Otoscope Device Market Size and Trends

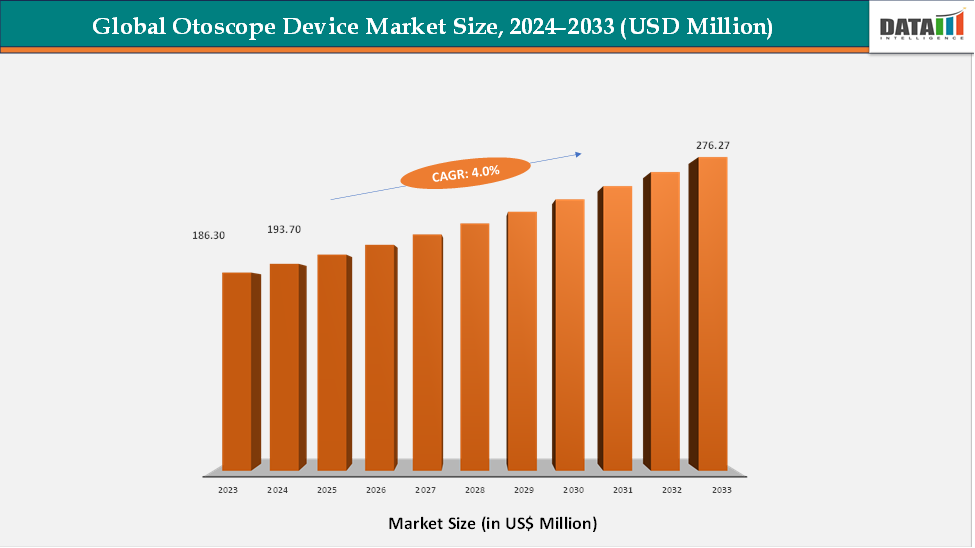

The global otoscope device market reached US$ US$ 186.3 million in 2023, with a rise to US$ 193.70 million in 2024, and is expected to reach US$ 276.27 million by 2033, growing at a CAGR of 4.0% during the forecast period 2025–2033. The global otoscope device Market is witnessing steady expansion, fueled by rising awareness of early ear disease detection, advancements in diagnostic technologies, and increasing healthcare accessibility worldwide. Otoscopes are seeing greater adoption across hospitals, ENT clinics, and home healthcare settings as ear infections and hearing disorders become more prevalent.

A key factor driving market growth is the surge in demand for portable and digital otoscopes that offer high-resolution imaging and real-time connectivity with smartphones and telemedicine platforms. These innovations are transforming traditional ear examinations, enabling remote diagnosis and improving clinical efficiency, particularly in rural and underserved areas. The integration of AI-driven imaging and wireless data transfer is further enhancing diagnostic accuracy and workflow efficiency for healthcare professionals.

Moreover, the growing pediatric population has increased the need for routine ear examinations, thereby driving consistent product demand. Rising disposable incomes, growing healthcare expenditure, and increased awareness of preventive ear care are also boosting the market outlook.

Manufacturers are focusing on ergonomic designs, rechargeable models, and LED-based illumination systems to improve user comfort and visualization quality. In parallel, sustainability trends are influencing product development, with companies exploring reusable and energy-efficient otoscope designs to reduce environmental impact.

With ongoing technological innovation, rising telehealth adoption, and a strong push toward preventive care, the otoscope device market is poised for robust growth. It stands as an integral segment of the global diagnostic equipment industry, bridging the gap between traditional examination methods and modern connected healthcare solutions.

Key Market highlights

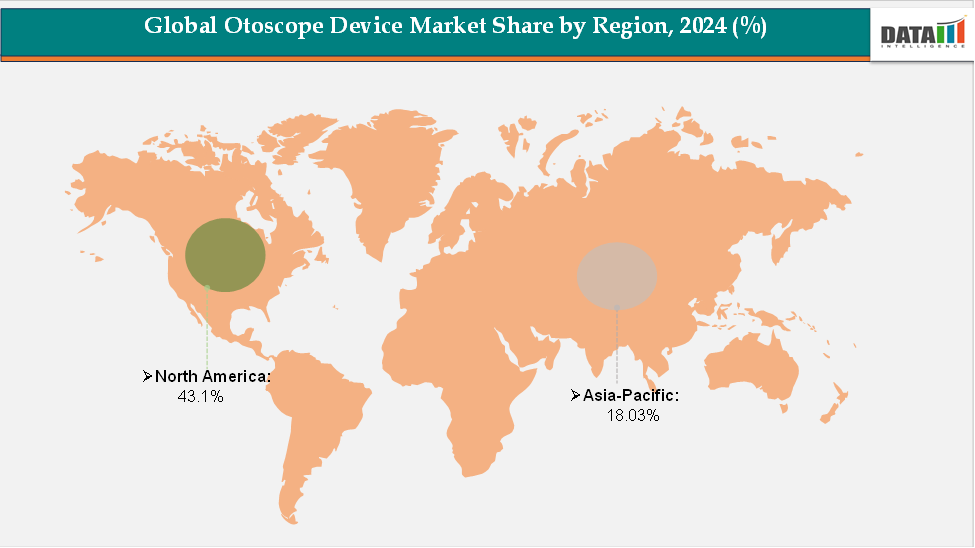

- North America accounted for approximately 43.1% of the global otoscope device Market in 2024 and is expected to maintain its leading position throughout the forecast period. The strong presence of established medical device manufacturers, advanced healthcare infrastructure, and high awareness regarding early diagnosis of ear and hearing disorders support the region’s dominance. Additionally, continuous technological innovation and favorable reimbursement policies further strengthen market growth.

- The Asia-Pacific region held around 18.03% of the global otoscope device Market in 2024 and is projected to be the fastest-growing region during the forecast period. The region’s expansion is driven by increasing healthcare spending, a rising patient pool suffering from ear infections and hearing impairments, and growing access to modern diagnostic devices.

- By product type, digital otoscopes dominated the global otoscope device market, accounting for approximately 47.6% of total revenue in 2024. Their dominance stems from superior image clarity, enhanced diagnostic accuracy, and compatibility with smartphones and electronic medical record systems.

Market Size & Forecast

- 2024 Market Size: US$193.70 million

- 2033 Projected Market Size: US$276.27 million

- CAGR (2025–2033): 4.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Otoscope Device Market Dynamics: Drivers & Restraints

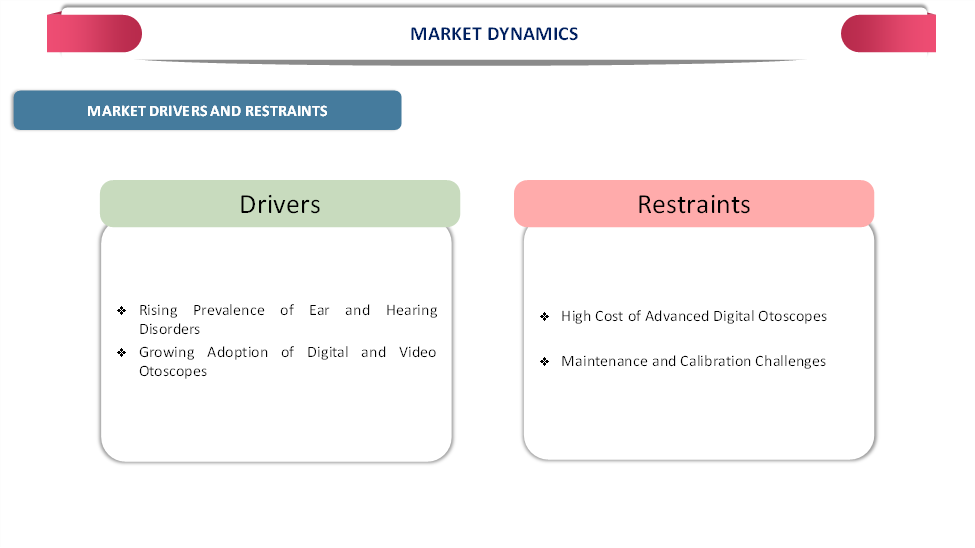

Driver: Rising Prevalence of Ear and Hearing Disorders

The rising prevalence of ear and hearing disorders is a key factor driving the growth of the global Otoscope Device Market, as these conditions increasingly demand accurate, routine, and early-stage diagnosis. Ear infections, hearing loss, and middle ear inflammations have become common across both pediatric and geriatric populations, significantly increasing the clinical use of otoscopes in hospitals, ENT clinics, and home healthcare settings. According to the World Health Organization (WHO), more than 430 million people globally currently live with disabling hearing loss, a number expected to surpass 700 million by 2050, underscoring the urgent need for accessible diagnostic tools. I

n the United States, the Centers for Disease Control and Prevention (CDC) reports that five out of six children experience at least one ear infection by the age of three, emphasizing the high burden of pediatric otitis media and the continuous demand for otoscopic examinations. Similarly, across the Asia-Pacific region, studies indicate that otitis media prevalence ranges from 3% in Thailand to over 12% in the Philippines, reflecting significant unmet diagnostic needs.

Furthermore, hearing loss remains one of the most common sensory impairments among older adults, with the National Institute on Deafness and Other Communication Disorders (NIDCD) estimating that one in three people aged 65–74 in the U.S. experiences hearing difficulties. These rising cases have heightened the emphasis on preventive ENT care and early screening, prompting widespread adoption of advanced digital and AI-enabled otoscopes for improved diagnostic accuracy and remote monitoring. As a result, the growing global burden of ear and hearing disorders continues to serve as a major catalyst for the expansion of the otoscope device market.

Restraint: High Cost of Advanced Digital Otoscopes

The high cost of advanced digital otoscopes could hinder market growth, particularly in developing regions where healthcare budgets and patient affordability are limited. These devices, equipped with high-resolution imaging, AI integration, and connectivity features, are significantly more expensive than traditional optical otoscopes, making them less accessible for small clinics and community healthcare centers.

For more details on this report, Request for Sample

Global Otoscope Device Market Segment Analysis

The global otoscope device market is segmented by product, portability, connectivity, application, end user and region.

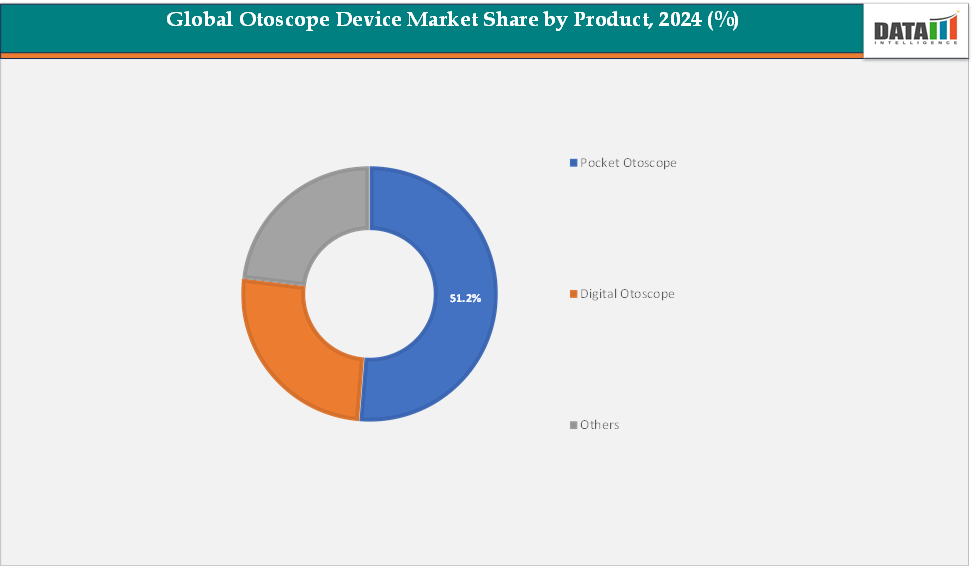

Product: The pocket otoscopes segment is estimated to have 51.2% of the otoscope device market share.

Pocket otoscopes currently hold the dominant position in the global otoscope device market. Their leadership stems from widespread use across hospitals, ENT clinics, and primary healthcare centers due to their compact design, affordability, and ease of handling. These traditional optical otoscopes have been the preferred diagnostic tool for decades, offering reliable visualization of the ear canal and tympanic membrane. Healthcare professionals continue to favor pocket otoscopes for routine examinations, particularly in general practice and pediatric assessments. Their longstanding clinical reliability, low maintenance costs, and broad availability have sustained their market dominance. Moreover, medical institutions in developing regions continue to rely on pocket otoscopes due to limited access to advanced digital imaging technologies, further reinforcing their leading market share.

The digital otoscopes segment is estimated to have 27.2% of the otoscope device market share.

Digital otoscopes are emerging as the fastest-growing segment in the Otoscope Device Market, driven by rapid technological innovation and the expanding adoption of telemedicine. These devices offer high-resolution digital imaging, wireless connectivity, and compatibility with smartphones and computers, allowing for real-time visualization, image capture, and remote consultations. The growing demand for AI-enabled diagnostic solutions and the integration of digital otoscopes into electronic medical record (EMR) systems are accelerating their uptake in hospitals and home care environments. Their ability to transmit images securely over telehealth platforms is revolutionizing ear care in rural and underserved regions. Additionally, the increasing prevalence of pediatric ear infections and age-related hearing loss, combined with the global shift toward connected healthcare ecosystems, is fueling strong growth for digital otoscopes.

Global Otoscope Device Market - Geographical Analysis

The North America otoscope device market was valued at 43.1% market share in 2024

North America remains the leading region in the global Otoscope Device Market, supported by its advanced healthcare infrastructure, early adoption of diagnostic technologies, and growing focus on preventive ENT care. The U.S. continues to drive regional dominance, fueled by strong investments in medical technology and the increasing prevalence of ear infections and hearing disorders. For instance, in February 2025, JEDMED Corporation partnered with Otologic Technologies to launch the world’s first AI-enabled digital otoscope in the United States. The device uses artificial intelligence to analyze ear images in real time, improving diagnostic accuracy and clinical efficiency. Such technological advancements reflect the region’s emphasis on innovation and digital transformation in healthcare. In addition, according to the Centers for Disease Control and Prevention (CDC), about five out of six children experience at least one ear infection by the age of three, underscoring the ongoing demand for otoscopic examinations. The combination of high disease prevalence, advanced diagnostic adoption, and supportive reimbursement systems ensures that North America maintains its stronghold in the global market.

The European otoscope device market was valued at 19.1% market share in 2024

Europe holds a significant position in the otoscope device market, supported by robust healthcare systems, established ENT care practices, and the growing use of digital diagnostic tools. Countries such as Germany, France, the U.K., and Italy have well-developed medical infrastructures that encourage the adoption of high-quality otoscope devices. For instance, in March 2024, Italy-based Inventis launched its “Harmonica” digital video otoscope, featuring high-definition imaging and ergonomic design to enhance clinical accuracy and comfort during ear examinations. This reflects Europe’s commitment to integrating modern imaging technologies in diagnostic procedures.

Furthermore, the European Hearing Instrument Manufacturers Association (EHIMA) reports that nearly one in ten Europeans experiences disabling hearing loss, reinforcing the importance of early diagnosis and regular ear health screening. With growing awareness of hearing disorders, strong regulatory oversight, and consistent technological upgrades, Europe continues to play a pivotal and stable role in the global otoscope device market.

The Asia-Pacific otoscope device market was valued at 18.03% market share in 2024

The Asia-Pacific region represents the fastest-growing market for otoscope devices, driven by rapid healthcare infrastructure expansion, rising disposable incomes, and increasing awareness of hearing and ear health. Countries such as China, India, Japan, South Korea, and Australia are experiencing significant improvements in healthcare access and diagnostic capacity. For instance, according to the World Health Organization (WHO), about 7% of people in the Western Pacific region suffer from hearing loss, and this proportion is expected to rise sharply by 2050, making the region one of the largest global markets for ear care diagnostics.

Additionally, a regional review found that otitis media prevalence among school-aged children ranges from 3% in Thailand to over 12% in the Philippines, highlighting the need for routine ear examinations. The rapid rise of telemedicine and smartphone-enabled diagnostic tools in the Asia-Pacific has further encouraged the use of portable digital otoscopes in both urban and rural settings. Government initiatives promoting primary healthcare modernization and school-based hearing screening programs are also strengthening regional growth. As healthcare providers and consumers increasingly embrace connected and affordable diagnostic technologies, the Asia-Pacific continues to emerge as the most dynamic and transformative market for otoscope devices.

Global Otoscope Device Market – Competitive Landscape

The major players in the otoscope device market include Hill-Rom Holdings, Inc., HEINE Optotechnik GmbH & Co. KG, Rudolf Riester GmbH, Sync Vision, KIRCHNER & WILHELM GmbH + Co. KG, INVENTIS s.r.l., IDCP B.V., Olympus Corporation, Midmark Corporation, AUG Medical, among others.

Key Developments:

- In October 2025, Rocket Doctor AI entered into a strategic partnership with Remmie Inc. to introduce and distribute the Remmie 4 Smart Otoscope, an FDA-approved and Health Canada-cleared device, across Canada. The innovative otoscope allows patients to conduct at-home examinations of the ear, mouth, and nose, transmitting high-quality images and videos directly to physicians via the Rocket Doctor telehealth platform. This collaboration aims to enhance remote diagnostic capabilities and expand access to virtual ENT care in Canada.

Market Scope

| Metrics | Details | |

| CAGR | 4.0% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$Mn) | |

| Segments Covered | Product | Pocket Otoscope, Digital Otoscope, Others |

| Portability | Hand-Held, Standalone | |

| Connectivity | Wired, Wireless | |

| Application | Diagnosis, Surgical | |

| End User | Hospitals, Specialty Clinics, ENT Clinics, Homecare Settings, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global otoscope device market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here