US Needle-Free Blood Drawing Devices Market Size

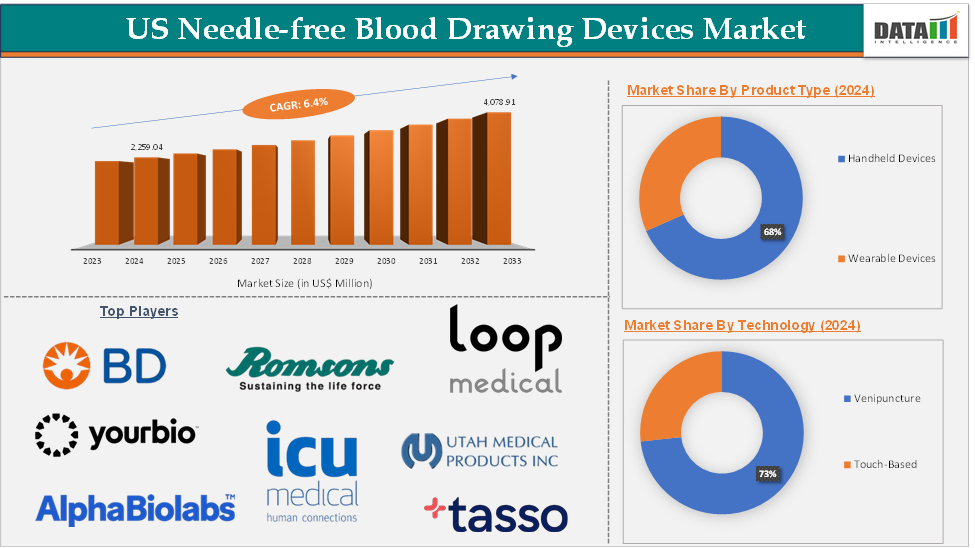

The US Needle-Free Blood Drawing Devices Market size reached US$ 2,259.04 Million in 2024 and is expected to reach US$ 4,078.91 Million by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033.

Needle-free blood drawing devices are innovative medical instruments designed to collect blood samples without the use of traditional needles. These devices aim to offer a more comfortable, safer, and less invasive alternative to conventional blood collection methods.

One of the primary market drivers is the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which require frequent blood monitoring. This has led to a surge in demand for devices that can provide quick, painless, and safe blood draws, especially for patients who experience needle anxiety or require regular testing.

There are significant market opportunities in both venipuncture-based and touch-based device segments. Venipuncture-based needle-free devices dominate the market due to their reliability and widespread acceptance in clinical settings. However, touch-based devices-which use microneedles, suction, or other non-invasive methods-are gaining traction, particularly for home healthcare and remote patient monitoring.

Market Executive Summary

For More Insights Request Free Sample

Market Scope

| Metrics | Details | |

| CAGR | 6.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Handheld Devices, Wearable Devices |

| Technology | Venipuncture, Touch-Based | |

| End-User | Hospitals, Ambulatory Surgical Centers, Diagnostic Laboratories, Others | |

US Needle-Free Blood Drawing Devices Market Dynamics

Increasing Demand for Pain-Free Alternatives

The demand for needle-free blood drawing devices in the U.S. is driven by multiple factors. One of the primary factors is the increasing demand for pain-free alternatives. The growing preference for needle-free blood drawing devices industry trends in the U.S. is largely driven by the desire for less painful medical procedures, particularly among patients who experience anxiety or discomfort with traditional needle-based methods. This trend is significant in hospitals where a high volume of blood draws occurs, impacting clinical decisions and patient care.

Conventional blood collection techniques, like venipuncture, frequently cause considerable pain and anxiety for patients. This discomfort stems from the process of inserting needles into the skin and veins, which can be especially troubling for individuals who have a fear of needles or for those who need to undergo blood draws regularly.

Moreover, key players in the industry outlook are more focused on technological advancements that help propel this market insight's growth. For instance, in April 2022, the Haiim device, developed by Winnoz Technology, represents a significant advancement in blood collection methods by offering a needle-free alternative to traditional venipuncture. This innovative device is designed to collect blood samples from the fingertips, utilizing vacuum-assisted technology to draw between 150 and 500 microliters of whole blood quickly and less painfully.

Also, in February 2022, Tasso, Inc. launched Tasso Care for Prescreening, a comprehensive service solution designed to enhance the prescreening process for clinical trials. This service aims to streamline the recruitment of participants by utilizing Tasso's innovative remote blood collection technology, which is patient-centric and clinically validated helps to drive the market forecast.

Regulatory Challenges

One of the key challenges facing the U.S. needle-free blood drawing devices market industry report is the complex and rigorous regulatory approval process required for new medical technologies. To be legally marketed and used in healthcare settings, needle-free blood drawing devices must undergo a thorough evaluation by regulatory bodies like the U.S. Food and Drug Administration (FDA). This process is essential to ensure that the devices are safe, effective, and reliable for patient use. However, the regulatory requirements are often extensive and time-consuming, which can create significant barriers to market entry.

US Needle-Free Blood Drawing Devices Market Segment Analysis

The US needle-free blood drawing devices market is segmented based on product type, technology, and end-user.

Product Type:

The handheld devices segment was valued at US$ 1,536.15 Million in 2024 and is estimated to reach US$ 2,773.66 Million by 2033, growing at a CAGR of 6.3% during the forecast period from 2025-2033

Handheld devices are compact, portable, and easy to use, making them particularly appealing in healthcare environments where space and resources may be limited. These devices can be used at the point of care, including in hospitals, outpatient clinics, ambulatory centers, and even for home healthcare applications. This portability allows healthcare providers to quickly and efficiently collect blood samples without needing specialized equipment or large setups.

A primary driver behind the dominance of handheld needle-free devices is the reduced pain and discomfort for patients drives the market trends. Traditional blood drawing methods, such as venipuncture, involve using needles, which can be painful, anxiety-inducing, and lead to complications like bruising and bleeding. Handheld needle-free devices, such as the BD PIVO Pro, provide a painless alternative by utilizing jet injection, microneedles, or other minimally invasive techniques. This leads to improved patient satisfaction and contributes to a more positive healthcare experience, making handheld devices the preferred choice in patient-centered care models.

For instance, in January 2025, the partnership between Carilion Clinic and BD (Becton, Dickinson and Company) marks a significant milestone in the U.S. needle-free blood drawing devices market share, particularly within the handheld devices segment.

Carilion Clinic, a not-for-profit healthcare organization serving over 1 Million people in Virginia, has become the first health system in the state and the Southeastern U.S. to implement needle-free blood draws using the BD PIVO Pro Needle-free Blood Collection Device. This collaboration highlights the growing adoption of handheld, needle-free technologies designed to improve patient care and enhance healthcare efficiency.

US Needle-Free Blood Drawing Devices Market Major Players

The major players in the US needle-free blood drawing devices market include Becton, Dickinson and Company (BD), YourBio Health, Inc., Tasso, Inc., Romsons, AlphaBiolabs Ltd, Loop Medical SA., Utah Medical Products, Inc., ICU Medical, Inc., and Winnoz Technology, Inc., among others.

US Needle-Free Blood Drawing Devices Market Key Developments

- In April 2024, the 1st generation TAP (Touch Activated Phlebotomy) device developed by YourBio Health represented a significant breakthrough in blood collection technology. It offered an easy-to-use, virtually painless alternative to traditional blood draws, making it suitable for clinical and remote clinical settings.

- In November 2023, BD introduced the PIVO Pro Needle-free Blood Collection Device, which allows blood samples to be drawn directly from a patient's peripheral IV line without using a traditional needle. This innovative device builds upon BD's existing PIVO technology that was first introduced for use with short peripheral IV catheters.

- In October 2022, Catapult Health and Tasso partnered to integrate the Tasso+ self-sampling blood collection device into annual healthcare checkups for employees at major corporations and national health plans in the USA. This collaboration aims to enhance the efficiency and comfort of blood testing during routine health assessments.

- In March 2022, Vitestro launched an autonomous blood collection device designed to empower patients by allowing them to participate actively in their blood draw procedures. This innovative device utilizes advanced technology, including artificial intelligence and ultrasound-guided imaging, combined with robotic needle insertion, to automate the blood collection process.