Global Levulinic Acid Market is segmented By Application (Cosmetics & Personal Care, Food Additives, Polymers & Plasticizers, Solvents, Resin & Coating, Pharmaceuticals, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Levulinic Acid Market Overview

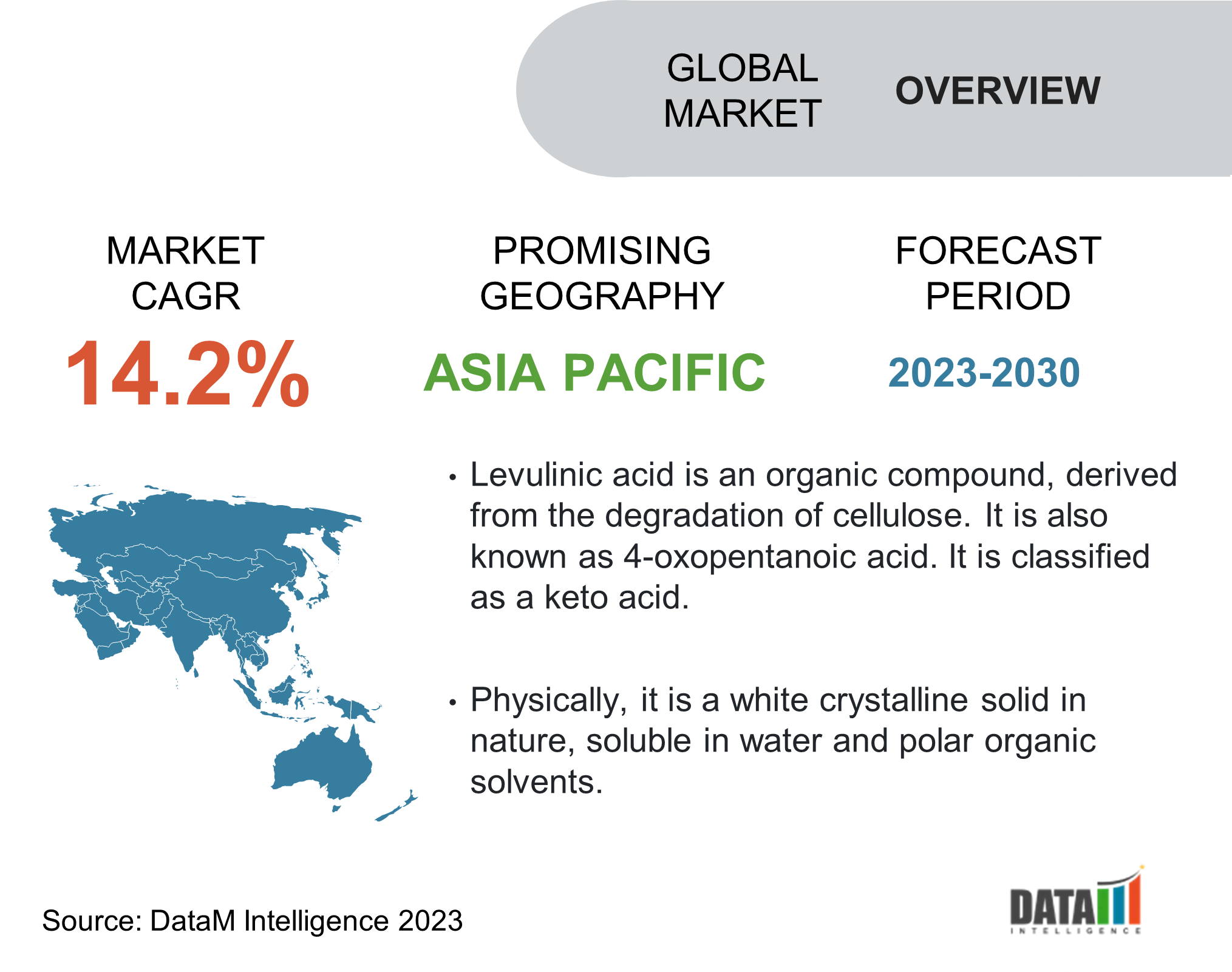

(230 Pages) A Report by DataM Intelligence estimates the Global Levulinic Acid market to grow at a CAGR Of 14.2% during the forecast period 2023- 2030. The market is expected to grow because it becomes important in different industries like Cosmetics & Personal Care, Food Additives, Polymers & Plasticizers, Solvents, Resin & Coating, Pharmaceuticals. The competitive rivalry intensifies with Merck KGaA, Biofine Technology, LLC., Biochemicals Ltd., and others operating in the market.

Levulinic acid is used as a precursor for synthesizing useful intermediates or additives such as ethyl levulinate, γ-valerolactone, pentanoic acid and 2-methyl-tetrahydrofuran. Derivatization and esterification of levulinic acid result in potential biofuels. Moreover, ethyl levulinate is extensively used in fragrances and perfumes. The most extensive application of levulinic acid is used in the production of aminolevulinic acid, a biodegradable herbicide used in South Asian countries such as India, Sri Lanka and others. Another key application is its use in cosmetics and personal care products.

Levulinic Acid Market Summary

|

Metrics |

Details |

|

Market CAGR |

14.2% |

|

Segments Covered |

By Application and By Region |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other key insights. |

|

Fastest Growing Market |

Asia Pacific |

|

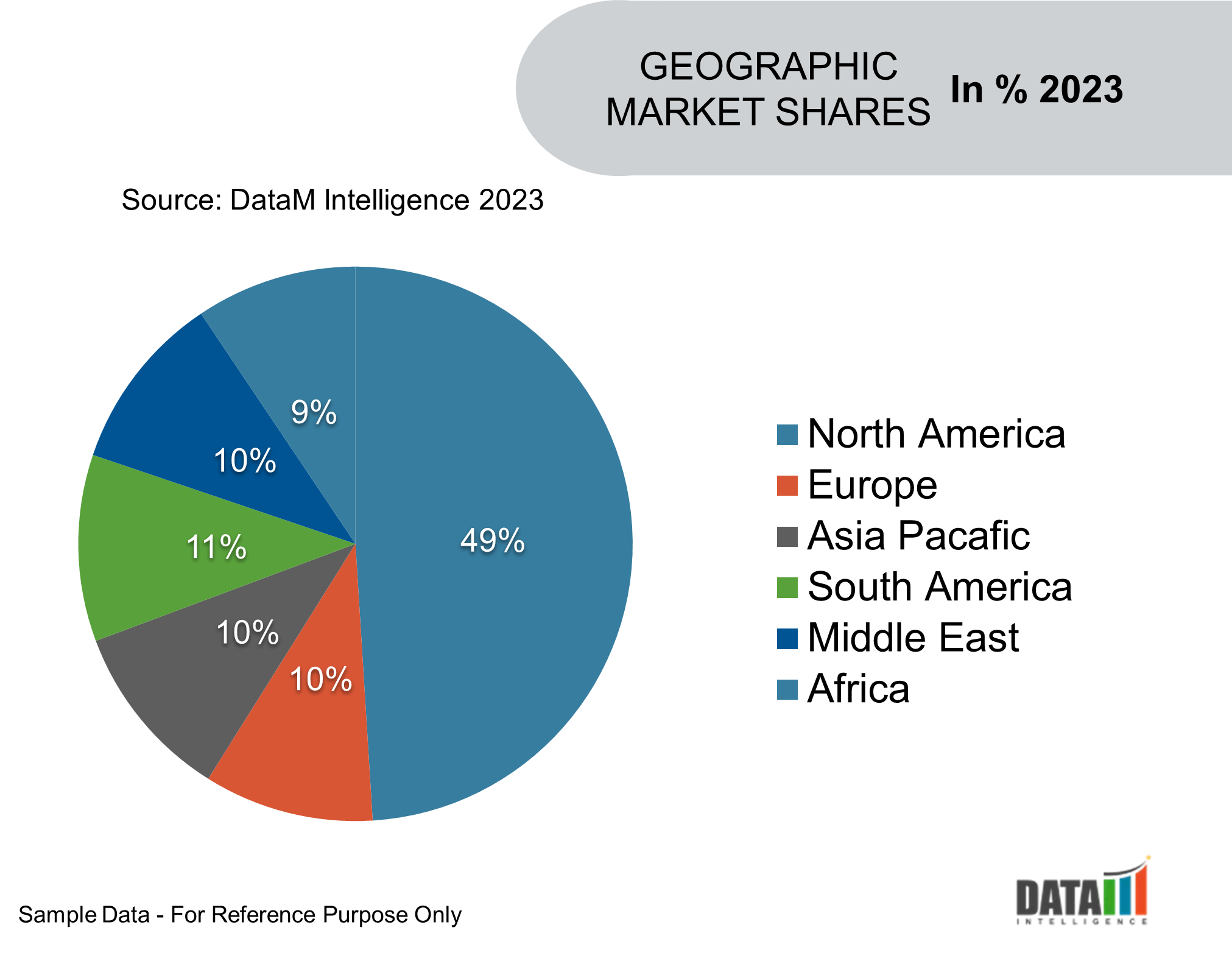

Largest Market Share |

North America |

To know more insights Download Sample

Levulinic Acid Market Growth and Trends

Increasing use of bio-based materials and biofuels is expected to drive the levulinic acid market

Development in production of levulinic acid from lignocellulosic biomass has resulted in a surge of demand for levulinic acid as a cheap, readily available, biobased material. Moreover, derivatization and esterification of levulinic acid result in potential biofuels.

As per current European Commission estimates, a more significant shift to biobased raw materials and biological processing methods could yield carbon dioxide savings of up to 2.5 billion tons a year by 2030, providing a natural solution, enabling us to plan for a fossil-fuel-free future.

Moreover, as per U.S Environmental Protection Agency (EPA), biodiesel’s total production continues to exceed its requirement under the Federal Renewable Fuel Standard significantly. For instance, in the last four years, the industry has produced more than two billion gallons and has surpassed the minimum requirements under the RFS. According to EPA figures, in 2019, the market was 2.8 billion gallons. Also, biodiesel reduces greenhouse gas emissions by 57 percent to 86 percent.

Less commercial use of levulinic acid is anticipated to restraint its market

Though levulinic acid has considerable potential as an industrial chemical, it has never reached commercial use in any significant volume. The non-commercialization of this chemical may be that most of the research was done in the early ’40s when the equipment for separation and purification was lacking, the raw materials were expensive, and thus the yield was low.

However, today, overproduction of raw materials and developments in science and technology have opened doors to re-evaluate the industrial potential of a forgotten chemical giant, levulinic acid.

Levulinic Acid Market Segmentation Analysis

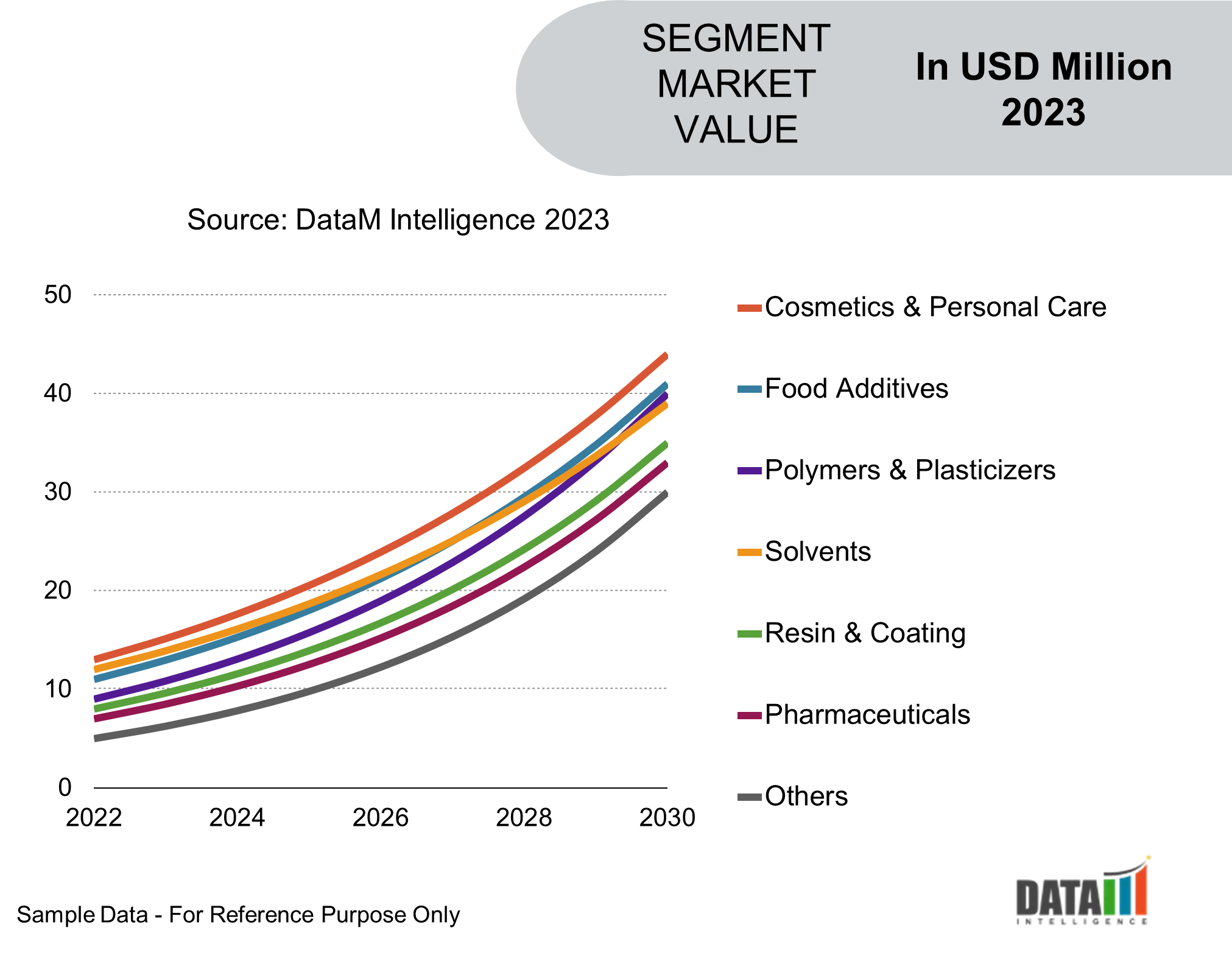

Based on application, levulinic acid market is segmented into cosmetics & personal care, food additives, polymers & plasticizers, pharmaceuticals, solvents, agrochemicals and others.

Cosmetics & personal care is expected to dominate the levulinic acid market owing to its extensive application in the segment

Levulinic acid and its derivatives, such as sodium levulinate, are used in organic and natural cosmetic compositions for perfuming, skin conditioning and pH-regulating purposes. They give inherent fresh odor, prevent wrinkles and stabilize formulations and emulsions. Moreover, they complement natural formulations to reduce greasiness while offering a dry, silky after-feel.

According to 2020 VCRP survey data, levulinic acid is used in approximately 130 cosmetic formulations, while sodium levulinate is used in about 400 cosmetic formulations. It has a maximum concentration of around 4.5% in hair dyes, while Sodium Levulinate is used at a maximum concentration of 0.62% in breath fresheners and mouthwashes. Moreover, these ingredients are reportedly safe for use in products that come in contact with the eyes. For instance, sodium levulinate is used around 0.57% in the lotions and eye-shadows.

Continuous growth in online beauty spending, use of social networks, accelerating urbanization, increasing interest in consumer interest in new and premium products, and the growth of the upper-middle-class population are the primary factors driving the cosmetics market worldwide. According to the Statista market forecast, the market for cosmetics and personal care declined by 4.19% in 2020 compared to the previous year reaching a total of US$ 483.34 billion. However, the market is estimated to reach US$ 615.82 billion in 2025.

Global Levulinic Acid Market Geographical Share

Asia-Pacific is the largest levulinic acid market and is expected to be the fastest-growing market over the forecast period

Countries such as Japan, China and India are the largest consumers of fertilizers owing to their increasing population and limited agricultural land. Therefore, the need for fertilizers is high in these countries.

Moreover, India's penetration of personal care products is low compared to developed or even other developing economies. However, improving the economic environment is expected to increase the country's adoption of personal care products, thereby increasing the demand for levulinic acid and its salts.

According to a report published by the Ministry of Economic and Industry, the country's beauty and personal care industry is expected to reach more than US$ 10 billion by 2021.

In addition, India is the third-largest pharmaceuticals in terms of volume. According to the India Brand Equity Foundation, India's pharmaceutical export stood at US$ 19.13 billion in 2018-2019, reached US$ 13.69 billion in 2019-2020 (till January 2020).

Levulinic Acid Market Companies and Competitive Landscape

The levulinic acid market is moderately competitive with presence of local as well as global companies. Some of the key players which are contributing to the growth of the market include GFBiochemicals Ltd., Alfa Aesar - Thermo Fisher Scientific, Tokyo Chemical Industry Co., Ltd., Ascender Chemical Co., Ltd., and Merck KGaA, Biofine Technology, LLC, Parchem fine & specialty chemicals., GODAVARI BIOREFINERIES LTD, AUROCHEMICALS, CSPC Pharmaceutical Group Limited., Zibo Changlin Chemical Co., Ltd., Hefei TNJ Chemical Industry Co.,Ltd., Apple Flavor & Fragrance Group Co., Ltd. among others. The major players are adopting several growth strategies such as product launches, acquisitions, and collaborations, which are contributing to the growth of the levulinic acid market globally.

Merck KGaA

Overview: The Merck Group is a German multinational science and technology company headquartered in Darmstadt. The group includes around 250 companies; the main company is Merck KGaA in Germany. The company is divided into three business lines: Life Sciences, Healthcare and Performance Materials.

Product Portfolio: The company is divided into three business lines: Life Sciences, Healthcare and Performance Materials.

Key Developments:

- In April 2021, Merck KGaA has announced an investment of EUR 20 million to expand R&D and manufacturing capabilities at its site in Shizuoka, Japan.

Why Purchase the Report?

- Visualize the composition of the levulinic acid market segmentation by application and region highlighting the key commercial assets and players.

- Identify commercial opportunities in levulinic acid market by analyzing trends and co-development deals.

- Excel data sheet with thousands of data points of levulinic acid market - level 4/5 segmentation.

- PDF report with the most relevant analysis cogently put together after exhaustive qualitative interviews and in-depth market study.

- Product mapping in excel for the key product of all major market players

The global levulinic acid market report would provide an access to an approx. 45 market data table, 35 figures and 230 pages.

Target Audience

- Service Providers/ Buyers

- Industry Investors/Investment Bankers

- Education & Research Institutes

- Research Professionals

- Emerging Companies

- Manufacturers