Market Size

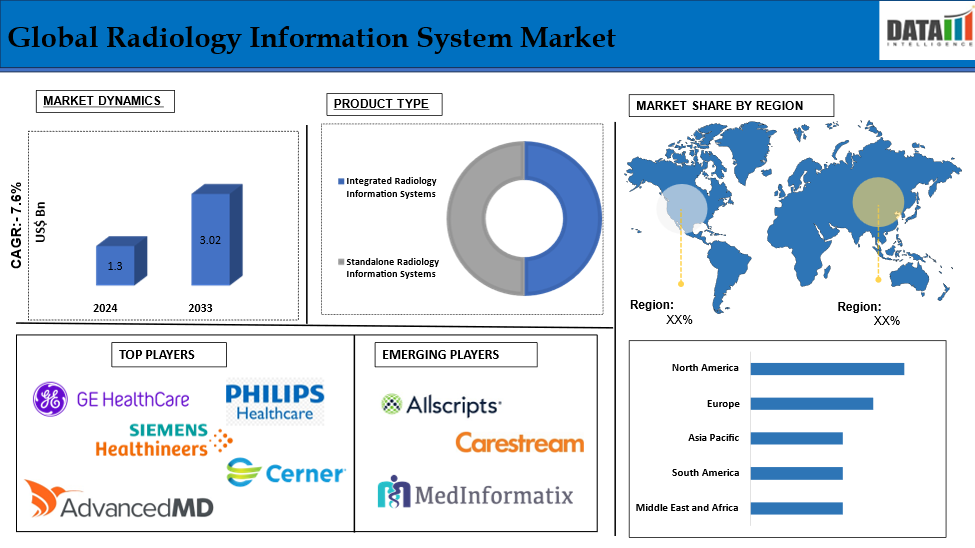

The Global Radiology Information System Market reached US$ 1.30 billion in 2024 and is expected to reach US$ 3.02 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2025-2033.

A Radiology Information System (RIS) is software dedicated to managing and easing radiology department operations within the hospital. The main skein of data, such as medical imaging records, reports, and patient information, includes patient X-rays within it. The radiology program smoothly integrates with other EHRs of healthcare systems, Picture Archiving and Communication Systems (PACS), and Hospital Information Systems mostly, facilitating improved workflow efficiency and entirely seamless data exchange.

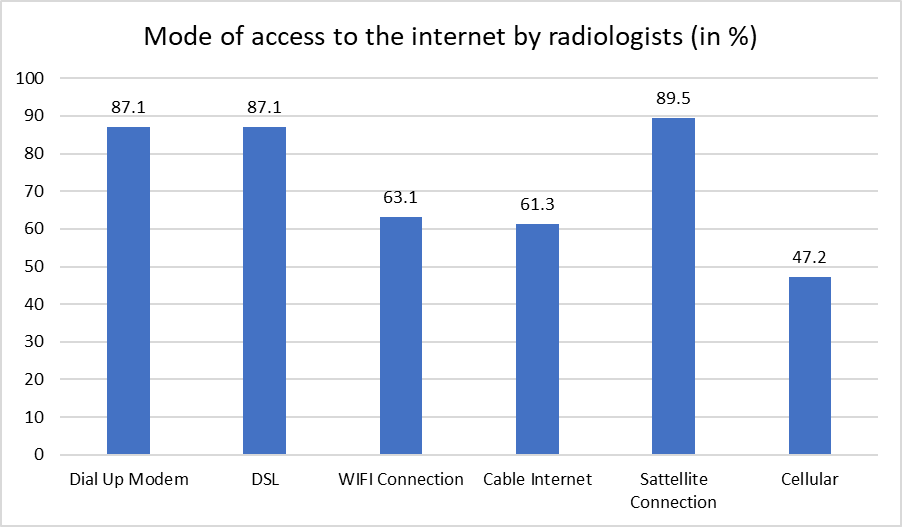

The above graph shows radiologists' internet access patterns, revealing the growth of the global Radiology Information System (RIS) market. Reliable internet options like DSL, satellite, and cable internet support cloud-based RIS solutions, enabling seamless data sharing, remote diagnostics, and collaboration. The growing use of Wi-Fi and cellular networks suggests mobile solutions are being adopted, enhancing operational efficiency. This data highlights the potential for increased RIS adoption due to widespread internet availability and advanced connectivity technologies.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rise in Technological Advancements in Healthcare IT

The global radiology information system (RIS) market has grown significantly due to advancements in healthcare IT, including Artificial Intelligence, Machine Learning, cloud computing, and advanced analytics. These technologies have improved diagnostic efficiency and patient care, enabling automated diagnosis, predictive analytics, and error reduction in radiology workflows. Cloud computing has enabled scalable and cost-effective RIS solutions, supporting teleradiology and decentralized healthcare models. Interoperability with EHRs, HIS, and LIS has improved patient data management, while data security and encryption protocols have addressed privacy concerns.

For instance, in December 2024, DeepHealth, RadNet's subsidiary, will unveil new AI-powered solutions at RSNA 2024, including DeepHealth OS, Diagnostic Suite, and TechLive. The company also introduced SmartDeployment Mode solutions, including SmartMammo and SmartSonography, in collaboration with GE HealthCare and Siemens Healthineers. These innovations aim to improve imaging-based diagnosis, population health screening, and operational efficiency.

Moreover, in November 2024, The American College of Radiology has launched the National Radiology Data Registry, which monitors AI results and collects contextual information like patient data and radiology report results. The registry aims to compare individual radiology practice results against national performance benchmarks using similar products.

Data Security and Privacy Concerns

The global radiology information system (RIS) market faces challenges in data security and privacy due to the increasing use of cloud-based and web-based deployments. These systems manage sensitive patient data, including medical imaging reports and personal health records. Healthcare organizations are required to comply with strict regulations like HIPAA and GDPR, which impose penalties for non-compliance. The complexity of maintaining compliance and adopting advanced RIS technologies can cause hesitancy among providers and slow adoption rates, especially in regions with weaker cybersecurity infrastructure.

Market Segment Analysis

The global radiology information system market is segmented based on product type, deployment mode, component, end user and region.

Product Type:

Integrated Radiology Information Systems segment is expected to dominate the Radiology Information System market share

The integrated radiology information systems segment holds a major portion of the radiology information system market share and is expected to continue to hold a significant portion of the Radiology Information System market share during the forecast period.

Integrated Radiology Information Systems (RIS) are crucial in the global market due to their seamless integration with other healthcare IT systems like EHRs, HIS, and advanced imaging modalities. This integration improves workflows, real-time data sharing, and interoperability, reducing redundancies and improving patient care. RIS solutions also support multi-location access, addressing the growing demand for workflow optimization in radiology departments.

For instance, in November 2023, Radiology Partners (RP), a leading radiology practice in the U.S., has launched its RPX AI orchestration platform on Amazon Web Services (AWS). The platform utilizes AWS HealthImaging, a HIPAA-eligible service for storing, analyzing, and sharing medical images at petabyte scale. This allows RP to deploy a suite of AI tools across any reading platform, providing a highly accessible and adaptable solution for hospitals and health systems to deliver high-quality, technology-enabled care.

End User:-

Hospitals segment is the fastest-growing segment in Radiology Information System market share

The hospitals segment is the fastest-growing segment in the radiology information system market share and is expected to hold the market share over the forecast period.

Hospitals are the primary users of Radiology Information System (RIS) systems, managing large volumes of imaging data. With increasing patient inflow and demand for diagnostic imaging, hospitals rely on RIS to optimize workflows, improve operational efficiency, and enhance patient care. RIS systems integrate with other healthcare IT solutions like EHRs and PACS, enabling efficient data sharing and real-time decision-making. Adoption of RIS helps hospitals comply with regulatory standards, reduce errors, and improve resource utilization, contributing to market growth.

For instance, in October 2024, IKS Health has partnered with Radiology Partners (RP), a top U.S. radiology practice, to streamline processes and improve access to critical imaging services. The Gen AI-powered Care Enablement Platform will allow RP's over 3,900 radiologists to offload non-clinical tasks, allowing teams to focus on clinical care, patient service, and radiologist satisfaction. The partnership aims to improve workflow and capacity for radiologists in the rapidly growing medical imaging demand.

Market Geographical Share

North America is expected to hold a significant position in the Radiology Information System market share

North America holds a substantial position in the radiology information system market and is expected to hold most of the market share due to advanced healthcare infrastructure, advanced technology adoption, and rising healthcare expenditure. The region's high demand for diagnostic imaging, chronic diseases, and aging population, cloud-based RIS solutions, digitization initiatives, and teleradiology trends support market growth.

For instance, according to Centers for Disease Control and Prevention Up to 129,000,000 Americans have at least one chronic condition classified as a major one by the US Department of Health and Human Services-(4). Included in the five of eleven predominant treatment conditions in America only, or closely related to them, are chronic diseases, most often preventive and treatable-(5). Over the last 20 years, the prevalence has doubled and is expected to double once again.

Hence, the increasing patient volume in chronic conditions necessitates the need for efficient, integrated radiology solutions in healthcare facilities. The doubling of prevalence over the next two decades underscores the need for advanced systems to streamline workflows, accelerating market adoption and growth.

Europe is growing at the fastest pace in the Radiology Information System market

Europe holds the fastest pace in the radiology information system market and is expected to hold most of the market share due to strict regulations like GDPR, promoting data security and privacy in healthcare. The region is also focusing on healthcare IT digitization, with hospitals and diagnostic centres adopting integrated RIS solutions for workflow optimization. The growing geriatric population and personalized medicine demand further drive RIS adoption.

For instance, in January 2024, Agfa Radiology Solutions has launched its My Agfa Radiology Solutions self-service portal in the US and Canada, offering services for managing Agfa equipment, requesting service, and monitoring fleet. The portal also provides access to the Agfa Library, user documentation, manuals, and safety instructions for Agfa modalities.

Major Global Players

The major global players in the radiology information system market include GE Healthcare, Philips Healthcare, Siemens Healthineers, Cerner Corporation, Epic Systems Corporation, AdvancedMD, Inc, DrChrono, Covetus LLC, Athenahealth EHR, Kareo, Inc and among others.

Key Developments

- In June 2024, Italy has recently launched a complete solution from DeepHealth to enhance the company's capabilities in the country, an integrative portfolio for Italy-inclusive. It offers a flexible, efficient, and future-proof spaces mechanism like a DeepHealth's Cloud native OS that is large scale Implementing Clinical Data Unification and AI Enhanced Personalization into Workspaces. To improve patient outcomes in the fields of lung, breast, prostate health, and brain, they are particularly useful for better disease detection through large-scale screening and diagnosis programs in the U.S. and even Europe.

| Metrics | Details | |

| CAGR | 7.6% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Product Type | Integrated Radiology Information Systems, Standalone Radiology Information Systems |

| Deployment Mode | Cloud-Based, On-Premise, Web-Based | |

| Component | Software, Services | |

| End User | Hospitals, Diagnostic Centers, Ambulatory Surgical Centers (ASCs), Academic and Research Institutes | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global radiology information system market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Component & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.