Knee Implants Market Size and Trends

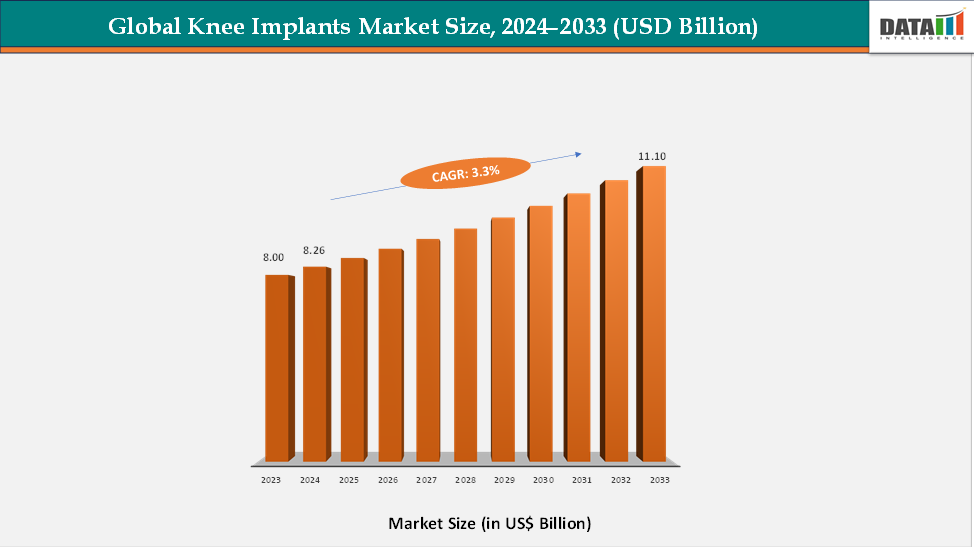

The global knee implants market reached US$ 8.00 billion in 2023, with a rise to US$ 8.26 billion in 2024, and is expected to reach US$ 11.10 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2025–2033. The global knee implants market is experiencing strong and sustained growth, driven primarily by the rising prevalence of osteoarthritis, rheumatoid arthritis, and degenerative joint diseases, as well as the growing elderly population worldwide. Increasing awareness of joint replacement procedures and higher demand for improved mobility and quality of life are further accelerating the adoption of knee implants.

Continuous technological advancements are significantly improving surgical precision, reducing complication rates, and extending implant durability. These innovations are enhancing patient outcomes and strengthening physician confidence in next-generation knee replacement solutions.

Healthcare systems are also shifting toward outpatient and same-day knee replacement models, supported by improved pain management protocols and minimally invasive methods. This transition is increasing procedure volumes by lowering costs and reducing the need for extended hospital stays, ultimately boosting the demand for efficient, high-performance implant systems.

Additionally, growing investments in orthopedic infrastructure across emerging markets are broadening access to knee arthroplasty. Countries in Asia-Pacific, Latin America, and the Middle East are rapidly expanding joint-replacement capabilities as healthcare spending increases and insurance coverage improves. With rising knee-related disease burdens, ongoing advancements in implant design and surgical technologies, and expanding global adoption, the Knee Implants market is solidifying its position as a critical pillar of modern orthopedic and mobility-restoration therapy.

Key Market highlights

- North America accounted for approximately 40.2% of the global Knee Implants market in 2024, retaining its position as the leading regional contributor. This dominance is supported by a high prevalence of osteoarthritis, widespread availability of advanced orthopedic centers, strong adoption of robotic-assisted and minimally invasive knee replacement procedures, and favorable reimbursement structures in the United States and Canada.

- The Asia-Pacific region held around 19.1% of the global market in 2024 and is expected to be the fastest-growing region over the next decade. Growth is driven by increasing healthcare investment, rapid expansion of orthopedic surgery capacity, rising incidence of knee osteoarthritis due to aging populations, and improved access to joint-replacement procedures in China, India, Japan, and South Korea.

- By product, the total knee replacement (TKR) segment dominated the global knee implants market, accounting for approximately 40.2% of total revenue in 2024. TKR remains the most widely performed joint-replacement procedure worldwide due to its proven long-term efficacy, broad clinical applicability, and ability to substantially improve patient mobility and quality of life. Advances such as patient-specific implants, improved polyethylene bearing surfaces, robotics-assisted surgery, and minimally invasive techniques continue to strengthen the segment’s leadership by enhancing surgical precision, reducing recovery times, and improving implant longevity.

Market Size & Forecast

- 2024 Market Size: US$8.26 Billion

- 2033 Projected Market Size: US$11.10 Billion

- CAGR (2025–2033): 3.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Knee Implants Market: Executive Summary

Global Knee Implants Market Dynamics: Drivers & Restraints

Driver: Increasing Prevalence of Osteoarthritis & Joint Disorders

The growing prevalence of osteoarthritis and other degenerative joint disorders is a primary driver of the global knee implants market. As populations age and lifestyle-related risk factors such as obesity, reduced physical activity, and longer life expectancy increase, more individuals experience chronic knee pain, cartilage deterioration, and mobility limitations. For instance, according to the World Health Organization (WHO), osteoarthritis affects over 300 million people globally, and the number of people requiring knee replacement is expected to rise sharply over the next decade.

In the United States alone, the American Academy of Orthopaedic Surgeons (AAOS) reports that nearly 700,000 total knee replacement surgeries are performed annually, with projections exceeding 1.2 million by 2030. Similarly, in India, the growing elderly population and rising awareness of joint replacement procedures have led to a surge in knee arthroplasty procedures. This expanding pool of patients has increased demand for advanced implant technologies, such as patient-specific implants, robotics-assisted surgery, and minimally invasive knee replacement techniques. Consequently, the rising burden of joint disease is accelerating the adoption of knee implants worldwide, driving sustained growth in the global Knee Implants market.

Restraint: High Cost of Surgery & Implants

The high cost of knee replacement surgery and implants limits market growth. In the U.S., a single procedure can cost $35,000–$70,000, while advanced technologies like robotic-assisted surgery raise costs further. In developing countries, limited insurance and out-of-pocket expenses restrict access, even when implant prices are regulated. These economic barriers reduce patient uptake and slow the adoption of premium implants, restraining overall market expansion.

For more details on this report, Request for Sample

Global Knee Implants Market Segmentation Analysis

The global knee implants market is segmented by type, component type, end-user and region.

Type: The total knee replacement segment is estimated to have 40.2% of the knee implants market share.

The Total Knee Replacement (TKR) segment is dominant in the global knee implants market because it addresses the most severe cases of knee joint degeneration, offering proven long-term functional outcomes and pain relief. Unlike partial knee replacements, TKR restores the entire knee joint, making it suitable for patients with widespread cartilage loss, deformities, or advanced osteoarthritis.

For instance, in the United States, nearly 700,000 total knee replacement operations are performed annually, as reported by the American Academy of Orthopaedic Surgeons (AAOS), and that number is projected to increase to more than 1.2 million by 2030. This high volume underlines TKR’s central role in managing advanced joint disease.

Moreover, advancements such as robotics-assisted surgery, patient-specific implants, and improved polyethylene materials have enhanced the precision, reliability, and lifespan of TKR implants, reinforcing its market leadership. As patients and surgeons increasingly adopt these innovations, the TKR segment continues to drive growth across the global knee implants industry.

Global Knee Implants Market - Geographical Analysis

The North America knee implants market was valued at 40.2% market share in 2024

North America is the largest contributor to the global knee implants market, accounting for around 40.2% of the total market share. The region’s dominance is largely due to well-established healthcare infrastructure, high awareness of joint disorders, and strong reimbursement policies. The United States performs nearly 700,000 total knee replacement surgeries annually, a number expected to exceed 1.2 million by 2030, driven by an aging population and rising prevalence of osteoarthritis.

Advanced technologies, such as robotics-assisted knee surgeries, computer-assisted navigation, and patient-specific implants, are widely adopted, offering higher surgical precision and improved patient outcomes. Major medical device companies like Stryker, Zimmer Biomet, and Johnson & Johnson are headquartered or heavily invested in North America, further strengthening market leadership. Additionally, high insurance coverage and government support for orthopedic procedures facilitate greater adoption of knee implants compared to other regions.

The European Knee Implants market was valued at 20.4% market share in 2024

Europe holds a significant and stable position in the global knee implants market, supported by well-developed public healthcare systems, high healthcare spending, and a large aging population. Countries such as Germany, France, and the United Kingdom have strong orthopedic expertise, widespread adoption of total knee replacement surgeries, and stringent regulatory frameworks ensuring high-quality implants. Europe is also characterized by early adoption of technological innovations, including minimally invasive surgeries, advanced prosthetics, and robotic-assisted systems.

The presence of leading global medical device manufacturers and a mature healthcare infrastructure ensures consistent demand for knee implants, making Europe a key contributor to the global market. Furthermore, initiatives to improve patient outcomes and reduce revision surgeries are prompting hospitals and clinics to adopt premium implant technologies, reinforcing Europe’s position in the market.

The Asia-Pacific knee implants market was valued at 19.1% market share in 2024

The Asia-Pacific region is projected to be the fastest-growing market for knee implants. Countries such as China, India, Japan, and South Korea are experiencing significant growth due to rapidly improving healthcare infrastructure, increasing geriatric populations, and rising prevalence of osteoarthritis. Growing awareness of joint-replacement procedures, along with expanding hospital capacities and government initiatives to modernize orthopedic care, are driving demand.

For instance, China has seen a sharp increase in knee replacement surgeries in tier-1 and tier-2 cities, supported by improved medical reimbursement schemes and rising disposable income. Furthermore, local manufacturing of implants and cost-effective solutions in India and Southeast Asia make knee replacement surgeries more accessible to a larger population, further accelerating market growth in this region.

Global Knee Implants Market – Competitive Landscape

The major players in the knee implants market include Zimmer Biomet, Meril Life, Stryker, Shalby Advanced Technologies, Inc, Covision Medical Technologies Limited, restor3d, Johnson & Johnson, among others.

Market Scope

| Metrics | Details | |

| CAGR | 3.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$Bn) | |

| Segments Covered | Type | Total Knee Replacement, Partial Knee Replacement, Revision Knee Replacement |

| Component Type | Fixed-bearing Implants, Mobile-bearing Implants | |

| End-user | Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global knee implants market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here