstructive Surgery, Others (Dental, Ophthalmology, etc.) |

| End-User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Academic & Research Institutions, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global advanced surgical equipment market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Medical Devices-related reports, please click here