Global Gastrointestinal Stents Market Size& Industry Outlook

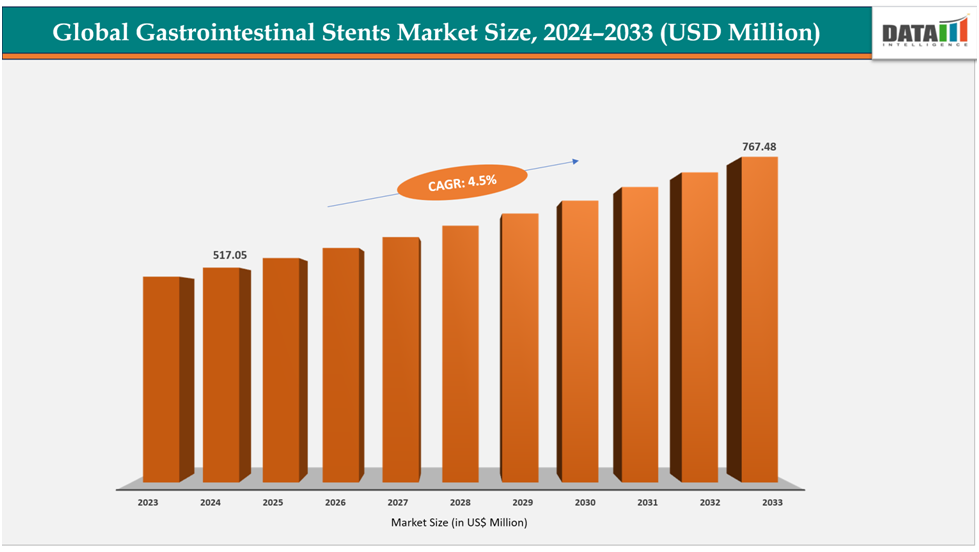

The global gastrointestinal stents market size reached US$517.05million in 2024 is expected to reach US$ 767.48million by 2033, growing at a CAGR of 4.5%during the forecast period 2025-2033.

The global rise in the elderly population is a significant driver for the gastrointestinal devices market, as aging is closely linked to a higher incidence of gastrointestinal disorders such as gastroesophageal reflux disease (GERD), colorectal cancer, and gastrointestinal bleeding. Older adults are more prone to digestive system complications due to weakened physiological functions and prolonged exposure to risk factors like medication use and dietary habits.

For instance, the World Health Organization (WHO) estimates that the global population aged 60 years and above will double by 2050, significantly increasing cases of GERD, colorectal cancer, and other GI disorders, thereby fueling the demand for endoscopic and minimally invasive gastrointestinal procedures.

This demographic shift is leading to increased demand for diagnostic and therapeutic endoscopy procedures, thereby boosting the adoption of advanced GI devices. Moreover, healthcare systems are focusing on early detection and prevention in aging populations, further stimulating market growth.

Key Highlights

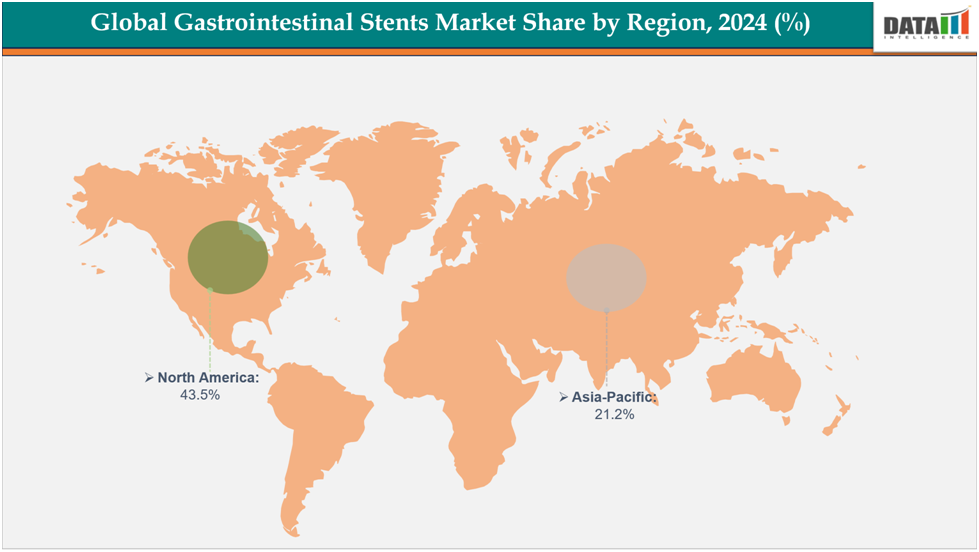

- North America dominates the gastrointestinal stents market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

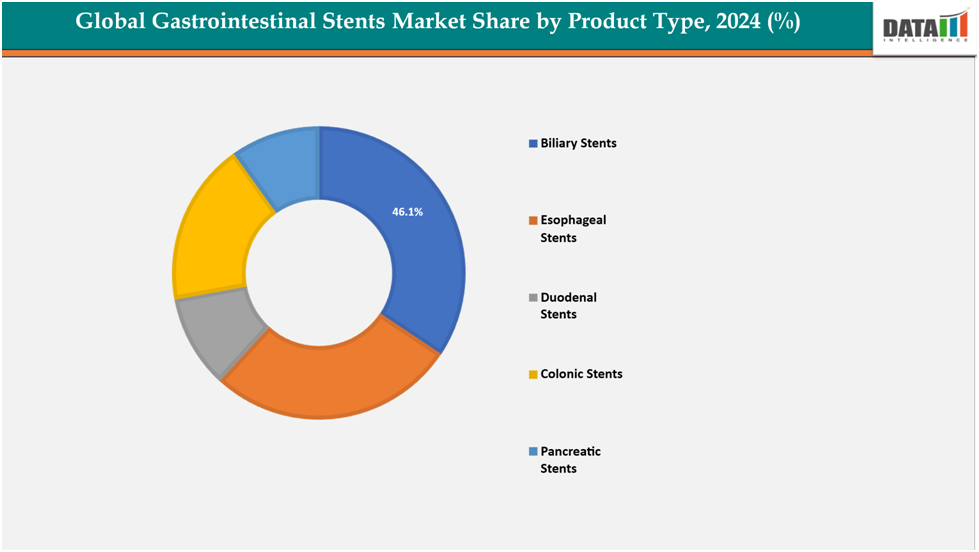

- Based on product type biliary stents segmented the market with the largest revenue share of 46.1% in 2024.

- The major market players in the gastrointestinal stents Boston Scientific Corporation, Cook Medical LLC, W. L. Gore & Associates, Inc., Endo‑Med Technologies Pvt. Ltd, Olympus Corporation, Becton Dickinson and Company, DuoMed, Taewoong Medical Co., Ltd., Micro‑Tech (Nanjing) Co., Ltd., Macromer Ltd and among others.

Market Dynamics

Drivers: Rising prevalence of gastrointestinal disorders, the global gastrointestinal stents market growth

The rising prevalence of gastrointestinal (GI) disorders such as gastroesophageal reflux disease (GERD), inflammatory bowel disease (IBD), peptic ulcers, and colorectal cancer is a major factor driving the growth of the gastrointestinal devices market. Unhealthy dietary habits, stress, sedentary lifestyles, and increasing use of medications like NSAIDs are contributing to a higher global disease burden.

For instance, overall, 49% of females and 36.6% of males met criteria for at least one FGID - the most common disorders in all regions being functional constipation, functional dyspepsia, proctalgia fugax, functional diarrhea and IBS at prevalence rates of 11.7%, 7.2%, 5.9%, 4.7% and 4.1, respectively.

As a result, there is a growing need for early diagnosis, advanced endoscopic procedures, and effective treatment options. This increasing patient pool is leading to higher adoption of gastrointestinal diagnostic and therapeutic devices across hospitals and clinics, thereby fueling overall market expansion.

Restraints: High cost of stents and procedures are hampering the growth of the Global Gastrointestinal Stents market

The high cost of gastrointestinal stents and related procedures acts as a major restraint on market growth, particularly in developing regions. The average price of a GI stent ranges from USD 800 to USD 2,500 per unit, depending on the type and material used, while endoscopic stent placement procedures can cost between USD 3,000 and USD 10,000 in hospitals and specialty clinics. These high expenses, combined with limited reimbursement coverage in many countries, restrict access to advanced gastrointestinal treatments for a large segment of the population. Consequently, cost-related barriers continue to hinder the widespread adoption of stenting and other minimally invasive GI interventions.

For more details on this report – Request for Sample

Market Segmentation Analysis

The global gastrointestinal stents market is segmented based on product type, material, application, end user and region.

Product Type:

The biliary stents segment from product type segment to dominate the global gastrointestinal stents market with a 46.1% share in 2024

The biliary stents segment is witnessing strong growth, driven by the increasing incidence of biliary obstructions, gallstones, and pancreatic cancer, which often lead to bile duct blockages requiring stent placement. Also, by novel product launches, the growing preference for minimally invasive endoscopic procedures over traditional surgeries has further accelerated the adoption of biliary stents.

For instance, in October 2025, Boston Scientific Corporation announced that it has received FDA 510(k) clearance to market its WallFlex Biliary RX fully and partially covered stents for the palliative management of malignant bile duct strictures. The uncovered WallFlex Biliary RX stent, which was previously cleared by the FDA in 2006, complements the newly approved models.

Moreover, technological advancements, such as the development of self-expanding metal stents (SEMS) and biodegradable stents, have improved patient outcomes by enhancing patency rates and reducing the need for repeat interventions.

Additionally, the rising geriatric population and growing awareness about early diagnosis of hepatobiliary diseases are contributing to the segment’s expansion within the gastrointestinal devices market.

Application:

The biliary leases estimated to have a 44.1% of the global gastrointestinal stents market share in 2024

The biliary leaks segment is primarily driven by the increasing number of gallbladder surgeries, liver transplants, and trauma-related bile duct injuries, which often result in postoperative bile leakage. The rising adoption of endoscopic retrograde cholangiopancreatography (ERCP) for the diagnosis and management of biliary leaks has significantly boosted the demand for advanced endoscopic devices and accessories.

Moreover, technological improvements in biliary stents, clips, and sealing agents have enhanced treatment efficiency and reduced hospital stays. The growing prevalence of liver and gallbladder disorders, coupled with the shift toward minimally invasive endoscopic management, continues to propel the growth of the biliary leaks segment within the gastrointestinal devices market.

Geographical Analysis

North America dominates the global gastrointestinal stents market with a 43.5% in 2024

Growth in North America is driven by the high prevalence of gastrointestinal disorders such as colorectal cancer and GERD, along with strong healthcare infrastructure and favorable reimbursement policies. Technological advancements and early adoption of minimally invasive endoscopic procedures further support market expansion in this region.

The U.S. leads the market due to continuous FDA approvals for advanced GI devices, high healthcare spending, and growing awareness of early diagnosis. The presence of key market players like Boston Scientific and Medtronic also accelerates innovation and product availability.

For instance, according to estimates from the American Cancer Society (ACS), in the United States in 2024, approximately 152,810 new cases of colorectal cancer (CRC) are expected, of which 106,590 will be colon cancers and 46,220 will be rectal cancers. In the same year, the ACS projects around 53,010 deaths from CRC. These statistics highlight the ongoing substantial burden of colorectal cancer in the U.S., despite advancements in early detection, screening, and treatment.

Europe is the second region after North America which is expected to dominate the global gastrointestinal stents market with a 34.5% in 2024

In Europe, market growth is supported by the increasing incidence of gastrointestinal cancers, well-established healthcare systems, and government initiatives promoting preventive healthcare. A rise in endoscopic screening programs and aging demographics further contribute to demand.

Germany represents one of Europe’s largest markets owing to its advanced hospital infrastructure, strong focus on endoscopic innovation, and high adoption of minimally invasive technologies. The country’s significant elderly population also contributes to the rising burden of GI diseases.

For instance, in Germany in 2024, gastrointestinal disorders remain a significant health concern, with approximately 24% of the population affected by some form of digestive condition. Among these, inflammatory bowel disease (IBD) alone impacts around 0.7% of the population, translating to roughly 600,000 individuals.

The Asia Pacific region is the fastest-growing region in the global gastrointestinal stents market ,with a CAGR of 8.1% in 2024

The Asia-Pacific region is experiencing rapid market growth due to increasing cases of digestive system disorders, improving healthcare access, and expanding medical infrastructure. Rising healthcare awareness and government investments in endoscopy units are key supporting factors.

In Japan, growth is mainly driven by the aging population and high incidence of gastrointestinal cancers. The country’s strong emphasis on technological innovation and early disease detection programs fosters the adoption of advanced diagnostic and therapeutic GI devices.

For instance, in July 2024, CGBIO, led by CEO Hyun-seung Yu and a specialist in bio-regenerative medicine, announced on the 1st that its biliary stent ‘ARISTENT’, the inaugural product from its gastrointestinal stent brand, is attracting significant attention in the Japanese market, thereby driving the company’s expansion in the global stent market.

Market Competitive Landscape

Top companies in the global gastrointestinal stents market Boston Scientific Corporation, Cook Medical LLC, W. L. Gore & Associates, Inc, Endo‑Med Technologies Pvt. Ltd, Olympus Corporation, Becton, Dickinson and Company, DuoMed, Taewoong Medical Co., Ltd., Micro‑Tech (Nanjing) Co., Ltd., Macromer Ltd and among others.

Boston Scientific Corporation:- Boston Scientific Corporation plays a pivotal role in the gastrointestinal devices market by offering a wide range of advanced endoscopic and stenting solutions for the management of gastrointestinal disorders. The company’s WallFlex Biliary RX Stenting System, available in fully covered, partially covered, and uncovered models, is used for the palliative treatment of malignant bile duct strictures, reflecting its focus on improving patient outcomes through minimally invasive interventions. Continuous FDA approvals, technological innovations, and global product availability enable Boston Scientific to maintain a strong market presence, particularly in North America, Europe, and select Asia-Pacific countries, thereby driving adoption of GI devices and supporting overall market growth.

Market Scope

| Metrics | Details | |

| CAGR | 4.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Biliary Stents, Esophageal Stents, Duodenal Stents, Colonic Stents, Pancreatic Stents |

| Material | Metal Stents, Plastic Stents, Others | |

| Application | Biliary Leaks, Gallstones, Colorectal Cancer, Duodenal Obstruction, Pancreatic Cancer, Esophageal Cancer, Others | |

| End User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global gastrointestinal stents market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggested Reports

For more medical devices-related reports, please click here