Portable Ultrasound Market Size & Industry Outlook

Technological advancements are propelling the growth of the portable ultrasound industry by creating devices that are more compact, lighter, and easier to use, facilitating point-of-care imaging in hospitals, clinics, and remote areas. The integration of wireless connectivity, artificial intelligence, and cloud-based systems allows for quicker image processing, enhanced diagnostic precision, and real-time sharing of data. For instance, in August 2023, GE HealthCare introduced the Vscan Air SL, a handheld wireless ultrasound device. It includes SignalMax and XDclear technologies with a single-crystal transducer, allowing for swift, high-resolution assessments of cardiac and vascular conditions at the point of care. These advancements decrease reliance on operators, shorten exam durations, and reduce costs, making portable ultrasound more reachable in developing markets.

Key Highlights

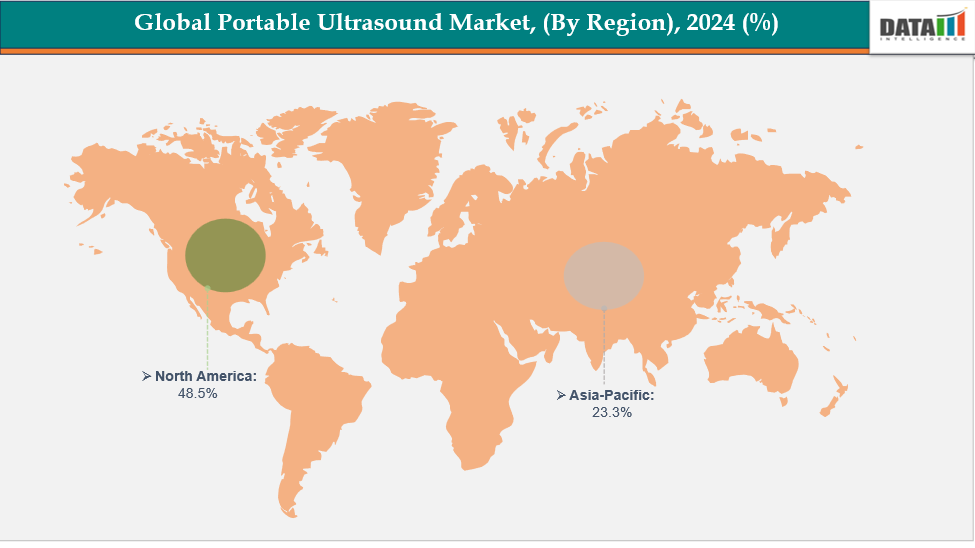

- North America is dominating the global portable ultrasound market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global portable ultrasound market, with a CAGR of 7.7% in 2024

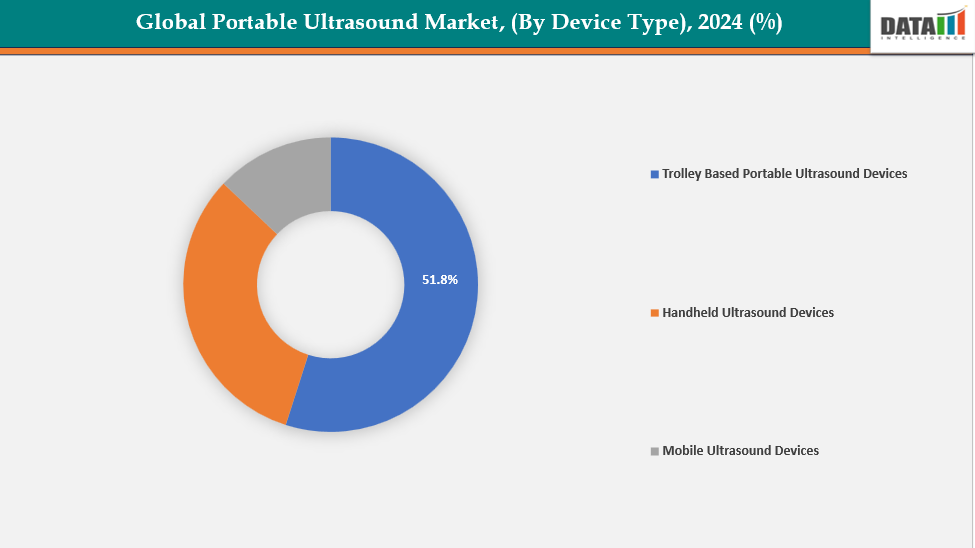

- The trolley-based portable ultrasound devices segment is dominating the portable ultrasound market with a 51.8% share in 2024

- The 2D ultrasound devices segment is dominating the portable ultrasound market with a 42.3% share in 2024

- Top companies in the portable ultrasound market are GE HealthCare, Butterfly Network, Inc., Clarius, FUJIFILM Sonosite, Inc., CHISON Medical Technologies Co., Ltd., ARI Medical Technology Co., Ltd., Mindray Medical India Pvt. Ltd., CANON MEDICAL SYSTEMS CORPORATION, SonoScape Medical Corp., Samsung Healthcare, and DAWEI MEDICAL, among others.

Market Dynamics

Drivers: Growing demand for point‑of‑care diagnostics and emergencies is accelerating the growth of the portable ultrasound market

The worldwide demand for point-of-care diagnostics is fueling the expansion of portable ultrasound technology. Emergency rooms need fast and precise imaging solutions. Portable ultrasound facilitates bedside examinations, minimizing patient transport and reducing wait times. Compact and handheld devices empower medical professionals to act swiftly in trauma and critical care situations. The growing incidence of chronic diseases leads to an uptick in emergency cases, increasing the utilization of these devices. Hospitals are implementing portable systems to enhance workflow and operational efficiency.

Additionally, technological advances, such as wireless connectivity and AI integration, enhance usability. For instance, in June 2025, Philips, a global health technology leader, launched the Flash Ultrasound System 5100 POC, a next‑generation point-of-care ultrasound. Designed for anesthesia, critical care, emergency, and musculoskeletal imaging, it offered exceptional image clarity, smart automation, and intuitive touchscreen controls, enabling rapid, confident diagnoses for clinicians of all experience levels.

Restraints: The higher cost of advanced portable ultrasound devices is hampering the growth of the portable ultrasound market

The steep cost of sophisticated portable ultrasound machines restricts their use. Numerous small clinics and diagnostic centers struggle to afford these devices. Hospitals in developing areas encounter financial limitations. Handheld or wireless ultrasound systems typically come at a higher price than standard devices. The costs associated with maintenance and software upgrades contribute to the total expense. Some portable devices equipped with AI and connectivity features are especially pricey. This complicates the procurement process for mid-sized facilities. Restricted reimbursement policies further deter investment.

For instance, the Butterfly iQ+ is a handheld, whole-body portable ultrasound device priced around ₹5–6 lakh (USD 6,000–7,000).

For more details on this report, see Request for Sample

Portable Ultrasound Market, Segmentation Analysis

The global portable ultrasound market is segmented based on device type, technology, application, end‑user, and region

By Device Type: The trolley-based portable ultrasound devices segment is dominating the portable ultrasound market with a 51.8% share in 2024

The portable ultrasound market is primarily led by trolley-based systems due to their flexibility and enhanced imaging features. These devices deliver high-quality visuals that are comparable to stationary consoles while still being portable within medical facilities. They are favored by hospitals for use across various departments, such as cardiology, obstetrics, and emergency medicine, as they can be conveniently relocated between patient rooms. Their larger displays, sophisticated Doppler and 3D/4D functions, as well as wider probe compatibility, make them ideal for intricate diagnostic tasks.

Moreover, continuous technological upgrades, AI-assisted imaging, seamless data integration, and rising FDA approvals are reinforcing the leading position of trolley-based portable ultrasound devices. For instance, in August 2025, Esaote proudly announced that its MyLab A50 and MyLab A70 ultrasound systems had received FDA approval, marking a significant milestone that validated their compliance with the highest standards of safety and clinical performance in diagnostic imaging.

By Technology: The 2D ultrasound devices segment is dominating the portable ultrasound market with a 42.3% share in 2024

The segment of portable ultrasound devices that features 2D ultrasound technology holds the largest share of the market due to its cost-effectiveness, user-friendly nature, and broad applicability in various clinical environments. These devices offer real-time imaging suitable for general diagnostics, obstetrics, cardiology, and emergency care, making them adaptable for use in hospitals, clinics, and point-of-care settings. In contrast to more sophisticated 3D/4D or Doppler systems, 2D devices are lightweight, compact, and energy-efficient, enhancing their portability and practicality in remote or resource-constrained areas.

Additionally, technological innovations in ultrasound devices and their frequent launches make them dominant. For instance, in November 2023, Samsung launched the V6 ultrasound system, offering comprehensive 2D, 3D, and color imaging for women’s health and urology. The device received FDA 510(k) clearance, providing a budget-friendly solution designed to enhance workflow, productivity, and clinical efficiency.

Portable Ultrasound Market, Geographical Analysis

North America is dominating the global portable ultrasound market with 48.5% in 2024

North America is at the forefront of the portable ultrasound market, propelled by sophisticated healthcare facilities, the swift embrace of digital imaging, and an increase in surgical and critical care cases. Robust reimbursement frameworks, ongoing product advancements, qualified medical staff, and stringent regulatory adherence further bolster the region's leading position and growth prospects.

In the USA, the market for portable ultrasound devices is growing, driven by improved healthcare infrastructure, regular product introductions, cutting-edge ultrasound technologies, favorable FDA approvals, and 510(k) clearances that boost diagnostic and critical care effectiveness. For instance, in January 2025, Butterfly Network received FDA clearance for its next-generation handheld ultrasound, Butterfly iQ3. The third-generation semiconductor-based device featured an ergonomic design, doubled processing speed, enhanced image resolution, and faster 3D capabilities, including automated iQ Slice and iQ Fan modes for optimized point-of-care imaging.

Europe is the second region after North America, which is expected to dominate the global portable ultrasound market with 34.5% in 2024

In Europe, the market for portable ultrasound devices is growing, attributed to improved healthcare systems, an aging population, and a rise in surgical procedures. Ongoing product introductions, supportive reimbursement policies, and EU/CE mark certifications are spurring innovation, improving patient safety, and facilitating regional market expansion in hospitals, clinics, and point-of-care environments.

Owing to factors like continuous EU and CE mark approvals, for instance, in January 2025, Clarius Mobile Health received CE Mark certification for its Clarius PAL HD3 wireless handheld ultrasound scanner. The dual-array device combined phased and linear probes on a single head, delivering high-definition imaging of superficial and deep anatomy at the bedside across Europe and the UK.

The Asia Pacific region is the fastest-growing region in the global portable ultrasound market, with a CAGR of 7.7% in 2024

The portable ultrasound industry in the Asia-Pacific area, which includes China, India, Japan, and South Korea, is experiencing significant growth driven by increased healthcare expenditure, advancements in technology, enhanced hospital infrastructure, favorable government policies, and a growing acceptance of point-of-care imaging solutions in both urban and rural healthcare settings.

In Japan, the market for portable ultrasound devices is expanding, bolstered by a sophisticated healthcare system, increasing demand for point-of-care services, the country's medical device certification processes, and ongoing technological advancements. For instance, in August 2025, Southwood Inc. announced it would begin sales of the Butterfly iQ3 portable ultrasound device in Japan from September 1, 2025, following its receipt of Class II medical device certification from Japanese authorities.

Portable Ultrasound Market Competitive Landscape

Top companies in the portable ultrasound market are GE HealthCare, Butterfly Network, Inc., Clarius, FUJIFILM Sonosite, Inc., CHISON Medical Technologies, ARI Medical Technology Co., Ltd., Mindray Medical India Pvt. Ltd., CANON MEDICAL SYSTEMS CORPORATION, SonoScape Medical Corp., Samsung Healthcare, and DAWEI MEDICAL, among others.

GE HealthCare: GE HealthCare is a leading global provider of portable ultrasound solutions, offering devices such as the Vscan Air series that deliver high-quality 2D, 3D, and color imaging for point-of-care diagnostics. The company focuses on innovation, workflow efficiency, and accessibility, enabling hospitals, clinics, and remote healthcare settings to perform rapid, reliable imaging across multiple clinical applications.

Key Developments:

- In November 2025, Pulsenmore Ltd. received FDA De Novo marketing authorization for its Pulsenmore ES home-use prenatal ultrasound platform. The device allowed expectant mothers to perform guided scans at home, with results remotely interpreted by physicians, marking a pioneering step in U.S. prenatal care and home diagnostics.

- In August 2025, DESKi commercially launched HeartFocus, its AI-enabled cardiac imaging software, in the U.S. Integrated with FDA-cleared Butterfly Network handheld ultrasound devices, the software enabled healthcare professionals to perform diagnostic-quality heart ultrasounds after minimal training, expanding access for health systems, clinics, and clinical education institutions.

Portable Ultrasound Market Scope

| Metrics | Details | |

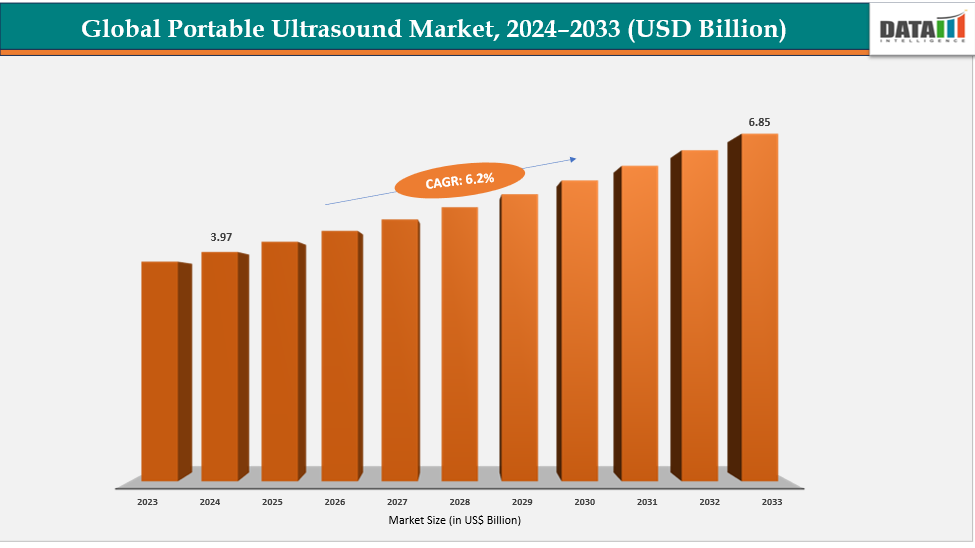

| CAGR | 6.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Device Type | Trolley-Based Portable Ultrasound Devices, Handheld Ultrasound Devices, Mobile Ultrasound Devices |

| By Technology | 2D Ultrasound, 3D & 4D Ultrasound, Doppler Ultrasound High‑Intensity Focused Ultrasound | |

| By Application | Gynecology, Cardiovascular, General Imaging, Orthopaedics, Others | |

| By End‑User | Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Home Care, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global portable ultrasound market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical imaging-related reports, please click here