3D Cell Culture Market Size & Industry Outlook

The rising need for more precise, human-like in-vitro models significantly propels the 3D cell culture market. Conventional 2D cultures are inadequate in mimicking the intricate architecture, cell-cell interactions, and microenvironments of human tissues, which limits their effectiveness in drug discovery, toxicity assessments, and disease modeling. On the other hand, 3D cell cultures, including spheroids, organoids, and scaffold-based systems, more accurately reflect in vivo conditions, leading to more dependable physiological responses. This advancement allows pharmaceutical and biotech companies to decrease their reliance on animal testing, enhance translational relevance, and expedite therapeutic development. The increasing recognition of personalized medicine and regulatory support for models relevant to humans further boosts the widespread adoption of 3D cell culture technologies.

Key Highlights

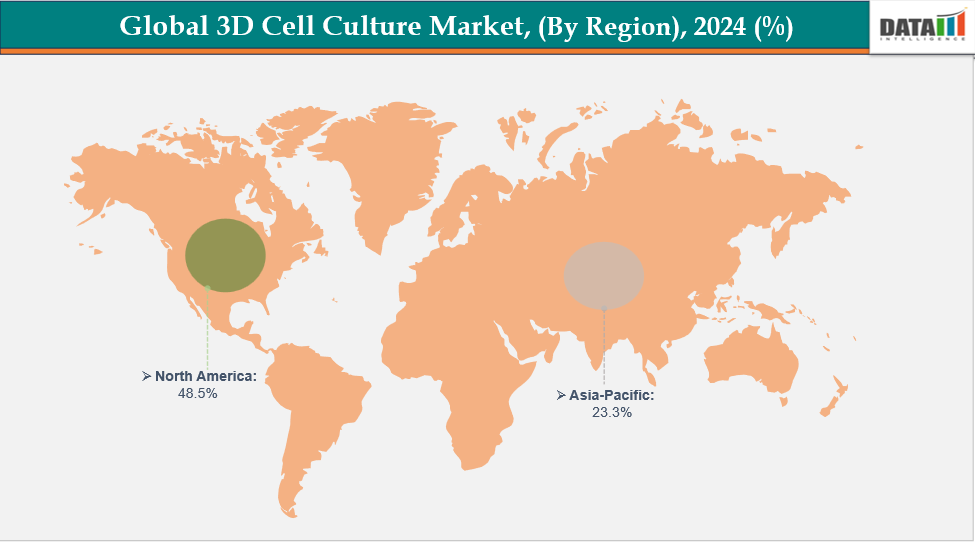

- North America is dominating the global 3D cell culture market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global 3D cell culture market, with a CAGR of 7.7% in 2024

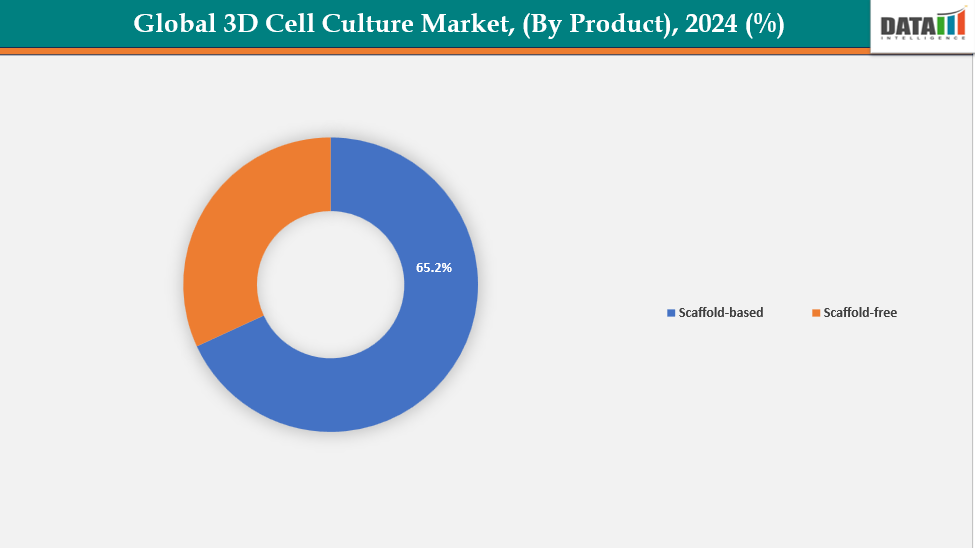

- The scaffold-based segment is dominating the 3D cell culture market with a 65.2% share in 2024

- The stem cell research and tissue engineering segment is dominating the 3D cell culture market with a 45.3% share in 2024

- Top companies in the 3D cell culture market include Thermo Fisher Scientific Inc., Merck, lena biosciences, Corning Incorporated, Sartorius AG, EPROCELL Inc., Mimetas, CN Bio Innovations Ltd, InSphero, and Lonza, among others.

Market Dynamics

Drivers: Better biological relevance is accelerating the growth of the 3D cell culture market

Improved biological relevance is driving the expansion of the 3D cell culture market, as these systems more effectively mimic the structural and functional intricacies of human tissues in contrast to conventional 2D cultures. By allowing for realistic interactions between cells and their matrix, 3D models deliver more reliable data for drug screening, cancer research, and toxicity assessments. For instance, in October 2024, InSphero and the FDA’s NCTR published a landmark benchmarking study using 3D InSight Human Liver Microtissues, demonstrating their ability to identify hepatotoxicity in 152 approved drugs and correctly flag 80% of compounds later withdrawn, significantly advancing early-stage drug safety testing.

Furthermore, this minimizes the risk of clinical failures in later stages and enhances the efficiency of research and development for pharmaceutical and biotechnology firms. Consequently, scientists are progressively opting for 3D platforms like organoids, spheroids, and organ-on-chip systems to investigate disease mechanisms, assess drug responses, and simulate conditions specific to individual patients.

Restraints: 3D cell culture systems are expensive and are expected to hamper the growth of the 3D cell culture market

The high expenses related to 3D cell culture systems are likely to inhibit market expansion, as these methods demand specialized consumables, advanced machinery, and trained staff. Materials like scaffolds, ECM hydrogels, spheroid plates, microfluidic organ-on-chip systems, and bioprinters cost significantly more than conventional 2D culture tools, thereby raising overall research and development budgets.

Furthermore, qualified staff are essential for handling intricate protocols and guaranteeing reproducibility, which contributes to operational costs. Numerous laboratories encounter financial limitations that hinder their ability to implement these technologies, even though they offer benefits compared to conventional 2D cultures. The absence of standardized protocols further raises expenses due to the need for repeated optimization and training.

For more details on this report, see Request for Sample

3D Cell Culture Market, Segmentation Analysis

The global 3D cell culture market is segmented based on technology, application, end user, and region

By Technology: The scaffold-based segment is dominating the 3D cell culture market with a 65.2% share in 2024

The scaffold-based segment is leading the worldwide 3D cell culture market because it effectively simulates the natural extracellular matrix (ECM), offering structural support that enhances cell adhesion, growth, and differentiation. Hydrogels, polymeric scaffolds, and various biomaterials form a 3D microenvironment that more accurately imitates in vivo conditions compared to scaffold-free systems, which makes them suitable for applications in tissue engineering, drug testing, and disease modeling.

Moreover, ongoing improvements in technology and the regular introduction of new products are propelling the leadership of this segment. For instance, in October 2025, REPROCELL Europe Ltd. launched Alvetex Advanced, a next-generation 3D cell culture platform that enhanced culture flexibility, assay compatibility, and translational accuracy, building on the original Alvetex scaffold and expanding capabilities for bioengineered tissue models, including human skin.

By Application: The stem cell research and tissue engineering segment is dominating the 3D cell culture market with a 45.3% share in 2024

The segment focused on stem cell research and tissue engineering leads the global 3D cell culture market because of the growing need for sophisticated models that accurately reflect human tissues and organ systems. Three-dimensional scaffolds and hydrogels create a microenvironment similar to that found in living organisms, facilitating stem cell attachment, growth, and specialization, which is crucial for regenerative medicine, disease modeling, and individualized treatments.

Moreover, recent mergers and acquisitions in stem cell research and tissue engineering are strengthening the 3D cell culture market’s growth. For instance, in January 2025, Merck acquired HUB Organoids Holding B.V., expanding its next-generation biology portfolio. The acquisition complemented Merck’s cell culture offerings, enabling earlier drug response insights, supporting project scalability, and reinforcing the company’s commitment to delivering differentiated solutions for faster, more effective drug development.

3D Cell Culture Market, Geographical Analysis

North America is dominating the global 3D cell culture market with 48.5% in 2024

North America accounted for a major portion of the worldwide 3D cell culture market, propelled by its advanced healthcare systems, a high incidence of chronic illnesses, leading biotech and pharmaceutical firms, substantial investments in research and development, favorable regulations, early integration of cutting-edge 3D technologies, and an increasing emphasis on personalized medicine and tissue-engineered solutions.

In the United States, the market for 3D cell culture has grown due to heightened investments in research and development, funding opportunities, grants supporting advanced cell culture technologies, and a growing prevalence of cancer and chronic illnesses.

For instance, in October 2025, REPROCELL USA, a leader in clinically relevant hiPSC production, received funding from the Maryland Stem Cell Research Fund. The hiPSCs were ethically sourced from screened healthy donors following strict FDA guidelines.

Europe is the second region after North America, which is expected to dominate the global 3D cell culture market with 34.5% in 2024

In Europe, the market for 3D cell cultures has experienced considerable growth, fueled by an increase in cancer and chronic disease cases, significant research investments, and a robust innovation landscape. Supportive regulations, advancements in biologics, and strategic partnerships between biotech and pharmaceutical companies have hastened product development, clinical research, and the expansion of the regional market.

Moreover, collaborations in 3D cell culture and organoid studies are bolstering Europe’s market by fostering innovation, promoting commercialization, and advancing research developments. For instance, in November 2025, Tebubio partnered with Apricell to advance 3D cell culture and organoid research. The collaboration expanded access to innovative 3D culture technologies and tools, supporting European researchers in developing organoid-based models and enhancing capabilities across drug discovery, tissue engineering, and regenerative medicine applications.

The Asia Pacific region is the fastest-growing region in the global 3D cell culture market, with a CAGR of 7.7% in 2024

The 3D cell culture market in the Asia-Pacific region has seen significant growth, propelled by heightened investments in biotechnology, an uptick in the occurrence of cancer and chronic diseases, favorable governmental healthcare programs, progress in epigenetic studies, the need for targeted therapies, and partnerships among major pharmaceutical and biotech firms in China, Japan, India, and South Korea.

The 3D cell culture market in China has grown swiftly, fueled by significant investments in research and development, a high occurrence of cardiovascular diseases, and strategic partnerships among firms that have boosted innovation, clinical progress, and the commercialization of cutting-edge 3D cell culture technologies.

3D Cell Culture Market Competitive Landscape

Top companies in the 3D cell culture market include Thermo Fisher Scientific Inc., Merck, lena biosciences, Corning Incorporated, Sartorius AG, EPROCELL Inc., Mimetas, CN Bio Innovations Ltd, InSphero, and Lonza, among others.

Thermo Fisher Scientific Inc.: Thermo Fisher Scientific, a global leader in life sciences, provides a robust 3D cell culture portfolio—including scaffold‑based matrices (like its AlgiMatrix alginate scaffold), low‑attachment Nunclon Sphera plates, optimized Gibco media, and advanced analytical instruments. Their integrated solutions facilitate organoid and spheroid workflows for drug discovery, regenerative medicine, and disease modeling, reinforcing their strong presence in the 3D cell culture market.

Key Developments:

- In September 2025, Fluidic Sciences acquired the business and assets of Sphere Bio, combining its MDS technology with Sphere Bio’s picodroplet platforms and high-throughput assays. The acquisition created a complementary technology suite, enabling seamless analysis from cellular function to molecular interactions and accelerating biotherapeutic discovery and development.

- In June 2025, Mitsui Chemicals announced the launch of InnoCell cell culture microplates, featuring high oxygen permeability. Developed by combining the company’s unique materials with precision cutting technologies, these microplates enhance cell viability and performance, supporting advanced 3D cell culture and organoid research applications.

3D Cell Culture Market Scope

| Metrics | Details | |

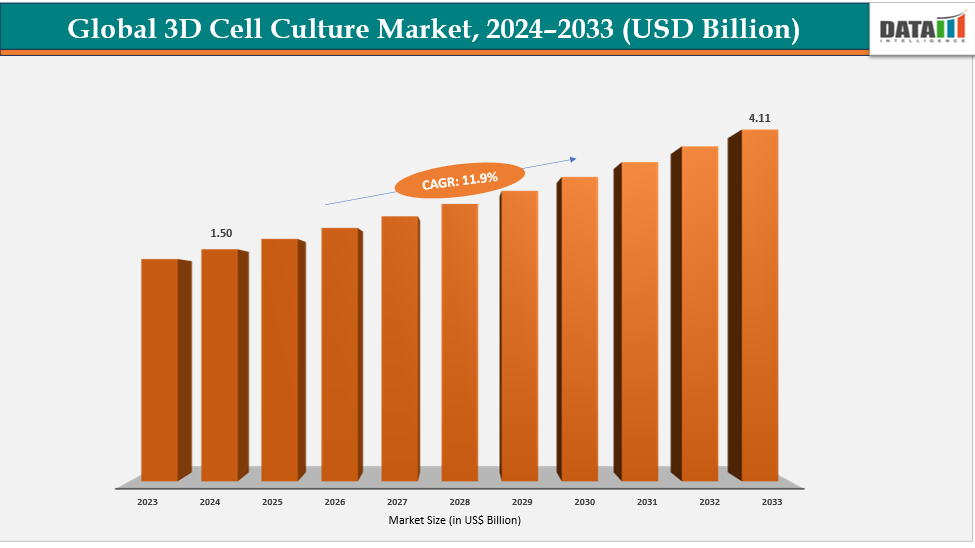

| CAGR | 11.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Technology | Scaffold-based, scaffold-free |

| By Application | Stem Cell Research and Tissue Engineering, Cancer Research, Drug Discovery, In Vitro Diagnostics, Others | |

| By End User | Biotechnology and Pharmaceutical Companies, Academic and Research Institutes, Contract Research Organizations, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global 3D cell culture market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here