Military Wearables Market Size

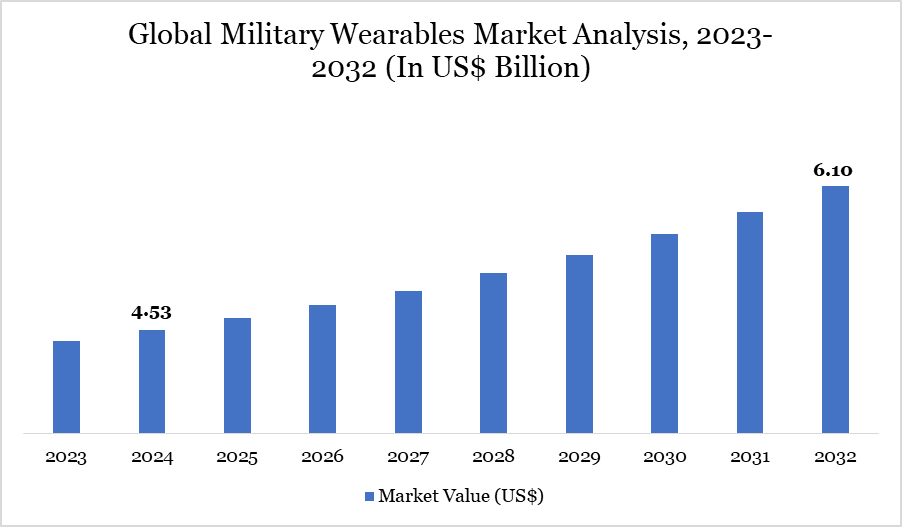

Global Military Wearables Market Size reached US$ 4.53 billion in 2024 and is expected to reach US$ 6.10 billion by 2032, growing with a CAGR of 3.80% during the forecast period 2025-2032.

The growing need for cutting-edge technologies that improve operational effectiveness, safety and situational awareness in high-stakes situations is driving an innovative development in the global military wearables market. To enhance mission outcomes, military personnel are progressively implementing body sensors, wearable exoskeletons, smart helmets and integrated communication systems. These devices speed up response times and improve decision-making by facilitating real-time data exchange, health monitoring and battlefield intelligence.

The market is expected to increase steadily as a result of large spending in defense modernization projects. To provide advanced wearable systems to the battlefield, major companies including Lockheed Martin, Boeing, Raytheon Technologies and Thales Group are making significant investments in research and development.

Wearables are becoming essential instruments for modern warfare as a result of the confluence of technologies like AI, AR and smart fabrics, which are changing military operations. By 2030, the military wearables market is anticipated to be a key component of next-generation soldier systems as governments throughout the world place a higher priority on digital transformation in defense.

Military Wearables Market Trend

The incorporation of advanced technologies like artificial intelligence (AI), augmented reality (AR) and smart textiles is a major trend influencing the military wearables market. By improving battlefield communication and providing real-time insights, these innovations are transforming operational capabilities. Wearables with AI capabilities offer predictive analytics, facilitating quicker and better decision-making.

One example of how AI platforms can identify threats in real time is Anduril Industries' partnership with Microsoft in September 2024 for the US Army's IVAS program. Heads-up displays and smart helmets with AR capabilities provide hands-free access to vital information, greatly enhancing target acquisition and navigation.

Furthermore, real-time health monitoring, adaptive camouflage and environmental resistance are made possible by the development of smart fabrics with embedded sensors. As military organizations transition to data-driven operations, integrating these technologies guarantees improved soldier performance and survival.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

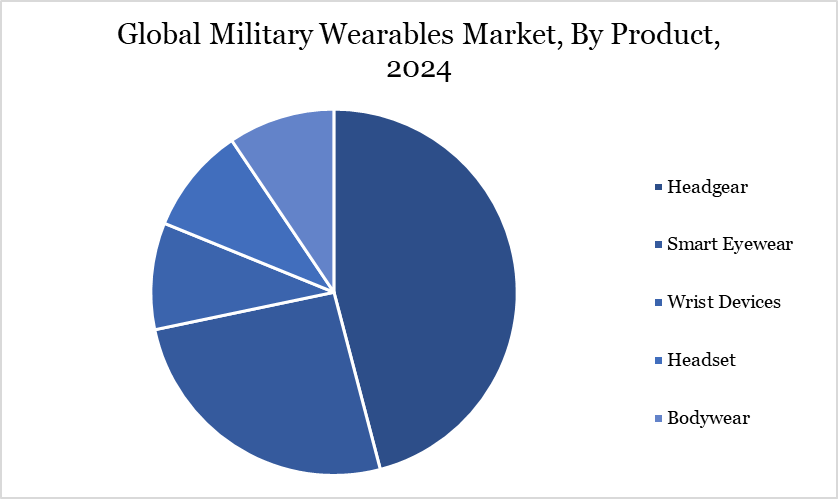

| By Product | Headgear, Smart Eyewear, Wrist Devices, Headset, Bodywear | |

| By Technology | Communication, Network and Connectivity, Imaging & Surveillance, Navigation, Intelligent Fabric, Other | |

| By End-user | Land Forces, Naval Forces, Air Forces | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Military Wearables Market Dynamics

Growing Modernization in Defense Spending Plans Encourages the Adoption of Wearables

The need for military wearables is being directly driven by governments all over the world raising defense budgets dramatically in an effort to modernize their armed services. Through the use of cutting-edge wearable technology, these initiatives seek to improve troop productivity, safety and tactical decision-making.

One notable example is the $1.1 million award given by the US Army to United Protected Technologies in February 2022 for the development of wearable mobile power solutions. These initiatives emphasize how important it is to lessen soldier load and increase mobility. Additionally, the way employees are trained and monitored is changing due to wearable technology with biometric sensors and augmented reality-based training tools.

Systems that provide real-time health information, predictive performance analysis and battlefield connectivity are being provided to soldiers by defense agencies. National security plans are depending more and more on wearable technology as geopolitical threats rise, especially in areas like Asia-Pacific and Europe. Wearables are positioned as a crucial part of future military capabilities due to this trend and the robust R&D funding from key defense contractors.

Cybersecurity Issues with Networked Wearable Technology

The military wearables provide many operational benefits, but, they also present serious risks, particularly in the area of cybersecurity. Modern wearable devices are particularly vulnerable to cyberattacks because to their interconnectedness and heavy reliance on data transfer and real-time connectivity. Unauthorized access to mission details, battlefield communications or private health information might jeopardize military plans and put lives in danger.

Combining wearables with AI and networked systems makes them more vulnerable to espionage and data breaches. Strong encryption, safe firmware upgrades and end-to-end network security become critical. It's still difficult to reach this degree of cybersecurity without sacrificing battery life or device performance.

Any weaknesses in cybersecurity infrastructure could prevent widespread adoption or cause implementation schedule delays when countries invest in digital soldier initiatives. Therefore, maintaining the long-term dependability and credibility of military wearable technology would require striking a balance between technological innovation and strict data security regulations.

Military Wearables Market Segment Analysis

The global military wearables market is segmented based on product, technology, end-user and region.

Strategic Significance of Smart Tactical Headgear in Modern Military Operations

The headgear category holds major market share in the military wearables space, with tactical helmets growing at the quickest rate. These helmets have developed into advanced systems with biometric sensors, integrated communication modules and augmented reality (AR) displays. These improvements greatly increase operational capabilities by providing real-time access to troop vitals, threat detection and navigation data.

Modern warfare requires advanced combat helmets because they offer environmental adaptation, impact resistance and ballistic protection. Smart helmets used in the IVAS program provide as an example of how next-generation headgear is essential for improving situational awareness and mission success.

Comfort is guaranteed without sacrificing safety thanks to the incorporation of strong, lightweight materials. Smart tactical helmet use is expected to grow quickly due to rising defense spending and the need for digital battlefield readiness. More AR capability and AI-driven analytics are anticipated in future designs, enhancing the segment's strategic significance in the global military wearables market.

Military Wearables Market Geographical Share

Increase in Military Modernization Drives Wearables Market Growth in Asia-Pacific

The military wearables market is expected to develop at the quickest rate in Asia-Pacific due to strong modernization initiatives and rising defense budgets. The Ministry of Defense received about US$ 82 billion in February 2025 from India's Union Budget, which included US$ 9.53 billion for modernization and US$ 13.5 billion for domestic purchases. These expenditures demonstrate the government's significant emphasis on independence and military preparedness for the future.

Wearable technology, including AI-powered surveillance gadgets, health monitoring systems and tactical gear, is being used by nations like China, India and Japan to improve battlefield performance and lower risk. The growing emphasis on troop health, survivability and real-time decision-making is driving the quick uptake of cutting-edge equipment like exoskeletons and smart helmets.

Market growth is also aided by state-sponsored R&D projects and the emergence of domestic defense technology companies. Asia-Pacific is expected to emerge as a key development area for military wearable makers over the course of the decade as regional security concerns escalate.

Technological Analysis

The development of the military wearables market is mostly driven by technological innovation. Rapid developments in AI, AR, sensor integration and power management are occurring in this field. Exoskeletons are being developed to increase soldiers' stamina and strength, which will lessen physical exhaustion during prolonged operations. AR-enabled tactical equipment overlays mission-critical information directly in the soldiers' field of vision, giving them access to real-time situational data.

Proactive health interventions are made possible by embedded biometric sensors in body armor that monitor vital signs, hydration and fatigue levels. Additionally, smart textiles with features like impact detection, thermal regulation and adaptive camouflage are being developed using nanotechnology.

One of the main drawbacks of wearable technology is power sustainability, which is addressed by small, portable power generators like those supported by the US Army. These developments are turning soldiers into data-driven, networked operators. Technology will continue to be a key element propelling acceptance and distinction in the military wearables market thanks to R&D expenditures from multinational defense conglomerates.

Military Wearables Market Major Players

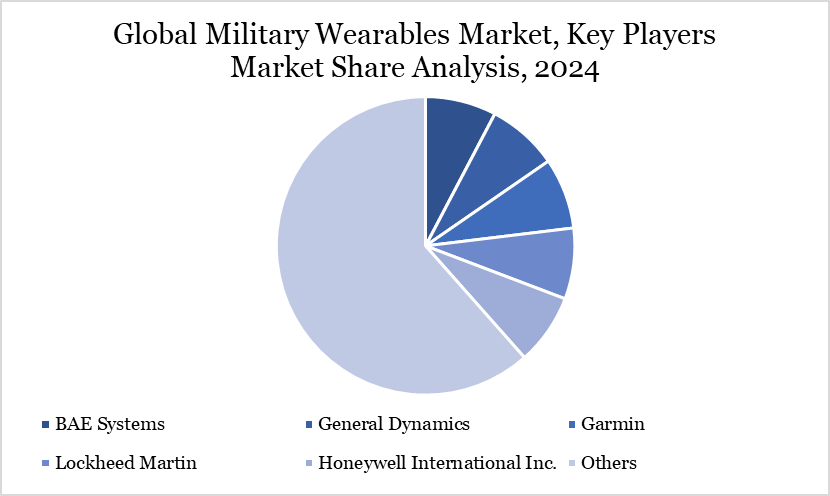

The major global players in the market include BAE Systems, Elbit Systems, Rheinmetall, Saab, Rheinmetall, Aselsan, General Dynamics, Garmin, Lockheed Martin, Honeywell International Inc.

Key Developments

- In December 2024, to continue developing the Striker II Helmet Mounted-Display (HMD), BAE Systems inked a £133 million deal with the Eurofighter Typhoon consortium (Germany, Italy, Spain and the UK). Modern technology like a color display and digital night vision, is combined in the helmet to provide the pilot with mission-critical information in real-time on their visor. The agreement will focus on strengthening its leadership position in military wearables for flight and expanding the helmet's capabilities through flight tests.

- In July 2024, the Secure Wireless Hub (SWH), a wearable tactical communications system for dismounted troops, was introduced by Viasat. The technology, which was co-developed with the US Special Operations Command (USSOCOM), offers a lightweight, single-unit tactical gateway that enhances ground forces' situational awareness and network connectivity. The SWH's weight of less than one kilogram reduces size, weight and power (SWaP), making it simple to integrate with body armor. While in combat mode, it provides secure VPN functionality and interoperability across a variety of devices, enabling dependable connectivity and near-real-time data sharing.

- In February 2024, Thales Group teamed up with the French Ministry of Armed Forces to supply wearable technology with next-generation integrated combat systems. This includes developing sophisticated communication systems for soldiers, body-worn sensors and networked helmets. The purpose of these wearables is to improve data transmission, health monitoring and soldier survivability on the battlefield. The alliance aims to maintain French military leadership in wearable defensive technology.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies