Market Size

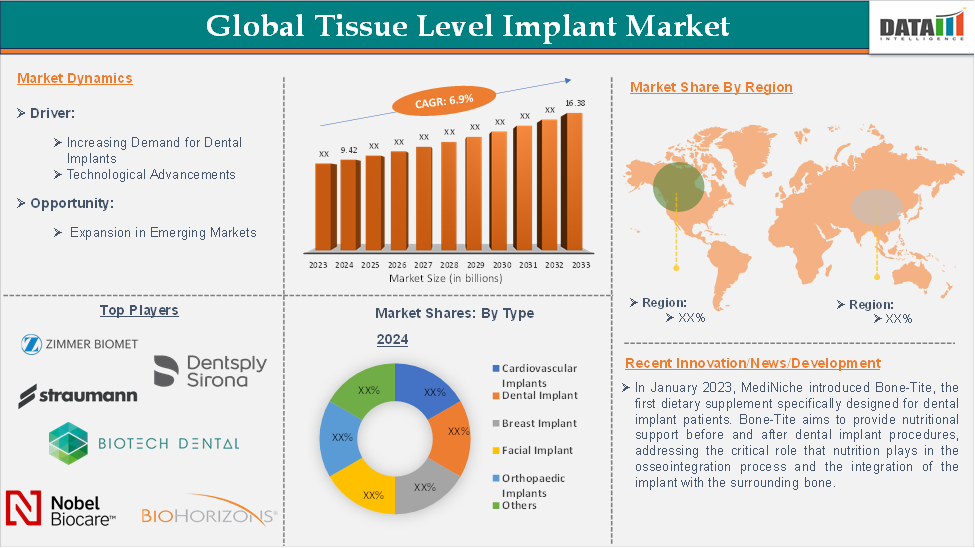

Global Tissue Level Implant Market reached US$ 9.42 billion in 2024 and is expected to reach US$ 16.38 billion by 2033, growing at a CAGR of 6.9 % during the forecast period of 2025-2033.

Tissue-level implants are a specialized type of dental implant characterized by their unique design, where the interface between the implant and the abutment is positioned above the bone level, directly in contact with the gum tissue. This design has several important implications for the healing process, patient care, and overall effectiveness of the implant.

The increasing geriatric population and the increasing burden of dental diseases, Rising geriatric population and burden of dental diseases, and technological advancements are expected to drive the market growth. People are more likely to lose teeth as they become older due to factors like decay, gum disease, and wear over time. The senior population frequently considers dental implants as a long-term solution for restoring oral function and aesthetics, increasing demand for tissue-level implants.

Executive Summary

For more details on this report, Request for Sample

Market Dynamics: Drivers & Restraints

Increasing Demand for Dental Implants

The increasing geriatric population and the increasing burden of dental diseases are expected to drive the market growth. People are more likely to lose teeth as they become older due to factors like decay, gum disease, and wear over time. The senior population frequently considers dental implants as a long-term solution for restoring oral function and aesthetics, increasing demand for tissue-level implants.

For instance, according to the report by the Herman Ostrow School of Dentistry of USC in 2024, it is estimated that around 5% of adults older than 65 years are edentulous. Additionally, according to the report by the World Health Organization in 2023, it is estimated that oral diseases affect nearly 3.5 billion people. The increasing number of dental diseases increases demand for tissue-level implants and drives market growth.

Furthermore, key players’ strategies such as partnerships & collaborations, and product launches would drive this market growth. For instance, in November 2022, a startup named Prayasta, in collaboration with the Indian Institute of Science (IISc), developed the world’s first 3D printer for implant-grade silicone, named Silimac. This innovative technology was unveiled at the IISc's Centre for BioSystems Science and Engineering (BSSE) and is designed to directly 3D print personalized silicone implants within a hospital setting.

High Costs of Implants

The high cost of tissue-level implants is a significant restraint in the global market, limiting accessibility for patients and creating challenges for healthcare providers. Tissue-level implants require high-quality biocompatible materials such as titanium, zirconia, or advanced polymers, which are costly. The precision manufacturing and sterilization processes add to the overall expense. Implant technology involves extensive R&D to ensure safety, durability, and compatibility with human tissues. Thus, the above factors could be limiting the global tissue-level implant market's potential growth.

Market Segment Analysis

The global tissue-level implant market is segmented based on type, material, end-user, and region.

Type:

The dental implant segment in type is expected to dominate the global tissue-level implant market with the highest market share

Dental implants are an artificial solution for tooth replacement, designed to provide a permanent and functional alternative to traditional prosthetics such as dentures and bridges. The rise in dental diseases, particularly periodontal disease and dental caries, is a significant driver of demand for dental implants. This demand is largely fueled by the consequences of these conditions, which often lead to tooth loss and the subsequent need for effective replacement solutions.

According to WHO data in March 2023, the prevalence of dental diseases, particularly dental caries and periodontal disease, is a significant public health concern globally. An estimated 2 billion people suffer from caries of permanent teeth, and 514 million children are affected by caries of primary teeth. This widespread occurrence is exacerbated by factors such as urbanization and changing living conditions, which contribute to the increasing prevalence of these oral diseases.

Innovations in materials, technology, and surgical techniques have enhanced the appeal of dental implants among both patients and practitioners. As advancements continue to evolve within this field, dental implants are increasingly recognized as the gold standard for tooth replacement solutions, offering lasting benefits that align with modern expectations for oral health and aesthetics.

Furthermore, key players in the industry product launchers that would drive this market growth. For instance, Nobel Biocare introduced two advanced surfaces for dental implants: Xeal for abutments and TiUltra for implants. These surfaces leverage Nobel Biocare's extensive expertise in anodization technology, which is crucial for optimizing tissue integration at every level of the implant system, from the abutment to the apex.

For instance, in March 2022, Bredent Medical launched a new generation of whiteSKY zirconia implants, enhancing its existing line of ceramic dental implants. This updated implant system is designed to meet the growing demand for aesthetic and biocompatible dental solutions, particularly for patients who prefer metal-free options. These factors have solidified the segment's position in the global tissue-level implant market.

Market Geographical Analysis

North America is expected to hold a significant position in the global tissue-level implant market with the highest market share

There is an increasing number of periodontal diseases in the North America region. Gum (periodontal) disease is a broad term for gingivitis and periodontitis. These conditions involve infection and inflammation of the tissues (e.g., gum and bone) around the teeth.

For instance, according to the World Health Organization (WHO), the most common oral health conditions include cavities, gum disease, tooth loss, and oral cancer. About 90% of U.S. adults 20 years and older have experienced at least one cavity. Nearly half (42%) of U.S. adults have periodontal (gum) disease. Thus, the above factors are expected to hold the region in the dominant position during the forecast period.

Continuous innovations in implant materials (like titanium and zirconia), design, and surgical techniques have improved the success rates of tissue-level implants. Enhanced biocompatibility and osseointegration properties make these implants more appealing to both patients and healthcare providers. Moreover, in this region, a majority of key players’ presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, technological advancements, & investments, and product launches & approvals would propel this market growth.

For instance, in February 2024, American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting, Anika Therapeutics launched the Integrity Implant System and the RevoMotion Reverse Shoulder Arthroplasty System, along with other key regenerative products. This event is a significant gathering for orthopedic professionals, showcasing the latest advancements in orthopedic surgery and rehabilitation.

Similarly, in June 2023, the FDA approved the SNUCONE Co., Ltd., developed the SNUCONE Tissue Level Implant System, which is designed for use in dental applications, specifically for partially or fully edentulous (toothless) mandibles (lower jaw) and maxillae (upper jaw). The system is intended to support single or multiple dental restorations, making it a versatile option for patients requiring dental implants. Thus, the above factors are consolidating the region's position as a dominant force in the global tissue-level implant market.

Major Global Players

The major global players in the tissue-level implant market include Institut Straumann AG, Nobel Biocare Services AG, Dentsply Sirona, Zimmer Biomet, Biotech Dental, BioHorizons, TBR Dental, Hiossen Implant Canada INC., Southern Implant, and Implant Direct, among others.

Key Developments

- In January 2023, MediNiche introduced Bone-Tite, the first dietary supplement specifically designed for dental implant patients. Bone-Tite aims to provide nutritional support before and after dental implant procedures, addressing the critical role that nutrition plays in the osseointegration process and the integration of the implant with the surrounding bone.

| Metrics | Details | |

| CAGR | 6.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Cardiovascular Implants, Dental Implant, Breast Implant, Facial Implant, Orthopaedic Implants, Others |

| Material | Titanium, Zirconia, Cobalt-Chromium Alloys, Polyetheretherketone, Polypropylene, Others | |

| End-User | Hospitals & Clinics, Dental Clinics, Ambulatory Surgical Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzed product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global tissue-level implant market report delivers a detailed analysis with 62 key tables, more than 59 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.