Global Epilepsy Drugs Market Size - Industry Trends & Outlook

The global market for epilepsy drugs is gaining traction due to a mix of key developments. A growing number of antiepileptic drugs are receiving approval, while pharmaceutical companies are increasing their focus on research, innovation, and funding. At the same time, greater public awareness around epilepsy is leading to more diagnoses and improved access to treatment. These shifts are setting the stage for continued progress in the market, with strong potential for new drug advancements and broader availability of care.

Global Epilepsy Drugs Market Executive Summary

Global Epilepsy Drugs Market Dynamics: Drivers & Restraints

Advancements in Drug Development is Expected to Drive the Epilepsy Drugs Market

Advancements in drug development are significantly shaping the epilepsy treatment landscape, offering new hope for patients and driving market growth. In March 2022, Marinus Pharmaceuticals, Inc. disclosed that its ZTALMY (ganaxolone) oral suspension received approval from the U.S. Food and Drug Administration (FDA) for the treatment of seizures linked to cyclin-dependent kinase-like 5 deficiency disorder (CDD), A uncommon genetic form of epilepsy that impacts individuals aged two years and above. This achievement highlights the company's dedication to meeting unfulfilled medical needs within the field of neurological disorders.

ZTALMY, a neuroactive steroid that enhances the function of the GABAA receptor as a positive allosteric modulator, marked a breakthrough as the first FDA-approved treatment exclusively for CDD. It was made accessible through a designated specialty pharmacy beginning in July 2022.

These advancements underscore a shift towards personalized and targeted therapies in epilepsy treatment, enhancing efficacy and safety profiles. As research continues, the epilepsy drug market is poised for further innovation and growth.

Adverse Effects Associated with the Drugs are Expected to Hinder the Epilepsy Drugs Market

The adverse effects associated with antiepileptic drugs (AEDs) significantly impact patient adherence to treatment, which in turn affects the overall effectiveness of epilepsy management and hinders the epilepsy drugs market growth. AEDs are known to cause a range of side effects, including drowsiness, fatigue, gastrointestinal issues (such as nausea and vomiting), and cognitive impairment (including difficulties with concentration and memory). These adverse effects can be especially troubling and may significantly impact a patient's well-being, leading them to discontinue their medication.

Global Epilepsy Drugs Market Segment Analysis

The global epilepsy drugs market is segmented based on disease type, drug type, route of administration, and region.

Drug Type:

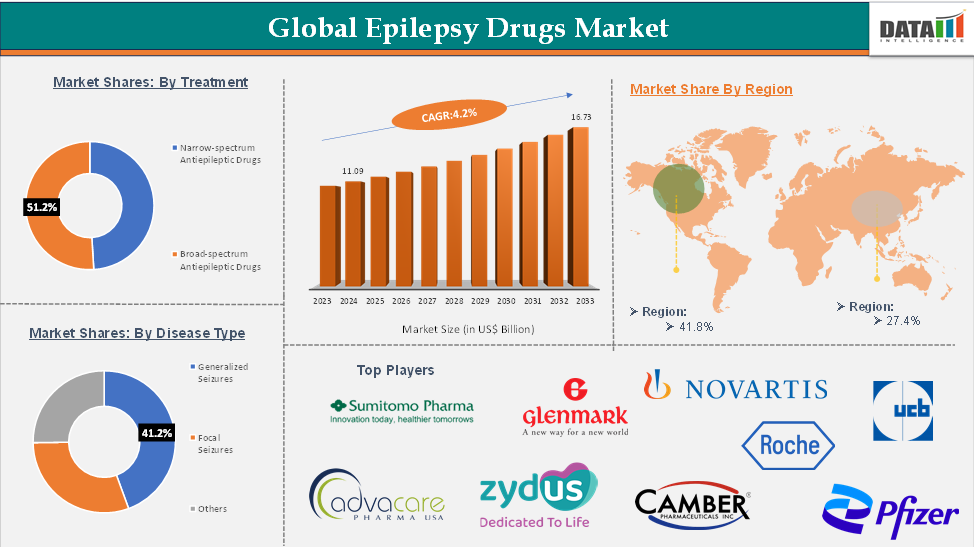

The broad-spectrum antiepileptic drugs segment was valued at US$ 5.6 billion in 2024 and is estimated to reach US$ 8.5 billion by 2033, growing at a CAGR of 4.0%.

Broad-spectrum antiepileptic drugs (AEDs) are expected to maintain their lead in the epilepsy drugs market due to their ability to treat both focal and generalized seizures, making them suitable for a wide range of patients.

Recent developments further support the dominance of the segment. For instance, in July 2024, Glenmark Pharmaceuticals received final approval from the U.S. FDA for its generic version of Topiramate, a widely used broad-spectrum AED. Topiramate is a versatile medication known for its effectiveness in managing different types of seizures, including those related to epilepsy, as well as for preventing migraines.

Additionally, in May 2024, Eisai Co., Ltd. announced that it has received approval in China for the expanded indication of its in-house developed antiepileptic drug (AED), Fycompa (perampanel hydrate). The approval grants Fycompa authorization for use as an adjunctive therapy in treating primary generalized tonic-clonic seizures in epilepsy patients aged 12 and older.

These advancements demonstrate that the segment holds a dominant position in the epilepsy drugs market. Additionally, the demand for broad-spectrum drugs is expected to increase during the forecast period.

Epilepsy Drugs Market Geographical Analysis

North America was valued at US$ 4.63 billion in 2024 and is estimated to reach US$ 6.99 billion by 2033, growing at a CAGR of 3.9%.

North America holds a dominant position in the global epilepsy drugs market and is expected to maintain the largest share in the coming years. A key factor driving this growth is the rising number of individuals diagnosed with epilepsy, particularly among the aging population. As people age, they face increased risks of neurological conditions and brain injuries, both of which can lead to epilepsy, thereby increasing demand for antiepileptic drugs (AEDs) tailored to older adults.

According to the Centers for Disease Control and Prevention (CDC), as of May 2024, nearly 3 million adults in the U.S. are living with epilepsy. Additionally, approximately 456,000 children under the age of 17 are affected by active epilepsy. From 2021 to 2022, an estimated 2.9 million U.S. adults reported having active epilepsy, highlighting the widespread and ongoing impact of the condition.

Several factors contribute to North America's strong position in this market, including the presence of major pharmaceutical companies, a highly developed healthcare infrastructure, supportive government initiatives, and active research and awareness campaigns. Regulatory agencies like the U.S. Food and Drug Administration (FDA) play a pivotal role by fast-tracking approvals and expanding treatment options.

For instance, in April 2025, Neurelis, Inc. announced that the FDA had approved VALTOCO (diazepam nasal spray) for the short-term treatment of seizure clusters in individuals aged 2 and older. Using INTRAVAIL technology, VALTOCO enables enhanced, noninvasive intranasal delivery of diazepam. It was also granted orphan drug exclusivity for being clinically superior to the rectal gel form.

Asia-Pacific is expected to hold 27.4% of the global epilepsy drugs market

The Asia-Pacific region is emerging as the fastest-growing market for epilepsy drugs, driven by its large population base and high prevalence of the condition. According to a 2023 research article published by BioMed Central Ltd (BMC), approximately 23 million people in Asia are affected by epilepsy, representing nearly half of the global epilepsy burden. This is particularly concerning in regions with limited access to healthcare resources.

Additionally, the World Health Organization (WHO) reports that around 50 million people worldwide live with epilepsy, and strikingly, about 20% of them are in India alone. These factors are fueling demand for antiepileptic drugs, with pharmaceutical companies responding through increased product launches tailored to the region.

Japan is experiencing significant growth in the epilepsy drugs market, driven by a combination of demographic trends, healthcare advancements, and active involvement from pharmaceutical companies. The country’s aging population contributes to a higher incidence of epilepsy, leading to increased demand for effective treatments. In response, Japan's robust healthcare infrastructure and regulatory environment support the development and adoption of innovative therapies.

Key players in the Japanese market are actively launching new antiepileptic drugs (AEDs) to address the evolving needs of patients. For instance, in January 2024, Eisai Co., Ltd. received approval in Japan for an injectable form of its antiepileptic drug Fycompa, offering an option for patients who can't take it orally. Developed in-house, Fycompa reduces seizure activity by selectively blocking AMPA receptors in the brain.

These developments highlight Japan's proactive approach in expanding treatment options for epilepsy, positioning it as the fastest-growing country in the Asia-Pacific region's epilepsy drugs market.

Epilepsy Drugs Market Competitive Landscape

The top companies in the epilepsy drugs market include Novartis AG, Hoffmann-La Roche Limited, Pfizer Inc., UCB, Inc., Sumitomo Pharma America, Inc., Camber Pharmaceuticals, Inc., Glenmark Pharmaceuticals Inc., AdvaCare Pharma, Zydus Healthcare Limited, among others.

Epilepsy Drugs Market Key Developments

- In February 2025, Biogen Inc. and Stoke Therapeutics, Inc. announced a collaboration to develop and commercialize zorevunersen in all regions outside the U.S., Canada, and Mexico. Zorevunersen is an investigational antisense oligonucleotide (ASO) designed to target the SCN1A gene, which is the primary cause of most Dravet syndrome cases.

- In April 2024, Eisai Co., Ltd. announced the launch of the intravenous (IV) injection formulation of its in-house developed antiepileptic drug, Fycompa (perampanel hydrate), in Japan.

Global Epilepsy Drugs Market Scope

| Metrics | Details | |

| CAGR | 16.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Generalized Seizures, Focal Seizures, Others |

| Treatment | Narrow-spectrum Antiepileptic Drugs, Broad-spectrum Antiepileptic Drugs | |

| Route of Administration | Oral, Parenteral | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global epilepsy drugs market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.