Hydrogen Electrolyzer Market Size

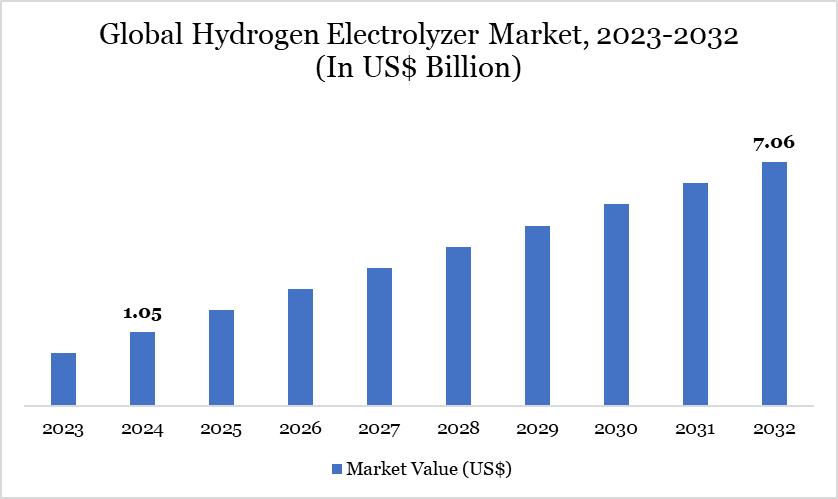

Hydrogen Electrolyzer Market reached US$ 1.05 billion in 2024 and is expected to reach US$ 7.06 billion by 2032, growing with a CAGR of 26.89% during the forecast period 2025-2032.

The hydrogen electrolyzer market is witnessing rapid expansion, propelled by regulatory requirements and increasing investments from both public and private sectors. Electrolyzers, especially for green hydrogen production, have become essential technology in the decarbonization of energy systems.

Global legislative frameworks, such the US Bipartisan Infrastructure Law, which allocates US$750 million for 52 projects in 2024, and the EU's REPowerEU initiative, are facilitating market maturation. India's National Green Hydrogen Mission emphasizes the global dedication to hydrogen. By the conclusion of 2023, electrolysis capacity had increased to 1.4 GW, and yearly production capacity had attained 25 GW.

The market is progressing towards large-scale deployment, with potential pipeline expansion ranging from 230 to 520 GW by 2030. Electrolyzers are increasingly vital for utilizing surplus renewable energy to generate hydrogen, hence mitigating storage and grid stability issues. This collaboration positions hydrogen electrolyzers at the vanguard of the worldwide clean energy transformation.

Hydrogen Electrolyzer Market Trends

Substantial technological progress is transforming the hydrogen electrolyzer market by enhancing efficiency and scalability. Improved engineering, sophisticated materials, and design advancements are facilitating superior integration with variable renewable energy sources like sun and wind. This technological convergence enhances energy storage, stabilizes power grids, and optimizes the utilization of intermittent renewable energy, especially via hydrogen synthesis during off-peak periods.

Consequently, electrolyzers are progressively included into transportation, industrial processing, and distributed energy networks. The manufacturing capacity for electrolyzers has significantly increased, reaching 25 GW annually by 2023. These advancements signify an evolving industry that is swiftly progressing from first projects to large-scale commercial implementations.

Although about 20 GW of projected capacity has attained Final Investment Decision (FID), the substantial project and innovation pipelines indicate a strong upward trend for the sector. The emphasis on roll-to-roll manufacturing methods, exemplified by the DOE's US$8 million investment, underscores the drive towards scalable production.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

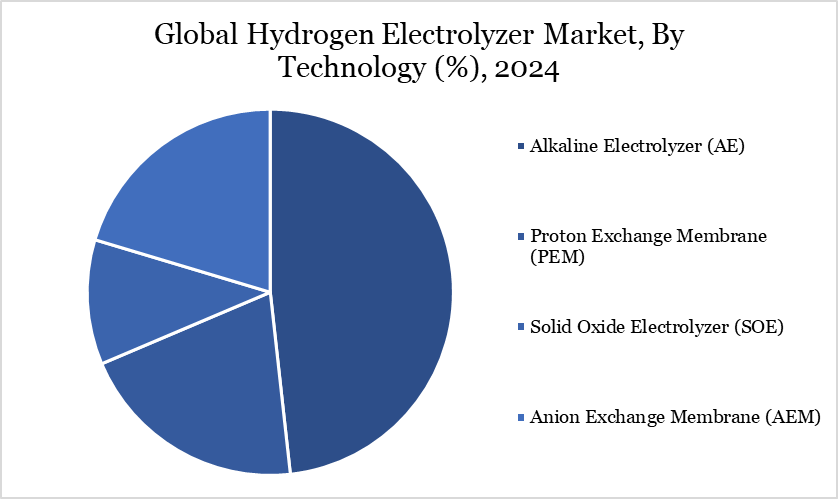

| By Technology | Alkaline Electrolyzer (AE), Proton Exchange Membrane (PEM), Solid Oxide Electrolyzer (SOE), Anion Exchange Membrane (AEM) |

| By Power Generation | <500 kW, 500-2,000 kW, >2,000 kW |

| By Application | Energy, Power Generation, CHP, Mobility, Industrial, Chemical, Industries, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Hydrogen Electrolyzer Market Dynamics

International Policy Initiatives Transform Hydrogen Infrastructure

The growth of the hydrogen electrolyzer market is primarily driven by significant government actions and financial instruments globally. The US Bipartisan Infrastructure Law, which allocated US$750 million in March 2024 for electrolyzer infrastructure and hydrogen hubs, has substantially reduced the financial obstacles for industry adoption.

The US Department of Energy's $8 million investment in roll-to-roll manufacturing underscores the public commitment to scalable and efficient production. The EU's REPowerEU strategy and India's National Green Hydrogen Mission illustrate worldwide policy initiatives to include green hydrogen as a fundamental element of national energy frameworks.

These policies include subsidies, loans, carbon contracts for difference (CCfDs), and tax incentives, stimulating private sector investment and mitigating innovation risks. This coordinated policy framework not only promotes infrastructure development but also reduces the cost of clean hydrogen, hence improving the worldwide competitiveness and long-term sustainability of electrolyzer technologies.

Dependence on Scarce Materials Limit Scalability

The hydrogen electrolyzer market has considerable material-related limitations, especially concerning Proton Exchange Membrane (PEM) technology. PEM systems depend significantly on rare and expensive elements, including iridium, platinum, and titanium. The anode functions under severe oxidizing circumstances (>1.4 V), requiring iridium, one of the rarest and most emission-intensive metals.

Cathodes also necessitate platinum, which is susceptible to supply chain vulnerabilities owing to its limited geographic distribution. These linkages exacerbate production expenses and present significant scalability obstacles, particularly as worldwide hydrogen demand increases. The restricted availability of platinum group metals (PGMs) engenders price fluctuation and supply uncertainty, potentially obstructing extensive implementation.

Despite ongoing research into alternate catalysts, the current dependence on PGMs limits cost reductions and hinders broad market accessibility. Resolving these difficulties is essential for guaranteeing the long-term sustainability and robustness of PEM-based electrolyzer technologies within the clean hydrogen ecosystem.

Hydrogen Electrolyzer Market Segment Analysis

The global hydrogen electrolyzer market is segmented based on technology, power generation, application and region.

Proton Exchange Membrane Technology Advances Hydrogen Utilization

Proton Exchange Membrane (PEM) technology constitutes a leading segment in the hydrogen electrolyzer market owing to its operational versatility, small architecture, and enhanced performance. In contrast to conventional methods, PEM electrolyzers operate at reduced temperatures and employ solid polymer electrolytes, providing improved safety and durability.

Their capacity to generate high-purity hydrogen is particularly advantageous for industries demanding rigorous fuel specifications, including transportation and clean energy storage. Furthermore, PEM systems are adept at integrating with renewable energy sources, effectively managing variable power inputs, therefore rendering them optimal for solar and wind applications.

The versatility and scalability of PEM designs facilitate implementation in various environments, ranging from distributed power systems to large-scale industrial hydrogen plants. Continued research aimed at diminishing reliance on expensive platinum group metals is anticipated to enhance PEM's market position. These benefits highlight PEM's significant financial impact and affirm its pivotal position in the further implementation of green hydrogen technologies.

Hydrogen Electrolyzer Market Geographical Share

Europe's Policy-Driven Leadership Sustains Growth

Europe is becoming a global center for hydrogen electrolyzer implementation, supported by extensive regulatory backing and industrial cooperation. Countries including Germany, France, the Netherlands, and Italy are actively investing in hydrogen infrastructure to decarbonize transportation, manufacturing, and energy sectors.

Germany maintains a preeminent income share, attributable to significant governmental incentives and its historical commitment to renewable energy implementation. The European Green Deal and national hydrogen initiatives reinforce the region's preeminence. Italy, utilizing its advantageous geographical location and dedication to renewable energy, is swiftly augmenting its electrolyzer presence, especially in chemical production and transportation.

Collaborative projects are amalgamating electrolyzers with solar and wind installations, bolstering Europe's objective to diminish fossil fuel use and achieve climate targets. These regional developments establish Europe as a laboratory for scalable hydrogen solutions, cultivating a strong ecosystem that is expected to impact worldwide market dynamics in the forthcoming years.

Sustainability Analysis

Hydrogen electrolyzers are crucial to worldwide decarbonization efforts, facilitating low-emission hydrogen generation from renewable and nuclear energy sources. Electrolyzers convert surplus renewable energy into storable hydrogen, thereby alleviating intermittency challenges and improving grid reliability.

In 2023, installed electrolysis capacity reached 1.4 GW, doubling from the previous year, while manufacturing capacity increased to 25 GW yearly, highlighting the sector's swift expansion efforts. Achieving the Net Zero Emissions (NZE) objective of 560 GW by 2030 necessitates sustained acceleration.

Sustainability challenges endure, particularly with the environmental impact of extracting rare metals like iridium and platinum. In response, industry players are investing in alternative materials and industrial advances, such as roll-to-roll processing, to decrease energy intensity and emissions. Notwithstanding these challenges, hydrogen electrolyzers are fundamental to sustainable energy transitions, providing a feasible means to decarbonize difficult-to-abate industries and greatly aiding long-term global climate goals.

Hydrogen Electrolyzer Market Major Players

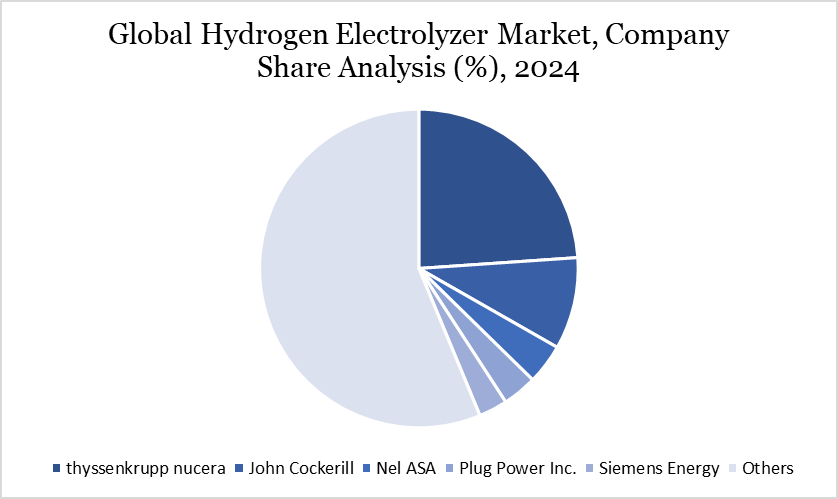

The major global players in the market include thyssenkrupp nucera, John Cockerill, Nel ASA, Plug Power Inc., Siemens Energy, Enapter S.r.l., Cummins Inc., ITM Power, McPhy Energy S.A., Topsoe and among others.

Key Developments

In September 2023, Enapter AG announced the expansion of its product line with the introduction of the AEM Flex 120, a modular electrolyzer engineered for scalability and ease of deployment in industrial and refueling hydrogen applications.

In June 2023, Air Liquide partnered with Siemens Energy to design, produce, and implement large-scale PEM electrolyzers for extensive hydrogen production facilities.

In June 2023, ITM Linde Electrolysis GmbH executed a memorandum of understanding (MOU) with Neste to establish a joint venture aimed at developing and delivering a 100 MW electrolyzer facility for green hydrogen generation in Finland.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies