Global Polycarbonate Sheet Market is segmented By Type (Solid, Multi-Walled, Corrugated), By End-User (Building & Construction, Automotive & Transportation, Electrical & Electronics, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Polycarbonate Sheet Market Size

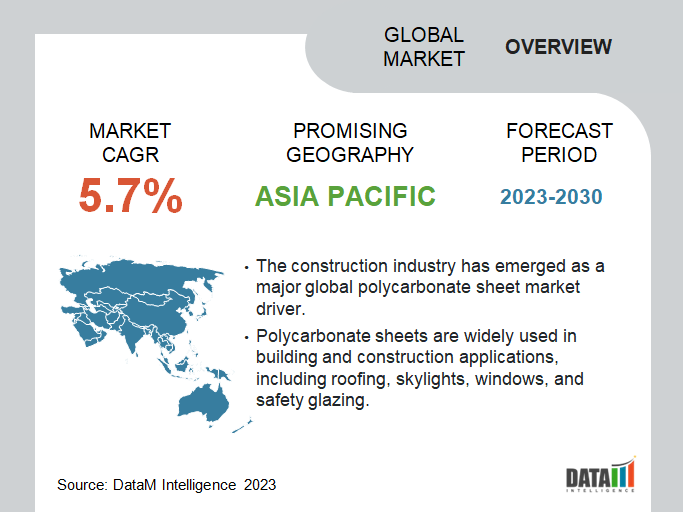

The Global Polycarbonate Sheet Market reached USD 1.6 billion in 2022 and is expected to reach USD 2.4 billion by 2031, growing with a CAGR of 5.7% during the forecast period 2024-2031.

The Global Polycarbonate Sheet Market has experienced significant upward market trend in recent years, driven by the rising demand across various industries such as construction, automotive, electronics, and packaging.

Polycarbonate sheets' durability, UV resistance, and thermal insulation properties make them suitable for various architectural designs.

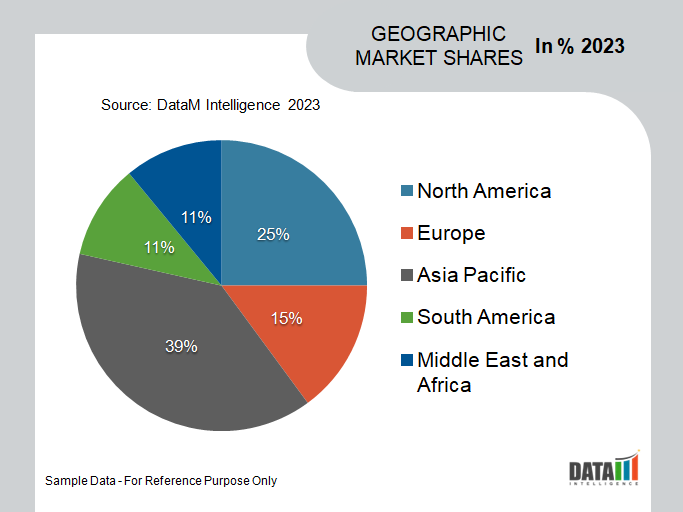

Asia-Pacific is among the growing regions in the global polycarbonate sheet market covering more than 1/4th of the market share due to its large population, high levels of disposable income, and robust growth in construction and automotive industries. The region has witnessed a surge in market opportunities and participation in polycarbonate sheet due to eco-friendly alternatives, aligning with the global trend of sustainable construction practices.

Further, solid polycarbonate sheet segment dominates the global market with almost 2/3rd of the market share.In short, the market shows promising opportunities for manufacturers and suppliers, driven by ongoing infrastructure development, automotive innovation, technological advancements, and sustainable packaging trends.

Polycarbonate Sheet Market Summary

|

Metrics |

Details |

|

CAGR |

5.7% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights Download Sample

Polycarbonate Sheet Market Dynamics

Growing Demand for Sustainability and Technological Innovations

Technological advancements and innovations have played a crucial role in driving the growth of the global polycarbonate sheet market. Continuous research and development efforts have led to the introduction of new product variants with enhanced properties, further expanding the application scope of polycarbonate sheets.

For instance, the National Institute of Standards and Technology (NIST) in U.S. reported advancements in the development of self-healing polycarbonate sheets. The respective sheets can repair minor damages and scratches, improving their longevity and reducing maintenance costs.

Further, sustainability has become a key driver in the global polycarbonate sheet market. Governments around the globe have been actively promoting the use of eco-friendly materials to reduce environmental impact and improve energy efficiency.

For instance, the European Union introduced the Circular Economy Action Plan in 2020, emphasizing the importance of recyclability and resource efficiency in the manufacturing sector. Polycarbonate sheets, which are recyclable and have a long lifespan, align with these objectives, driving their adoption in various industries.

Growth in Application of Polycarbonate Sheets in Construction and Automotive Industries

The construction and building sector has emerged as a major driver in the Global Polycarbonate Sheet Market. Polycarbonate sheets offer a variety of advantages, including excellent durability, high impact resistance, and versatility, making them suitable for various applications within the construction industry.

Government sources report a surge in construction activities globally, particularly in emerging economies. For instance, in India, the Ministry of Housing and Urban Affairs reported a rise in the number of affordable housing projects, which has spurred the demand for polycarbonate sheets for roofing, skylights, and wall claddings.

Similarly, The automotive sector has been a significant driver in the global polycarbonate sheet market. Polycarbonate sheets offer exceptional strength, lightweight properties, and high impact resistance, making them ideal for automotive applications such as windshields, windows, and interior components.

Recent data highlight the growing demand for polycarbonate sheets in the automotive industry. For instance, he Ministry of Industry and Information Technology of China reported a significant rise in the production of electric and hybrid vehicles in the country, contributing to increased demand for polycarbonate sheets for automotive applications.

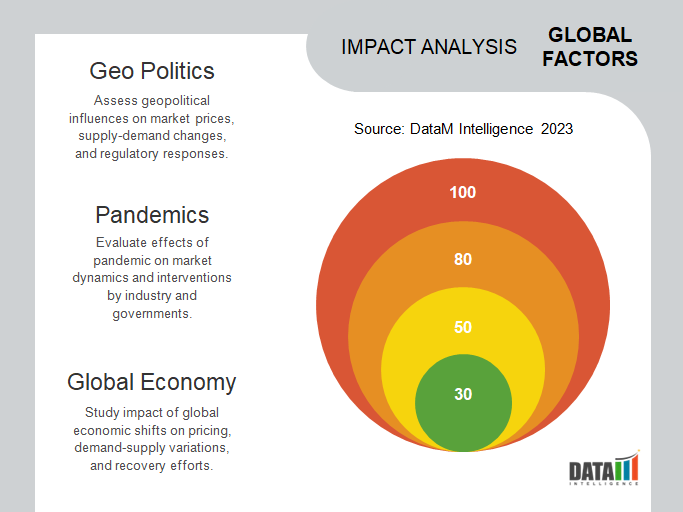

Volatility in Raw Material Prices and Environmental Concerns

One of the primary restraints in the global polycarbonate sheet market is the volatility in raw material prices. Polycarbonate sheets are manufactured using bisphenol-A (BPA) and other chemical components, the costs of which are subject to fluctuations in the petrochemical industry. The prices of petrochemical derivatives, including BPA, witnessed significant fluctuations post-2020, leading to uncertainties in the overall production costs and pricing of polycarbonate sheets.

For example, data from the U.S. Energy Information Administration (EIA) shows that the average price of petrochemical feedstock experienced a notable increase of 2-3% in 2021 compared to the previous year, impacting the cost of raw materials for polycarbonate sheet manufacturers globally.

Environmental concerns surrounding the production and disposal of polycarbonate sheets pose another major restraint in the market. Polycarbonate sheets are derived from fossil fuels and have a high carbon footprint. Government initiatives aimed at reducing greenhouse gas emissions and promoting sustainable practices have led to stricter regulations and increased scrutiny of the use of polycarbonate sheets. For instance, the European Union's Single-Use Plastics Directive, implemented in 2021, restricts the use of certain single-use plastic products, including polycarbonate sheets, to reduce plastic waste and promote a circular economy.

Polycarbonate Sheet Market Segment Analysis

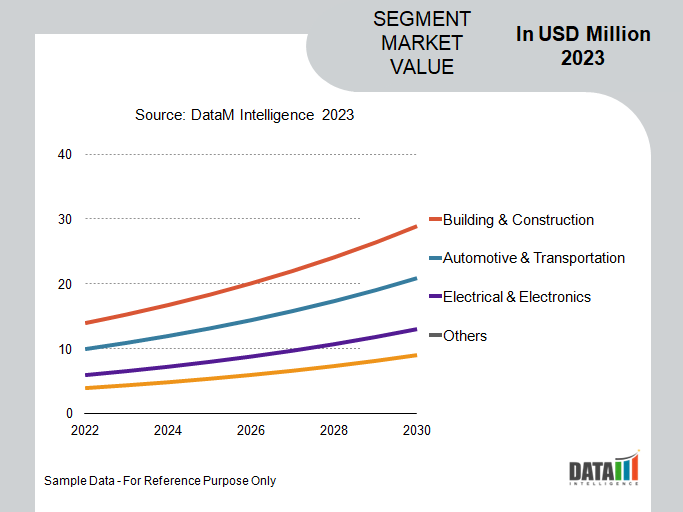

The Global Polycarbonate Sheet Market is segmented based on type, end-user and region.

Superior Properties and Versatility

The global polycarbonate sheet market has witnessed remarkable growth, with the multi-walled segment emerging as a dominant force. Multi-walled polycarbonate sheets have gained significant traction in various industries due to their superior properties and versatility. Polycarbonate sheets are constructed with multiple layers, offering enhanced strength, thermal insulation, light transmission, and impact resistance. The unique combination of features has propelled the growth of the multi-walled segment in the global polycarbonate sheet market.

The construction industry has been a major driver of the multi-walled polycarbonate sheet market. The sheets are widely used in architectural applications such as skylights, roofing, and walls. The excellent thermal insulation properties and ability to transmit natural light make them an ideal choice for energy-efficient buildings. Government initiatives promoting sustainable construction have further propelled the demand for multi-walled polycarbonate sheets.

Global Polycarbonate Sheet Market Geographical Share

The boom in Construction and Automotive Industries in Asia-Pacific

The Asia-Pacific region has experienced a significant boom in construction activities, driving the demand for polycarbonate sheets. The respective versatile materials find extensive application in roofing, cladding, skylights, and windows due to their durability, lightweight, and excellent thermal insulation properties. As the largest construction market in the region, China has witnessed substantial growth in the use of polycarbonate sheets.

The Chinese government's infrastructure development plans and urbanization initiatives have fueled the demand for these sheets in various construction projects. With ongoing urbanization and infrastructure development, India has emerged as a key market for polycarbonate sheets. Government initiatives such as "Housing for All" and "Smart Cities Mission" have accelerated construction activities, driving the demand for these sheets.

Further, The Asia-Pacific region is a hub for the automotive industry, with significant production and consumption of vehicles. Polycarbonate sheets are increasingly used in automotive applications, including windows, sunroofs, and exterior components, owing to their lightweight, impact resistance, and design flexibility. The Japanese automotive industry has been at the forefront of adopting polycarbonate sheets for various applications. The country's focus on lightweighting vehicles and improving fuel efficiency has led to increased utilization of these sheets.

Polycarbonate Sheet Market Companies

The major global players include Teijin Limited, SABIC, Covestro AG, Mitsubishi Gas Chemical Company, Inc, Suzhou Omay Optical Materials Co, Ltd, 3A Composites GmbH, Plazit-Polygal Group, Excelite, Trinseo and Evonik Industries AG.

COVID-19 Impact on Polycarbonate Sheet Market

COVID Impact

The outbreak of the COVID-19 pandemic in late 2019 had far-reaching effects on global industries, including the polycarbonate sheet market. Polycarbonate sheets are widely used in various sectors such as construction, automotive, electrical, and others. COVID-19 led to significant disruptions in global supply chains, affecting the production and availability of polycarbonate sheets.

Manufacturing plants faced temporary closures and reduced capacity due to lockdowns and restrictions imposed by governments globally. The disruption resulted in delayed production, shortage of raw materials, and logistical challenges, impacting the overall supply of polycarbonate sheets.

Further, The COVID-19 pandemic also resulted in reduced demand for polycarbonate sheets in key end-use industries. The construction sector, which accounts for a significant portion of the polycarbonate sheet market, experienced slowdowns and project delays due to restrictions and economic uncertainties. The automotive industry, another major consumer of polycarbonate sheets, witnessed a decline in production and sales during the pandemic.

Despite the challenges posed by the pandemic, certain application areas within the polycarbonate sheet market witnessed growth and presented new opportunities. The healthcare sector, in particular, witnessed increased demand for polycarbonate sheets for medical equipment, protective barriers, and healthcare facilities.

Russia- Ukraine War Impact

The ongoing conflict between Russia and Ukraine has had significant implications across various industries, including the global polycarbonate sheet market. Ukraine is a major global supplier of raw materials essential for the production of polycarbonate sheets, such as bisphenol A (BPA) and phosgene. For instance, Ukraine has historically been a significant exporter of BPA, accounting for a considerable share of the global market.

Post-2020 data indicates a decline in Ukraine's BPA exports due to the war, leading to potential shortages and increased prices in the global polycarbonate sheet market. The conflict has disrupted the supply chains, causing uncertainty and volatility in the availability of these critical inputs.

Moreover, the disruption in raw material supply, coupled with geopolitical tensions, has resulted in increased production costs for polycarbonate sheet manufacturers. The increased costs may be passed on to customers, potentially leading to higher prices in the market.

Additionally, the ongoing conflict has created an atmosphere of uncertainty, making it difficult for businesses to make long-term investment decisions. Market players may adopt a cautious approach, affecting the stability and growth of the global polycarbonate sheet market.

Key Developments

- SABIC, a Saudi Arabian player in the chemical industry, revealed on July 26, 2021, that its Functional Forms plant located in Bergen op Zoom, Netherlands, has achieved accreditation under the International Sustainability & Carbon Certification (ISCC) PLUS scheme. The respective accreditation recognizes the plant's ability to produce a new line of LEXAN polycarbonate film and sheet products using certified renewable feedstock. The development aligns with SABIC's existing TRUCIRCLE initiative and addresses the rising global demand for sustainable material solutions in a rapidly evolving circular plastics economy.

- Exolon Group introduced a groundbreaking multiwall polycarbonate sheet called "Multi UV Hybrid X" on January 25, 2022. The respective product offers enhanced strength, flexibility, and sustainability compared to existing options in the market.

- On February 9, 2023, Mitsui Chemicals, Inc. and Mitsubishi Gas Chemical Company, Inc. collaboratively launched initiatives to produce and market biomass polycarbonate resin (PC) as part of both companies commitment to achieving carbon neutrality by 2050. Under the BePLAYER brand by Mitsui Chemicals, biomass-derived bisphenol A ("biomass BPA") will be supplied. Mitsubishi Gas Chemical Company will utilize this biomass BPA as a monomer feedstock in the manufacturing of their PC Iupilon 1 polycarbonate sheet. This joint endeavor highlights their dedication to sustainable and environmentally-friendly practices in the production of polycarbonate materials.

Why Purchase the Report?

- To visualize the Global Polycarbonate Sheet Market segmentation based on type, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of polycarbonate sheet market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Polycarbonate Sheet Market Report Would Provide Approximately 53 Tables, 46 Figures And 183 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies