India Air Ambulance Market – Industry Trends & Outlook

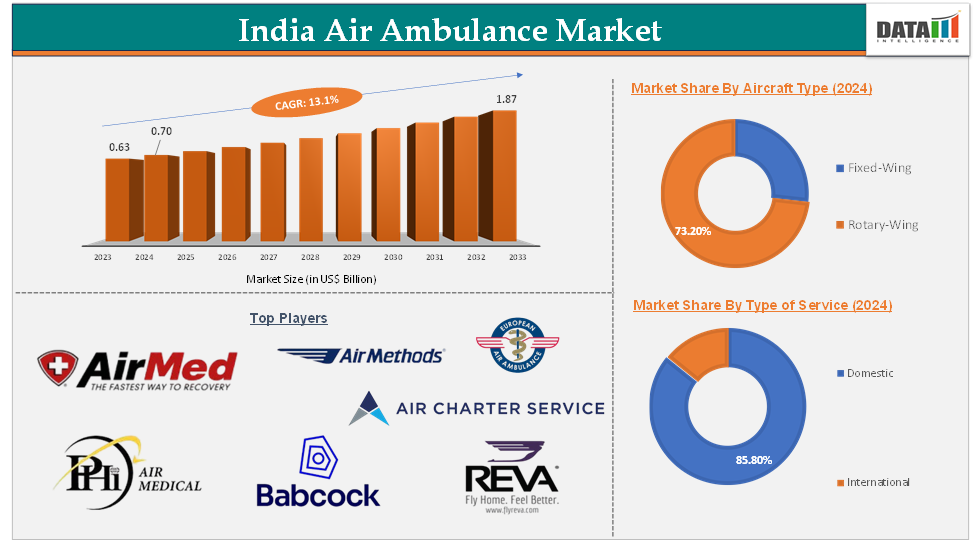

The India air ambulance market was valued at US$ 0.63 Billion in 2023. The market size reached US$ 0.70 Billion in 2024 and is expected to reach US$ 1.87 Billion by 2033, growing at a CAGR of 13.1% during the forecast period 2025-2033.

The India air ambulance market is primarily driven by the growing demand for rapid emergency medical transport, especially in cases of trauma, cardiac arrest, and other critical medical emergencies. This demand is further intensified in rural and underserved regions where road infrastructure is inadequate, making quick air evacuation essential for saving lives.

A significant trend in the India air ambulance market is the adoption of advanced medical technologies and telemedicine. Air ambulances are increasingly equipped with sophisticated medical equipment, enabling real-time consultations and better patient care during transport. The use of private and commercial aircraft for medical emergencies is expanding, allowing for greater reach, especially in remote areas. Partnerships between providers and hospitals are becoming more common, streamlining patient transfers and improving operational efficiency.

India Air Ambulance Market – Executive Summary

India Air Ambulance Market Dynamics: Drivers

Rising demand for emergency medical services (EMS)

The rising demand for emergency medical services (EMS) is a major driver of growth in the global air ambulance market. As the global population grows and ages, the need for rapid medical intervention in emergencies becomes more pressing. Factors such as chronic diseases, accidents, and natural disasters are contributing to an increase in medical emergencies, many of which require quick transport to healthcare facilities. Air ambulances provide an efficient solution in these situations, especially in areas where ground transportation is limited due to traffic, geographical challenges, or long distances.

This growing demand is also fueled by an increasing awareness of the importance of receiving timely medical care. In critical situations such as heart attacks, strokes, or trauma, the quicker a patient gets medical treatment, the higher their chances of survival and recovery. Additionally, key players in the industry have innovative launches that would drive the global air ambulance market growth.

For instance, in March 2024, the Ministry of Civil Aviation (MoCA) is leading a transformative healthcare initiative in India by introducing Helicopter Emergency Medical Services (HEMS). This pioneering move aims to redefine medical outreach by providing rapid emergency medical care within the critical "golden hour" following life-threatening incidents.

India Air Ambulance Market Dynamics: Restraints

High operational costs

High operational costs are a significant restraint for the India air ambulance market, making these life-saving services out of reach for a large portion of the population. The expenses associated with air ambulance operations are driven by several factors, including the type of aircraft used—helicopters for short distances and fixed-wing planes for longer or international routes, which come with high fuel, maintenance, and operational costs.

Additionally, every mission requires advanced ICU-level medical equipment and the presence of highly trained medical staff such as doctors, nurses, and paramedics, all of which add to the overall expense. Costs are further increased by airport landing and clearance fees, which can be substantial, especially in metro cities, as well as by the urgency of the service, with emergency or last-minute bookings incurring premium charges. Other factors like ground ambulance support, specialized care needs, and accommodation for accompanying family members can also raise the total bill.

A single air ambulance transfer within India can cost anywhere from ₹2 lakh to ₹10 lakh, and even more for international evacuations. Since these high costs are often passed directly to patients and are rarely covered by insurance, air ambulance services remain inaccessible to most middle- and lower-income families, thus limiting market growth and broader accessibility.

India Air Ambulance Market Dynamics: Opportunities

Technological advancements

Technological advancements are revolutionizing the air ambulance sector, particularly through the integration of telemedicine, advanced life support systems, and remote patient monitoring. With telemedicine, air ambulances are now equipped with secure, high-speed communication systems that allow the onboard medical team to consult with hospital-based specialists in real time during flight.

This means that critical patient data such as vital signs, ECGs, or even live video can be shared instantly, enabling experts on the ground to guide complex procedures or help make urgent treatment decisions. Furthermore, government support initiatives and key developments would drive this global air ambulance market growth.

For instance, in October 2024, Prime Minister Narendra Modi inaugurated India's first free Helicopter Emergency Medical Service (HEMS) at the All-India Institute of Medical Sciences (AIIMS) in Rishikesh. This innovative initiative aims to provide rapid medical assistance to accident victims and patients in remote and critical areas of Uttarakhand, particularly during the crucial 'golden hour' following an emergency. The golden hour refers to the critical time frame in which prompt medical intervention can significantly improve survival rates and outcomes for seriously injured patients.

For more details on this report, Request for Sample.

India Air Ambulance Market - Segment Analysis

The India air ambulance market is segmented based on aircraft type, type of service, application, and end-user.

Aircraft Type:

The rotary-wing aircraft type segment in the India air ambulance market was valued at US$ 0.51 Billion in 2024

The rotary-wing segment currently holds a significant portion of the global air ambulance market and is expected to continue holding a significant portion during the forecast period. The rotary-wing segment of the global air ambulance market involves the use of helicopters for emergency medical transport. Helicopters are particularly suited for short-distance services in urban or hard-to-reach areas. Their ability to bypass traffic, reach remote locations, and land in confined spaces makes them essential for rapid patient transport, especially in critical situations like heart attacks, strokes, and trauma.

The demand for rotary-wing air ambulances is expected to rise due to urbanization, an increase in medical emergencies, and technological advancements in helicopter design. As healthcare systems focus more on providing fast, life-saving care, rotary-wing air ambulances remain vital. Their lower operating costs compared to fixed-wing aircraft and ability to serve densely populated areas further boost their role in the air ambulance market.

Additionally, key players in the industry's innovative launches propel this segment's growth in the global air ambulance market. For instance, in January 2024, the Children’s Air Ambulance (TCAA) made a significant advancement in pediatric emergency care by launching England's first incubator on a rotary-wing aircraft.

This innovative initiative aims to assist specialist NHS transport teams during life-saving flights, specifically for critically ill babies and children. The introduction of this incubator is a vital step in enhancing the capabilities of air medical transport, particularly for vulnerable patients who require intensive care during transit. These factors have solidified the segment's position in the global air ambulance market.

India Air Ambulance Market – Competitive Landscape

The major players in the India air ambulance market include Air Methods., AirMed International, Acadian Ambulance Service, PHI Air Medical., REVA, Inc., Babcock International Group PLC, EAA, Air Charter Service, Gulf Helicopters, and CareFlight, among others.

India Air Ambulance Market – Key Developments

In February 2025, Indian startup ePlane secured a $1 billion deal to supply 788 electric vertical takeoff and landing (eVTOL) air ambulances to the International Critical-Care Air Transfer Team (ICATT), an air ambulance service provider in India. This agreement, currently a non-binding memorandum of understanding, is one of the largest initial orders in the global eVTOL industry.

In September 2024, RED. Health, a leading emergency care provider with a fleet of over 6,000 ambulances and advanced air ambulance services, demonstrated its rapid response capabilities by completing a critical air ambulance transfer from Birgunj, Nepal, to Hyderabad.

In November 2024, Uttarakhand recently secured approval from the central government to launch the country's first helicopter ambulance service, a significant initiative aimed at addressing the healthcare challenges posed by the state's difficult geographical conditions.

In July 2024, French aerospace giant Airbus is partnering with Tata Advanced Systems Limited (TASL) to establish India’s first private-sector helicopter final assembly line (FAL) for the H125 helicopter. This initiative is a significant boost to India’s Atmanirbhar Bharat (self-reliant India) goals, aiming to strengthen domestic aerospace manufacturing and reduce dependence on imports.

In May 2024, Air India announced a landmark partnership with MedAire, a leading provider of aviation medical support, to deliver enhanced in-flight healthcare for passengers and crew across its entire fleet. This collaboration makes Air India the first airline in India to implement MedAire’s advanced medical assistance system fleet-wide, setting a new standard in the country's aviation sector.

In January 2024, Airbus and Tata Advanced Systems Limited (TASL) forged a landmark partnership to establish India’s first private-sector helicopter final assembly line (FAL) for the Airbus H125 helicopter. The facility will be set up in Kolar, Karnataka, marking a significant step for India’s aerospace sector and the government’s “Make in India” and “Atmanirbhar Bharat” (self-reliant India) initiatives.

India Air Ambulance Market – Scope

Metrics | Details | |

CAGR | 13.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Aircraft Type | Fixed-Wing, Rotary-Wing |

Type of Service | Domestic, International | |

Application | Inter-Facility Transport, Rescue Helicopter Services, Organ Transplant Logistics, Infectious Disease Transport, Neonatal and Pediatric Transport, General Patient Transport, Emergency Medical Services (EMS), Others | |

End-User | Hospitals, Government Organizations, Military & Defense, Others | |

DMI Insights:

Our research indicates that the market for India air ambulance is expected to expand at a compound annual growth rate (CAGR) of 10.2% from 2025 to 2033, driven by the rising incidence of critical medical emergencies, growing demand for rapid inter-city and remote area patient transport, and increasing public awareness of emergency medical services.

The sector benefits from the expansion of premium and corporate healthcare offerings, government initiatives to strengthen emergency response infrastructure, and technological advancements in medical aviation, with growth opportunities seen in both rural outreach and advanced urban healthcare networks. Competitive dynamics are shaped by strategic partnerships, fleet modernization, and the integration of advanced medical and telemedicine technologies, positioning the industry for sustained growth and enhanced patient outcomes over the forecast period.

The India air ambulance market report delivers a detailed analysis with 42 key tables, more than 29 visually impactful figures, and 156 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here