Neuropathic Pain Market – Industry Trends & Overview

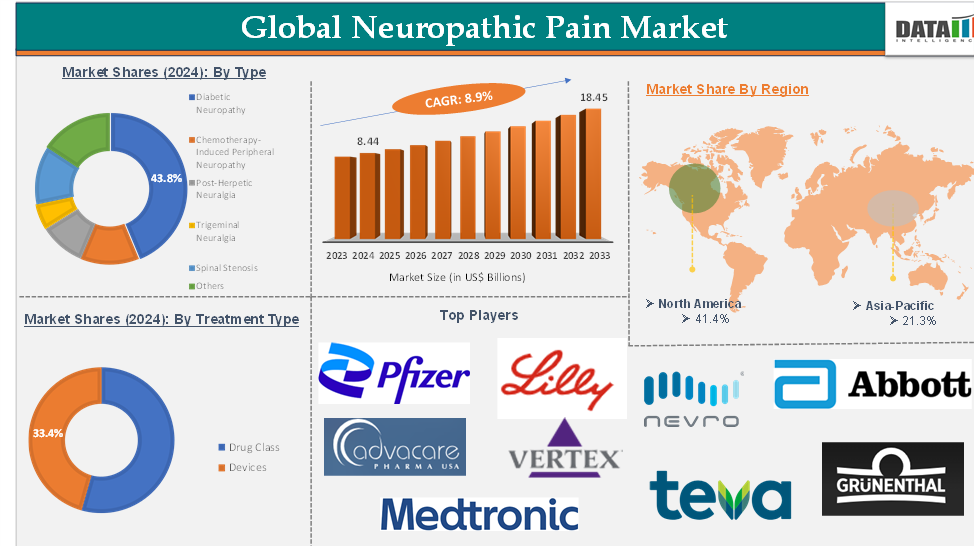

Neuropathic Pain Market reached US$ 8.44 Billion in 2024 and is expected to reach US$ 18.45 Billion by 2033, growing at a CAGR of 8.9 % during the forecast period 2025-2033.

Neuropathic pain is a type of chronic pain that arises from damage or dysfunction in the nervous system, rather than from direct tissue injury. It is characterized by symptoms such as burning, shooting, or electric shock-like sensations, numbness, tingling, or hypersensitivity to touch. This condition can result from various causes, including diabetes, infections, spinal cord injuries, autoimmune diseases, or as a side effect of certain medications, and it often significantly impairs the quality of life for affected individuals.

The global neuropathic pain market is primarily driven by the rising prevalence of chronic diseases such as diabetes and cancer, the aging global population, increased awareness and diagnosis of neuropathic pain, and advancements in pharmaceutical research leading to more effective treatment options. Government initiatives to raise awareness and the growing demand for pain management drugs also support market growth.

Opportunities in the neuropathic pain market include the rapid adoption of digital health technologies, the development of personalized medicine approaches, fueled by advances in genomics and biomarker research, as well as expanding clinical trial activity and R&D investment, particularly in emerging markets like Asia-Pacific.

Key trends shaping the neuropathic pain market include the shift toward non-opioid therapies such as anticonvulsants, antidepressants, and topical agents, as well as the integration of artificial intelligence and advanced imaging technologies for better diagnosis and personalized treatment.

Executive Summary

For more details on this report – Request for Sample

Neuropathic Pain Market Dynamics: Drivers

Increasing prevalence of diabetic neuropathy

As diabetes is a leading cause of neuropathic pain, the increasing number of diabetic patients directly correlates with a higher prevalence of diabetic neuropathy. Diabetic neuropathy is one of the most prevalent complications associated with diabetes. This prevalence can vary based on geographical location and demographic factors. This rise is primarily linked to the growing incidence of diabetes, which is one of the leading causes of neuropathic pain, alongside conditions such as cancer and multiple sclerosis.

According to the National Center for Biotechnology Information (NCBI) research publication in February 2024, at the time of diabetes diagnosis, literature estimates indicate that 10% to 20% of patients are concurrently diagnosed with diabetic peripheral neuropathy (DPN). However, studies focusing on individuals with long-standing diabetes mellitus report a higher prevalence of DPN among these patients. After five years, approximately 26% of individuals develop peripheral neuropathy, and this figure rises to 41% after ten years. Overall, the literature suggests that between 50% to 66% of individuals with diabetes will eventually develop DPN during their lifetime.

DPN can occur in both type 1 and type 2 diabetes, but its prevalence is notably higher in individuals with type 2 diabetes, primarily due to the longer duration of the disease and the higher incidence of associated comorbidities. Additionally, diabetes mellitus is recognized as the most common cause of Charcot neuroarthropathy, with an incidence rate ranging from 0.1% to 0.4%, and this rate can be as high as 29% among patients who already have peripheral neuropathy. All these factors demand the global neuropathic pain market.

Neuropathic Pain Market Dynamics: Restraints

Side effects of medications

The side effects of medications will hinder the growth of the global neuropathic pain market. The treatment of neuropathic pain often involves a variety of medications, including anticonvulsants, antidepressants, and opioids. While these medications can be effective, they are also associated with a range of side effects that can significantly impact patient adherence and overall quality of life.

One of the major complications associated with diabetes is diabetic neuropathy, which primarily affects the nerves, particularly those extending to the feet. This condition arises from prolonged high blood sugar levels, which can damage nerve fibers over time.

Anticonvulsants such as gabapentin and pregabalin are commonly prescribed for the management of neuropathic pain. However, these medications can lead to several side effects that may impact patient compliance. Patients using gabapentin and pregabalin may experience a range of adverse effects, including dizziness, drowsiness, nausea, and peripheral swelling.

These side effects can be intolerable for some individuals, leading them to discontinue the medication. Additionally, other potential side effects may include blurred vision and mood fluctuations, which can further discourage patients from adhering to their treatment plans. Thus, the above factors could be limiting the global neuropathic pain market's potential growth.

Neuropathic Pain Market Segment Analysis

The global neuropathic pain market is segmented based on type, treatment type, distribution channel, and region.

Type:

The diabetic neuropathy type segment is expected to hold 43.8% of the global neuropathic pain market in 2024

Diabetic neuropathy is a significant segment within the global neuropathic pain market, characterized by nerve damage resulting from diabetes. This condition primarily affects the feet and legs, leading to various complications that can severely impact patients' quality of life.

Diabetic neuropathy refers to a range of nerve disorders caused by diabetes, affecting approximately 50% to 66% of individuals with diabetes at some point in their lives. It can manifest in different forms, including peripheral neuropathy, autonomic neuropathy, proximal neuropathy, and focal neuropathy.

The growing prevalence of obesity, often linked to sedentary lifestyles and poor dietary habits, contributes to the rising incidence of diabetes and subsequently diabetic neuropathy. In regions like the United States, where obesity rates are climbing, there is a corresponding increase in cases of diabetic neuropathy. The escalating number of diabetes cases worldwide is a primary driver for the diabetic neuropathy segment. Projections indicate that the number of adults affected by diabetes will continue to rise significantly, leading to an increased incidence of diabetic neuropathy.

Ongoing research and development efforts are leading to the introduction of novel therapeutics aimed at effectively managing diabetic neuropathy. The launch of new products specifically designed for treating diabetic nerve pain is expected to enhance global neuropathic pain market growth.

Furthermore, key players in the industry are focusing more on the clinical trials that would drive this segment's growth in the global neuropathic pain market. For instnace, in May 2024, Medidata was been selected by Lexicon Pharmaceuticals, Inc. to support the advancement of the PROGRESS study, a Phase 2b clinical trial evaluating LX9211 for the treatment of diabetic peripheral neuropathic pain (DPNP).

This collaboration is particularly significant as LX9211 has the potential to become the first new non-opioid medication approved for neuropathic pain in over two decades. These factors have solidified the segment's position in the global neuropathic pain market.

Neuropathic Pain Market Geographical Share

North America is expected to hold 41.4 % of the global neuropathic pain market in 2024

The increasing incidence of neuropathic pain conditions, particularly among the aging population, significantly fuels market demand. As the population ages, the prevalence of chronic diseases such as diabetes and cancer, which are known to cause neuropathic pain, continues to rise. This demographic shift leads to a greater need for effective pain management solutions.

The rise in diabetes cases in North America is a major contributor to the neuropathic pain market. It is projected that over 55 million adults in North America will be affected by diabetes by 2030, leading to a corresponding increase in diabetic neuropathy cases. This growing burden creates a substantial demand for effective therapeutic options.

Ongoing research and development efforts are leading to the introduction of novel therapeutics specifically designed for neuropathic pain management. Innovative drug formulations and combination therapies are being developed to target multiple pain pathways, enhancing treatment efficacy and patient outcomes.

Moreover, in this region, a major number of key players' presence, well-advanced infrastructure, government initiatives & regulatory support, investments, and product launches & approvals would propel the global neuropathic pain market. For instnace, in April 2024, in the U.S., Vertex Pharmaceuticals made significant strides in its development of suzetrigine (formerly known as VX-548), an investigational oral medication designed to treat acute and neuropathic pain.

This drug represents a potential breakthrough as it could be the first new class of medicine for pain management in over 20 years, specifically targeting the NaV1.8 sodium channel, which plays a crucial role in transmitting pain signals in the nervous system. Thus, the above factors are consolidating the region's position as a dominant force in the global neuropathic pain market.

Neuropathic Pain Market Major Players

The major global players in the neuropathic pain market include Pfizer Inc., AdvaCare Pharma, Eli Lilly and Company., Vertex Pharmaceuticals, Abbott, Medtronic, Nevro Corp., Grünenthal, Teva Pharmaceuticals Inc., and Sun Pharmaceutical Industries Ltd., among others.

Key Developments

In November 2024, Grünenthal announced that its U.S. subsidiary, Averitas Pharma, Inc., had completed recruitment for the Phase III clinical trial known as AV001. This trial is designed to evaluate the efficacy, safety, and tolerability of QUTENZA (capsaicin) 8% topical system specifically for treating post-surgical neuropathic pain (PSNP). If the trial results are positive, they could support an extension of QUTENZA's label in the U.S. market.

Market Scope

Metrics | Details | |

CAGR | 8.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Diabetic Neuropathy, Chemotherapy-Induced Peripheral Neuropathy, Post-Herpetic Neuralgia, Trigeminal Neuralgia, Spinal Stenosis, Others |

Treatment Type | Drug Class, Devices | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |