Absorbent Fruit Pads Market Size

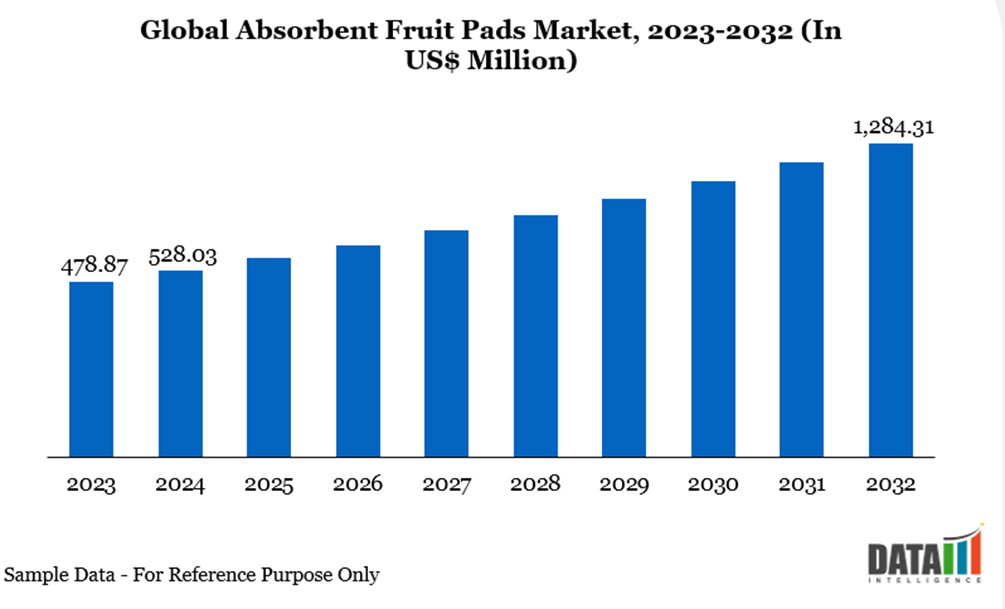

The global absorbent fruit pads market reached US$528.03 million in 2024 and is expected to reach US$1,284.31 million by 2032, growing at a CAGR of 11.9% during the forecast period 2025-2032. This growth is driven by increasing consumer demand for fresh, high-quality fruits with longer shelf life. The adoption of absorbent fruit pads helps reduce spoilage, maintain hygiene, and enhance product presentation in retail settings. Rising popularity of organized retail and e-commerce platforms further supports market expansion.

Absorbent Fruit Pads Industry Trends and Strategic Insights

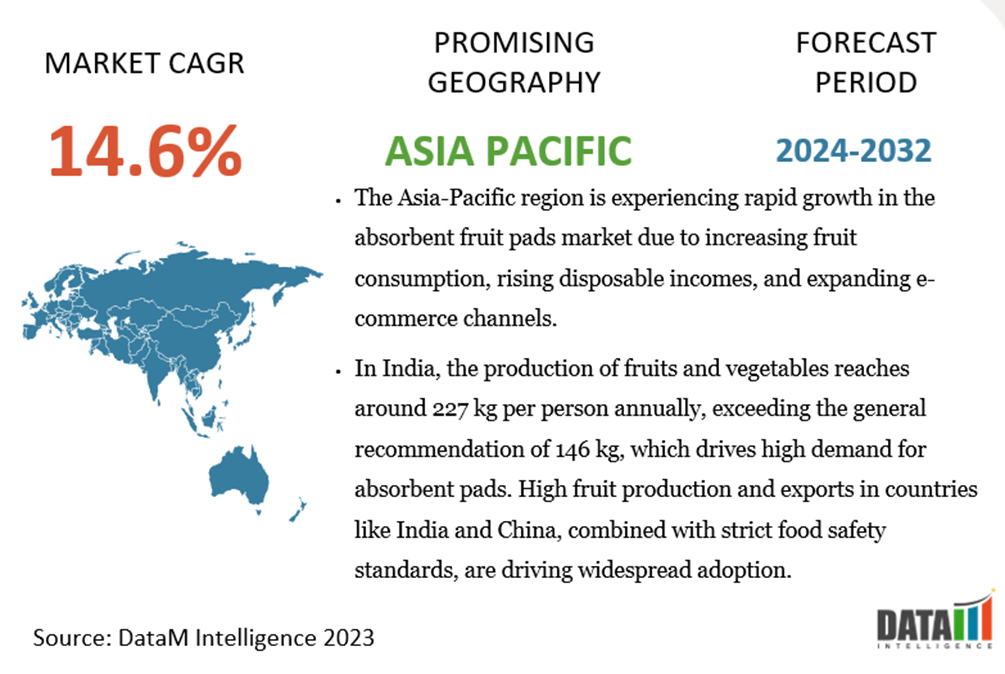

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 36.58% in 2024.

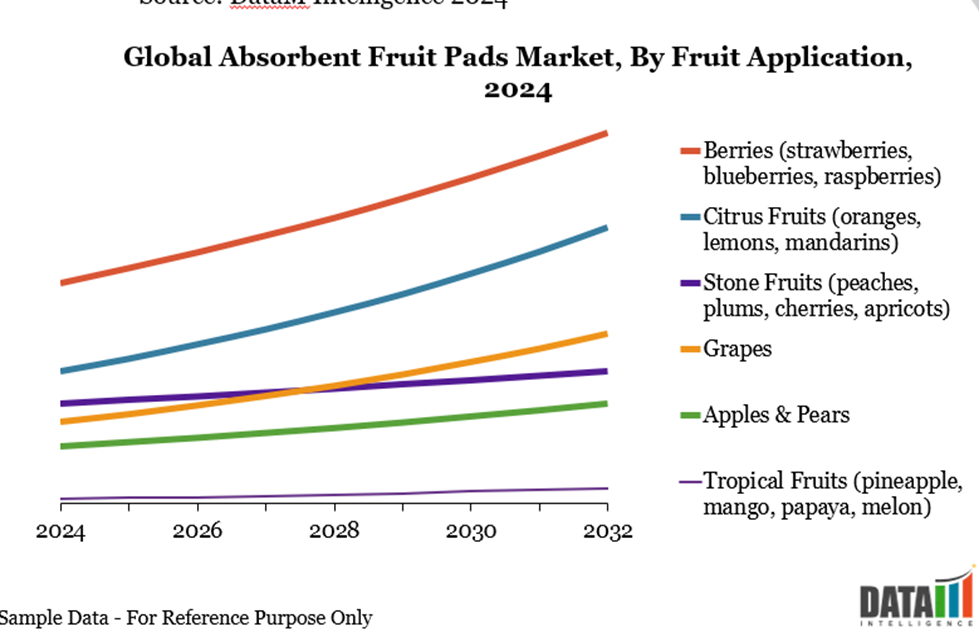

By fruit application, the Berries (strawberries, blueberries, raspberries) segment is projected to experience the largest market, registering a significant 40.13% in 2024.

Absorbent Fruit Pads Market Size and Future Outlook

2024 Market Size: US$528.03 Million

2032 Projected Market Size: US$1,284.31 Million

CAGR (2025-2032): 11.9%

Largest Market: Europe

Fastest Market: Asia-Pacific

Market Scope

Metrics | Details |

By Material Type | Polyethylene (PE), Super Absorbent Polymers (SAP), Non-woven Fabrics, Biodegradable/Compostable Materials |

By Absorbency Capacity | Low Absorbency (50–100 ml), Medium Absorbency (100–300 ml), High Absorbency (300 ml and above) |

By Absorbent Pad | Standard Absorbent Pads, Cushion Absorbent Pads, Antimicrobial/Functional Pads, Custom/Smart Pads |

By Fruit Application | Berries (strawberries, blueberries, raspberries), Citrus Fruits (oranges, lemons, mandarins), Stone Fruits (peaches, plums, cherries, apricots), Grapes, Apples & Pears, Tropical Fruits (pineapple, mango, papaya, melon) |

By Distribution Channel | Direct Sales, Retail Packaging, Online & E-commerce Platforms, Wholesalers & Distributors, Foodservice & Institutional Supply |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Driver - Rising Demand for Extended Shelf Life and Reduction of Post-harvest Losses

The increased desire for longer shelf life and lower post-harvest losses in fresh produce is a major driver of the global absorbent fruit pads market. Berries, grapes, stone fruits and cut fruit are all highly perishable and susceptible to moisture accumulation, microbial growth and deterioration during harvesting, transportation and retail display.

Absorbent fruit pads effectively handle excess juice and condensation, preserving quality and increasing the shelf life of packaged goods. According to FAO estimates, more than 1.3 billion tons of food are lost or discarded each year, with fresh fruits and vegetables accounting for a sizable portion. Absorbent pads reduce losses and provide a cost-effective option for producers, packers and retailers while guaranteeing higher-quality food reaches customers.

Consumers' expectations for fresh, visually beautiful and ready-to-eat fruit items exacerbate this demand. Retailers, particularly in Europe and North America, are increasingly requesting high-performance pads with rapid absorption, anti-browning or anti-fungal properties to preserve fruit quality.

The advent of e-commerce and home delivery of fresh produce has increased demand for packaging solutions that can survive longer transport durations and varying temperature conditions. The elements motivate widespread adoption of absorbent fruit pads in global marketplaces. With a global push to reduce food waste, governments, retailers and growers are aggressively supporting technology that prolong freshness. As a result, providers who provide pads with excellent absorption capacity and compatibility with various tray shapes are gaining popularity, increasing demand for absorbent fruit pads.

Segmentation Analysis

The global absorbent fruit pads market is segmented based on material type, absorbency capacity, absorbent pad type, fruit application, distribution channel and region.

Berries Lead the Market for Its High Perishability Nature

Berries are one of the most important drivers of the global absorbent fruit pad market due to their delicate structure, fast respiration rate and rapid perishability. Strawberries, blueberries, raspberries and blackberries are especially susceptible to moisture buildup, leakage and mold growth during post-harvest handling, packaging and retail display.

Absorbent fruit pads made specifically for berries help regulate excess juice and condensation inside clamshells, preventing microbial growth and increasing freshness. The International Blueberry Organization predicted that global blueberry output exceeded 2 million tons in 2022 and is expected to exceed 3 million tons by 2025, with a double-digit increase in Europe and Asia, highlighting the growing requirement for protective packaging solutions to reduce loss during transport and storage.

Grapes Have Significant Share in the Market for Extended Shelf Life

Grapes are sensitive to moisture and fungal growth, making absorbent pads essential for packaging. Pads help control condensation, reduce decay, and preserve quality during long-distance transport. The increasing global consumption of fresh grapes, both for direct consumption and processing, supports higher pad usage. Retailers and distributors prefer padded packaging to ensure consumer satisfaction. Growing awareness about reducing food waste further drives the adoption of absorbent pads for grapes.

Geographical Penetration

Europe Leads The Market With Strict Food Safety Rules and High Demand For Fresh Fruits Boost Absorbent Pad Adoption

The European absorbent fruit pad industry is being propelled forward by efforts to reduce food waste and comply with stricter packaging regulations. The EU estimates more than 59 million tons of food waste per year and is pursuing SDG 12.3 aims to halve retail/consumer waste by 2030. This puts a premium on technology that keep berries, grapes, stone fruit and cut fruit fresher for longer and drier in-pack. Pads with fast absorption, high retention and anti-microbial or anti-browning properties are popular among farmers, packers and retailers.

Recent products, like as Sirane's Dri-Fresh Fresh-Hold ABV pads, which use natural bio-flavonoids/organic acids to boost the fruit's inherent defense, have increased demand. At the same time, regulations are changing standards. The new EU Packaging & Packaging Waste Regulation demands that all packaging be recyclable by 2030 and recycled at scale by 2035, hastening the transition away from difficult-to-recycle multi-material laminates and toward mono-material or compostable pad designs that nonetheless provide barrier and hygiene.

Germany Absorbent Fruit Pads Market Outlook

Germany’s strong presence in the absorbent fruit pads market is driven by strict food safety standards and advanced packaging technologies. In 2024, German firm Bizerba launched a line of smart absorbent pads with antimicrobial properties for berries and grapes. Additionally, the EU-funded Sustainable Packaging Initiative involves German companies like Leipa Group GmbH, promoting biodegradable and eco-friendly absorbent pads. High consumer awareness about freshness and reduced food waste further strengthens Germany’s market position.

UK Absorbent Fruit Pads Market Trends

The UK market benefits from growing demand for fresh, high-quality fruits and stringent hygiene regulations. In 2023, Mondi Group UK introduced biodegradable absorbent pads for berries and stone fruits, supporting sustainable packaging trends. Retailers such as Tesco and Sainsbury’s increasingly adopt padded packaging to extend shelf life. Rising e-commerce fruit sales and emphasis on reducing spoilage drive the widespread use of absorbent fruit pads across the country.

Asia-Pacific is the Fastest-Growing Market Due to Rapid Fruit Consumption and the Expanding E-Commerce

The Asia-Pacific region is witnessing rapid growth in the absorbent fruit pads market due to increasing demand for fresh fruits, rising disposable incomes, and expanding organized retail and e-commerce channels. Consumers are increasingly aware of food hygiene and freshness, driving adoption of advanced packaging solutions. Growing fruit exports from countries like China and India also contribute to market expansion.

India Absorbent Fruit Pads Market Insights

India's burgeoning fruit consumption and export activities are significantly contributing to the demand for absorbent fruit pads. The country produces around 227 kg of fruits and vegetables per person per year, exceeding the general recommendation of 146 kg per person annually, which highlights both high production and consumption levels. The adoption of absorbent pads helps maintain the quality and freshness of fruits such as mangoes, apples, and grapes during transit and storage, catering to both domestic and international markets. Growing organized retail and e-commerce platforms further support market expansion.

China Absorbent Fruit Pads Industry Growth

China's position as a leading global producer and exporter of fruits like apples, citrus, and grapes underscores its significant role in the absorbent fruit pads market. The country's emphasis on food safety and quality standards has driven the adoption of advanced packaging solutions, including absorbent pads, to ensure the freshness and shelf life of fruits during domestic distribution and international exports.

Regulatory Analysis

The global absorbent fruit pads market is heavily regulated due to food safety, hygiene, and environmental requirements. Pads must comply with food-contact material rules, such as the EU’s Regulation (EC) No 1935/2004 and EFSA guidelines, the US FDA regulations, and national Food Sanitation Acts in countries like Japan and China. This ensures that materials like superabsorbent polymers, cellulose, and nonwoven fabrics do not compromise food safety.

Environmental regulations are also shaping the market, with initiatives like the EU’s Single-Use Plastics Directive, Extended Producer Responsibility, and Germany’s VerpackG promoting recyclable or compostable pads. US states including California, Oregon, and Washington mandate compostable or recycled-content packaging. Companies such as Sirane are innovating biodegradable and fiber-based pads to meet standards like EN 13432 and ASTM D6400, driving eco-friendly solutions while increasing compliance costs and competitive pressure on traditional plastic-based products.

Competitive Landscape

The global absorbent fruit pads market is fairly fragmented but led by a handful of specialty packaging firms with strong retail and grower–packer relationships. Key players such as Sirane, Elliott Absorbent Products, Mundo Product Co. Ltd., Novipax Buyer, LLC, Felix, AptarGroup, Inc., McAirlaid‘s, Cellcomb AB, Kapelis Packaging and Hydra-Sorb., command significant market share through their extensive global footprint.

Retailer cost-cutting strategies and sustainability scorecards increase competitiveness. Winning vendors promote plastic-free, compostable or paper-heavy pads, FSC-certified fibers and mono-material designs that eliminate loose super-absorbent polymer (SAP) granules; they also provide LCA data and food-contact compliance dossiers (EU 1935/2004, BfR, FDA) as standard.

Scale companies maintain market share through multi-plant footprints (service levels, freight savings), audited hygiene systems (BRCGS/IFS) and collaboration with tray and lidding-film OEMs.

Key Developments

In November 2024, Elliott Absorbent Products introduced the ECHO Pad, a new fruit pad designed to extend the shelf life of berries by twelve hours. The pads are fully recyclable, compostable, and 100% plastic-free, made from cellulose derived from straw crop residues.

In March 2023, Sirane introduced the EarthPad, the first absorbent fruit pad approved for recycling by OPRL. The pad combines cellulose absorbency with a paper outer layer, making it both recyclable and compostable, and is available in regular and cushioned versions for delicate fruit.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies