Vegan Sauces, Dressings and Spreads Market Size

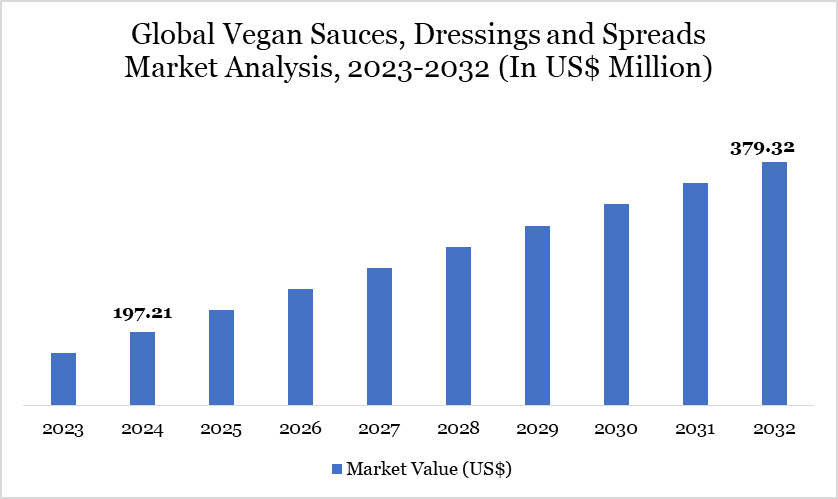

Vegan Sauces, Dressings and Spreads Market Size reached US$ 197.21 million in 2024 and is expected to reach US$ 379.32 million by 2032, growing with a CAGR of 8.52% during the forecast period 2025-2032.

The global vegan sauces, dressings, and spreads market is expanding rapidly, fueled by increasing consumer preference for plant-based, sustainable, and clean-label foods. According to the Food and Agriculture Organization (FAO), global demand for plant-based products has risen by over 15% in the last five years, reflecting a significant shift toward sustainable diets. The United Nations Environment Programme (UNEP) highlights that plant-based food production reduces greenhouse gas emissions by up to 50% compared to animal-based alternatives, reinforcing governmental pushes for such diets worldwide.

Regionally, North America remains a dominant player due to strong regulatory support, including the US Department of Agriculture’s (USDA) promotion of plant-based protein initiatives and increasing organic certification for vegan food producers. Meanwhile, the European Union has launched the “Farm to Fork” strategy to encourage plant-based food consumption as part of its Green Deal, aiming to reduce carbon footprints in food production by 2030.

Vegan Sauces, Dressings and Spreads Market Trend

A key trend in the global vegan sauces, dressings, and spreads market is the rising consumer demand for clean-label and sustainably sourced ingredients, driven by increasing environmental awareness and health consciousness. Governments worldwide, including the EU and Canada, are supporting plant-based innovation through funding and regulatory frameworks. Additionally, there is a growing focus on developing shelf-stable, preservative-free products to meet consumer preferences for convenience without compromising quality. This trend is expected to accelerate market growth as more consumers shift towards plant-based diets.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

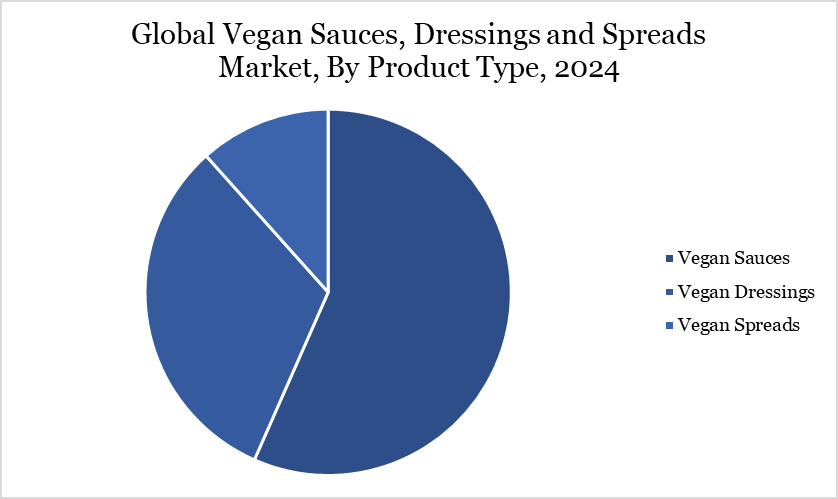

| By Product Type | Vegan Sauces, Vegan Dressings, Vegan Spreads |

| By Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Online Channel, and Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Vegan Sauces, Dressings and Spreads Market Dynamics

Surge in Plant-Based Convenience Food Consumption among Urban Millennials

The surge in plant-based convenience food consumption among urban millennials is driving the global vegan sauces, dressings, and spreads market. According to a 2023 report by the Food and Agriculture Organization (FAO), over 31% of urban millennials globally are increasing their consumption of plant-based convenience foods, particularly in regions such as Western Europe, North America, and Southeast Asia.

The European Commission’s 2022 survey highlighted that 41% of millennials in EU urban centers regularly purchase plant-based sauces and spreads as part of their flexitarian diets. Similarly, in Canada, Health Canada data shows that 30% of adults aged 25–40 prefer vegan condiments for daily meals, citing convenience, sustainability, and allergen avoidance. This demographic trend is encouraging global brands to develop clean-label, ready-to-use vegan products that align with urban consumption habits.

Limited Shelf Stability and Preservation Challenges in Clean-Label Vegan Formulations

Limited shelf stability in clean-label vegan formulations is emerging as a significant restraint in the vegan sauces, dressings, and spreads market. According to a 2023 report by the USDA’s Agricultural Research Service (ARS), clean-label sauces with minimal preservatives exhibit up to 35% shorter shelf life compared to conventional counterparts, posing distribution and inventory challenges.

The FDA’s food labeling modernization initiative has further restricted the use of synthetic additives, encouraging natural preservatives that often lack equivalent antimicrobial performance. This preservation hurdle particularly impacts small to mid-scale manufacturers aiming for extended shelf life in retail and export markets.

Vegan Sauces, Dressings and Spreads Market Segment Analysis

The global vegan sauces, dressings and spreads market is segmented based on product type, distribution channel and region.

Vegan Sauces Segment Driving Vegan Sauces, Dressings and Spreads Market

The vegan sauces segment is emerging as a key growth driver within the broader vegan sauces, dressings, and spreads market, largely propelled by health, sustainability, and government-backed innovation. According to the USDA’s Economic Research Service, plant-based sauce categories including tomato-based and nut-based variants grew by over 18% in retail sales from 2020 to 2023. The FDA’s Nutrition Innovation Strategy has also contributed by encouraging reformulation toward cleaner labels and reduced sodium, which many vegan sauces inherently offer.

In Canada, Agriculture and Agri-Food Canada (AAFC) data shows that condiments made from domestic pulses and oilseeds common bases for vegan sauces saw a 12% year-over-year production increase in 2022, signaling upstream supply growth. Furthermore, Protein Industries Canada (PIC) has co-invested in several projects to create globally scalable vegan sauces, including those using fermented pea protein and algae oil. These trends underscore the rising market viability and institutional support for the vegan sauces segment.

Vegan Sauces, Dressings and Spreads Market Geographical Share

Demand for Vegan Sauces, Dressings and Spreads Demand in North America

The demand for vegan sauces, dressings, and spreads in North America is growing steadily due to shifting consumer preferences toward clean-label, plant-based products. According to data from the US Department of Agriculture (USDA), the number of certified organic food processors—many of which manufacture vegan condiments—increased by over 14% between 2020 and 2023.

The USDA’s 2023 Organic Survey also revealed that US organic food sales exceeded US$ 63 billion, with a significant portion attributed to condiments and specialty food products, including vegan alternatives. This signals not only consumer acceptance but also a retail shift toward offering more plant-based, allergen-free condiment options in mainstream grocery chains across the US.

Brands supported by PIC and Agriculture and Agri-Food Canada (AAFC) are entering both retail and foodservice channels, increasing accessibility and affordability for vegan sauces and spreads. Additionally, Health Canada regulations updated in 2022 mandate clearer labeling of plant-based products, which has improved consumer trust and further driven demand. These government-supported developments emphasize the strong institutional and consumer push behind vegan condiment market growth in North America.

Sustainability Analysis

The sustainability profile of the Vegan Sauces, Dressings, and Spreads Market is increasingly aligned with global environmental goals, particularly in reducing greenhouse gas emissions and resource consumption. According to the USDA and the United Nations FAO, plant-based food production, including vegan condiments, uses up to 87% less water and emits 30–90% fewer greenhouse gases compared to animal-based counterparts.

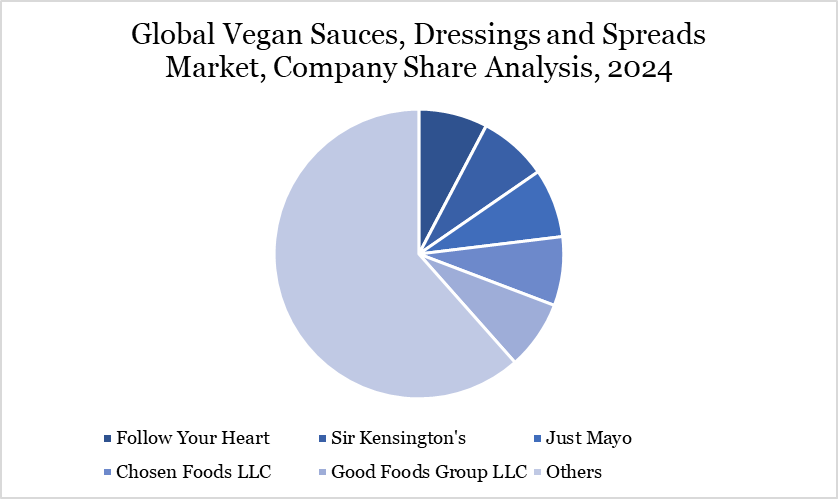

US-based brands such as Follow Your Heart and Good Foods Group have adopted compostable packaging and use solar-powered manufacturing facilities, directly supporting the US Environmental Protection Agency’s (EPA) sustainable manufacturing goals. The EPA’s “SmartWay” program has also recorded growing participation from food manufacturers in optimizing low-emission logistics for plant-based products.

Vegan Sauces, Dressings and Spreads Market Major Players

The major global players in the market include Follow Your Heart, Sir Kensington's, Just Mayo, Chosen Foods LLC, Good Foods Group LLC, O'Dang Foods LLC, Dr. Will's Ltd, Biona Organic, The Vurger Co. Ltd, and Primal Kitchen.

Key Developments

In April 2022, The Vurger Co., the UK-based plant-based QSR chain announced the opening of its newest location in Manchester, revealed a national retail deal for its Cheezy Vegan Sauce which launched into 635 Co-op stores nationwide.

In May 2023, Nestle Germany launched two new vegan BBQ sauces from its Thomy brand: 'Thomy Vegan Garlic Sauce' and 'Thomy Vegan Burger Sauce'; one pack contains 300ml of sauce.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies