India Automotive Testing, Inspection, and Certification (TIC) Market Size

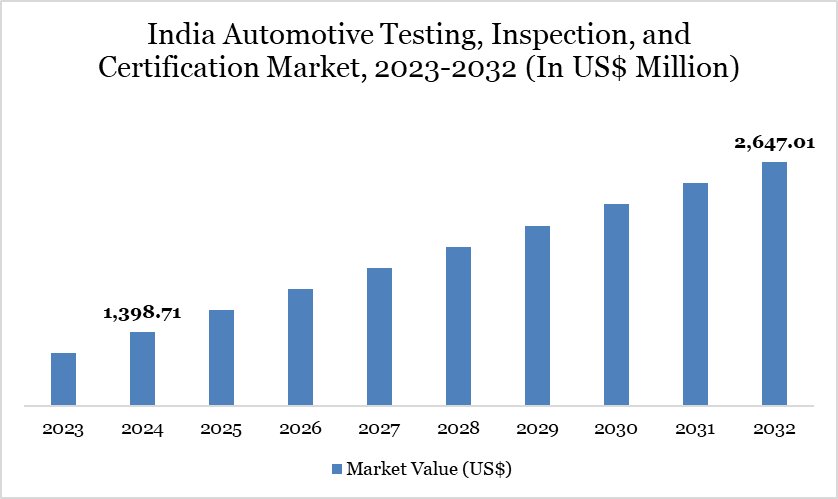

India Automotive Testing, Inspection, and Certification (TIC) Market reached US$ 1,398.71 million in 2024 and is expected to reach US$ 2,647.01 million by 2032, growing with a CAGR of 8.3% during the forecast period 2025-2032.

India Automotive Testing, Inspection, and Certification (TIC) market is growing rapidly, driven by stringent safety and emission regulations such as BS-VI norms and Automotive Industry Standards (AIS), which mandate rigorous testing of vehicles and components. Institutions like ARAI, iCAT, and CIRT play a key role in providing homologation, emission testing, and safety validation for OEMs and component suppliers.

The rise of electric vehicles, supported by government initiatives like FAME II, has further accelerated demand for battery testing, EV safety, and performance validation services. Global TIC players such as TÜV SÜD, Bureau Veritas, and Intertek are expanding their presence in India by partnering with OEMs to meet both domestic and export certification needs. Increasing consumer awareness of safety and quality has also boosted periodic vehicle inspections and third-party certification services.

India Automotive Testing, Inspection, and Certification (TIC) Market Trend

One of the major trends in the India Automotive TIC market is the growing adoption of digital testing and simulation platforms, which are helping OEMs reduce physical prototype costs and speed up time-to-market. For example, ARAI and iCAT are increasingly using virtual validation tools for emission, durability, and crash simulations, ensuring compliance with BS-VI and international standards more efficiently.

Another key trend is the rising focus on cybersecurity and software testing, driven by the rapid adoption of connected and electric vehicles in India. Global players like TÜV SÜD and Intertek, along with Indian institutions, are introducing specialized testing services for automotive software, electronic control units (ECUs), and data security. These trends highlight the industry’s transition from traditional mechanical testing to advanced digital and electronic validation. Together, they are reshaping the TIC ecosystem to address the challenges of electrification, connectivity, and future mobility in India.

Market Scope

Metrics | Details |

By Service Type | Testing Services, Inspection Services, Certification Services, Others |

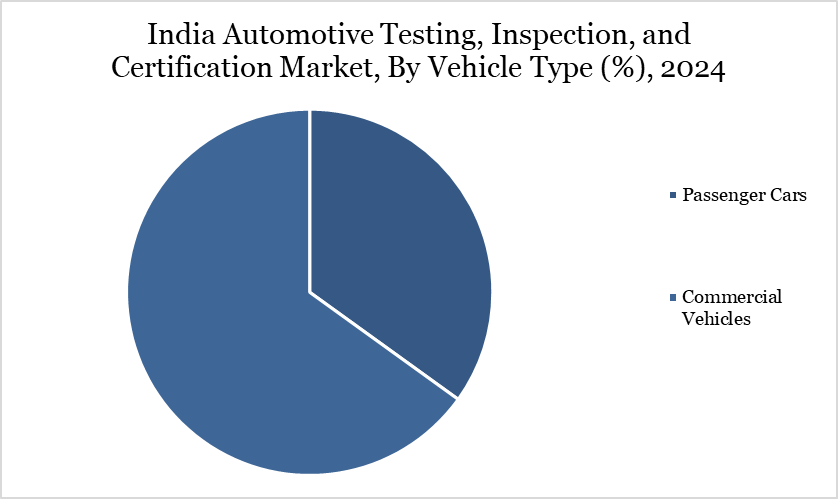

By Vehicle Type | Passenger cars, Commercial vehicles |

By Sourcing Type | In-House Services, Outsourced Services |

By Application | Electrical & Electronics Testing, Emission Testing, Fuel & Material Testing, Vehicle Inspection Services, Homologation Testing, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Stringent government regulations on vehicle safety and emissions

Stringent government regulations on vehicle safety and emissions are a major driver of the India Automotive TIC market, as automakers are mandated to comply with strict norms before launching vehicles. The introduction of BS-VI emission standards has pushed OEMs and component suppliers to invest in advanced emission testing, fuel system validation, and catalytic converter certification.

Similarly, safety mandates like mandatory airbags, ABS for two-wheelers, and crash test compliance under AIS standards have increased demand for specialized testing services. Institutions such as ARAI and iCAT provide homologation and regulatory certification, ensuring vehicles meet both Indian and global benchmarks. For instance, India’s Bharat New Vehicle Safety Assessment Program (BNVSAP) requires crash and safety tests for passenger cars, creating opportunities for TIC providers.

Global players like TÜV SÜD and Bureau Veritas collaborate with Indian OEMs to meet not only domestic but also export-oriented certification needs. These regulations not only safeguard consumer safety and environmental sustainability but also ensure Indian vehicles are globally competitive. As policies tighten further with EV-specific safety and emission norms, the need for testing, inspection, and certification services will continue to expand significantly.

High cost of advanced testing infrastructure and certification processes

The high cost of advanced testing infrastructure and certification processes acts as a restraint for the India Automotive TIC market, as setting up crash labs, emission chambers, and EV battery testing facilities requires huge investments. Smaller OEMs and component manufacturers often find it difficult to afford these services, limiting their access to timely certifications. For example, advanced EV battery safety tests or ADAS validation demand specialized equipment that only a few labs like ARAI and iCAT currently possess. This cost burden slows down wider adoption of TIC services, especially among Tier-II and Tier-III suppliers.

Segment Analysis

The India automotive testing, inspection, and certification (TIC) market is segmented based on service type, vehicle type, sourcing type, application.

Safety, Emissions, and Innovation: How TIC Shapes India’s Passenger Car Market

The passenger car segment is a key driver of the India Automotive TIC market, as it accounts for the largest share of vehicle production and sales in the country. With increasing consumer demand for safer, fuel-efficient, and technologically advanced cars, OEMs are required to conduct extensive testing for crashworthiness, emissions, noise, and electronic systems.

For instance, models like the Maruti Suzuki Baleno or Tata Nexon undergo rigorous homologation and safety testing at institutions such as ARAI and iCAT before launch. The implementation of BNVSAP crash test ratings and mandatory features like airbags and ABS further push manufacturers to ensure compliance through certification.

Additionally, rising exports of Indian passenger cars to Europe, Africa, and Latin America demand adherence to international standards like UNECE and ISO, boosting the need for TIC services. With the growing adoption of electric passenger cars such as the MG ZS EV and Tata Tiago EV, there is a rising demand for battery testing, electrical safety, and EMC validation.

Technological Analysis

India Automotive TIC market is witnessing rapid technological advancements, transforming traditional testing into more efficient and precise processes. Digital simulation and Computer-Aided Engineering (CAE) tools are increasingly used for crash tests, emission analysis, and durability assessments, reducing dependency on physical prototypes. Advanced sensor-based inspection systems are being deployed for real-time vehicle diagnostics and predictive maintenance.

The rise of electric vehicles has accelerated the need for specialized technologies like battery thermal management testing, high-voltage safety validation, and electromagnetic compatibility (EMC) testing. Cybersecurity testing tools are also becoming critical as connected cars and ADAS systems gain traction in India.

Institutions such as ARAI and iCAT are upgrading labs with automated test rigs and digital platforms to meet BS-VI and international standards. These technological innovations are streamlining compliance, lowering testing timelines, and preparing the TIC ecosystem for next-generation mobility solutions.

Competitive Landscape

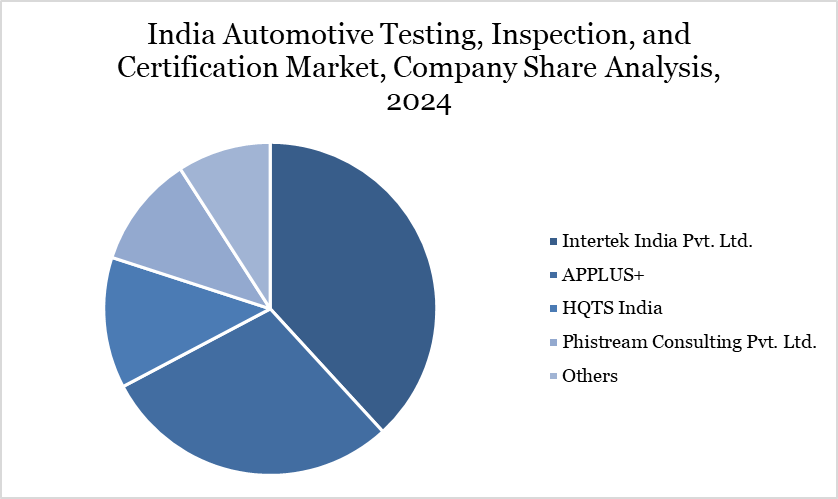

The major India players in the market include Bureau Veritas India, TÜV India (TÜV NORD Group), TÜV SÜD South Asia Pvt. Ltd., Intertek India Pvt. Ltd., APPLUS+, HQTS India, Phistream Consulting Pvt. Ltd., EUROFINS, KSH Automotive Pvt. Ltd., Intriwa Cloud Garage Pvt. Ltd and among others.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies