Market Overview

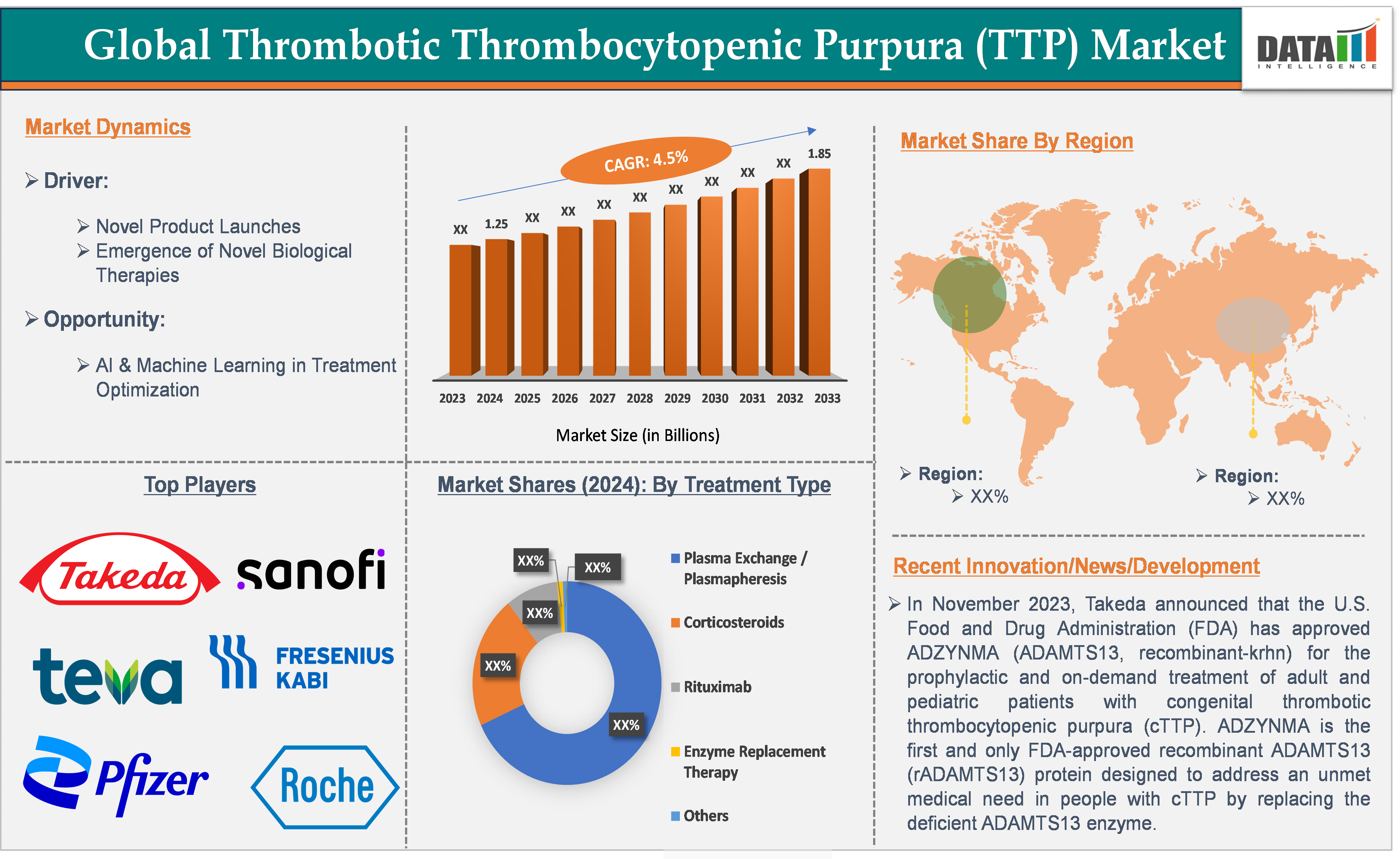

The global thrombotic thrombocytopenic purpura (TTP) market size reached US$ 1.25 billion in 2024 and is expected to reach US$ 1.85 billion by 2033, growing at a CAGR of 4.5% during the forecast period of 2025-2033.

Thrombotic thrombocytopenic purpura (TTP) is a rare, life-threatening hematologic disorder characterized by widespread microvascular thrombosis (small blood clots in the blood vessels), severe thrombocytopenia (low platelet count), and microangiopathic hemolytic anemia (MAHA). The disease is primarily caused by a deficiency or dysfunction of the ADAMTS13 enzyme, which is responsible for regulating the von Willebrand factor (vWF), a key protein involved in blood clotting. Early intervention and continuous monitoring are key to survival and long-term management.

Executive Summary

Market Dynamics: Drivers & Restraints

Novel product launches are significantly driving the thrombotic thrombocytopenic purpura market growth.

Novel product launches are undeniably driving the growth of the TTP market, as they offer more targeted, effective, and convenient treatments for this rare, life-threatening disorder. The approval of Caplacizumab, advancements in ADAMTS13 replacement therapies, the potential of gene therapy, and the expanding use of Rituximab are all playing pivotal roles in transforming the TTP treatment landscape. These innovations are leading to better patient outcomes, fewer relapses, and an overall increase in market demand, propelling the TTP market's growth in the coming years.

For instance, in November 2023, Takeda announced that the U.S. Food and Drug Administration (FDA) had approved ADZYNMA (ADAMTS13, recombinant-krhn) for the prophylactic and on-demand treatment of adult and pediatric patients with congenital thrombotic thrombocytopenic purpura (cTTP). ADZYNMA is the first and only FDA-approved recombinant ADAMTS13 (rADAMTS13) protein designed to address an unmet medical need in people with cTTP by replacing the deficient ADAMTS13 enzyme.

Additionally, caplacizumab, a monoclonal antibody developed by Sanofi, was approved by the FDA in 2019 for the treatment of acquired TTP. It is a first-in-class therapy that works by binding to the von Willebrand Factor (vWF) to prevent platelet aggregation and the formation of blood clots.

Dependence on plasma exchange (PEX) is hampering the market growth

Plasma exchange therapy is costly and labor-intensive and requires specialized medical infrastructure. This dependence on PEX contributes significantly to the overall treatment cost, which is a major barrier for patients and healthcare systems, especially in low-resource settings. The procedure requires specialized equipment, trained staff, and an adequate blood supply. This restricts the availability of PEX in areas lacking proper medical facilities, especially in low-income countries or rural settings.

PEX is time-sensitive and needs to be initiated immediately upon diagnosis for effective outcomes. Delayed initiation can lead to higher mortality rates, especially in patients with acute TTP. In areas where PEX treatment centers are scarce or not readily available, patients may not receive timely care, leading to poor prognosis and increased healthcare burden.

Overall, the dependence on Plasma Exchange (PEX) is hampering the growth of the TTP market in multiple ways. It adds significant costs, resource constraints, and patient accessibility issues to the treatment process. Additionally, PEX comes with risks of complications, limited infrastructure, and a growing plasma shortage, all of which make it less desirable in the long run. The emergence of biologic therapies like Caplacizumab and the exploration of gene therapies are gradually reducing the reliance on PEX, offering more effective and less resource-intensive alternatives. These shifts in treatment paradigms are expected to transform the TTP market and drive more sustainable growth in the future.

For more details on this report – Request for Sample

Segment Analysis

The global thrombotic thrombocytopenic purpura (TTP) market is segmented based on disease type, treatment type, end-user, and region.

Treatment Type:

The plasma exchange/plasmapheresis segment is expected to dominate the thrombotic thrombocytopenic purpura (TTP) market with the highest market share.

Plasma exchange is considered the first-line treatment for acute TTP, which is a life-threatening medical emergency. Immediate plasma exchange is essential to remove autoantibodies that inhibit the ADAMTS13 enzyme, which is responsible for cleaving the von Willebrand factor (vWF). PEX also replaces deficient plasma proteins and restores normal blood clotting mechanisms. Without PEX, the mortality rate of TTP can exceed 90%, but early initiation of PEX reduces the mortality rate to less than 10%.

While newer therapies like Caplacizumab (Cablivi) have introduced additional treatment options, PEX continues to play a complementary role. Caplacizumab is often used in combination with PEX to enhance clinical outcomes. PEX is used initially to stabilize the patient, followed by Caplacizumab or other biologics for long-term disease management, reducing the frequency of relapses.

The Plasma Exchange (PEX) segment is expected to dominate the TTP market for the foreseeable future due to its proven efficacy, timely intervention, widespread availability, and cost-effectiveness. Despite the emergence of biologics like Caplacizumab, PEX remains the cornerstone of treatment for acute TTP and continues to play a key role in managing relapsing or refractory cases. As a result, PEX will maintain its market leadership, particularly in emergency care settings and for severe acute TTP episodes, while newer therapies complement its usage for long-term management.

Geographical Analysis

North America is expected to hold a significant position in the global thrombotic thrombocytopenic purpura (TTP) market with the highest market share

North America, especially the United States, leads in the development and adoption of innovative therapies for TTP. Caplacizumab (Cablivi), a monoclonal antibody approved for TTP, was first introduced in North America in 2019. The FDA’s expedited approval process for novel treatments has allowed North America to be at the forefront of cutting-edge therapies, reducing the dependency on traditional treatments like plasma exchange (PEX).

North America has well-established regulatory frameworks that facilitate the approval and availability of treatments for rare diseases like TTP. Furthermore, insurance coverage for rare diseases is relatively high in North America, which ensures that patients have access to high-cost treatments like plasma exchange (PEX) and biologics.

North America’s advanced healthcare systems, high incidence of TTP, pioneering role in innovative treatments, and strong regulatory support. The FDA’s approval processes, the presence of leading pharmaceutical companies, and the focus on rare diseases all contribute to the region’s position as the primary market for TTP treatments. With a growing number of TTP new therapies entering the market, North America is expected to remain the largest and most influential market for TTP management in the years to come.

Competitive Landscape

Top companies in the thrombotic thrombocytopenic purpura market include Takeda Pharmaceutical Company Limited, Sanofi, Pfizer Inc., F. Hoffmann-La Roche Ltd, Sandoz Group AG, Fresenius Kabi USA, LLC, Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd., and others.

Scope

| Metrics | Details | |

| CAGR | 4.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Inherited (Congenital) TTP and Acquired (Immune-Mediated) TTP |

| Treatment Type | Plasma Exchange / Plasmapheresis, Corticosteroids, Rituximab, Enzyme Replacement Therapy, and Others | |

| End-User | Hospitals, Specialty Clinics, Academic and Research Institutes, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global thrombotic thrombocytopenic purpura (TTP) market report delivers a detailed analysis with 56 key tables, more than 52 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.