Diabetes Devices Market Size

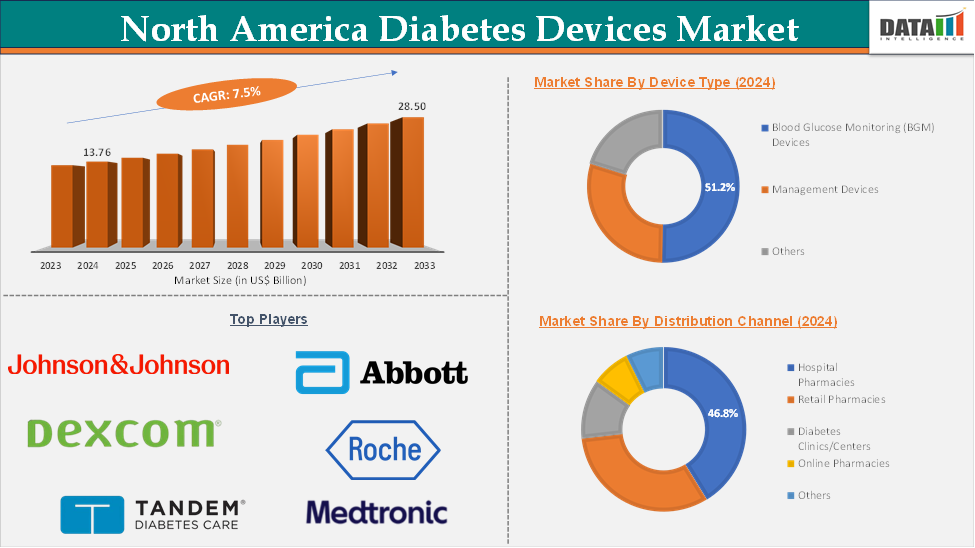

The North America Diabetes Devices market size reached US$ 13.76 Billion in 2024 and is expected to reach US$ 28.50 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Diabetes Devices Market Overview

The North America diabetes devices market is poised for steady growth, driven by the rising prevalence of diabetes, increasing adoption of advanced monitoring and insulin delivery technologies, and supportive healthcare infrastructure. The region, particularly the United States and Canada, represents one of the largest and most mature markets globally, owing to a high diabetic population, strong reimbursement systems, and significant awareness among patients and healthcare providers.

Key market drivers include the growing burden of diabetes fueled by sedentary lifestyles, obesity, and aging populations. Technological advancements, such as continuous glucose monitors (CGMs), insulin pumps, and integration with mobile health apps, are enhancing disease management and patient adherence. Additionally, government support through policies, funding, and insurance coverage further accelerates device adoption.

Diabetes Devices Market Executive Summary

Diabetes Devices Market Dynamics: Drivers & Restraints

Rising technological advancements is significantly driving the diabetes devices market growth

Technological advancements are a key driver of growth in the North America diabetes devices market, as innovations continue to enhance accuracy, convenience, and user experience in diabetes management. For instance, in March 2025, Tandem Diabetes Care launched its next-generation Control-IQ+ technology in the U.S., an advanced hybrid closed-loop algorithm compatible with both the t:slim X2 insulin pump and Tandem Mobi System. This upgrade, available for people with type 1 diabetes aged 2 and older and adults with type 2 diabetes, reflects the industry’s focus on personalization and automation.

Similarly, Abbott received FDA clearance in June 2024 for two new over-the-counter continuous glucose monitoring (CGM) systems, Lingo and Libre Rio, which expand access to CGM technology beyond insulin users. Lingo is designed for wellness-conscious consumers, while Libre Rio serves adults with type 2 diabetes managing their condition through lifestyle changes. These developments highlight how cutting-edge technologies are making diabetes care more accessible, adaptable, and effective, significantly boosting market demand across the region.

The high costs of diabetes devices hampering the growth of the diabetes devices market

The high costs associated with diabetes devices are significantly hampering the growth of the diabetes devices market, particularly among low- and middle-income populations. Advanced technologies such as continuous glucose monitors (CGMs), insulin pumps, and hybrid closed-loop systems offer improved management and convenience, but their upfront costs and ongoing maintenance expenses can be prohibitive for many patients.

Even in developed regions like North America, not all insurance plans fully cover these devices, leaving patients with substantial out-of-pocket expenses. This financial barrier discourages adoption, especially for those managing diabetes through more affordable, traditional methods. As a result, despite technological progress, the high price point limits market penetration and slows the overall growth of the diabetes devices sector.

For more details on this report – Request for Sample

Diabetes Devices Market, Segment Analysis

The North America diabetes devices market is segmented based on device type and distribution channel.

The blood glucose monitoring (BGM) devices from the device type segment are expected to hold 51.2% of the market share in 2024 in the diabetes devices market

Blood glucose monitoring (BGM) devices are expected to dominate the North America diabetes devices market due to their affordability, accessibility, and crucial role in daily glucose tracking, especially among individuals with type 2 diabetes. For instance, in June 2024, Prevounce Health launched its first remote blood glucose monitoring device, the Pylo GL1-LTE. This clinically validated meter supports cellular connectivity across multiple networks in the U.S., ensuring reliable data transmission and seamless integration with remote care platforms.

BGM devices maintain a strong foothold due to their cost-effectiveness and widespread use. The blood glucose monitors are being innovated continuously, which is contributing to the segment’s growth. For example, in September 2024, Senseonics Holdings received FDA approval for the Eversense 365 system, the world’s first one-year implantable CGM, marking a significant advancement in long-term diabetes monitoring. Despite these innovations, the practicality and lower cost of BGM devices keep them at the forefront of the North American market.

Diabetes Devices Market Competitive Landscape

Top companies in the North America diabetes devices market include Johnson & Johnson Services, Inc., Abbott, Dexcom Inc, Tandem Diabetes Care, Inc., LifeScan IP Holdings, LLC., Medtronic, Insulet Corporation, F. Hoffmann-La Roche AG, ACON Laboratories, Inc., Novo Nordisk A/S., among others.

Diabetes Devices Market, Key Developments

In April 2025, DexCom, Inc. has received FDA clearance for its Dexcom G7 15-Day Continuous Glucose Monitoring (CGM) System for adults aged 18 and older with diabetes in the United States. The new system offers an overall Mean Absolute Relative Difference (MARD) of 8.0%, enhancing the accuracy and reliability of glucose readings.

In August 2024, DexCom, Inc. announced the launch of Stelo, the first over-the-counter glucose biosensor available in the U.S. Consumers can now purchase Stelo without a prescription directly through Stelo.com, marking a major step toward more accessible diabetes monitoring solutions.

Diabetes Devices Market Scope

Metrics | Details | |

CAGR | 7.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Device Type | Blood Glucose Monitoring (BGM) Devices, Management Devices, Others |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Online Pharmacies, Others | |

The North America diabetes devices market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.