Fabry Disease Market Size

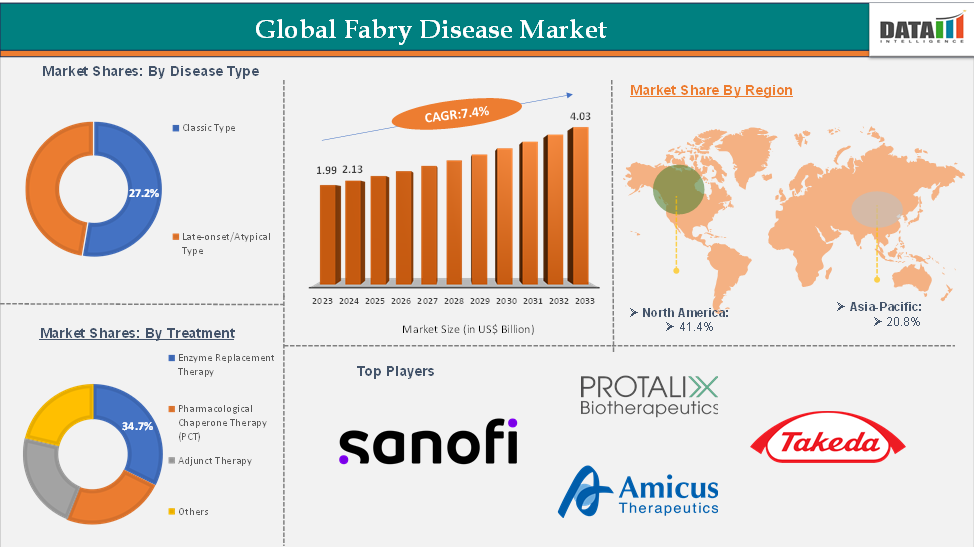

In 2023, the global Fabry disease market was valued at US$ 1.99 Billion. The global Fabry disease Market size reached US$ 2.13 Billion in 2024 and is expected to reach US$ 4.03 Billion by 2033, growing at a CAGR of 7.4% during the forecast period 2025-2033.

Fabry Disease Market Overview

Fabry disease is a rare inherited lysosomal storage disorder caused by the accumulation of globotriaosylceramide in cells, leading to progressive damage to various organs, including the heart, kidneys, and nervous system. The market for Fabry disease treatment is primarily driven by increasing awareness, advancements in diagnostic techniques, and the growing availability of enzyme replacement therapies (ERT) and gene therapies. Strategic collaborations among biotech companies and healthcare institutions, as well as the expanding focus on rare disease research, present significant growth opportunities.

North America currently dominates the Fabry disease treatment market, driven by strong healthcare infrastructure, early adoption of novel therapies, and robust R&D investment. However, the Asia-Pacific region is emerging as the fastest-growing market, propelled by improving healthcare access, increasing patient diagnosis rates, and supportive government initiatives aimed at addressing rare diseases.

Fabry Disease Market Executive Summary

Fabry Disease Market Dynamics: Drivers & Restraints

Increasing awareness and diagnosis of rare genetic disorders are significantly driving the Fabry disease market growth

With growing education initiatives targeting both healthcare professionals and the public, rare conditions like Fabry are being recognized more frequently, reducing diagnostic delays that have historically hindered timely care. This heightened awareness is also encouraging governments and healthcare systems to invest in genetic screening programs and rare disease registries, further aiding identification efforts. For instance, the Japan Ministry of Health, Labour and Welfare expanded its national rare disease screening framework to include Fabry disease as part of its newborn screening panel, aiming to improve early detection and access to therapy.

Similarly, in January 2025, NORD (National Organization for Rare Disorders) launched a new U.S.-based awareness campaign specifically focused on lysosomal storage disorders, including Fabry disease, to promote genetic testing and reduce misdiagnosis rates. These efforts reflect a broader global push to close the diagnostic gap, which in turn is expected to significantly boost demand for Fabry-specific therapies in the coming years.

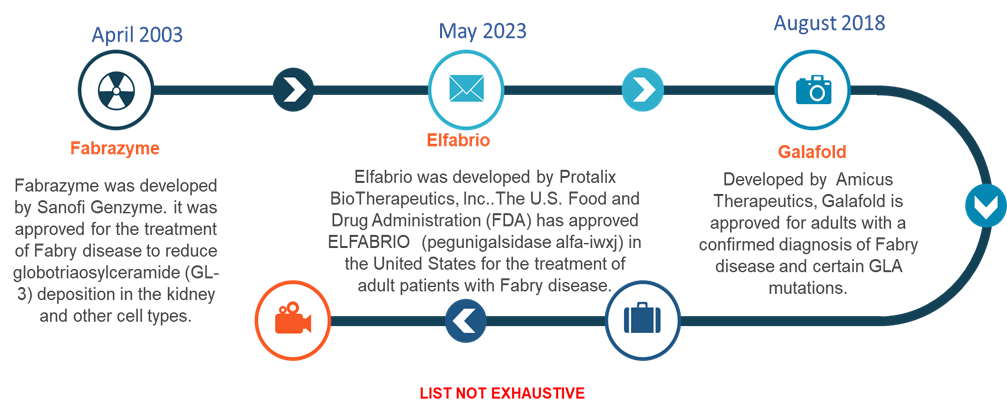

Currently Approved Treatments

Advancements in enzyme replacement therapy (ERT) and gene therapy are significantly driving the Fabry disease market growth

Advancements in enzyme replacement therapy (ERT) and gene therapy are expected to significantly drive the growth of the Fabry disease market, as they represent a shift toward more targeted, effective, and potentially durable treatment options. ERT has long been the standard of care, and continued improvements in its formulation and delivery are enhancing patient outcomes and convenience.

At the same time, gene therapy is emerging as a promising frontier, aiming to provide long-lasting therapeutic benefits through a single administration. These innovations are not only addressing the limitations of current treatments but also attracting increased regulatory and commercial interest.

Regulatory bodies are showing growing support for gene therapies aimed at Fabry disease. For instance, in October 2024, Sangamo Therapeutics announced a successful interaction with the U.S. FDA, securing a clear regulatory pathway to Accelerated Approval for ST-920, its gene therapy candidate for Fabry disease, highlighting the agency’s receptiveness to transformative therapies.

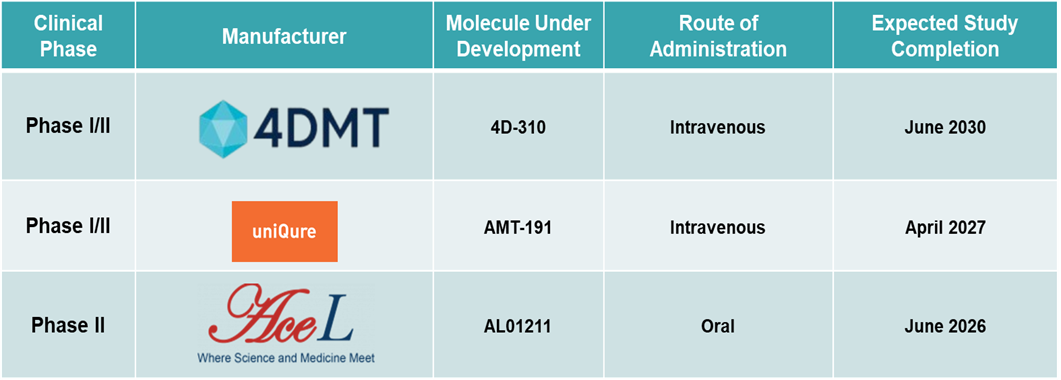

Biotech companies are actively expanding their gene therapy pipelines with support from orphan drug incentives. For instance, in September 2024, uniQure received Orphan Drug Designation from the FDA for AMT-191, further underscoring the momentum in gene therapy development for Fabry.

Meanwhile, innovation in enzyme therapies is progressing in parallel, with new candidates entering early-stage clinical development. For instance, in September 2024, GC Biopharma and Hanmi Pharmaceutical received IND clearance from the FDA for their joint ERT candidate LA-GLA (GC1134A/HM15421) to initiate Phase 1/2 clinical trials, reflecting continued advancements in enzyme-based treatment options.

These developments demonstrate how cutting-edge therapeutic strategies are expanding the treatment landscape and accelerating growth in the Fabry disease market.

Restraint:

The high cost of treatment is expected to hamper the growth of the Fabry disease market

The high cost of treatment is a major factor expected to hamper the growth of the Fabry disease market, particularly in low- and middle-income regions where access to advanced therapies remains limited. Enzyme replacement therapies (ERT), which are the current standard of care, can cost a huge amount per patient annually, placing a significant financial burden on healthcare systems and patients alike. This limits widespread adoption, especially in countries lacking robust insurance coverage or rare disease reimbursement policies.

For instance, according to the data given, Amicus Therapeutics Inc. has priced Galafold (migalastat) at $315,000 per year, and Fabrazyme (agalsidase beta), from Sanofi Genzyme, is another medication used to treat Fabry disease. Fabrazyme is reported to cost roughly $340,000. But these costs may vary depending on the insurance coverage, but still, it will be a burden to an individual with limited financial resources.

Opportunity:

Development of next-gen gene therapies is expected to create a lucrative opportunity for the growth of the Fabry disease market

The development of next-generation gene therapies presents a highly lucrative opportunity for the Fabry disease market by offering the potential for long-term, and possibly curative, treatment options. Gene therapies aim to address the root cause of the disease by delivering functional copies of the defective GLA gene. This could significantly reduce or even eliminate the need for repeated treatments, improving patient outcomes and quality of life.

As clinical trials for AAV-based and lentiviral gene therapies advance, early data showing sustained enzyme activity and reduced substrate accumulation are generating strong interest from both investors and the medical community.

Additionally, regulatory agencies are offering fast-track and orphan drug designations for gene therapy candidates, accelerating development timelines and market entry. With increasing R&D investment, strategic partnerships, and growing support for innovative treatment models, next-gen gene therapies are expected to transform the Fabry disease market and unlock substantial market growth.

Pipeline Analysis:

For more details on this report – Request for Sample

Fabry Disease Market, Segment Analysis

The global Fabry disease market is segmented based on disease type, treatment, route of administration, and region.

The enzyme replacement therapy (ERT) from the treatment segment is expected to hold 34.7% of the market share in 2024 in the Fabry Disease Market

The enzyme replacement therapy (ERT) segment is expected to dominate the Fabry disease market due to its established clinical efficacy, increasing regulatory approvals, and continuous advancements in therapeutic formulations. For instance, on May 10, 2023, Chiesi Global Rare Diseases announced FDA approval for ELFABRIO (pegunigalsidase alfa-iwxj) for the treatment of adult patients with Fabry disease in the United States. This approval reinforces ERT’s central role in disease management by expanding the range of available therapeutic options, particularly for patients who have limited alternatives.

This regulatory success not only marks a significant milestone in Fabry disease treatment but also reflects the growing investment and commercial confidence in the enzyme replacement therapy space. For instance, in May 2023, Protalix BioTherapeutics confirmed eligibility to receive a $20 million milestone payment from Chiesi Global Rare Diseases, triggered by the FDA approval of ELFABRIO. These developments highlight the strong commercial momentum and continued investment in ERT solutions.

The long-standing use of ERT as a standard of care, combined with its ability to directly address the underlying enzyme deficiency in Fabry patients, supports its leading market position. Furthermore, the increasing global focus on early diagnosis and treatment initiation further drives demand for enzyme-based therapies, solidifying the segment’s dominance in the Fabry disease treatment market.

Fabry Disease Market, Geographical Analysis

North America is expected to dominate the global Fabry disease market with a 41.4% share in 2024

North America is expected to dominate the Fabry disease market, driven by its advanced healthcare infrastructure, strong regulatory support, high awareness levels, and robust investment in rare disease research. The region benefits from widespread access to diagnostic tools, early adoption of innovative therapies, and a well-established reimbursement framework that encourages treatment uptake.

Additionally, the U.S. FDA’s proactive stance in supporting rare disease drug development through fast-track approvals and orphan drug designations continues to attract major biopharmaceutical players. For instance, in September 2024, Exegenesis Bio announced that the U.S. FDA granted Orphan Drug Designation (ODD) to EXG110, its novel gene therapy for Fabry disease, underscoring the region’s regulatory commitment to accelerating treatment options.

Similarly, in September 2024, uniQure received ODD from the FDA for AMT-191, its investigational gene therapy targeting Fabry disease, further reflecting the momentum of gene therapy development in the U.S. These developments highlight North America’s leadership in advancing therapeutic innovation and fostering a supportive environment for rare disease markets like Fabry.

Asia-Pacific is growing at the fastest pace in the Fabry disease market holding 20.8% of the market share

Asia-Pacific is emerging as the fastest-growing region in the Fabry disease market due to a combination of improving healthcare infrastructure, rising awareness of rare diseases, and growing access to advanced diagnostic tools such as genetic and enzyme testing. Pharmaceutical companies are also investing in the region by entering strategic partnerships, launching clinical trials, and establishing regional manufacturing and distribution networks to address the unmet needs

Fabry Disease Market Competitive Landscape

Top companies in the Fabry disease market include Sanofi, Protalix BioTherapeutics, Inc., Amicus Therapeutics, Inc., and Takeda Pharmaceutical Company Limited, among others.

Fabry Disease Market Scope

Metrics | Details | |

CAGR | 7.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Disease Type | Classic Type, Late-onset/Atypical Type |

Treatment | Enzyme Replacement Therapy, Pharmacological Chaperone Therapy (PCT), Adjunct Therapy, Others | |

Route of Administration | Oral, Intravenous, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Fabry disease market report delivers a detailed analysis with 44 key tables, more than 46 visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here