Orthobiologics Market Size & Industry Outlook

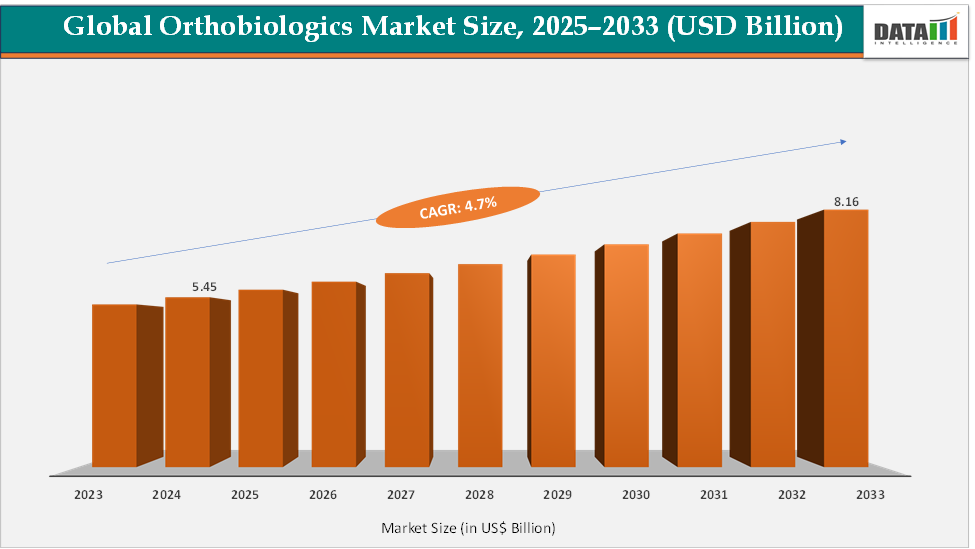

The global orthobiologics market size reached US$ 5.45 Billion in 2024 from US$ 5.26 Billion in 2023 and is expected to reach US$ 8.16 Billion by 2033, growing at a CAGR of 4.7% during the forecast period 2025-2033.

The market is primarily driven by the increasing prevalence of musculoskeletal disorders, such as osteoarthritis, fractures, and spinal conditions, which are closely linked to the aging global population. The surge in sports-related injuries, trauma cases, and obesity also contributes to the growing burden of orthopedic disorders worldwide, further boosting the need for effective orthobiologic treatments.

A major trend shaping the market is the rapid innovation in regenerative medicine. The introduction of biologically derived materials, including growth factors, stem cells, and biomaterials, is transforming orthopedic surgery and sports medicine by enhancing natural healing and tissue regeneration. There is also a notable shift toward outpatient and ambulatory surgical centers, where orthobiologics are increasingly used due to their procedural efficiency and cost-effectiveness.

Key Market Trends & Insights

The orthobiologics market presents substantial opportunities for growth, particularly through continued advancements in biotechnology. Innovations in stem cell therapies and biologically derived materials hold promise for addressing unmet clinical needs in musculoskeletal repair and regeneration.

As regulatory frameworks evolve and clinical evidence supporting the efficacy of orthobiologics accumulates, emerging economies are expected to benefit from broader access and adoption of these therapies.

North America dominates the orthobiologics market with the largest revenue share of 44.01% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.1% over the forecast period.

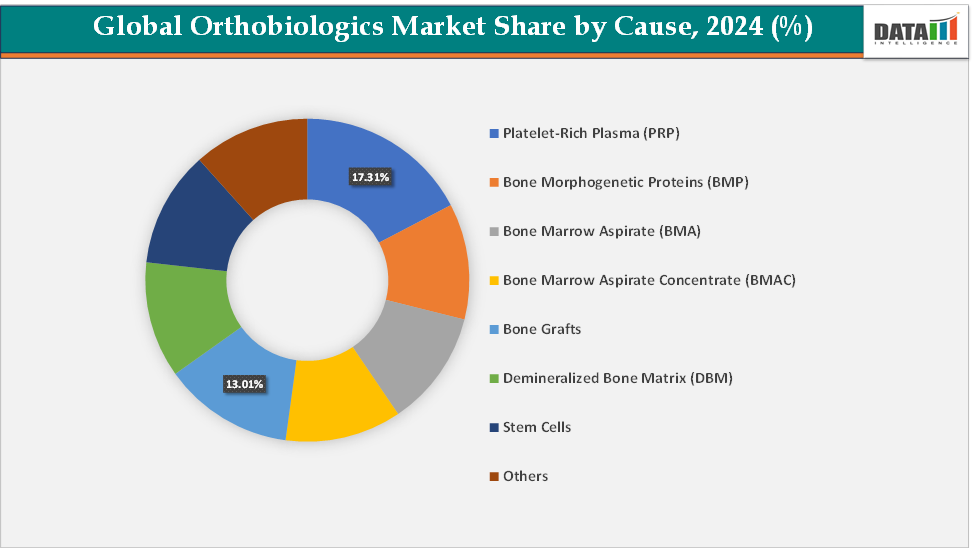

Based on product type, the Platelet-Rich Plasma (PRP) segment led the market with the largest revenue share of 17.31% in 2024.

The major market players in the orthobiologics market are Stryker, Zimmer Biomet, Arthrex, Inc., Sanofi, Anika Therapeutics, Inc., Ferring, Bioventus LLC, SeaSpine, and Globus Medical, among others

For more details on this report – Request for Sample

Market Dynamics

Drivers:

The rising prevalence of orthopedic conditions is significantly driving the orthobiologics market growth

Orthobiologics are the designated therapies for several orthopedic conditions, such as osteoarthritis, traumatic injuries, spinal injuries, and bone fractures etc. Due to their novelty and non-invasive nature, their demand has been rising for the past decade. These are the newer therapies in orthopedics, and as they promote regeneration and quick healing, they are gaining huge importance and are being integrated into the standard of care.

Moreover, with the growing elderly population worldwide, the prevalence of several orthopedic conditions is rising across the globe. This rising patient population is a significant opportunity for the orthobiologics market expansion. For instance, according to the Lancet Rheumatology Journal, it has been stated that in 2020, globally, 595 million cases of osteoarthritis were reported. The study projected that by 2050, osteoarthritis cases are expected to reach 1.1 billion.

Restraints:

The high cost of orthobiologics is hampering the growth of the market

The high cost of orthobiologics remains a major barrier to widespread adoption and is slowing overall market growth. These products, such as stem cell therapies, bone morphogenetic proteins (BMPs), and platelet-rich plasma (PRP), involve complex manufacturing processes, stringent regulatory requirements, and advanced storage needs, all of which drive up prices.

Orthobiologics offer pain-free and regenerative therapy for the recipient, as compared to surgical approaches. However, the majority of the orthobiologics are expensive and are not usually covered under medical insurance. Patients who are opting to get the orthobiologic treatment must spend out of their pockets. This can pose an economic burden on certain patient populations, especially those in the low- to middle-income category. For instance, upon review of prices from various clinics and hospitals in the U.S., the cost of a protein-rich plasma session can vary between US$ 1,300 US$ 2,500 per session. A patient may need multiple sessions based on their indication to get the therapeutic benefits.

Orthobiologics Market Segment Analysis

The global orthobiologics market is segmented based on product type, application, end-user, and region.

Product Type:

The platelet-rich plasma (PRP) segment is dominating the orthobiologics market with a 17.31% share in 2024

Platelet-rich plasma (PRP) is derived from the blood of the patient by centrifuging the patient’s whole blood. The concentrated plasma is rich in platelets, which contain growth factors essential for tissue healing, regeneration, and inflammation modulation. In orthopedics, platelet-rich plasma (PRP) is widely used as an orthobiologic due to its ability to heal musculoskeletal tissues. It is commonly used in chronic tendinopathies like tennis elbow and patellar tendinitis, where it stimulates collagen production and repairs tendon damage. PRP also shows promise in managing osteoarthritis (OA) by reducing inflammation, alleviating pain, and slowing cartilage degradation. In fracture healing and bone grafts, PRP aids in bone regeneration by activating osteoblasts. Its anti-inflammatory properties help mitigate chronic swelling, contributing to improved joint function and mobility.

Among the other orthobiologics, PRP is the preferred choice in many conditions, as its autologous nature poses no immunogenic, infectious threat to patients, and is a safe and painless solution. For instance, as per the article published in the Journal of Arthroscopic Surgery and Sports Medicine in September 2024, platelet-rich plasma (PRP) has widely emerged as the most commonly used orthobiologic agent for knee osteoarthritis, as it directly influences the cartilage microenvironment.

The bone grafts segment is the fastest-growing segment in the orthobiologics market, with a 33.56% share in 2024

Radiotherapy-induced Orthobiologics is recognized as the fastest-growing segment in the Orthobiologics market, largely due to the increasing global burden of head and neck cancers, where radiotherapy is a primary treatment modality. Unlike chemotherapy, which affects systemic tissues, radiotherapy delivers high-dose localized energy to the oral and pharyngeal regions, directly damaging the mucosal lining and triggering painful ulcerations. According to the National Institutes of Health, patients receiving radiation, especially in the cases of head and neck cancer, have 30%–60% chances of developing mucositis.

Market Geographical Analysis

North America is expected to dominate the global orthobiologics market with a 44.01% in 2024

North America dominates the global orthobiologics market due to its high adoption rates of orthobiologics and strong research and development activities by market players. Additionally, the prevalence of orthopedic conditions, such as osteoarthritis, sports injuries, and spinal injuries, is steadily rising in the region. The United States in the North America region dominates the market, with 85.28% market share. The region also has a significant patient population who are aware of and demand minimally invasive procedures, supported by skilled healthcare professionals who adopt emerging therapies rapidly. According to the Centers for Disease Control and Prevention (CDC), osteoarthritis affects approximately 32.5 million adults in the U.S., which is approximately 10% of the total population in 2023. This population is expected to rise steadily in the future due to the aging population.

Moreover, a robust pipeline of orthobiologics and collaborations between industry and academic institutions further reinforce the region's market leadership. For instance, the American Academy of Orthopaedic Surgeons released a new 2024–2028 Strategic Plan. It focuses on collaboration efforts in the musculoskeletal (MSK) community and encourages partnerships with specialty societies, digital health organizations, etc. For orthobiologics, this collaboration can improve the development and adoption. These are some of the factors that position North America as the leading region in the global orthobiologics market.

The Asia Pacific region is the fastest-growing region in the global orthobiologics market, with a CAGR of 5.1% in 2024

Countries such as India, China, and Japan are witnessing a surge in orthopedic procedures, including spinal fusion and joint replacement surgeries, where orthobiologics like bone grafts, PRP, and stem cell therapies are increasingly being adopted. For instance, Apollo Hospitals in India recently launched a Joint Preservation Programme that integrates orthobiologic solutions, reflecting the growing clinical acceptance in the region. The affordability gap compared to Western markets has encouraged local players and international companies to introduce cost-effective products.

The growing awareness among both healthcare professionals and patients about the benefits of orthobiologics, such as faster healing and minimally invasive procedures, is further accelerating market adoption. The Asia-Pacific orthobiologics market is characterized by strong growth potential, driven by demographic trends, healthcare investment, and technological advancement. With China and Japan leading the way, and other countries like India and Southeast Asian nations rapidly catching up, the region is poised to be a major engine of growth for the global orthobiologics industry in the coming years.

Orthobiologics Market Top Companies

Top companies in the orthobiologics market include Stryker, Zimmer Biomet, Arthrex, Inc., Sanofi, Anika Therapeutics, Inc., Ferring, Bioventus LLC, SeaSpine, and Globus Medical, among others.

Orthobiologics Market Scope

Metrics | Details | |

CAGR | 4.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Platelet-Rich Plasma (PRP), Bone Morphogenetic Proteins (BMP), Bone Marrow Aspirate (BMA), Bone Marrow Aspirate Concentrate (BMAC), Bone Grafts, Demineralized Bone Matrix (DBM), Stem cells, and Others |

Application | Osteoarthritis & Degenerative Arthritis, Spinal Fusion, Fracture Recovery, Soft Tissue Injuries, Maxillofacial & Dental Applications, and Others | |

End User | Hospitals, Orthopedic Clinics, Dental Clinics, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global orthobiologics market report delivers a detailed analysis with 56 key tables, more than 59 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.