Overview

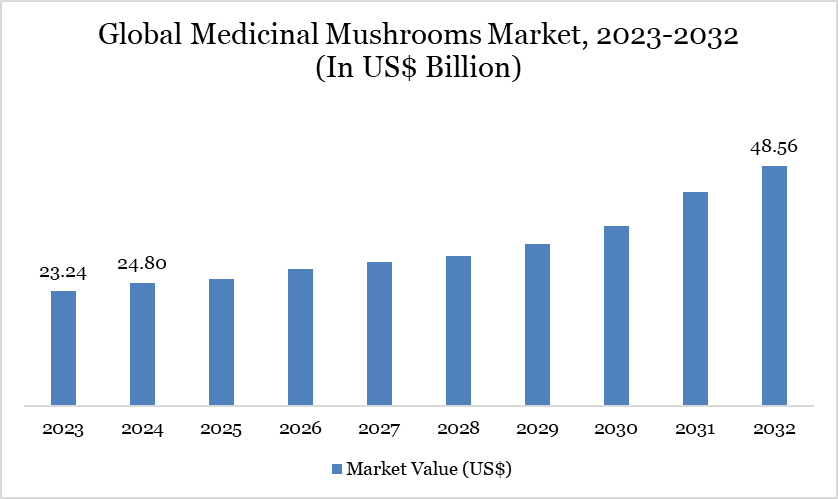

The global market for medicinal mushrooms reached US$ 24.8 billion in 2024 and is expected to reach US$ 48.56 billion by 2032, growing at a CAGR of 8.84% during the forecast period 2025-2032.

The medicinal mushroom market is witnessing accelerated growth, driven by increasing consumer demand for natural, preventive health solutions. With applications in immune support, cognitive health and stress relief, mushrooms like Reishi, Chaga and Lion’s Mane are gaining popularity across Europe. The market is projected to grow at a strong CAGR, supported by trends in clean-label wellness, functional nutrition and holistic health. Companies offering high-quality extracts and consumer education, such as MycoMedica, are well-positioned to capitalize on this momentum and expand their footprint in both established and emerging markets.

Medicinal mushrooms, known for their immune-boosting, anti-inflammatory and cognitive-enhancing properties, are increasingly incorporated into dietary supplements, teas and functional beverages.

For instance, in April 2024, the Herbtender, an adaptogenic wellness brand, launched its wellness supplements in 600 Holland & Barrett stores across the UK, becoming a flagship functional mushroom brand for the retail chain. Crafted in the UK by medical herbalists, the Herbtender’s botanical blends include the Daily Defence tonic, featuring adaptogens like Astragalus, Reishi, Chaga and Cordyceps, designed to enhance resilience and restore vigor.

Medicinal Mushrooms Market Trend

The growing consumer appetite for functional foods is profoundly reshaping the medicinal mushrooms market. Health-conscious consumers are increasingly turning to their daily diet and lifestyle products to help maintain wellness, boost energy and manage stress, shifting their preferences from reactive health care to proactive health solutions.

This transformation is driven by a clear market opportunity to leverage the rich nutritional profile of medicinal mushrooms — particularly their beta-glucans, adaptogens and antioxidants — to create products that align with consumers’ health goals. The result is a powerful convergence of health and food trends, where ingredients previously confined to health stores are now entering mainstream food and beverage products.

Functional food companies are innovating by adding varieties such as Reishi, Chaga, Cordyceps, Turkey Tail and Lion’s Mane into everyday products — from coffee and tea to snack bars and fortified drinks — making health benefits more accessible and convenient. This approach not only adds value to food products but also differentiates them in a fiercely competitive market.

As consumers become more health-savvy and education about the benefits of these ingredients grows, this trend is expected to accelerate, unlocking sustained growth opportunities for companies that successfully blend functionality, taste and lifestyle appeal in their product portfolios.

Market Scope

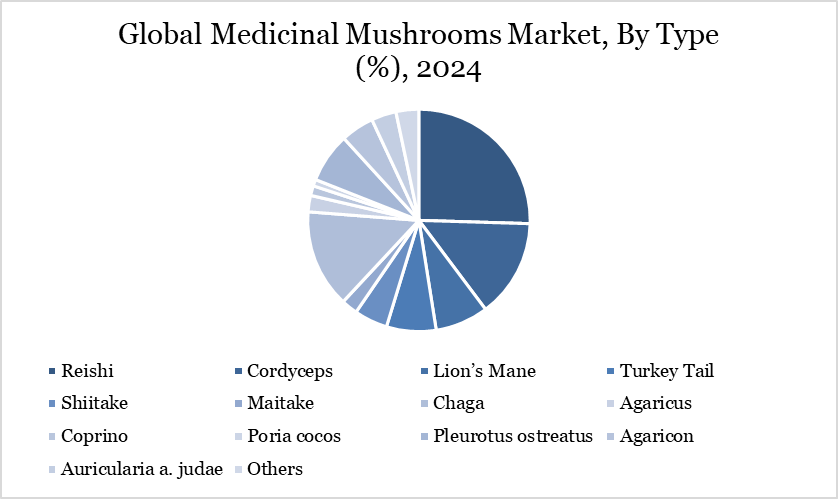

Metrics | Details |

By Type | Reishi, Cordyceps, Lion’s Mane, Turkey Tail, Shiitake, Maitake, Chaga, Agaricus, Coprino, Poria cocos, Pleurotus ostreatus, Agaricon, Auricularia a. judae and Others |

By Form | Fresh, Dried and Others |

By Application | Dietary Supplements, Pharmaceuticals, Functional Foods, Cosmetics, Personal Care Products and Others |

By Distribution Channel | Supermarkets/Hypermarkets, Online Retail, Health Stores/Pharmacies and Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Awareness of Medicinal Properties

The growing awareness of the medicinal properties of mushrooms is a major driver of the European medicinal mushroom market, as more consumers seek natural remedies for improving their health and well-being. Scientific research and traditional knowledge have highlighted the numerous benefits of mushrooms such as reishi, chaga, lion’s mane and cordyceps, which are known for their immune-boosting, anti-inflammatory and antioxidant properties.

As the wellness trend expands, people increasingly seek holistic and plant-based supplements to address stress, cognitive decline, fatigue and immunity support. Medicinal mushrooms fit well within this trend, providing a natural alternative to synthetic supplements or pharmaceutical solutions.

By promoting mushrooms as a vital component of a healthy diet, the organizations are taking the initiative to enhance consumer understanding of their medicinal properties, such as immune-boosting and anti-inflammatory effects.

For instance, in July 2023, the European Mushroom Growers’ Association (GEPC) launched a US$ 5.71 (€5) million campaign titled “European mushroom, the hidden gem” to promote the benefits of European mushrooms among millennials. The initiative, co-funded by the EU, aims to boost sales by US$ 31.98 (€28) million over three years and will be rolled out in nine countries, including Belgium, France, Germany and Spain. The campaign seeks to enhance consumer awareness of European mushrooms as a vital component of a healthy, balanced diet.

This type of campaign, helps expand the market by encouraging more consumers to explore mushrooms as natural supplements. The increased visibility drives both demand and market growth for medicinal mushrooms in Europe.

Competition from Synthetic Alternatives

The medicinal mushroom market faces growing competition from synthetic alternatives, which is impacting its development. Synthetic options, particularly in pharmaceuticals, are often seen as more reliable, cost-effective and easily scalable, challenging the market for natural medicinal mushrooms, which can be limited by cultivation constraints and variability in active compounds.

Synthetic products also benefit from advanced research, regulation compliance and faster innovation cycles, providing consistent results that appeal to consumers seeking quick, reliable health solutions. In contrast, medicinal mushrooms rely on slower, more traditional cultivation methods, making them susceptible to market fluctuations, seasonal yields and varying efficacy based on growth conditions.

Additionally, synthetics often offer similar or superior therapeutic effects, such as immune modulation, antioxidant benefits and cognitive enhancement, which are key selling points for medicinal mushrooms.

Furthermore, consumer preference for convenience and predictable outcomes drives the shift towards synthetic supplements, which are typically available in standardized doses and forms, offering a more accessible health solution.

Segment Analysis

The global medicinal mushrooms market is segmented based on type, form, application, distribution channel and region.

Global Growth of Shiitake in Functional Foods

The global Shiitake mushroom market is experiencing strong growth, driven by its well-known health benefits and rich nutritional profile. Shiitake is recognized for its abundance of beta-glucans and other bio-active compounds that help support immune health and cardiovascular wellness, making it a key ingredient in functional foods, dietary supplements and health products across numerous markets.

This growth is supported by a shift in consumer preferences toward natural, plant-based ingredients and a growing awareness of health and wellness benefits. Rising health consciousness and the demand for clean-label, sustainable products are fueling the expansion of Shiitake in health stores, online platforms and grocery chains globally.

In keeping with this trend, many governments and regulators are developing policies and guidelines to encourage the use of Shiitake in food and health products. The organic food market is growing at a rate of about 7% per year in many regions, reflecting a strong consumer pull for products made from organically cultivated and responsibly sourced ingredients.

Shiitake is increasingly incorporated into a range of products — from functional foods, health drinks and sauces to powders and capsules — to meet this growing demand. Furthermore, its approval by regulators in key markets underscores its role as a recognized and valued health ingredient, boosting its appeal to food innovators and health companies.

As a result, the global Shiitake market is poised for sustained growth, supported by health trends, policy encouragement and a growing portfolio of products that align with consumers’ lifestyle preferences for natural, functional and health-promoting ingredients.

Geographical Penetration

Rising Demand for Medicinal Mushrooms in Europe

The demand for medicinal mushrooms in Europe has been on a consistent upward trend, fueled by rising awareness of their health benefits, especially in areas such as immune system support, cognitive health and stress management. The market includes products like fresh and dried mushrooms, extracts, powders and capsules, used widely in supplements, pharmaceuticals and functional foods. As European consumers increasingly seek natural, plant-based health remedies, medicinal mushrooms have carved out a significant niche, with Germany emerging as a key player within this market.

Germany is one of Europe's largest markets for medicinal mushrooms, driven by its strong health and wellness culture that favors natural and holistic treatments. In 2023, the country witnessed a growth of about 6% in its dietary supplements sector, where medicinal mushrooms such as Reishi, Lion’s Mane and Cordyceps are increasingly being integrated.

German consumers are drawn to these mushrooms due to their recognized health benefits. Reishi mushrooms, for example, are renowned for their potential to reduce inflammation and alleviate stress, while Lion’s Mane is widely sought after for its possible cognitive enhancement effects.

A survey conducted by the European Nutraceutical Association (ENA) in 2023 revealed that 30% of German consumers regularly incorporate medicinal mushrooms into their supplement routines. This highlights a growing acceptance of these mushrooms within mainstream consumer health products.

Additionally, the aging population in Germany is contributing to the growing demand, as these mushrooms are often associated with improved mental health and anti-aging properties.

Consumer Analysis

India possesses a favorable agro-climatic environment conducive to mushroom cultivation, offering a wide spectrum of edible and medicinal varieties. Despite this potential, per capita mushroom consumption in India remains considerably lower than in global markets, particularly in Western regions such as Gujarat.

A 2023 study conducted in Gujarat assessed consumer behavior towards mushrooms, revealing insights critical for the future growth of both edible and medicinal mushroom segments. The survey, which engaged 213 respondents across generational cohorts, found that:

16% of consumers mistakenly classified mushrooms as non-vegetarian, indicating a significant cultural misconception that hinders adoption.

14% of participants were uncertain whether they had ever consumed mushrooms, highlighting low product familiarity and market penetration.

Among consumers, button mushrooms (50%) and oyster mushrooms (32%) were the most commonly preferred varieties.

Strategic Implications for Medicinal Mushrooms

While the study primarily focuses on edible mushrooms, its findings have direct implications for the emerging medicinal mushroom sector. The current lack of awareness and entrenched dietary biases serve as barriers not just for edible mushroom adoption, but also for higher-value medicinal mushrooms such as Reishi, Lion’s Mane, Chaga and Cordyceps.

Competitive Landscape

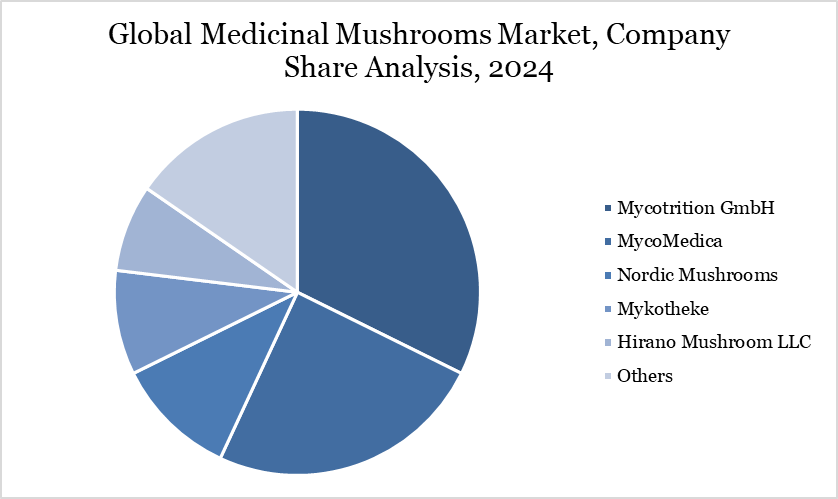

The major global players in the market include Mycotrition GmbH, MycoMedica, Nordic Mushrooms, Mykotheke, Hirano Mushroom LLC, Hifas Da Terra, Aloha Medicinals, YUKIGUNI MAITAKE Co., Ltd, Monterey Nutra and Shroomwell.

Key Developments

In April 2024, the Herbtender, an adaptogenic wellness brand, launched its wellness supplements in 600 Holland & Barrett stores across UK, becoming a flagship functional mushroom brand for the retail chain. Crafted in UK by medical herbalists, the Herbtender’s botanical blends include the Daily Defence tonic, featuring adaptogens like Astragalus, Reishi, Chaga and Cordyceps, designed to enhance resilience and restore vigor.

In August 2024, Bristol Fungarium launched a new line of organic medicinal mushroom tinctures made from fresh, locally grown mushrooms at its Somerset farm. The initiative reflects the company’s focus on sustainability, quality control and meeting rising demand for natural, UK-produced health products.