Fruits and Vegetables Market Size

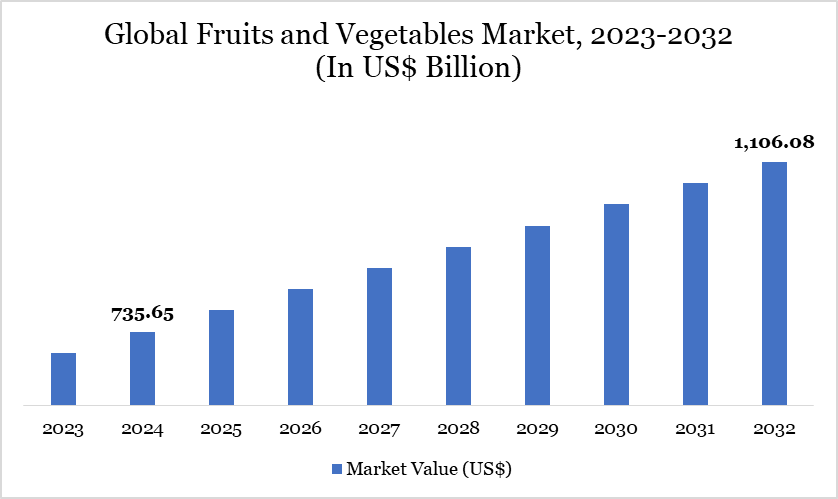

Fruits and Vegetables Market Size reached US$ 735.65 billion in 2024 and is expected to reach US$ 1,106.08 billion by 2032, growing with a CAGR of 5.23% during the forecast period 2025-2032.

The global fruits and vegetables market is experiencing rapid growth, driven by increasing consumer awareness of health benefits, a shift toward plant-based diets and initiatives promoting sustainable agriculture. As consumers become more health-conscious, there is a rising demand for fresh, frozen and processed produce across various sectors, including food and beverage, cosmetics and pharmaceuticals.

Innovations such as hydroponics, precision farming and improved cold storage solutions enhance product quality, yield and shelf life. Furthermore, government initiatives aimed at promoting sustainable practices and reducing food waste are fueling this growth. For example, the European Union's Green Deal focuses on minimizing food waste and greenhouse gas emissions, which aligns with the increasing consumer preference for environmentally friendly products.

Countries like China, India and Japan are witnessing rising demand because of government programs that encourage agricultural advancements and rural progress. China's Ministry of Agriculture and Rural Affairs (MARA) has launched initiatives aimed at enhancing crop production and advocating for organic farming. The Indian government promotes the 'Eat Right Fruit and Vegetable Market' initiative led by FSSAI aims to raise the quality and safety of unorganized fruits and vegetables retail markets.

Fruits and Vegetables Market Trend

Organic and clean label demand is a key trend in the fruits and vegetables market as consumers increasingly prioritize health, safety, and transparency. Shoppers are actively seeking produce that is free from synthetic pesticides, GMOs, and harmful chemicals. This shift is driven by growing awareness of the health benefits associated with organic diets and concerns over food safety and environmental sustainability. According to the Agricultural and Processed Food Products Export Development Authority (APEDA), India produced around 3.6 million metric tonnes (FY24) of certified organic products, including fruits, vegetables, spices, and other food categories.

Clean-label fruits and vegetables, which emphasize minimal processing and clear ingredient sourcing, are gaining trust among health-conscious buyers. Retailers and brands are responding by expanding their organic offerings and investing in certification and traceability. This trend is especially strong in urban markets and among millennials and Gen Z consumers.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Product | Fruits, Vegetables |

By Type | Fresh, Dried, Frozen, Others |

By Category | Organic, Conventional |

By Distribution Channel | Supermarkets/Hypermarkets, Grocery Stores, E-Commerce, Others |

By End-User | Retail/Household, Food Service Sector |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Fruits and Vegetables Market Dynamics

Rising Health Awareness and Technological Advancements

The growing awareness of the health benefits of fruits and vegetables is significantly driving market demand. Governments and health organizations worldwide are promoting daily consumption to combat lifestyle diseases such as obesity, heart disease, and diabetes. Campaigns and dietary guidelines have increased consumer focus on fresh, nutrient-rich foods. According to the WHO, inadequate fruit and vegetable intake is linked to approximately 1.7 million deaths annually, highlighting the urgency for healthier diets. This health-driven shift is encouraging higher consumption and boosting the overall fruits and vegetables market.

Moreover, advancements in controlled-environment agriculture (CEA), including vertical farming and hydroponics, are improving productivity and sustainability in areas with restricted arable land. Cold storage and refrigeration technologies have extended shelf life, minimizing food waste. Additionally, mobile applications and AI-driven tools help farmers optimize crop yields, conserve resources and reduce environmental impact.

Pest and Disease Outbreaks

The global fruits and vegetables market is impacted by climate change and unpredictable weather conditions. Increasing temperatures, droughts and extreme weather events disrupt crop yields, making it difficult for producers to maintain consistent supply levels. According to the Food and Agriculture Organization (FAO), global agriculture, including fruit and vegetable farming, faces increasing risks from climate variability, which affects crop quality and availability. Furthermore, pests and diseases are a significant restraint in the fruits and vegetables sector.

Crops are particularly vulnerable to infestations that can severely reduce yields or necessitate the use of chemical treatments, which can impact the quality of produce. Every year, pests cause a loss of 20% to 40% in global crop production. Annually, plant diseases result in an estimated US$ 220 billion loss to the global economy, while invasive insects contribute approximately US$ 70 billion, as reported by the Food and Agriculture Organization of the United Nations. Moreover, controlling these outbreaks adds to production costs, impacting the affordability of fruits and vegetables for end consumers.

Fruits and Vegetables Market Segment Analysis

The global fruit and vegetables market is segmented based on product, type, category, distribution channel, end-user and region.

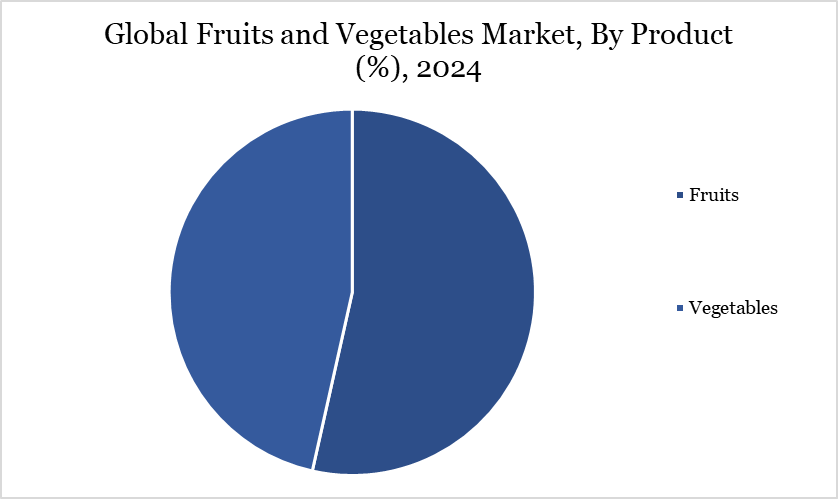

High Demand for Organic and Clean-Label Fruits

The demand for fruits has significantly increased as consumers increasingly prefer chemical-free and sustainably sourced products. According to the Food and Agriculture Organization (FAO), the global per capita supply of fruits in 2022 varied widely. Developed nations like the US and UK reported higher per capita fruit consumption, with averages of 93.8 kg and 86.4 kg per year, respectively. In contrast, countries such as Mongolia and Cambodia had lower averages, around 13.5 kg per year. Some African nations, including Chad, Zambia, and Togo, reported annual per capita fruit consumption below 7 kg.

This surge in consumption aligns with a broader consumer trend favoring organic and sustainably grown produce, reflecting heightened awareness regarding health and environmental sustainability. It also shifts towards organic and sustainable agriculture is not only a response to consumer preferences but also a reflection of changing agricultural practices. Farmers are increasingly adopting methods that prioritize environmental health and reduce reliance on synthetic chemicals. The growing market for organic fruits is supported by initiatives that facilitate direct procurement and improve supply chain efficiencies, such as those pioneered by online retailers.Top of Form

Fruits and Vegetables Market Geographical Share

North America Holds a Significant Share Due to High Per Capita Consumption, Advanced Supply Chains, and Strong Health Awareness

North America significantly influences the global fruits and vegetables market, primarily due to the increasing demand for organic produce and convenient ready-to-eat food options. The US and Canada benefit from robust distribution networks and advanced agricultural practices that enhance their market position. According to the Organic Trade Association (OTA), organic produce sales in the US totaled US$ 22 billion in 2022, which was 15% of all fruit and vegetable sales in the country.

Furthermore, the rise in health consciousness among consumers, coupled with supportive government initiatives such as the National Organic Program (NOP), has bolstered the organic sector in both countries. Canada is also experiencing an uptick in fresh fruit and vegetable imports, particularly from Latin America, which helps satisfy consumer preferences despite seasonal limitations.

Sustainability Analysis

Sustainability in the fruits and vegetables market has become a critical focus as companies strive to minimize their environmental impact through various innovative practices. Many businesses are adopting biodegradable and compostable packaging solutions to combat plastic waste, which is a significant contributor to environmental degradation. Similarly, advancements in materials such as starch-based plastics, seaweed wraps and mushroom packaging are paving the way for greener alternatives that minimize landfill contributions and enhance product preservation.

In addition to packaging innovations, addressing water scarcity is another priority within the sector. Companies are investing in water-saving technologies and developing drought-resistant crops, recognizing that agriculture accounts for approximately 20% of global freshwater usage, as reported by the World Bank. Furthermore, the integration of renewable energy sources in greenhouse operations aligns with global climate objectives, contributing to a more sustainable agricultural framework.

Fruits and Vegetables Market Major Players

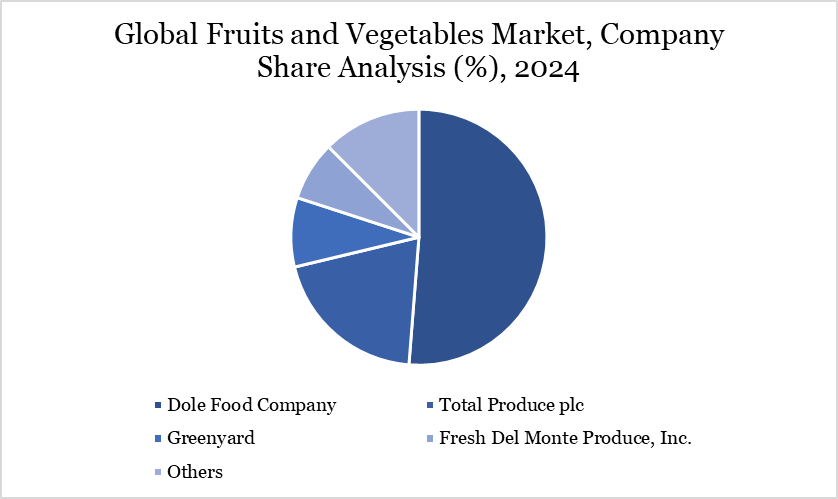

The major global players in the market include Dole Food Company, Total Produce plc, Greenyard, Fresh Del Monte Produce, Inc., General Mills, Ardo Group, Berry Global Inc., Sysco Corporation, METRO AG, Global Green Company and others.

Key Developments

In March 2025, UK-based Tropic developed a banana that resists browning for up to 12 hours post-peeling, aiming to reduce food waste.

In November 2024, Fresh Del Monte’s Mann Packing partnered with Newman’s Own to launch its first-ever salad kits. These kits feature high-quality lettuce, toppings, and Newman’s dressings, with proceeds supporting children’s charities.

In March 2024, AgriNurture, Inc. (ANI) finalized its purchase of the Australian produce firm Freshness First Pty. Limited. After nearly five years of negotiations and preparation since its initial announcement in October 2018, ANI finalized the purchase for US$ 0.65 million, bringing the Australian firm under its full control. This acquisition marks a strategic step for ANI in broadening its presence in the fruits and vegetables market.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies