Market Overview

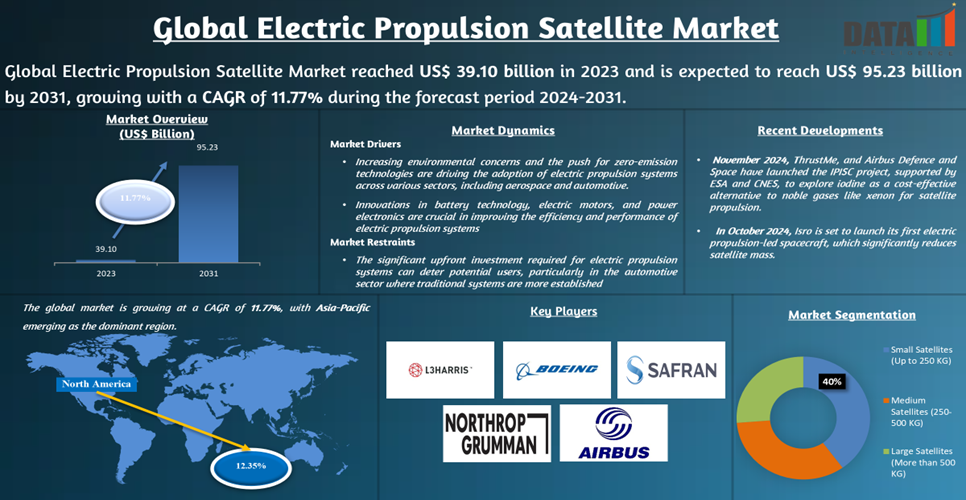

Global Electric Propulsion Satellites Films Market reached US$39.10 billion in 2023 and is expected to reach US$95.23 billion by 2031, growing with a CAGR of 11.77% during the forecast period 2024-2031, according to DataM Intelligence report.

The electric propulsion satellites market is experiencing growth as a result of the growing demand for cost-effective and efficient propulsion systems, as well as the most recent advancements in satellite technology. The propulsion systems enable the use of electric thrust instead of conventional chemical propulsion, thereby extending the operational duration and optimizing fuel consumption, thereby reducing the cost of launch.

The growth of this market will be further fueled by the increased deployment of satellites for earth observation, communication and other applications. The electric propulsion market is going to experience transformative changes as a result of the emergence of small satellite constellations and cube satellites. Utah State University predicts that 2080 nanosatellites launched from the beginning of 2022 to the end of 2027. CubeSats are small, extremely inexpensive satellites that are used for a variety of applications, including remote sensing, research and communications.

Asia-Pacific is the fastest-growing region in the electric propulsion satellites market, driven by countries such as India, China, South Korea, and Japan. In India, the Indian Space Research Organisation (ISRO) has made a significant stride forward by deploying its GSAT-9 communication satellite, which is powered by electric propulsion. India's Ministry of Science and Technology also indicates that the country intends to establish an entire ecosystem for electric propulsion technology by 2030, with the objective of fostering international collaboration and indigenous production.

Executive Summary

Market Scope

| Metrics | Details |

| CAGR | 11.77% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Orbit, Type, Size, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report -Request for Sample

Market Dynamics

Increasing Demand for Low-Cost Satellite Launch Solutions

The growing emphasis on cost reduction in satellite launches is a critical driver for the electric propulsion satellite market. Chemical propulsion is typically more fuel-intensive due to its denser nature, which results in higher launch costs. In contrast, electric propulsion systems are lighter and more fuel-efficient. An EDI press release asserts that the implementation of electric propulsion may reduce the launch weight by up to 50%, thereby enabling the deployment of additional payloads.

Governments are also interested in these low-cost alternatives to provide support to national space programs. For example, the U.S. Federal Communications Commission (FCC) has allocated $20 billion for the Rural Digital Opportunity Fund, which relies on satellite connectivity powered by advanced propulsion systems. Within the near future, it seems that electric propulsion will be at the vanguard of economics and sustainability in satellite operations.

Rising Energy Demand and Climate Goals

The demand for earth-weather and communications satellites is driven by the increasing need for real-time data to ensure the efficient operation of weather forecasts, disaster management and global communications. The satellite's capability is enhanced by electric propulsion systems, which enable the execution of long-duration missions with greater efficiency. The National Oceanic and Atmospheric Administration has verified that the number of Earth observation (EO) satellites has increased exponentially over the past decade, growing by 714.37% from 2013 to 2023.

Space-based communication and observation programs are receiving substantial investment from governments worldwide. For instance, the European Union's state-of-the-art Copernicus space-based earth observation program extensively integrates satellites with electric propulsion technology to ensure the precise and expeditious delivery of data. This is expanding the availability of satellite solutions to address climate challenges and bridge digital disparities.

High Initial Development Costs

The development of electric propulsion satellites is a complex process in terms of both technical and financial aspects. Small and medium-sized space companies are typically discouraged from utilizing electric propulsion due to these types of expenses. The development cost mitigation of electric propulsion systems will be significantly influenced by initiatives such as NASA's Small Business Innovation Research (SBIR) program, which will facilitate their widespread adoption.

Moreover, the supply chain for electric propulsion components has been severely restricted, as evidenced by the ion thrusters and Hall effect thrusters. Thus, procurement costs have increased and satellite production schedules have been delayed. As a result of their limited human capital, emerging space countries such as South Africa and Brazil are unable to identify local technology capable of fulfilling the task, necessitating the use of imports. To mitigate this, government and private stakeholders collaborate to establish funding mechanisms and research initiatives.

Market Segment Analysis

The global electric propulsion satellite films market is segmented based on orbit, type, size, application, end-user and region.

Growing Demand for Electric Propulsion in Earth Observation and Sciences

The operational efficiency, accuracy, and duration of satellites for earth observation and science missions will be revolutionized by electric propulsion systems. Earth observation satellites are employed in a variety of applications, including environmental monitoring, disaster management, climate studies, and resource management. Electric propulsion satellites are capable of maintaining stable orbits for extended periods and executing precise movements that are necessary for the acquisition of high-resolution images and data.

Electric power is also advantageous for space missions. For instance, the Aeolus satellite, operated by the European Space Agency (ESA), employs electric propulsion to improve the comprehension of wind patterns on Earth, thereby enhancing the accuracy of weather forecasts and climate models. Additionally, electric propulsion reduces the cost of missions and is associated with numerous satellites in a constellation, thereby enabling the continuous real-time observation of any location on the Earth's surface.

Market Geographical Share

Advanced Space Infrastructure and Robust Government Support in North America

The electric propulsion satellite industry is currently dominated by North America, due to the strong foundation in space infrastructure and the exceptional support of governments, particularly agencies such as NASA, which launch satellites in the region. Electric propulsion is utilized by the majority of satellites launched globally, and US accounts for nearly 40% of global satellite launches. This feature facilitates sustainable and efficient operation in the country. With its robust research and development investment base and the presence of industry key players such as Boeing and SpaceX, North America continues to enhance its market offerings.

Furthermore, the US government's Space Policy further fortifies this market by promoting the adoption of cost-effective satellite technology. Simultaneously, Canada is making substantial investments in electric propulsion technologies for its earth observation and communication satellites, a reflection of the significance of the development of space capabilities. This trend is also facilitated by the anticipation of large-scale satellite launches to provide services, such as broadband internet, to underserved areas.

Competitive Landscape

The major global players in the market include Accion Systems, Ad Astra Rocket, L3Harris Technologies, Inc., Safran Group, Airbus, ArianeGroup, Boeing, Lockheed Martin and Northrop Grumman and Thales.

Sustainability Analysis

Electric propulsion systems significantly contribute to the sustainability of the satellite industry by reducing the consumption of chemical propellants and minimizing the environmental impact. Satellites that operate with electric propulsion emit substantially less greenhouse gases during their launch and operation, according to the United Nations Office for Outer Space Affairs (UNOOSA).

Additionally, these systems are cost-effective in resource-dependent systems since they extend the lifespan of satellites, necessitating rarely replacements. Efforts by organizations such as the European Space Agency (ESA) to produce satellite components that are both eco-sustainable and recyclable are in alignment with the objectives of global sustainability. Electric propulsion systems are anticipated to provide an advantage in the development of an environmentally sustainable space industry due to the growing demand for green technologies.

By Orbit

- Low Earth Orbit (Up to–2,000 KM)

- Medium Earth Orbit (2,000–35,000 KM)

- Geostationary Orbit (More than 35,000 KM)

By Type

- Full Electric

- Hybrid

By Size

- Small Satellites (Up to 250 KG)

- Medium Satellites (250-500 KG)

- Large Satellites (More than 500 KG)

By Application

- Earth Observation & Sciences

- Navigation

- Telecommunication

- Astronomy

- Interplanetary & Space Exploration

- Others

By End-User

- Government

- Defense

- Research Institute

- Commercial

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In November 2024, ThrustMe and Airbus Defence and Space have launched the IPISC project, supported by ESA and CNES, to explore iodine as a cost-effective alternative to noble gases like xenon for satellite propulsion. Focused on satellites over 500 kg, the project evaluates iodine's impact on satellite materials and components to meet the demands of long-duration missions.

- In October 2024, Isro is set to launch its first electric propulsion-led spacecraft, which significantly reduces satellite mass. Upcoming missions include Gaganyaan in 2026, Chandrayaan-4 in 2028 and Chandrayaan-5 post-2028. The Indo-US NISAR satellite is prepped for a February launch, advancing earth imaging technology.

- In August 2024, Safran strengthening its U.S. footprint by establishing a new manufacturing facility in Colorado to produce the “Made-in-the-USA” EPS®X00 electric propulsion system, targeting the booming North American small satellite market, projected to surpass US$ 5 billion by 2030.

Why Purchase the Report?

- To visualize the global electric propulsion satellite films market segmentation based on orbit, type, size, application, end-user, and region.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points at the electric propulsion satellite films market level for all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global electric propulsion satellite films market report would provide approximately 78 tables, 73 figures and 203 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies