Overview

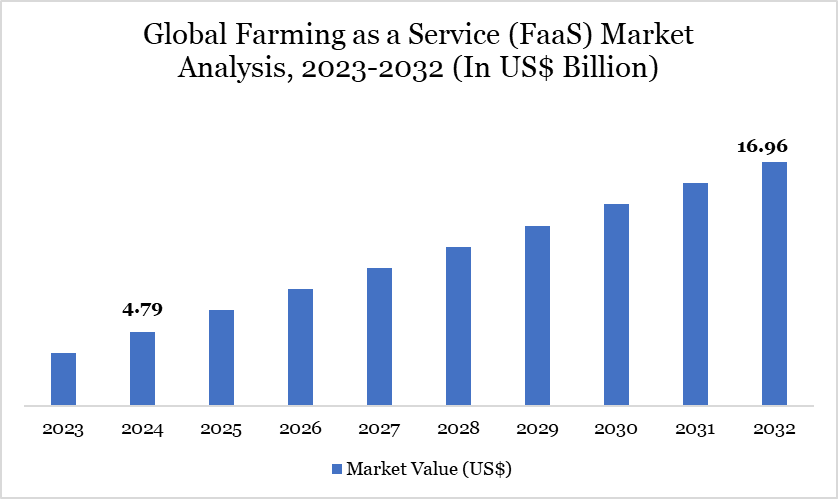

Global farming as a service (FaaS) market size reached US$ 4.79 billion in 2024 and is expected to reach US$ 16.96 billion by 2032, growing with a CAGR of 17.12% during the forecast period 2025-2032.

Farming as a Service (FaaS) is reshaping global agriculture by offering technology-driven solutions such as equipment rentals, data analytics, precision farming and advisory services on a pay-per-use or subscription model. Governments are increasingly supporting FaaS to empower small and marginal farmers.

For instance, the USDA's Farm Service Agency provides financial assistance and technical support to reduce the capital burden on farmers. Similarly, India's PM-KISAN and National e-Governance Plan in Agriculture (NeGPA) are promoting tech access and digital services. These efforts are improving access to high-end machinery, real-time crop data and customized agronomic advice.

Similarly, India is leveraging space data to enhance farming efficiency. For instance, Indian farmer Lokeswara Reddy increased his net profit to US$ 234.11 per acre from US$ 58-63 by utilizing satellite data provided by Cropin and Syngenta. This approach offers actionable insights on optimal sowing times, weather forecasts and resource management, leading to increased yields and profits.

Request for Free Sample : Click Here

Farming as a Service (FaaS) Market Trend

A major trend in FaaS is the integration of satellite and geospatial data into precision agriculture. In India, farmers using satellite data from collaborations like ISRO-Cropin-Syngenta have reported up to 3x increases in per-acre profits. Globally, such digital platforms are enabling hyper-local recommendations, optimized input use and climate-smart practices. Governments in the US, Australia and the EU are facilitating data-sharing ecosystems to further accelerate this shift.

Market Scope

| Metrics | Details |

| By Service Type | Farm Management Solutions, Production Assistance, Access to Market, Financial Services, Advisory Services and Others |

| By Delivery Model | Subscription-based, Pay-per-use, Hybrid |

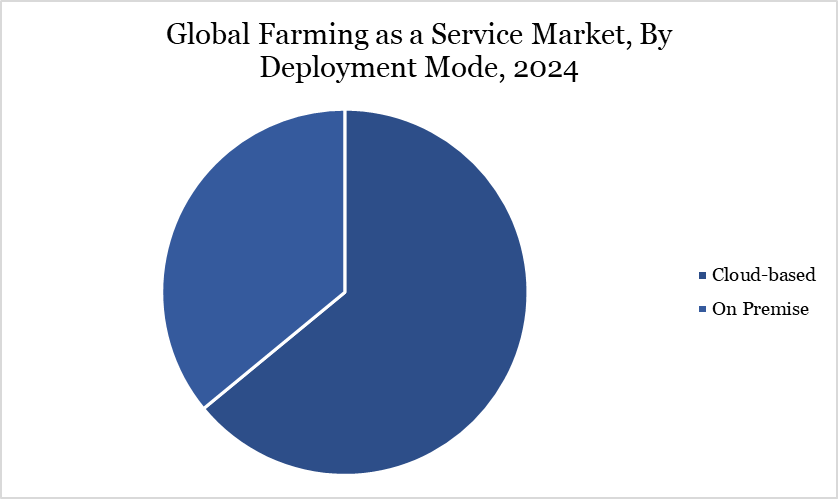

| By Deployment Mode | Cloud based, On premise |

| By End-User | Commercial Farmers, Small and Marginal Farmers and Farmer Cooperatives & Agribusinesses |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Government-Led Open Data Platforms Enabling Precision Agriculture Integration

Government-led open data initiatives are significantly accelerating the adoption of precision agriculture technologies, fueling the growth of the Farming-as-a-Service (FaaS) market. For example, India’s Digital Agriculture Mission (2021–2025) promotes open access to datasets like soil health, crop patterns and weather via platforms such as AgriStack, enabling data-driven services for smallholder farmers. Similarly, the European Union’s INSPIRE Directive facilitates geospatial data sharing to support smart farming applications across member states.

According to the US Department of Agriculture (USDA), over 70% of US farms used precision agriculture tools like GPS guidance and soil mapping in 2022, supported by open government data. These efforts lower barriers to tech adoption, allowing service providers to tailor solutions in real time, thus expanding the FaaS market footprint.

Fragmented Land Holdings Hindering Scalability of FaaS Solutions

Fragmented land holdings significantly hinder the scalability of Farming-as-a-Service (FaaS) solutions, particularly in countries like India, where over 86% of farmers are small and marginal, each owning less than 2 hectares. This dispersion increases operational costs and complicates service delivery for FaaS providers. As per NABARD’s Financial Inclusion Survey, over 70% of such farmers lack access to mechanization, further constraining FaaS adoption and efficiency.

Segment Analysis

The global farming as a service (FaaS) market is segmented based on service type, delivery model, deployment mode, end-user and region.

Cloud-Based Segment Driving Farming as a Service (FaaS) Market

The integration of cloud-based technologies in India's Farming as a Service (FaaS) sector is significantly transforming agricultural practices. The Indian government's initiatives, such as the National e-Governance Plan in Agriculture (NeGP-A), have been pivotal in promoting the use of digital technologies like Artificial Intelligence, Machine Learning and the Internet of Things in agriculture.

Private sector participation has also been instrumental in advancing cloud-based FaaS solutions. Companies like Cropin Technology Solutions have collaborated with global tech giants to process satellite data, providing farmers with actionable insights on optimal sowing times, weather forecasts and resource management. Such collaborations have led to substantial increases in crop yields and farm revenues. For instance, a project involving Cropin and the World Bank digitized over 30,000 farm plots across 244 villages, resulting in 92% of participating farmers increasing their average yield by 30% and farm revenue by nearly 37%.

Geographical Penetration

Demand for Farming as a Service (FaaS) in North America

In North America, the demand for Farming as a Service (FaaS) is experiencing significant growth, driven by the increasing reliance on specialized agricultural support services. According to the US Census Bureau's 2022 Economic Census, the value of receipts from agricultural services establishments in the US surged by 263% from 1978 to 2022, reaching approximately US$ 59.3 billion.

The substantial increase underscores a shift towards outsourcing various farming activities, including soil preparation, planting, harvesting and livestock breeding, to specialized service providers. The trend reflects a broader movement towards operational efficiency and cost-effectiveness in the agricultural sector.

North American agricultural landscape is evolving, with FaaS becoming an integral component in addressing the challenges of modern farming, such as labor shortages, technological advancements and the need for specialized expertise. The growing demand for these services reflects a strategic shift towards more sustainable and efficient farming practices.

Technological Analysis

The Farming as a Service (FaaS) market is witnessing significant technological advancements, particularly in India, where government initiatives are fostering the adoption of modern agricultural technologies. The Indian Council of Agricultural Research (ICAR) has established 729 Krishi Vigyan Kendras (KVKs) across various districts to disseminate and demonstrate modern agricultural technologies to farmers, including small and marginal ones.

Furthermore, the National Agriculture Market (eNAM) platform, launched by the Government of India, facilitates online trading of agricultural commodities, providing better price discovery and smooth marketing of produce. This digital platform integrates various markets across the country, enabling farmers to access a unified national market. The integration of such digital tools and platforms is transforming the agricultural landscape, making FaaS a pivotal component in modern farming practices.

Competitive Landscape

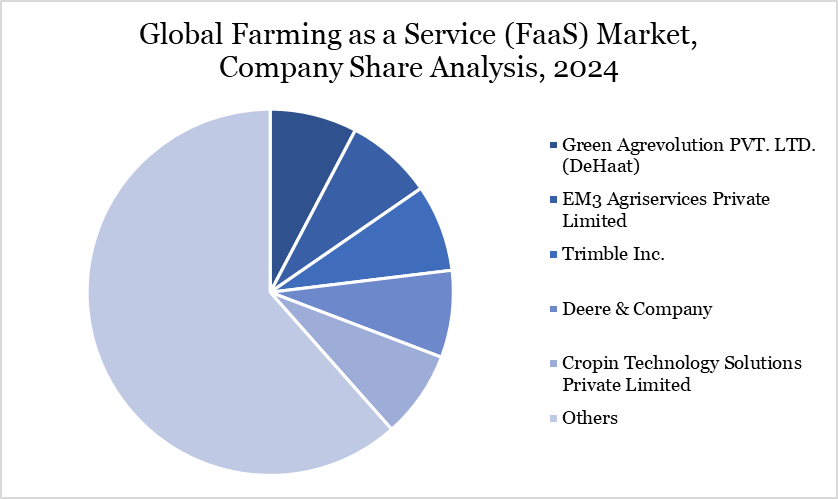

The major global players in the market include Green Agrevolution Pvt. Ltd. (DeHaat), EM3 Agriservices Private Limited, Trimble Inc., Deere & Company, Cropin Technology Solutions Private Limited, CropX Inc., Aibono Smart Farming Private Limited, Farmerline Limited, CRYSP Farms LLC and Sisu Agro Solutions Private Limited.

Key Developments

- In January 2024, AGCO Corporation, a global leader in the design, manufacture and distribution of agricultural machinery and precision ag technology, announced the launch of FarmerCore, a transformative global initiative to deliver a next-generation farmer and dealer experience. The launch of the new end-to-end distribution model is a significant milestone in advancing AGCO’s Farmer-First strategy and solidifying its commitment to helping farmers across the globe become more profitable, productive and sustainable.

- In February 2021, Mahindra & Mahindra Limited’s Farm Equipment division has launched its ‘Farming as a Service’ (FaaS) business in Karnataka by opening Krish-e centres that offer agronomy advisory, access to advanced farm equipment rentals, precision farming solutions and digitisation enablement. The centres were opened in Jamkhandi, Mysuru, Vijayapura, Bidar and Kalaburgi.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report