Gluten-Free Bakery Market Size

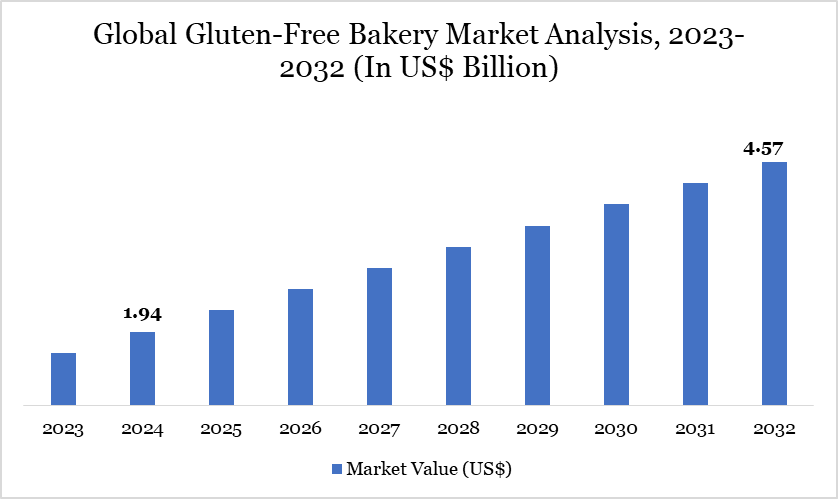

Gluten-Free Bakery Market Size reached US$ 1.94 billion in 2024 and is expected to reach US$ 4.57 billion by 2032, growing with a CAGR of 11.32% during the forecast period 2025-2032.

The global gluten-free bakery market is experiencing robust growth, primarily driven by rising health awareness, medical diagnoses, and evolving dietary preferences. According to the US National Institutes of Health (NIH), celiac disease affects nearly 2 million Americans, with many more adopting gluten-free diets due to non-celiac gluten sensitivity.

In response, manufacturers are expanding product lines that comply with FDA's gluten-free labeling regulations, which mandate less than 20 parts per million of gluten per product. Meanwhile, the European Commission supports gluten-free labeling harmonization under Regulation (EU) No 828/2014, contributing to a surge in certified product launches across the EU.

Gluten-Free Bakery Market Trend

A unique trend shaping this market is the increasing demand for clean-label, nutrient-dense gluten-free bakery goods that go beyond simple wheat replacements. Government-supported programs, such as Canada's Gluten-Free Certification Program (GFCP), ensure product integrity and foster consumer trust. Simultaneously, school nutrition policies and healthcare procurement guidelines in several regions are promoting gluten-free options, normalizing their availability in mainstream channels.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

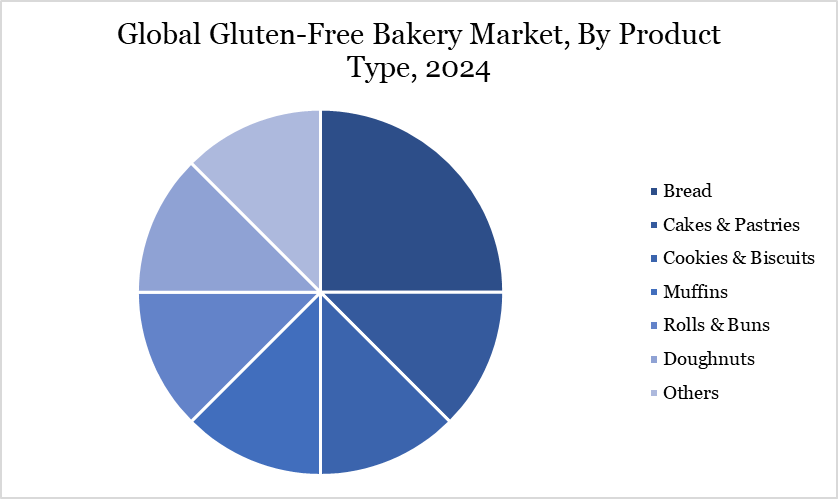

| By Product Type | Bread, Cakes & Pastries, Cookies & Biscuits, Muffins, Rolls & Buns, Doughnuts, Others |

| By Source | Rice, Corn, Millet, Sorghum, Others |

| By Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Online Channel, and Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Gluten-Free Bakery Market Dynamics

Rising Diagnosis Rates of Celiac Disease and Gluten Sensitivity Globally

The global rise in diagnosed cases of celiac disease and gluten sensitivity is significantly driving demand for gluten-free bakery products. According to the NIH, approximately 1% of the global population is affected by celiac disease, with rising awareness leading to increased diagnosis rates. In Europe, the European Food Safety Authority (EFSA) reports a steady annual increase in gluten-related health concerns. This growing medical need has propelled both consumer demand and product innovation in the gluten-free bakery sector.

High Cost of Gluten-Free Ingredients Impacting Product Affordability

The high cost of gluten-free ingredients, such as almond flour and xanthan gum, is a significant restraint on the gluten-free bakery market. According to data from the USDA, alternative flours can cost up to four times more than conventional wheat flour, impacting affordability and pricing strategies. The US Bureau of Labor Statistics also reports higher average retail prices for gluten-free baked goods compared to their gluten-containing counterparts. This cost disparity limits accessibility for price-sensitive consumers and poses challenges for mass-market adoption.

Gluten-Free Bakery Market Segment Analysis

The global gluten-free bakery market is segmented based on product type, source, distribution channel and region.

Bread Segment Driving Gluten-Free Bakery Market

The bread segment is a key driver in the gluten-free bakery market, supported by growing consumer demand for allergen-free staples. According to the US Department of Agriculture (USDA), bread remains one of the most consumed bakery items in North America, making it a primary target for gluten-free innovation. The Canadian Celiac Association has noted increased availability of gluten-free bread options in mainstream grocery chains, signaling strong market integration. Additionally, FDA-regulated gluten-free labeling has enabled greater transparency and boosted consumer trust in gluten-free bread offerings.

Gluten-Free Bakery Market Geographical Share

Demand for Gluten-Free Bakery Demand in North America

Demand for gluten-free bakery products in North America is being driven by a rise in diagnosed celiac disease and gluten sensitivity cases. According to the US National Institutes of Health (NIH), around 1% of the US population has celiac disease, while up to 6% may experience non-celiac gluten sensitivity.

The US Food and Drug Administration (FDA) mandates strict gluten-free labeling, which has helped increase consumer confidence and product uptake. Additionally, Health Canada reports that gluten-free product claims have grown significantly, reflecting strong domestic demand.

Sustainability Analysis

Sustainability in the gluten-free bakery market is increasingly supported by governmental policies and corporate initiatives promoting eco-conscious production. According to the US Department of Agriculture, demand for organically grown gluten-free grains like sorghum and millet has risen by over 20% from 2020 to 2023. Companies such as General Mills have adopted regenerative agriculture practices for gluten-free product lines, reducing soil erosion and carbon emissions. Additionally, Canada's Agri-Food Sustainability Initiative encourages clean-label baking, fostering traceable and environmentally sustainable gluten-free ingredient sourcing.

Gluten-Free Bakery Market Major Players

The major global players in the market include Dr. Schär AG / SPA, General Mills, Inc., Boulder Brands, Inc., Hain Celestial Group, Inc., Warburtons Limited, Freedom Foods Group Limited, Katz Gluten Free, Inc., Genius Foods Ltd, Kinnikinnick Foods Inc., and Udi’s Gluten Free Foods, LLC.

Key Developments

In August 2024, T. Marzetti Company, a wholly-owned subsidiary of Lancaster Colony Corporation introduced its first-ever gluten-free line of New York Bakery frozen bread. This new offering features gluten-free versions of the brand’s classic Garlic Texas Toast and Five Cheese Texas Toast. Both products will be available nationwide this Fall.

In April 2024, Franz Bakery expanded its portfolio of gluten-free bread in honor of celiac awareness month (May). The new selections include sourdough, brioche and rye flavored varieties. Franz also said these new bread offerings are vegan and contain no nuts, soy, dairy, egg or high-fructose corn syrup.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies