Electrocardiograph Market Size& Industry Outlook

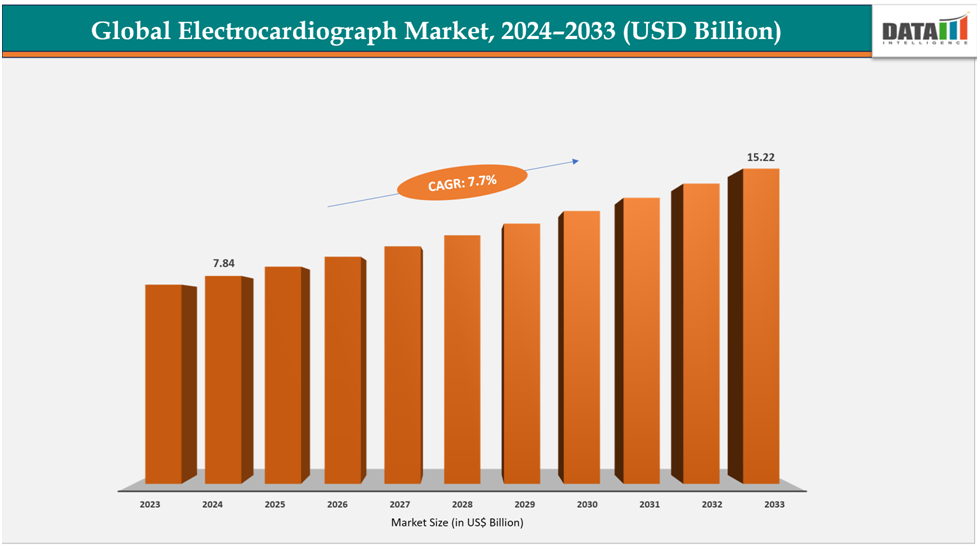

The global electrocardiograph market size reached US$ 7.29 Billion with a rise of US$7.84Billion in 2024 and is expected to reach US$ 15.22Billion by 2033, growing at a CAGR of 7.7%during the forecast period 2025-2033.

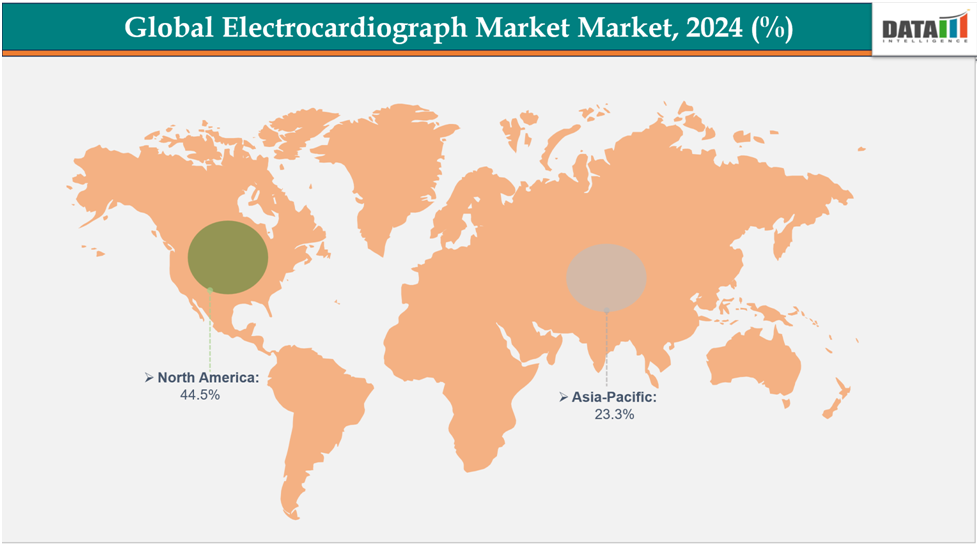

As cardiovascular disorders become more common and there is a greater need for early diagnosis and ongoing monitoring, the global electrocardiograph (ECG) market is growing gradually. Advances in technology, such as wearable, cordless, and portable gadgets with AI built in, are improving accessibility and accuracy. The industry is growing thanks to the increasing use of home care and remote monitoring services. North America is in the lead because of its sophisticated healthcare system, but Asia Pacific is becoming the fastest-growing region thanks to rising healthcare expenditures. Cost pressures, data privacy issues, and legal obstacles still exist, though, and these could have an impact on market adoption and worldwide expansion.

Owing to the factors like technological advancements, for instance,in September 2023, iRhythm Inc. announced the U.S. launch of its next-generation Zio monitor and enhanced long-term continuous monitoring (LTCM) service. The Zio monitor was the smallest, lightest, and thinnest cardiac monitor, improving the monitoring experience for patients and healthcare providers with new service enhancements.

Key Highlights

- North America dominates the electrocardiograph market with the largest revenue share of 44.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.1% over the forecast period.

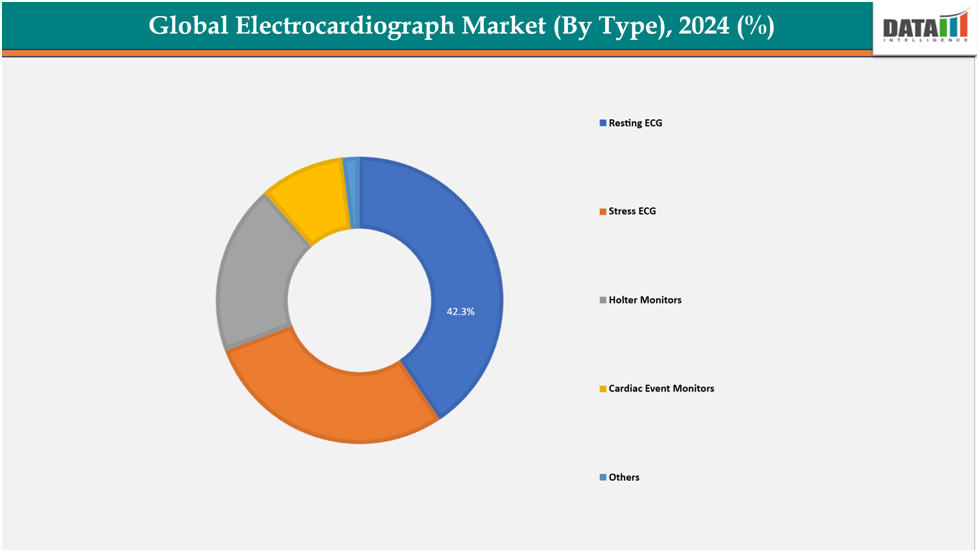

- Based on type, the resting ECG segment led the market with the largest revenue share of 42.3% in 2024.

- Top companies in the electrocardiograph market include GE HealthCare, Koninklijke Philips N.V., NIHON KOHDEN CORPORATION, SCHILLER, Mindray Medical India Pvt. Ltd., EdanUSA, Baxter International Inc., iRhythm Inc., AliveCor, Inc., BPL Medical Technologies, and OMRON Healthcare, Inc., among others.

Market Dynamics

Drivers:

Rising cardiovascular disease prevalence's are significantly driving the electrocardiograph market growth

The market for electrocardiographs (ECGs) is primarily driven by the increasing prevalence of cardiovascular diseases (CVDs). As heart failure, coronary artery disease, and arrhythmias become increasingly prevalent, there is an increasing need for prompt and precise diagnosis. ECGs offer noninvasive, economical, and trustworthy detection, which is crucial for continuous monitoring and early action. Adoption is further increased by aging populations and initiatives for preventative healthcare. The global ECG market is expanding rapidly due to wearable technology and AI-enabled ECG devices, which also allow for continuous and remote monitoring, improve patient management, and generate recurring demand.

For instance, recent data published by WHO and CDC 2023, show that cardiovascular diseases (CVDs) were the leading cause of death globally. Every year, about 805,000 people in the United States have a heart attack. Of these, 605,000 experienced a first heart attack, and 200,000 were people who had already suffered a heart attack. An estimated 19.8 million people died from CVDs in 2022, representing approximately 32% of all global deaths, of which 85% were caused by heart attacks and strokes. Every year, about 805,000 people in the United States have a heart attack of these, 605,000 experienced their first heart attack, and 200,000 were people who had already suffered a heart attack.

Restraints:

High equipment costs are hampering the growth of the electrocardiograph market

The market expansion for electrocardiographs (ECGs) is being hindered by high equipment costs, which restrict accessibility and usage. Advanced hospital-grade ECG machines and wearable or AI-enabled technology are sometimes too costly for emerging markets, smaller clinics, and rural healthcare facilities. High costs can discourage consumers from using personal ECG equipment, and budgetary restrictions cause providers to postpone purchases or updates. Consequently, despite an increase in the frequency of cardiovascular illness, the adoption of sophisticated diagnostic and remote monitoring tools slows, posing a serious obstacle to the expansion and growth of the industry as a whole.

For instance, in India and numerous Southeast Asian nations, advanced 12-lead ECG equipment with AI-based diagnostic features can cost between US$3,000 and US$10,000 per unit, which is too costly for small clinics and rural hospitals. This limits the accuracy of diagnosis and hinders the broad use of remote cardiac monitoring since many institutions still rely on antiquated or simple single-lead systems.

For more details on this report, see Request for Sample

Segmentation Analysis

The global electrocardiograph market is segmented based on type, lead type, end user, and region.

Type:

The resting ECG segment from type is dominating the electrocardiograph market with a 42.3% share in 2024

The electrocardiograph (ECG) market is dominated by the resting ECG sector because of its extensive application in routine cardiac diagnostics, such as arrhythmia identification and heart health evaluation. Because of its affordability and simplicity of use, hospitals, clinics, and outpatient centers can use it. Compatibility with cardiovascular information systems and electronic health records improves workflow efficiency. Its quick results can help with early diagnosis and healthcare prevention. In the worldwide ECG market, resting ECG devices continue to be the most popular and widely utilized segment due to these reasons as well as their widespread acceptance in a variety of healthcare settings.

For instance, in June 2025, AliveCor, Inc. received dual FDA clearance for its Kardia 12L resting ECGSystem, an AI technology that delivered 35 cardiac determinations and was the first-of-its-kind Kardia 12L ECG System. The company subsequently launched the device in India in July 2025.

Lead Type:

The 12-lead type segment is estimated to have a 35.3% of the electrocardiograph market share in 2024

The market for electrocardiographs is led by the 12-lead ECG sector because of its widespread clinical acceptability, thorough cardiac monitoring, and accuracy in diagnosis. It offers 12 comprehensive views of the electrical activity of the heart using 10 electrodes, which is crucial for identifying structural problems, myocardial infarctions, and arrhythmias. Supported by insurance reimbursement and medical guidelines, it continues to be the gold standard in clinics, hospitals, and emergency rooms. Its accessibility is improved by innovations like portable and AI-powered gadgets. The 12-lead's demonstrated therapeutic benefit ensures its sustained market dominance, even in the face of the growing popularity of single-lead devices for remote usage.

For instance, in December 2024, HeartBeam, Inc., announced FDA 510(k) clearance for HeartBeam 12-lead ECG SystemAt-Home, High-Fidelity Heart Monitoring Technology, the first cable-free, ambulatory ECG that captures the heart’s electrical signals from three distinct directions for high-fidelity data collection and advanced diagnostics.

Geographical Analysis

North America is dominates the global electrocardiograph market with44.5% in 2024.

North America's dominance in the global electrocardiograph (ECG) market is driven by several key factors. The region has a high and growing prevalence of cardiovascular diseases, necessitating widespread use of diagnostic tools. Its advanced healthcare infrastructure, coupled with high healthcare spending and favorable reimbursement policies, supports the adoption of sophisticated ECG technologies. The presence of major medical device companies and a strong focus on technological innovation, including the integration of AI and telemedicine, further accelerates market growth. These factors collectively position North America as a leader in the ECG market.

Owing to the factors like technological innovation, in July 2024, Tempus received U.S. FDA 510(k) clearance for Tempus ECG-AF, an AI-based algorithm that identifies patients at an increased risk of atrial fibrillation/flutter (AFib). This was the first FDA clearance for an AFib indication in the category known as “cardiovascular machine learning-based notification software,” paving the way for physicians to use this algorithm in patient care.

Europe is the second region after North America, which is expected to dominate the global electrocardiograph market with34.5% in 2024.

The European electrocardiograph (ECG) market is expected to dominate as the second largest globally, with key contributions from countries such as Germany, the UK, and France. Growth in the region is driven by the high incidence of cardiovascular diseases, advanced healthcare infrastructure, and rapid adoption of innovative diagnostic solutions like portable and wearable ECG devices. A growing elderly population and increasing focus on early detection of cardiac conditions are further boosting demand. In addition, supportive regulatory frameworks and initiatives from bodies such as the European Society of Cardiology (ESC) and the European Medicines Agency (EMA) are strengthening preventive care, accelerating timely diagnosis, and improving patient outcomes consolidating Europe’s strong position in the global ECG market.

Germany dominates the European ECG market due to its high healthcare spending, advanced hospital infrastructure, and large aging population. A high prevalence of cardiovascular diseases fuels strong demand, while early adoption of digital and wearable ECG technologies boosts growth. The presence of leading MedTech companies further strengthens Germany’s position as the region’s top ECG market.

For instance, in May 2024, Cardiomatics partnered with BIOTRONIK in Germany to expand access to its AI-powered ECG analysis solution. Through the partnership, BIOTRONIK’s sales team distributed the software alongside its netECG advanced Patch Holter Monitor. This combination drove wider adoption of AI for early detection and management of individuals at risk of cardiac events.

The Asia Pacific region is the fastest-growing region in the global electrocardiograph market, with a CAGR of 7.1% in 2024.

The electrocardiograph (ECG) market is growing rapidly in the Asia-Pacific region, led by countries such as China, India, Japan, and South Korea. Rising cases of cardiovascular diseases, expanding healthcare infrastructure, and a large aging population are key drivers. In Japan, advanced technology adoption and government healthcare initiatives support growth, while in China and India, increasing awareness of preventive care, better access to diagnostic services, and investments in digital health are fueling greater demand for ECG devices and monitoring solutions.

Japan’s ECG market is growing due to its aging population, high cardiovascular disease burden, and strong government focus on preventive care. Advanced healthcare infrastructure, domestic manufacturers, and rapid adoption of AI-powered wearable and remote monitoring devices further accelerate demand.

For instance, in November 2024, iRhythm Technologies announced Japanese regulatory approval of the Zio ECG Monitoring System, the first product that delivered arrhythmia monitoring services utilizing artificial intelligence. The Zio long-term continuous monitoring (LTCM) service uses a prescription-only patch ECG device worn for up to 14 days. Its ZEUS AI software generates a detailed report, reviewed and curated by certified cardiographer technicians.

Competitive Landscape

Top companies in the electrocardiograph market include GEHealthCare,Koninklijke Philips N.V., NIHON KOHDEN CORPORATION,SCHILLER, Mindray Medical India Pvt. Ltd.,EdanUSA, Baxter International Inc., iRhythm Inc., AliveCor, Inc., BPL Medical Technologies, andOMRON Healthcare, Inc., among others.

GEHealthCare: GE HealthCare is a leading global medical technology and diagnostics company that provides a wide range of products, services, and digital solutions. The company operates in four main segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics. With a global presence, they are dedicated to advancing patient care and improving healthcare efficiency through innovation and technology.

Key Developments:

- In July 2025, Koninklijke Philips N.V. received FDA clearance for its ECG AI Marketplace, with Anumana’s LEF algorithm becoming the first certified third-party solution, providing cardiac care teams easy and efficient access to multiple AI-powered diagnostic tools in a single centralized platform.

Market Scope

| Metrics | Details | |

| CAGR | 7.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Resting, Stress, Holter Monitors, Cardiac Event Monitors, Others |

| Lead Type | Single-lead, 3–6 lead, 12-lead, Others | |

| End User | Hospitals, Clinics & Outpatient Cardiac Centers, Ambulatory care, home care | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global electrocardiograph market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here