Silent Generator Market Size & Overview

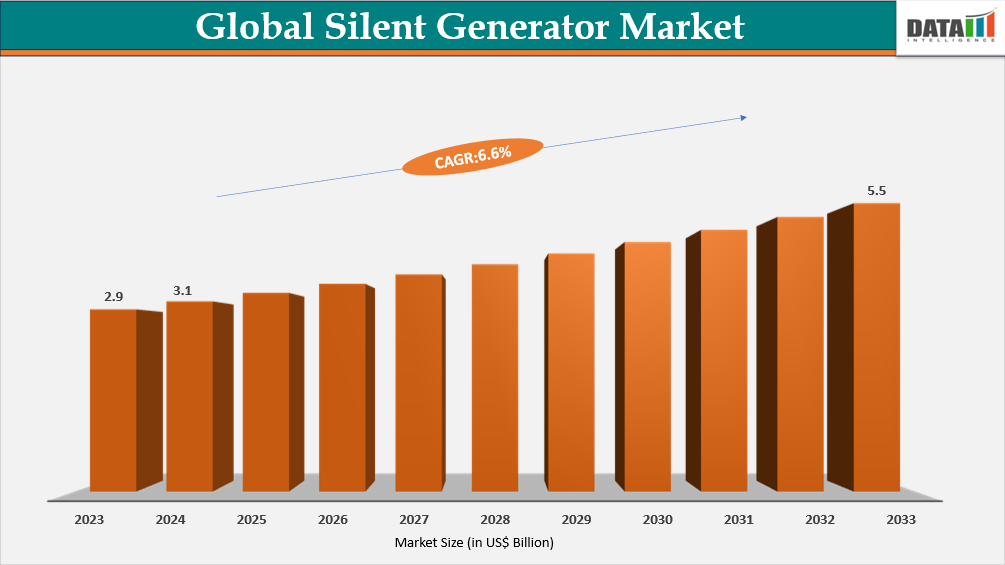

Global Silent Generator Market reached US$ 3.1 billion in 2024 and is expected to reach US$ 5.1 billion by 2032, growing with a CAGR of 6.6% during the forecast period 2025-2032. The global silent generator market is witnessing strong growth, driven by rising demand for reliable, low-noise power solutions across residential, commercial, and industrial sectors. This growth is fueled by rapid urbanization and industrial expansion, particularly in the Asia-Pacific, where the need for uninterrupted power in residential complexes, commercial establishments, and industrial facilities is rising. Stringent noise regulations across the globe further boost adoption, compelling industries to implement quieter generators that comply with environmental standards. Technological innovations, such as advanced acoustic enclosures, vibration-dampening systems, and efficient exhaust mechanisms, have enhanced generator performance while minimizing noise, making them increasingly attractive for diverse applications. Overall, the market is poised for robust growth, supported by rising demand for quiet, efficient, and reliable power solutions worldwide.

Silent Generator Industry Trends and Strategic Insights

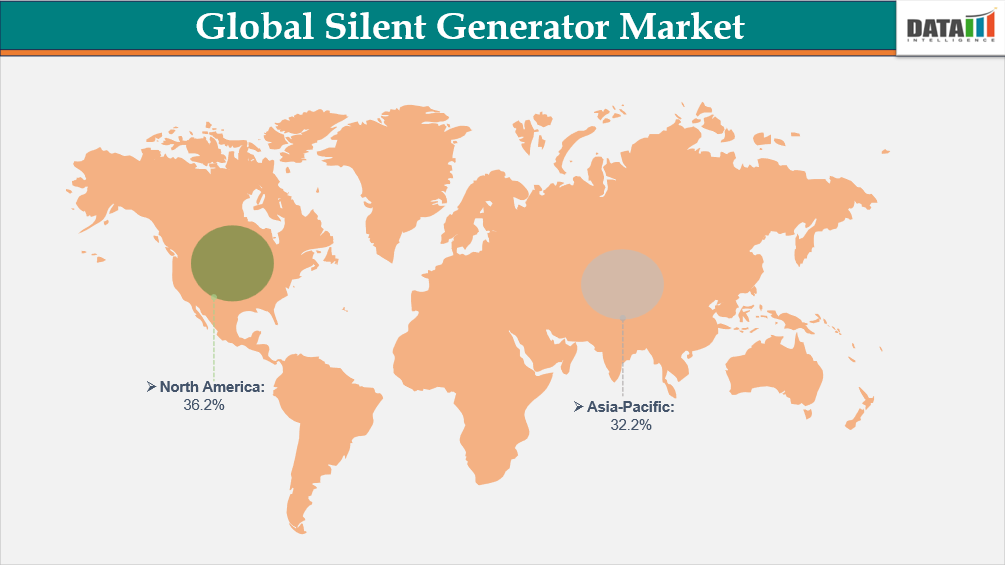

- North America dominates the silent generator market, capturing the largest revenue share of 36.2% in 2024.

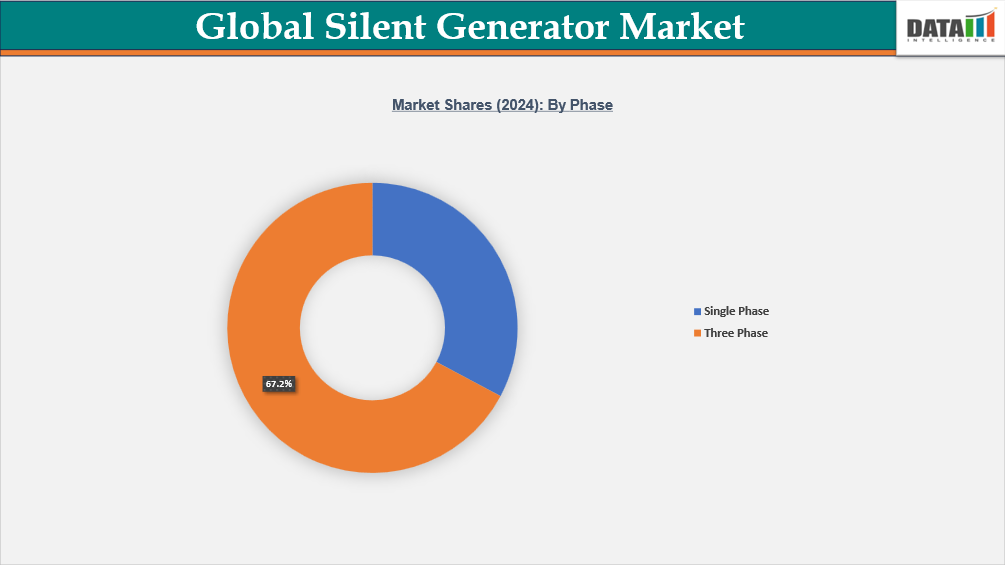

- By phase, the three phase segment is projected to be the largest market, holding a significant share of 67.2% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 3.1 Billion

- 2032 Projected Market Size: US$ 5.1 Billion

- CAGR (2025-2032): 6.6%

- Largest Market: North America

- Fastest Market: Asia-Pacifice

Market Scope

| Metrics | Details |

| By Power Capacity | Up to 25 kVA, 25–75 kVA, 75–375 kVA, 375–750 kVA and Above 750 kVA |

| By Fuel Type | Diesel Silent Generators, Natural Gas Generators and Others |

| By End User | Residential, Commercial and Industrial |

| By Phase | Single Phase and Three Phase |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

The Surge in Data Center Proliferation and Uptime Imperatives

The growth in data consumption, cloud computing, and digitalization is a primary driver for the silent generator market. Data centers form the backbone of the digital economy and require absolute, uninterrupted power to prevent catastrophic data loss and service disruptions, with even a momentary outage costing billions. Consequently, sophisticated backup power systems are non-negotiable. Silent generators are critical in urban and suburban data center locations due to strict municipal noise pollution ordinances.

A compelling case study is Switch's "The Citadel" campus in Nevada, one of the world's largest data center parks. Its power resilience strategy includes a massive bank of silent, low-emission diesel generators capable of seamlessly taking over the entire load during a grid failure, ensuring 100% uptime for its clients, including major tech giants and government entities, while complying with environmental and acoustic regulations.

High Initial Investment and Total Cost of Ownership

The substantial upfront and operational cost of silent generators remains a primary market restraint. Advanced acoustic enclosures, vibration-dampening technologies, and emissions-control systems required to meet stringent noise and environmental regulations significantly increase the initial purchase price compared to conventional generators. This premium can be prohibitive for cost-sensitive segments, particularly in developing regions and for small businesses. Furthermore, the total cost of ownership is amplified by maintenance requirements for complex emission after-treatment systems such as DPFs (Diesel Particulate Filters). Tier 4 Final/Stage V compliant silent generator can carry a 30-50% cost premium over a basic equivalent, directly limiting market penetration among price-sensitive buyers.

Segmentation Analysis

The global silent generator market is segmented based on power capacity, fuel type, end user, phase and region.

Industrialization and Critical Infrastructure Demands Drive the Three Phase Segment.

Three phase segment is expected to hold about 67.2% of the global market in 2024. The primary driver for the three phase silent generator segment is the global surge in industrial automation and critical infrastructure development, which demands robust, high-quality power. Industries such as manufacturing, data centers, and healthcare rely on three phase power for heavy machinery, server farms, and medical imaging equipment, where voltage stability is non-negotiable. The industrial segment accounts for significant three phase generator sales due to rapid manufacturing expansion. This trend is reinforced by infrastructure upfuel types in developed economies, where aging power grids necessitate reliable backup solutions for operational continuity.

The rising frequency of power outages due to aging grid infrastructure and extreme weather events also drives market growth. In the US alone, the average electricity customer was without power for over 7 hours in 2021, with major weather events causing most of those outages. This vulnerability underscores the need for dependable backup power solutions.

Single Phase is in Demand due to Residential and Small Business Electrification and Grid Instability

The single-phase silent generator segment is primarily fueled by the growing demand for reliable backup power in residential and small-scale commercial settings, driven by increasing grid instability and the electrification of essential home systems. As households and small businesses become more dependent on continuous power for everything from remote work and security systems to medical equipment, the need for accessible, quiet backup solutions has surged.

In North America, the power outages caused by severe weather have increased by nearly 70% over the past decade, directly correlating with a spike in single-phase generator adoption. For instance, following Hurricane Fiona in 2022, sales of portable silent inverters in Atlantic Canada saw a 300% month-over-month increase as residents sought reliable, quiet backup power.

Geographical Penetration

North America Silent Generator Market Insights

North American market is largely driven by the convergence of severe weather events and the high value placed on business continuity and residential comfort. The region experiences a disproportionate number of climate-related disasters, with the NOAA reporting an average of 20 billion-dollar weather events annually in the US alone. This has normalized the use of backup power, with a strong preference for silent models due to strict suburban noise ordinances and the high density of urban data centers and healthcare facilities that cannot tolerate operational disruption from either outages or noise complaints.

US Silent Generator Market Insights

The critical need for resilience in its digital infrastructure drives the US market. The country hosts over 30% of the world's data centers, a sector requiring absolute uptime. The Uptime Institute notes that even a brief data center outage costs over $300,000 on average. This necessitates highly reliable, silent backup systems to comply with urban noise laws. For example, major cloud providers like AWS and Google mandate multi-megawatt silent generator installations at their facilities, creating a continuous, high-value demand for advanced units that can start instantaneously and operate unobtrusively in various environments.

Canada Silent Generator Industry Growth

Canada's market is driven by its extreme climate and remote community needs. Harsh winters can cause extended power failures, making generators essential for safety. More uniquely, many northern and indigenous communities rely on diesel-generated prime power. A 2022 report by Natural Resources Canada highlighted investments of over $200 billion in clean energy for remote communities. This funds the replacement of old, noisy power stations with new, silent, and fuel-efficient generator sets that reduce both acoustic and environmental pollution, creating a specialized market focused on reliability and sustainability in isolated locations.

Asia-Pacific Silent Generator Market Outlook

The market is driven by the region's vulnerability to natural disasters, which frequently cause prolonged grid failures. Countries such as the Philippines, Japan, and Indonesia face an average of 20 major typhoons annually, creating a robust demand for reliable residential and commercial backup power. The World Bank estimates that natural disasters cost the region over US$ 80 billion yearly. This has led to government initiatives promoting disaster resilience, such as Japan's subsidies for households to install silent generators, ensuring essential power during earthquakes and typhoons and fueling market growth as a critical component of emergency preparedness.

India Silent Generator Market Outlook

High growth of India’s healthcare and education sectors which require uninterrupted power for critical services, drives the silent generators market. The national healthcare infrastructure is expanding at a CAGR of 22% since 2022, according to the India Brand Equity Foundation. A prominent driver is the mandate for all NABH-accredited hospitals to maintain backup power for life-saving equipment. For instance, chains such as Apollo Hospitals utilize silent canopy generators to ensure ICU functionality during frequent urban power fluctuations, protecting patient safety without violating noise ordinances in densely populated areas, thus creating sustained demand from this vital sector.

China Silent Generator Market Trends

China's driver is the rapid digitalization of its rural economy and the expansion of 5G infrastructure into remote areas. The government's "Digital Village" initiative aims to bring e-commerce and telecommunication to underserved regions, often with an unreliable grid. Over 600,000 5G base stations were built in 2023 alone. To power these remote towers consistently, telecom giants like China Mobile deploy silent, containerized generators that operate autonomously for extended periods. This massive infrastructure rollout creates a vast, sustained market for silent generators as essential enablers of national digital inclusion strategies.

Sustainability Analysis

The sustainability analysis of the global silent generator market reveals a critical paradox. While these units provide essential energy resilience, their reliance on diesel and natural gas presents significant environmental challenges, including GHG emissions and local air pollution. However, the market is advancing towards greater sustainability through stringent emission standards like EPA Tier 4 and EU Stage V, which mandate advanced after-treatment systems. Key manufacturers are investing in hybrid systems, biofuels like HVO, and energy storage integration to reduce carbon footprints. The industry's future hinges on balancing operational necessity with the transition to lower-carbon alternatives, amid growing regulatory and consumer pressure for greener solutions.

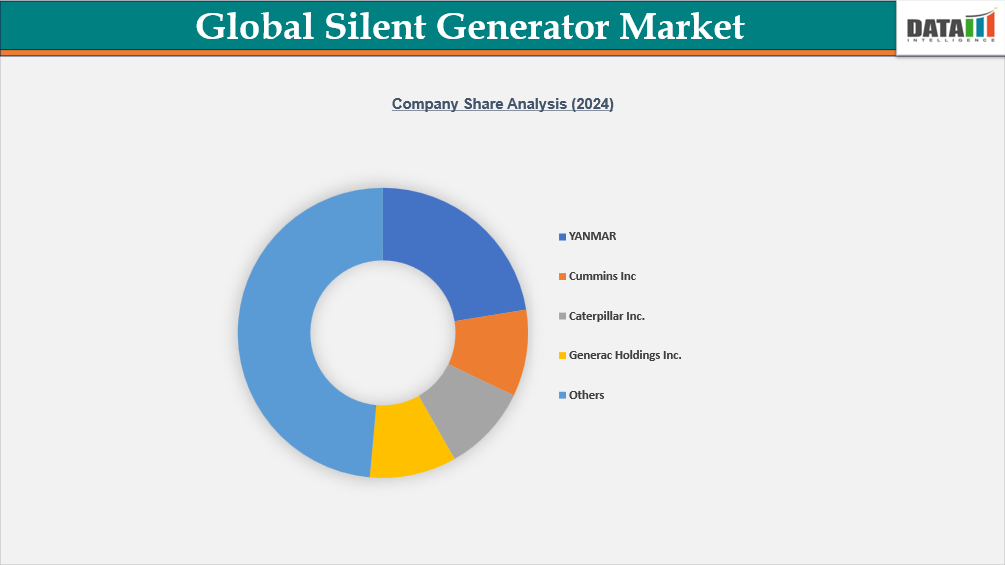

Competitive Landscape

- The global silent generator market features intense competition between established giants and agile regional players.

- Key players include YANMAR, Cummins Inc, Caterpillar Inc., Generac Holdings Inc., Atlas Copco Group, HIMOINSA, JAKSON GROUP, JIANGXI VIGOROUS NEW ENERGY TECHNOLOGY CO., LTD, CONSTANT POWER SOLUTIONS LTD. And Kubota Corporation.

- Key differentiators have evolved from basic noise reduction to advanced compliance with stringent global emission standards like EPA Tier 4 and EU Stage V.

- The competitive landscape is further shaped by a strategic focus on developing natural gas and bi-fuel models, catering to the increasing demand for sustainable backup power solutions across data center, healthcare, and commercial applications.

Key Developments

- In early 2024, Yanmar launched a new series of ultra-silent generator sets, with the 4TN107LSN model as a flagship, specifically engineered to meet the EU's stringent Stage V emission standards without requiring a Diesel Particulate Filter (DPF). This innovation reduces system complexity and maintenance costs.

- In late 2023, the Spanish power solutions manufacturer HIMOINSA, acquired a significant stake in Qnergy, a leading U.S.-based provider of natural gas and methane-powered generators. This move is part of a strategic push to integrate Qnergy's patented piston engine technology into HIMOINSA's silent generator power capacity lines.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies