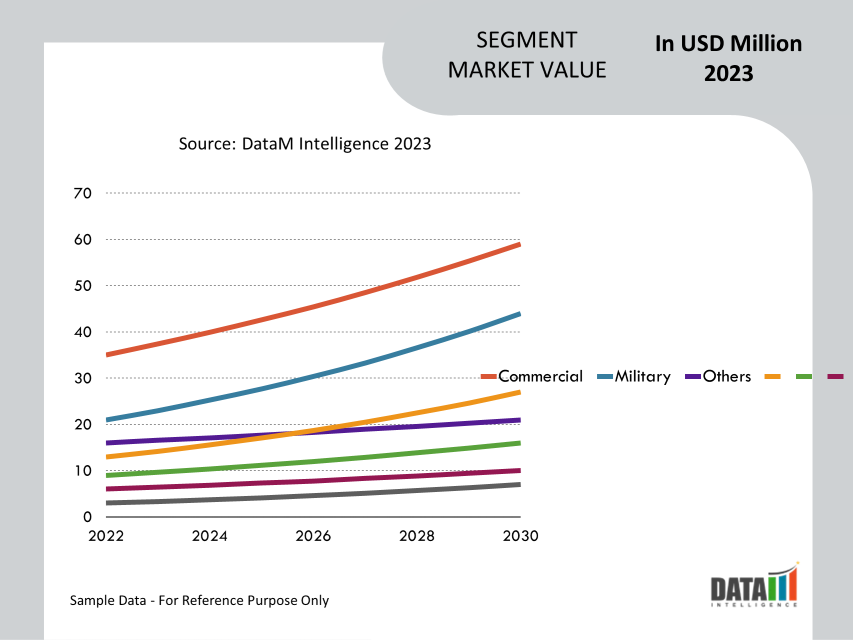

Global Powered Wheels For Aircraft Landing Market is segmented By Wheels (Main Wheels, Cement, Nose Wheels or Tail Wheels), By Component (Bearings, Axles, Brake Systems, Others), By Aircraft (Commercial, Military, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Powered Wheels For Aircraft Landing Market Size

Global powered wheels for aircraft landing market reached USD 4.2 billion in 2022 and is expected to reach USD 7.9 bllion by 2030, growing with a CAGR of 8.3% during the forecast period 2024-2031. In order to ensure secure and effective aeroplane operations during takeoff, landing, and taxiing, the global powered wheels for aircraft landing market plays a crucial role.

The landing gear system of an aircraft includes powered wheels, which offer propulsion and control during ground movements. The demand for innovative landing gear technology, rising aircraft deliveries, and the ongoing expansion of the aviation industry all drive the market for powered wheels.

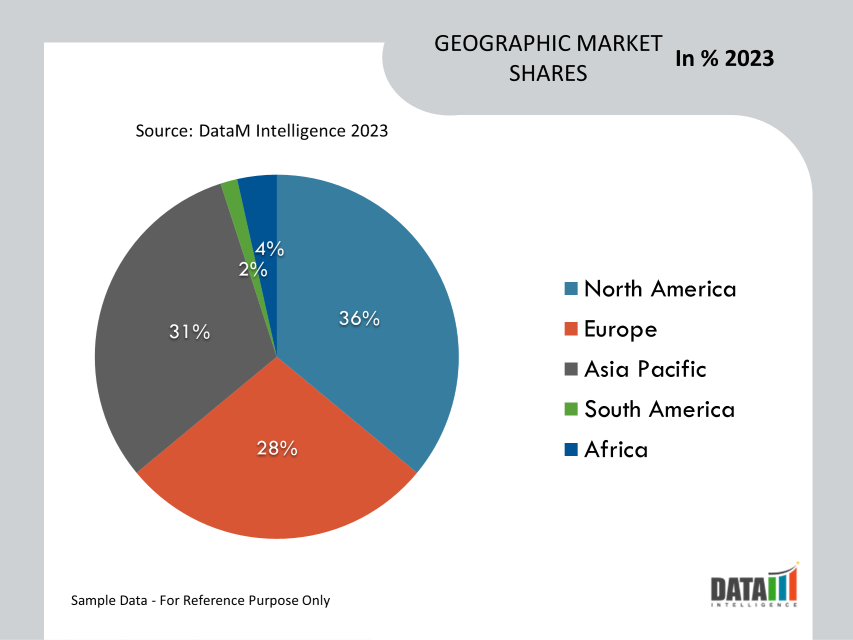

The aircraft industry is subject to strict safety laws and certification requirements throughout Europe. Certification from the European Aviation Safety Agency (EASA) is highly valued globally. The employment of innovative landing gear systems and components, including powered wheels, is necessary to comply with these specifications. European manufacturers put a lot of effort into creating powered wheels that adhere to the strict safety and performance standards, helping to expand the industry. Therefore, Europe accounted for nearby 1/3rd of the global shares and is expected to grow at a significant CAGR during the forecasted period.

Market Summary

| Metrics | Details |

| CAGR | 8.3% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Wheels, Component, Aircraft and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Wheels Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights about the Market Request Free Sample

Market Dynamics

Technological Advancements

The use of wheels with electric propulsion is expanding. Instead of using conventional hydraulic or pneumatic systems, these wheels use electric motors, which has benefits including better control, less maintenance, and more efficiency. Electric-powered wheels are being developed by manufacturers to offer precise control during braking and taxiing, enhancing the overall performance and sustainability of aircraft landing gear systems.

The use of lightweight materials, such as advanced composites and alloys, is being investigated by manufacturers as a way to reduce the weight of powered wheels without compromising strength or durability. Lightweight materials boost payload capacity, improve overall aircraft performance, and improve fuel efficiency. By addressing the need for lighter, more effective components, these developments aid in the expansion of the powered wheels market.

Industry Collaboration and Partnerships

The global powered wheels for aircraft landing market is growing as a result of partnerships and industry collaboration. Collaboration between aircraft producers, suppliers, and academic institutions encourages creativity, speeds up technological development, and increases market potential.

For instance, to develop electrically operated landing gear systems, Collins Aerospace and Safran Landing Systems formed a strategic alliance. In order to create powered wheels for aeroplanes that are more effective and sustainable, the cooperation will bring together Safran Landing Systems' expertise in landing gear and Collins Aerospace's expertise in electric systems. This collaboration highlights the teamwork required to spur innovation and meet the sector's changing needs.

High Initial Costs

Research, development, testing, and manufacturing facilities must be heavily invested in in order to develop and produce high-quality powered wheels. It can be expensive to start these facilities, purchase specialized equipment, and employ professionals at first. Smaller companies and new competitors may find it difficult to compete in the market due to the capital-intensive nature of the industry.

Market Segment Analysis

The global powered wheels for aircraft landing market is segmented based on wheel, component, aircraft and region.

Owing to Its Weight-Bearing Capacity, Main Wheels Segment Dominates the Global Market

During landing, takeoff, and ground operations, the aircraft's main wheels support the majority of its weight. They are made to bear large loads and give the aircraft stability. Main wheels can support more weight than nose or tail wheels because of their larger size and sturdy design. As a result, main wheels are crucial for commercial airliners and larger aircraft, which make up a significant percentage of the total number of aircraft. Therefore, main wheels segment holds the more than half of total segmental share.

Market Geographical Share

North America's Strong Aerospace Industry Positions it as a Leading Player in the Global Powered Wheels Market

The demand for aircraft, technical development, safety standards, and market competition are some of the variables that have an impact on the global market for powered wheels. Although the aerospace industry is robust in North America, especially in U.S, and contributes significantly to the market's growth, there are numerous prominent manufacturers, suppliers, and customers present on a global scale. Therefore, North America dominates the global market with majority of market shares.

Powered Wheels For Aircraft Landing Market Companies

The major global players include United Technologies Corporation (UTC) Aerospace Systems, Safran Group, Boeing Company, Airbus Group, Bombardier Aerospace, General Electric Aviation, Spirit AeroSystems Holdings Inc., GKN Aerospace, FACC AG and RUAG Aerostructures.

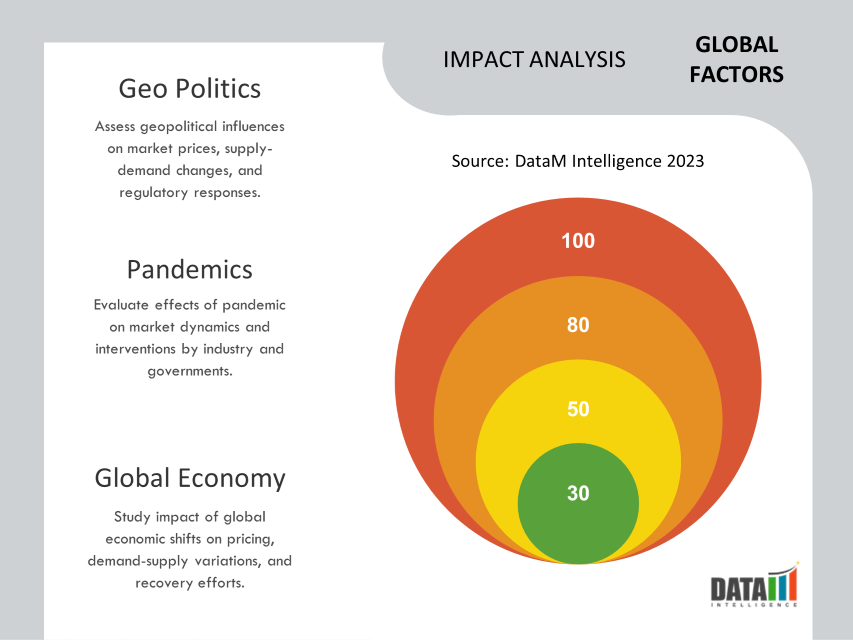

COVID-19 Impact Analysis

Widespread travel restrictions, border closures, and a decline in passenger demand for air travel were all caused by the pandemic. Airlines cut back on operations, which led to a sharp reduction in aircraft utilization and a decrease in new aircraft purchases. Airlines postponed or scrapped plans to expand their fleets as a result of the decline in air travel demand, which had an adverse effect on the market's expansion.

Due to temporary production line closures or reduced capacity, airplane manufacturers have trouble delivering new aircraft. The delayed delivery of new aircraft due to interrupted supply chains and logistical challenges had an impact on the demand for powered wheels and associated landing gear components.

Russia- Ukraine War Impact

Uncertainty has been brought on by geopolitical tensions and conflicts in the aviation sector. Uncertainty can have an impact on an airline's financial stability, passenger demand, and operational efficiency. This could therefore lead to fewer new aircraft orders and a decline in the market for powered wheels.

Key Developments

- In July 2023, As the company seeks to preserve its advantage over US rival Boeing, Airbus is continuing on with plans to develop a lightweight wing in UK for the next generation of its best-selling A320 airliners.

- In March 2023, U.S. Defense Security Cooperation Agency (DSCA) has informed Congress of a potential E-2D Advanced Hawkeye (AHE) aircraft foreign military sale (FMS) to Japan. It has already received State Department approval. Up to five E-2D AHE airborne early warning and control (AEW&C) aircraft and 12 T56-A-427A engines, of which two will be furnished as spares and ten will be delivered pre-installed, are included in the FMS, which is valued at around USD 1.38 billion.

- In July 2022, On June 30, 2022, it was revealed that France, Germany and Sweden had decided to construct a new fixed-wing medium-lift transport aircraft. The three nations inaugurated the Future Mid-Size Tactical Cargo (FMTC) programme during the European Wings event, which was sponsored by the French Presidency of the Council of the European Union (PFUE), according to a release by the French Ministry of Defense.

Why Purchase the Report?

- To visualize the global powered wheels for aircraft landing market segmentation based on wheel, component, aircraft and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of powered wheels for aircraft landing market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global powered wheels for aircraft landing market report would provide approximately 61 tables, 56 figures and 183 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies