Sanofi, the French pharmaceutical company, recently announced a €1 billion ($1.05 billion) investment to build an innovative insulin production facility in Yizhuang, Beijing. This new establishment, Sanofi's second in Beijing and fourth overall in China, demonstrates the company's commitment to solving the country's rising diabetes epidemic. This project is strategically designed to increase local insulin production, minimize dependency on imports, and fulfil the growing need for diabetes care in one of the world's fastest growing countries.

Addressing the Diabetes Epidemic in China

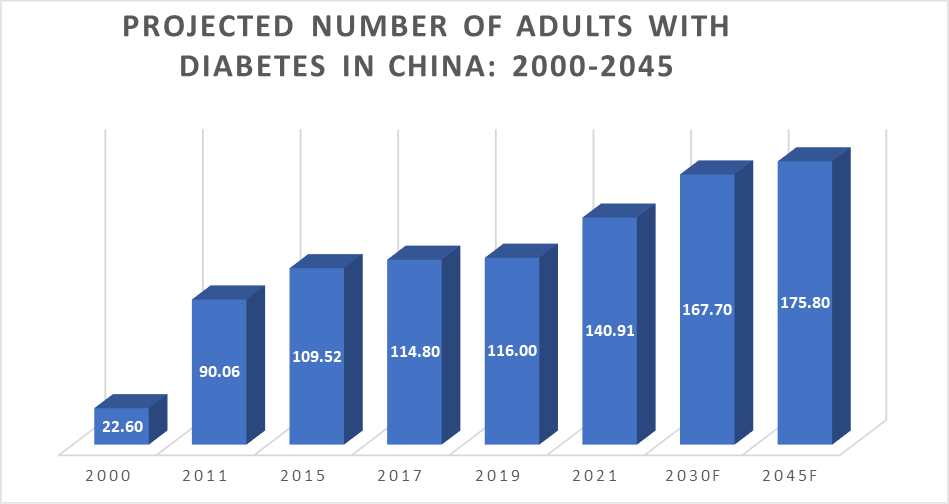

The total amount of diabetes cases in China continues to rise significantly. According to the Guidelines for the Prevention and Treatment of Type 2 Diabetes in China (2020 Edition), the nationwide incidence of diabetes in adults is 11.2%, impacting near 141 million people. Worryingly, around 51.7% of these cases go undetected, emphasizing the need for improved awareness and early intervention. As a result, the demand for insulin which is essential to controlling both Type 1 and advanced Type 2 diabetes is increasing.

Sanofi’s new investment comes at a crucial time, as China’s insulin market is projected to grow at a compound annual growth rate (CAGR) of 9.9%, driven by the country’s aging population, increasing urbanization, and expanding healthcare access. In line with this, Sanofi aims to boost local production to address this surge in demand and ensure a reliable, cost-effective supply chain for insulin.

According to DataM Intelligence’s China Insulin Pens Market Report, insulin pens due to their ease of use and precision are gaining popularity among diabetic patients in China, further accelerating the demand for insulin.

Enhancing Sanofi’s Manufacturing Presence in China

The production capacity of Sanofi in China will be greatly increased by the new facility in the Beijing Economic and Technological Development Zone (Yizhuang). The facility will be one of the most cutting-edge insulin production facilities in the area thanks to its sophisticated automated production methods, digital management systems, and environmentally friendly operations. Digital system integration will aid in operational optimization, enhancing the resilience and efficiency of the supply chain.

Sanofi’s long-standing presence in China, dating back to 1982, has been marked by steady expansion. The new facility complements the company’s existing operations in Beijing, Shenzhen, and Hangzhou, positioning Sanofi well to capture a significant share of China’s expanding insulin market. Moreover, local production allows for more streamlined distribution, reduced logistical costs, and adherence to China's "Made in China" initiatives, which support the development of domestically produced healthcare products.

Aligning with China’s Healthcare Goals

The National Health Commission of China has prioritized the improvement of chronic disease management, including diabetes. Sanofi's funding supports this national priority by bolstering efforts to improve diabetes treatment accessibility and availability. The company's commitment to domestic manufacture aligns with China's broader goal of strengthening its pharmaceutical supply chain, reducing reliance on foreign imports, and boosting healthcare quality for millions of diabetics.

Frédéric Oudéa, Chairman of Sanofi’s Board of Directors, highlighted the company’s confidence in China’s long-term economic growth. Sanofi’s investment reflects the company’s belief in the stability and openness of the Chinese market, which fosters innovation and supports foreign enterprises. By expanding its manufacturing capabilities, Sanofi is not only solidifying its footprint in China but also contributing to the high-quality development of the pharmaceutical industry in the region.

Competitive Landscape and Market Trends

The insulin and diabetes care market in China is highly competitive, with both global and local players striving to secure their positions. Multinational companies such as Novo Nordisk, Eli Lilly, and Sanofi are increasing their local manufacturing efforts, recognizing that local production is a crucial strategy to maintain a competitive edge in this rapidly expanding market. According to DataM Intelligence’s analysis, Sanofi's €1 billion investment in China further strengthens its position, ensuring a reliable supply chain and addressing the growing demand for affordable insulin in a country with over 125 million diabetics—the largest diabetic population in the world.

In this dynamic landscape, local companies like Meiqi, China’s leading manufacturer of advanced Continuous Glucose Monitoring (CGM) products, are also making significant strides. Meiqi is pushing the boundaries of technology to meet the needs of the growing diabetic population. In partnership with Analog Devices, Inc., Meiqi is advancing its solutions to provide innovative and effective diabetes management options, helping to shape the future of diabetes care in China.

Furthermore, regulatory changes, such as the inclusion of insulin products in China’s National Reimbursement Drug List (NRDL), have improved access to insulin for a broader segment of the population. This regulatory shift has made insulin more affordable, further driving demand. Sanofi’s investment ensures the company can quickly adapt to these changes and continue meeting the growing needs of diabetes patients in China.

In a rapidly growing market for diabetes and obesity treatments, China has become a key battleground for leading global pharmaceutical companies. The two dominant glucagon-like peptide-1 (GLP-1) receptor agonists for obesity and type 2 diabetes, Novo Nordisk’s semaglutide (Wegovy/Ozempic) and Eli Lilly's tirzepatide (Mounjaro/Zepbound), are gaining traction in the country. This is particularly significant given that China holds the world’s largest population of diabetes and obesity patients, making it a crucial market for these innovative treatments.

China's GLP-1 market, valued at approximately $1.80 billion in 2023, is poised for rapid expansion. According to DataM Intelligence, the market is expected to experience significant growth due to the country’s rising rates of obesity. By 2033, the number of obesity patients in China is projected to exceed 500 million, which will undoubtedly drive demand for GLP-1 medications. The Chinese GLP-1 market is anticipated to grow at an annual rate of 23%, reaching a projected CNY81 billion (approximately $12.1 billion) by 2033.

One key aspect of this growth will be the increasing market share of Chinese companies, with forecasts indicating they could capture up to 25% of the GLP-1 market by 2033. This shift will be driven by the ability of local firms to offer competitive pricing, leverage vast sales networks, and meet the specific demands of the local population, which is becoming more health-conscious. These dynamics present significant opportunities for both Chinese pharmaceutical companies and contract research, development, and manufacturing organizations.

The GLP-1 drugs, initially developed to treat type 2 diabetes, are now gaining popularity as treatments for obesity and weight loss. Their endorsement by celebrities and influencers has further fuelled their demand, transforming these medications into mainstream solutions for weight management. Despite the U.S. being the largest market for these drugs, China’s potential remains enormous, with its population presenting both challenges and opportunities for GLP-1 drug makers.

DataM Intelligence forecasts that China's expanding healthcare awareness and growing economic development will further accelerate the adoption of these drugs, making it a key market for pharmaceutical companies seeking growth. As China embraces innovative treatments for diabetes and obesity, the competition for market share in the GLP-1 space is intensifying, and the results could have a significant impact on global sales and market strategies in the coming years.

Looking Ahead: DataM Intelligence Insights

Sanofi’s €1 billion investment in insulin production is a pivotal move in China’s pharmaceutical sector. According to DataM Intelligence’s research, this investment will not only address the immediate demand for insulin but also prepare for future growth in diabetes cases. The facility will play a crucial role in improving patient outcomes by increasing access to insulin and contributing to the overall health of China’s population.

Looking ahead, the diabetes care market in China is expected to continue its robust growth. With government policies focused on expanding healthcare access, pharmaceutical companies—both local and international will have ample opportunities to expand their reach. Sanofi’s investment is well-timed to capture a larger share of this growing market while helping to improve healthcare infrastructure and access to diabetes care.

Where to Learn More

For additional insights into the growing diabetes care market in China, explore the comprehensive China Diabetes Care Market, China Insulin Pen Market, China Diabetes Treatment Market, China Insulin Market, China Type 2 Diabetes Market, China Diabetes Drug Market, China Glucose Monitoring Market, China Diabetes Injection Devices Market, and China GLP-1 Market reports by DataM Intelligence.

These reports provide in-depth details on the China market, including size, forecast, segmentation, China dynamics, industry trends, competitive landscape, key market drivers and challenges, regulatory environment, pricing analysis, demand and supply analysis, and market opportunities.

Additionally, they cover growth strategies, recent developments, product innovations, and competitive positioning of key players in the market. Stay ahead with key market intelligence and trends shaping the future of diabetes care.