Smart Inhalers Market: Industry Outlook

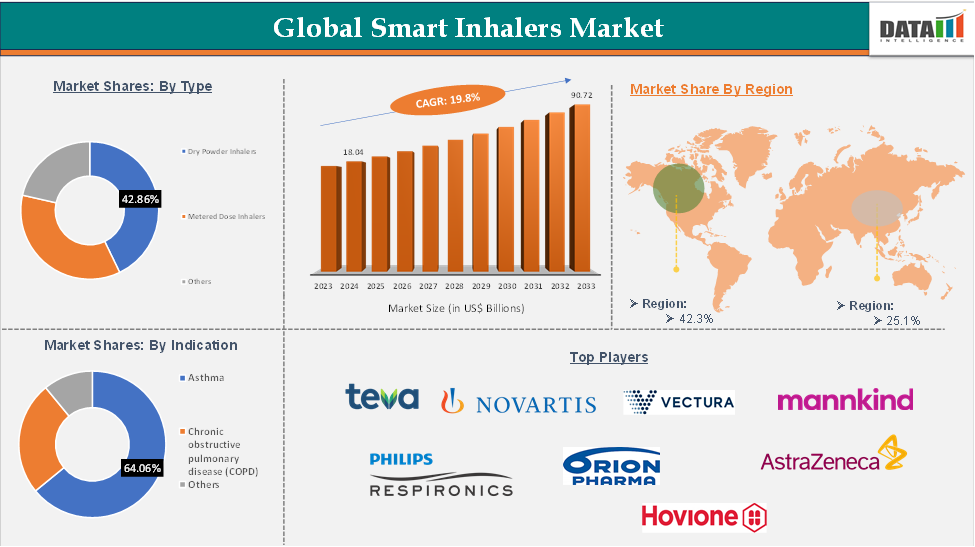

Smart Inhalers Market reached US$ 18.04 Billion in 2024 and is expected to reach US$ 90.72 Billion by 2033, growing at a CAGR of 19.8% during the forecast period 2025-2033.

Smart inhalers are devices that are enable with sensors, bluetooth connectivity, and mobile applications, enabling real-time monitoring of inhaler usage, medication adherence, and respiratory patterns, improving disease management and reducing hospitalizations.

The global smart inhalers market is growing due to the rise in respiratory conditions like asthma and COPD and the demand for connected healthcare solutions. The market is driven by digital health technologies, healthcare digitization, and government initiatives promoting telemedicine and remote patient monitoring. Collaborations between pharmaceutical companies and technology providers are fostering innovation in device design, usability, and patient engagement.

North America leads the market due to advanced healthcare infrastructure and high awareness levels, while the Asia Pacific region is emerging due to growing healthcare access and technology adoption.

Smart Inhalers Market: Market Infographics

For more details on this report, Request for Sample

Smart Inhalers Market Dynamics: Drivers & Restraints

Driver: Technological Advancements in Inhaler Devices

The smart inhalers market is growing due to technological advancements in inhaler devices. Innovations like breath-actuated mechanisms, dose counters, and digital sensors have improved usability, accuracy, and monitoring capabilities. Smart DPIs with Bluetooth connectivity and mobile applications allow real-time tracking of medication usage, adherence patterns, and inhalation technique. These features improve disease management, reduce hospital readmissions, and reduce healthcare costs. The integration of artificial intelligence and cloud-based platforms enables personalized treatment regimens and remote patient monitoring. These technological innovations are expected to drive demand for advanced DPIs and reshape the respiratory care landscape.

For instance, in May 2022, Teva's ProAir Digihaler is the first digital inhaler with built-in sensors, enabling remote monitoring and treatment plan adjustments. This technology became crucial during the COVID-19 pandemic and has become a standard of care. Smart inhalers empower patients by enabling active condition management and tracking usage and symptoms.

Restraint: Side Effects Associated with the Usage of Smart Inhalers

Smart inhalers have gained popularity due to their benefits, but they face challenges due to side effects and limitations. The inhalation effort required for effective medication delivery can be challenging for patients, especially young children, elderly patients, or those with severe respiratory impairment. Improper inhalation can lead to suboptimal drug delivery, reducing treatment efficacy and increasing the risk of exacerbations.

Additionally, some patients may experience throat irritation, coughing, or hoarseness. The risk of local fungal infections, particularly with corticosteroid-based DPIs, is also a concern. These limitations and the complexity of patient usage without professional supervision hinder wider DPI adoption, especially in low-resource settings or populations with limited health literacy.

Smart Inhalers Market Segment Analysis

The global smart inhalers market is segmented based on type, indication, distribution channel, and region.

Type:

The dry powder inhalers segment of the type is expected to hold 42.8% in the smart inhalers market

Dry Powder Inhalers (DPIs) are medical devices that deliver medication directly into the lungs as a dry powder, unlike metered-dose inhalers (MDIs). They disperse the medication into the respiratory tract through the patient's inhalation effort, offering benefits like ease of use, environmental friendliness, and improved drug stability, making them commonly prescribed for respiratory conditions like asthma and COPD.

The dry powder inhalers segment is growing due to the significant product launches, rise in respiratory diseases like asthma and COPD, particularly in urban areas. Technological advancements, such as smart devices with sensors and Bluetooth connectivity, are enhancing treatment outcomes and remote monitoring.

For instance, in June 2024, Aseptika introduced the PUFFClicker3, a smart inhaler dose tracker that is compatible with pressurized metered dose inhalers and dry powder inhalers. It aims to enhance inhaler adherence for patients of all ages and respiratory conditions, supporting 101 SNOMED-coded inhalers and providing graphical instructions for easy inhaler switch-overs.

Hence, dry powder inhalers (DPIs) are gaining popularity due to rising respiratory disease prevalence, eco-friendliness, and improved patient adherence. Innovations like Aseptika's PUFFClicker3 enhance dose tracking and simplify inhaler use, supporting better disease management and remote monitoring.

Smart Inhalers Market - Geographical Analysis

North America in the global smart inhalers market is growing with 6.96 Billion in 2024, which is expected to grow 35.02 Billion by 2033.

The North America smart inhalers market is driven by the high prevalence of chronic respiratory conditions like asthma and COPD, which have one of the highest diagnosis and treatment rates globally. This demand for advanced inhalation therapies is fueled by widespread access to digital infrastructure and electronic health records, which enable seamless integration of smart inhaler data into patient care workflows.

Major players like Teva Pharmaceuticals, Propeller Health, and Adherium are accelerating market growth by partnering with other players and novel technological advancements. Regulatory support from agencies like the FDA encourages innovation in digital health, and growing awareness of the economic burden of uncontrolled respiratory diseases has prompted both public and private sectors to prioritize remote monitoring and digital therapeutics, further fueling the market in North America.

For instance, in October 2024, Modivcare Inc., a leading healthcare services company, has partnered with Tenovi to deliver Adherium's Hailie Smart inhalers for chronic respiratory disease patients. The partnership aims to enhance the care provided by the innovative cellular-connected remote monitoring solutions offered by Adherium.

Hence, digital inhaler solutions in North America are being embraced through strategic collaborations and regulatory backing. Companies like Modivcare and Tenovi, along with innovators like Adherium, are utilizing remote monitoring tools to address the clinical and economic impact of poorly managed respiratory diseases, presenting strong business growth and investment opportunities.

Asia-Pacific region in the global smart inhalers market is expected to grow with the highest CAGR of 18.5% in the forecast period of 2025 to 2033

The Asia-Pacific smart inhalers market is growing due to demographic, technological, and healthcare factors. Chronic respiratory diseases like asthma and COPD are increasing due to urbanization, pollution, tobacco use, and aging populations. The need for real-time monitoring and medication adherence has led to increased interest in smart inhalers. Governments are investing in healthcare infrastructure and supporting digital health technologies, encouraging smart inhaler adoption.

For instance, COPD prevalence in Japan is 10.9% among adults aged 40 and above, with a significant underdiagnosis rate of 80.6%. Smart inhalers with features like adherence tracking and real-time monitoring can improve disease management and reduce underdiagnosis. Collaborations between pharmaceutical companies and digital health firms, such as Propeller Health and Novartis, are driving the smart inhaler market.

Hence, Japan's high COPD underdiagnosis rate underscores the need for improved disease management solutions. Smart inhalers, offering real-time monitoring and adherence tracking, are being used to address these gaps. Also, collaborations between pharma and digital health companies are enhancing patient outcomes.

Smart Inhalers Market- Key Players

The major global players in the smart inhalers market include Teva Pharmaceuticals, Novartis, Vectura Group, MannKind, Respironics, Orion Pharm, Hovione, AstraZeneca, OPKO Health Inc, and Boehringer-Ingelheim among others.

Industry Trends

- In May 2024, an NHS-funded study provided around 300 children and young people in Leicester with smart inhalers that monitor usage and provide feedback via a smartphone app. The Hailie digital inhaler will be used for six months to evaluate its effectiveness in preventing asthma attacks among high-risk children. The study will use the Hailie digital inhaler to monitor preventer inhaled corticosteroid and rescue short-acting beta-agonists (SABA) use, asthma control, medication use, and the number of asthma attacks experienced.

- In July 2023, Teva introduced a digitally-enabled inhaler in the UK, marking the first European market for the device, designed for patients with asthma and COPD. The GoResp Digihaler, which delivers budesonide and formoterol, features built-in sensors that record patient usage data. It connects to a smartphone via Bluetooth, allowing users to view results and share them with their healthcare provider.

Scope

| Metrics | Details | |

| CAGR | 19.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Dry Powder Inhalers, Metered Dose Inhalers, Others |

| Indication | Asthma, Chronic obstructive pulmonary disease (COPD), Others | |

| Distribution Channel | Intravenous, Subcutaneous | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |