Narcolepsy Therapeutics Market Size and Trends

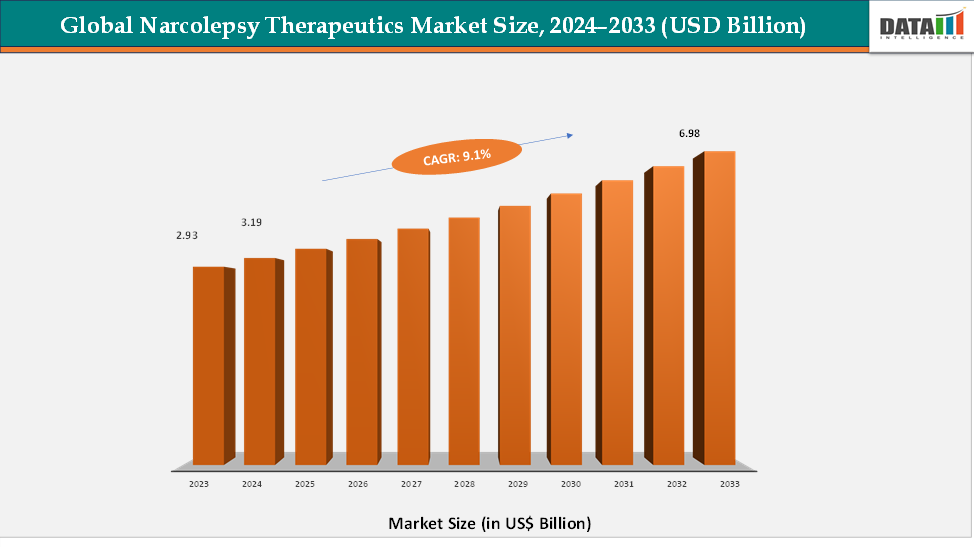

The global narcolepsy therapeutics market reached US$ 2.93 billion in 2023, with a rise to US$ 3.19 billion in 2024, and is expected to reach US$ 6.98 billion by 2033, growing at a CAGR of 9.1% during the forecast period 2025–2033. The narcolepsy therapeutics market is witnessing steady growth, driven by recent FDA approvals, reformulated drugs, and an active pipeline targeting unmet needs. The approval of LUMRYZ, a once-nightly extended-release sodium oxybate, marked a significant advance by reducing the dosing burden compared with older twice-nightly oxybate formulations, improving patient adherence and convenience.

Established wake-promoting agents such as modafinil and armodafinil remain standard first-line treatments for excessive daytime sleepiness, while low-sodium oxybate formulations like Xywav and legacy products such as Xyrem continue to play a central role in managing cataplexy and severe symptoms under restricted distribution programs. Alongside these therapies, next-generation candidates such as orexin-2 receptor agonists (e.g., TAK-861) are showing promise in clinical trials, with the potential to directly address the underlying pathophysiology of narcolepsy and redefine long-term care strategies.

At the same time, advances in digital health and remote monitoring tools are enhancing diagnosis, treatment personalization, and adherence monitoring, reflecting the broader shift toward patient-centric and technology-driven healthcare delivery. Collectively, these developments are accelerating the growth of the narcolepsy therapeutics market while raising new considerations around accessibility, safety monitoring, and reimbursement.

Key Market highlights

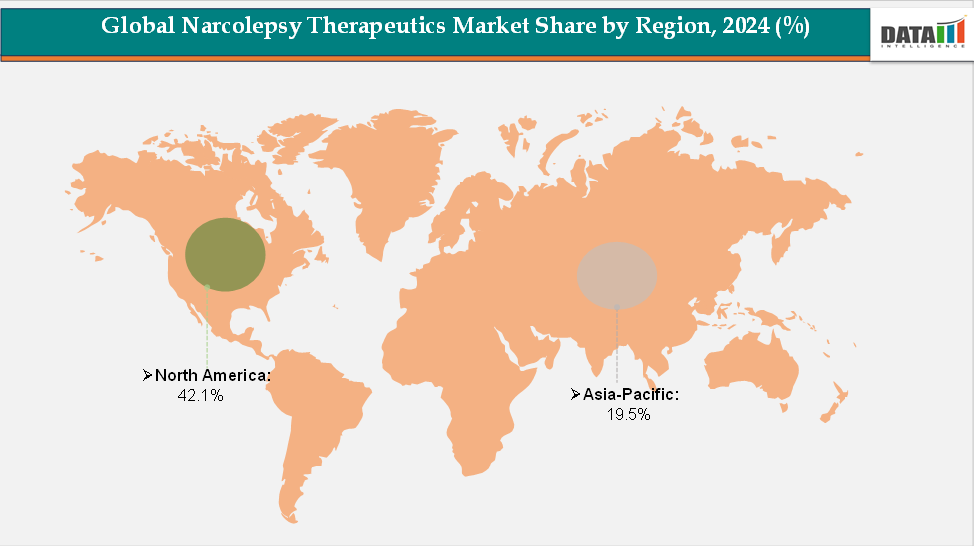

- North America leads the narcolepsy therapeutics market, accounting for approximately 42.1% of global revenue, supported by high diagnosis rates, strong adoption of advanced therapeutics, and the presence of leading pharmaceutical companies driving innovation and patient access.

- Asia-Pacific is the fastest-growing regional market, holding about 19.5% of the share, fueled by rising disease awareness, expanding healthcare access, and increasing investments in sleep disorder management across countries such as China, India, Japan, and South Korea.

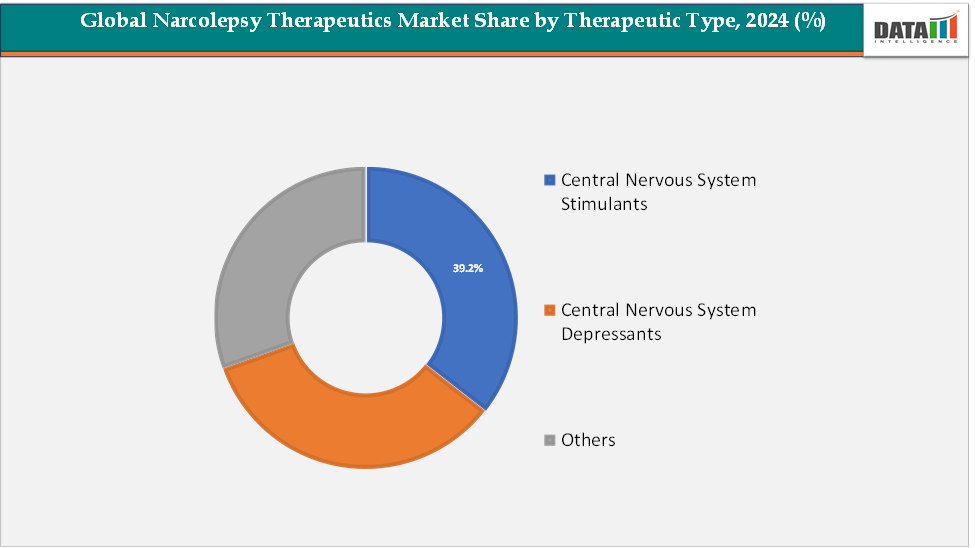

- Central nervous system (CNS) stimulants remain the dominant therapy segment, contributing around 46.8% of global revenue. Their established role as first-line treatment for excessive daytime sleepiness, coupled with broad clinical adoption and cost-effectiveness, underscores their continued importance in driving market growth.

Market Size & Forecast

- 2024 Market Size: US$ 3.19 billion

- 2033 Projected Market Size: US$ 6.98 billion

- CAGR (2025–2033): 9.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Narcolepsy Therapeutics Market: Executive Summary

Market Dynamics

Driver: Rising Prevalence of Sleep Disorders

The rising prevalence of sleep disorders is a key driver of the narcolepsy therapeutics market, as increasing awareness and diagnosis translate into higher demand for effective treatments. According to the American Sleep Apnea Association, an estimated 50–70 million adults in the United States suffer from sleep-related problems, with narcolepsy affecting nearly 1 in 2,000 people, many of whom remain undiagnosed.

The broader increase in conditions such as obstructive sleep apnea, insomnia, and restless legs syndrome has heightened attention on sleep health, encouraging more patients to undergo diagnostic evaluations like polysomnography, which often reveal underlying narcolepsy. For instance, the National Institute of Neurological Disorders and Stroke highlights that narcolepsy is frequently misdiagnosed as depression or epilepsy, but improved screening is now bringing more patients into the therapeutic fold.

The launch of advanced drugs like modafinil, armodafinil, sodium oxybate, and LUMRYZ further supports treatment uptake as patients seek better daytime functioning and nighttime symptom relief. Collectively, the surge in sleep disorder prevalence is expanding the diagnosed narcolepsy population and directly fueling the demand for specialized therapeutics.

Restraint: Side Effects and Safety Concerns

Side effects and safety concerns pose a significant restraint to the growth of the narcolepsy therapeutics market. Many commonly prescribed therapies, including central nervous system stimulants, wake-promoting agents, and sodium oxybate, are associated with adverse effects such as cardiovascular complications, dependency risks, nausea, dizziness, and sleep disturbances.

For more details on this report, Request for Sample

Global Narcolepsy Therapeutics Market Segment Analysis

The global narcolepsy therapeutics market is segmented by disease type, therapeutic type, and distribution channel, and region.

Product Type: The central nervous system stimulants segment is estimated to have 39.2% of the narcolepsy therapeutics market share.

Central nervous system (CNS) stimulants dominate the narcolepsy therapeutics market because they effectively target excessive daytime sleepiness (EDS), the most debilitating symptom of narcolepsy, making them the preferred first-line treatment.

Medications like modafinil (PROVIGIL), armodafinil (NUVIGIL), and methylphenidate work by promoting wakefulness and improving alertness without significantly disturbing nighttime sleep. Their widespread clinical use, established safety profiles, and ability to enhance daily functioning for patients contribute to their market dominance.

Additionally, these stimulants can be combined with other therapies, such as sodium oxybate for cataplexy management, allowing a flexible, symptom-focused approach that further reinforces their central role in narcolepsy care. Moreover, CNS stimulants are widely supported by clinical guidelines and real-world evidence, which further reinforces physician confidence in prescribing them.

Recent developments in this landscape have further solidified the segment’s position. For instance, in January 2025, Apotex Inc., Canada’s largest pharmaceutical company, announced that its affiliate Nuvo Pharmaceuticals (Ireland) DAC acquired U.S. rights to PROVIGIL (modafinil) and NUVIGIL (armodafinil), adding these branded therapies to Apotex Group’s global portfolio of over 550 prescription, OTC, and biosimilar products.

The central nervous system depressants segment is estimated to have 31.6% of the narcolepsy therapeutics market share.

Central nervous system (CNS) depressants represent the fastest-growing segment in the narcolepsy therapeutics market, primarily driven by the increasing adoption of sodium oxybate and its extended-release formulations for managing cataplexy and excessive daytime sleepiness. These therapies offer a unique mechanism of action compared to stimulants and wake-promoting agents, providing more comprehensive symptom control and improving nighttime sleep quality in patients.

The segment’s growth is further supported by favorable regulatory approvals, expanding insurance coverage, and ongoing clinical developments focused on next-generation oxybate therapies with reduced dosing frequency and improved safety profiles. As awareness of cataplexy management increases and patient preference shifts toward effective, long-term treatment options, CNS depressants are positioned to record the highest growth rate within the therapeutic landscape.

Geographical Analysis

The North America narcolepsy therapeutics market was valued at 42.1% market share in 2024

North America is expected to continue its leadership in the narcolepsy therapeutics market, driven by several key factors. The region boasts a high prevalence of the disorder. For instance, according to the American Heart Association, Inc., an estimated 135,000 to 200,000 people in the United States have narcolepsy, although the actual number may be higher due to frequent underdiagnosis. Narcolepsy often begins in childhood or adolescence, and individuals with a family history of the disorder face a significantly increased risk.

Advancements in diagnostic capabilities, coupled with increased awareness and improved reimbursement policies, have facilitated earlier detection and better management of narcolepsy. Additionally, the robust healthcare infrastructure and significant pharmaceutical investments in North America have fostered a conducive environment for the development and approval of novel therapies.

Recent developments also underscore North America's pivotal role in advancing narcolepsy treatments. In 2024, Avadel Pharmaceuticals received FDA approval for Lumryz, an extended-release sodium oxybate formulation, for the treatment of cataplexy and excessive daytime sleepiness in pediatric patients aged 7 years and older. This once-a-day bedtime treatment offers a more convenient dosing schedule compared to traditional therapies.

Axsome Therapeutics' AXS-12 has demonstrated promising results in Phase 3 trials, showing significant reductions in cataplexy frequency and improvements in excessive daytime sleepiness, cognition, and overall narcolepsy severity. These findings have positioned AXS-12 as a potential new treatment option for narcolepsy.

Furthermore, in June 2024, Harmony Biosciences' Wakix (pitolisant) was approved for pediatric use, expanding treatment options for younger patients with narcolepsy. These advancements reflect a dynamic and evolving landscape in narcolepsy therapeutics within North America.

Overall, North America's strong healthcare infrastructure, high awareness and diagnosis rates, supportive regulatory environment, and active pharmaceutical research and development make it the leading region in the narcolepsy therapeutics market, ensuring continued innovation and improved patient outcomes.

The Europe narcolepsy therapeutics market was valued at 22.9% market share in 2024

Europe plays a pivotal role in the narcolepsy therapeutics market, supported by strong regulatory frameworks, rising awareness campaigns, and well-established sleep disorder clinics across key countries such as Germany, France, the U.K., and Italy. The region benefits from robust healthcare infrastructure, high diagnosis rates, and active participation in clinical research trials focused on novel orexin-based therapies. Favorable reimbursement systems in several European nations further encourage the adoption of advanced narcolepsy treatments, while collaborations between academic institutions and pharmaceutical companies are accelerating innovation. Additionally, the growing emphasis on early diagnosis and patient-centric care models is expanding treatment uptake, positioning Europe as a significant contributor to global market revenue.

The Asia-Pacific narcolepsy therapeutics market was valued at 19.5% market share in 2024

Asia-Pacific is emerging as the fastest-growing region in the Narcolepsy Therapeutics Market, driven by improving access to healthcare services, rising disease recognition, and increasing investments in sleep medicine research. Countries such as China, Japan, South Korea, and India are witnessing the rapid adoption of therapeutic options, supported by expanding healthcare infrastructure and growing physician awareness about narcolepsy management. Japan, in particular, holds a notable share due to its advanced pharmaceutical landscape and ongoing clinical developments in orexin receptor agonists.

Furthermore, the rising prevalence of sleep-related disorders, coupled with a larger undiagnosed patient pool, creates significant growth opportunities for both global and regional players. The expanding presence of digital health platforms and supportive government initiatives aimed at addressing neurological and sleep disorders further strengthens Asia-Pacific’s role in shaping the future of narcolepsy therapeutics.

The rising emphasis on preventive health screenings, combined with the growing affordability of diagnostic technologies, is accelerating adoption across both urban and rural settings. As healthcare infrastructure continues to modernize and patient awareness increases, the Asia-Pacific region is set to remain the fastest-growing market for narcolepsy therapeutics in the coming years.

Competitive Landscape

The major players in the narcolepsy therapeutics market include Jazz Pharmaceuticals, Inc., Avadel, Apotex Inc., Novartis AG, and Harmony Biosciences among others.

Key Developments:

- In January 2025, Apotex Inc. announced that its affiliate, Nuvo Pharmaceuticals (Ireland) DAC, acquired U.S. rights to PROVIGIL (modafinil) and NUVIGIL (armodafinil), adding to Apotex Group’s global portfolio of over 550 generic, branded, OTC, and biosimilar products.

- In June 2024, Harmony Biosciences announced FDA approval of its supplemental NDA for WAKIX® (pitolisant) tablets to treat excessive daytime sleepiness in pediatric patients aged 6 and older with narcolepsy. The FDA issued separate decisions for EDS approval and a complete response for cataplexy treatment in this age group.

Market Scope

| Metrics | Details | |

| CAGR | 9.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Narcolepsy Type 1, Narcolepsy Type 2 |

| Therapeutic Type | Central Nervous System Stimulants, Central Nervous System Depressants, Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Other Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global narcolepsy therapeutics market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.