Education Technology Market Size

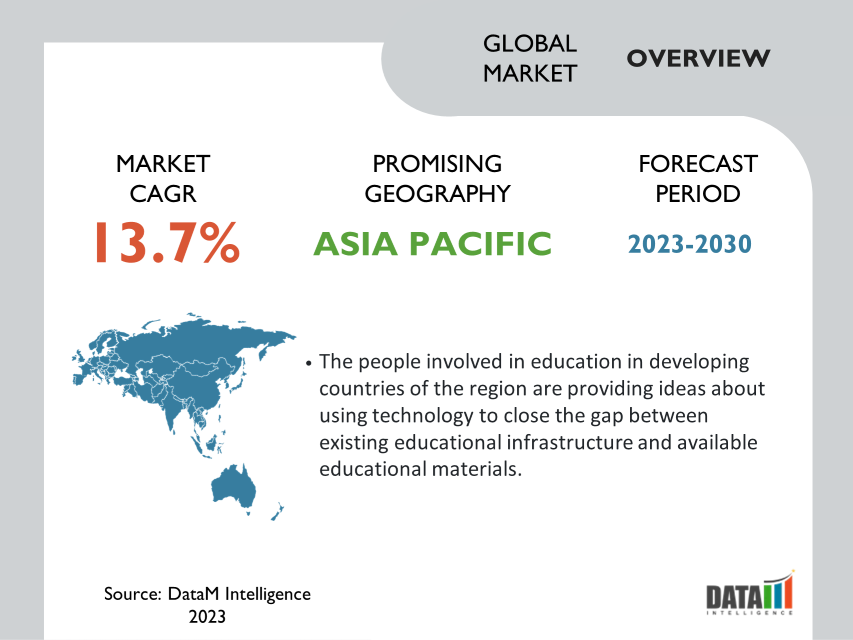

Global Education Technology (EdTech) Market reached USD 125.41 billion in 2022 and is expected to reach USD 404.6 billion by 2031, growing with a CAGR of 13.7% during the forecast period 2024-2031. Increasing student involvement is becoming one of top priorities educators.

As a result, market players respond to the concerns by releasing innovative interactive technologies, driving the expansion of the global education technology market.

During the forecast period of 2023–2030, Asia-Pacific is expected to experience significant growth, accounting for about 1/4th of the global education technology (EdTech) market. China's educational institutions have been experimenting with using AI in the classroom. For instance, the Jinhua Xiaoshun Primary School in eastern China recently assessed children' focus levels using headbands made by the American company BrainCo. The headband would transmit information about how engaged the kids were in real-time.

Market Scope

| Metrics | Details |

| CAGR | 13.7% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Sector, Deployment, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For More Insights Request Free Sample

Market Dynamics

The Growing Preference of Digital Learning

Compared to printed content, which has greater manufacturing costs, digital content is simpler to create. A larger user base can easily translate and retrieve digital books which are readily available in various languages. Additionally, students can listen to educational content in an audio format to expand their vocabulary and promote better interpretive reading, especially those with physical limitations.

For instance orbitNote, a pdf-enabled app, was introduced in January 2022 by Texthelp Ltd., a well-known assistive technology provider for the EdTech sector. It would be beneficial for students who are visually impaired to access the document by recording voice notes. OrbitNote will also allow users to interact with digital copies in completely new ways.

The Rising Investments in EduTech Sector

Increasing student involvement is becoming one of educators' top priorities. The market players have developed advanced interactive apps, whiteboards and switched from projector-based displays to touchscreen displays. For instance, in January 2023, an ed-tech business called Creative Galileo announced the launch of the educational learning app Toondemy. It provides educational materials for students aged 3-10 years in line with NEP, NCERT and CBSE.

The venture capitalist heavily invested in corporate or professional education and skill development. The high demand for software professionals makes the IT sector appear huge. For instance, U.S. Bureau of Labor Statistics anticipates a 22.2% increase in job opportunities by the end of the decade. People who desire to enter the IT sector have a clear path thanks to online programming classes and other edtech tools.

High Costs and Data Privacy Concerns

The high cost of establishing and maintaining technology-based educational programs is one of the major problems facing the global edtech market. It was necessary to make large investments in hardware, software and teacher training in order to integrate education technology. Some educational institutions find the expense of the technology to be excessive, particularly those with limited funds.

Educational institutions must make the necessary infrastructure investments, specifically those in hardware like laptops, tablets and interactive whiteboards, in order to fully utilize the potential of edtech. A seamless edtech experience requires hardware as well as software licensing, networking tools and dependable internet connectivity. The upfront infrastructure requirements may be expensive for many schools, those in low-income areas or developing nations.

Market Segmentation Analysis

The global education technology (EdTech) market is segmented based on type, sector, deployment, end-user and region.

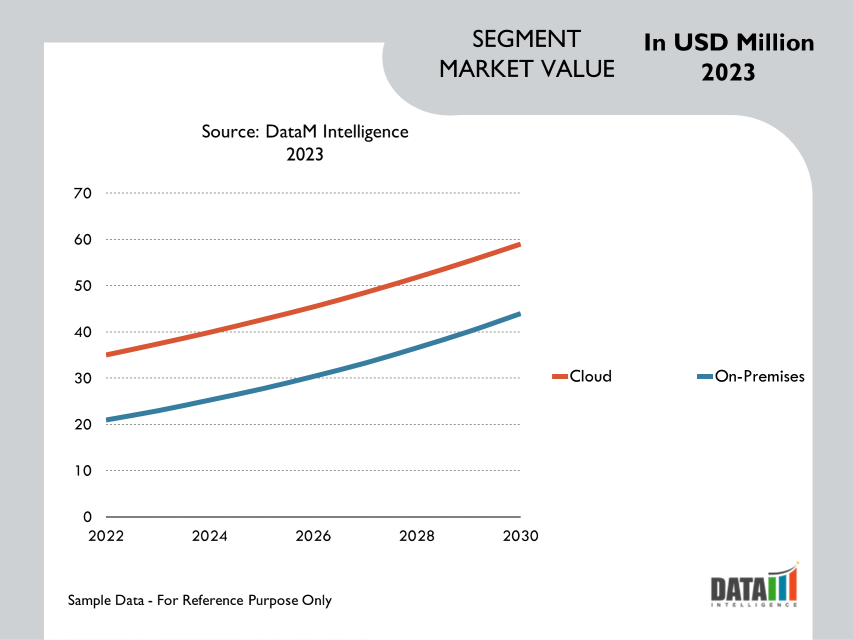

The High Reliability on On-Premises Deployment

During the forecast period, on-premises deployment is expected to hold more than 60.7% of the global education technology (EdTech) market. The greater market share is attributed to the EdTech sector's dependability and scalability of utilization. Installing software or services on the company's systems or premises is referred to as on-premises deployment. It is in charge of providing software maintenance services as well as maintaining, licensing and distributing on-premises and mobile software products.

The on-premises deployment provides professional services, including educational services. It exceeds other platforms in terms of security. For instance, Knowledgehut Solutions Private Limited, a significant player in the EdTech sector, was bought by upGrad Education Private Limited, an EdTech company, in August 2021. It will enable upGrad Education Private Limited to compete in the market for short-term upskilling and reskilling.

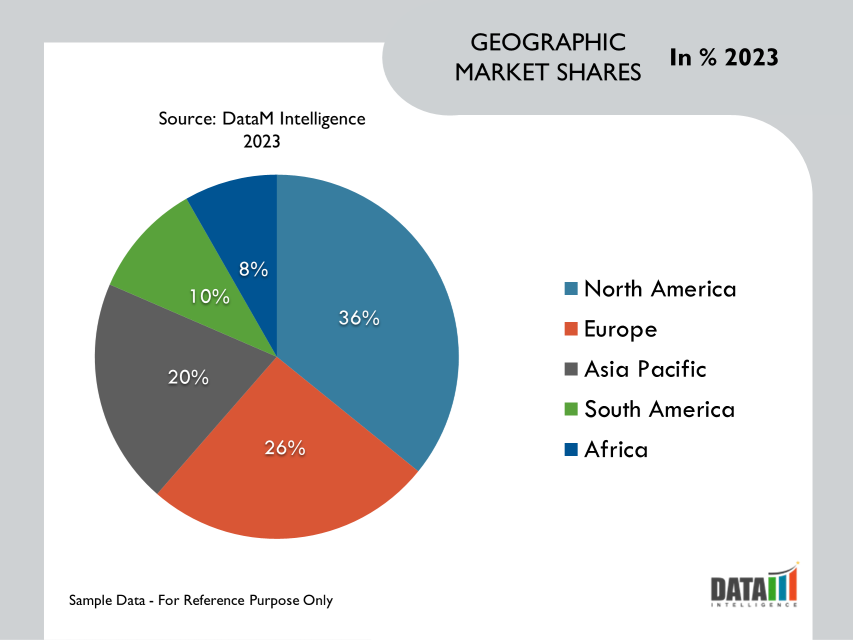

Market Geographical Share

The Growing Investments and Product Developments in North America

North America Education Technology (EdTech) market has witnessed significant growth covering more than 1/3rd of the global market share in 2022. The growth of the region’s market is attributed to a large number of venture capital firms and private equity investors investing in the EdTech sector. For example, Class Technologies Inc., a U.S.-based EdTech platform, raised around USD 105 million in Series B funding in July 2021.

zSpace, Inc., a U.S.-based EdTech startup that provides hybrid or remote learning, released a new AR/VR learning device in January 2022 that will help connect students with multidimensional information in a virtual world without the use of glasses. The incorporation of blockchain technology enables end-users to maintain and safeguard student and learner records, allowing educators to examine the consumption habits of the material supplied to the learners and make data-driven decisions.

Market Key Players

The major global players include Blackboard Inc., Byju’s, Chegg, Inc., Coursera, Inc., Edutech, Edx, Inc., Google Llc, Microsoft, Instructure, Inc. and Udacity.

COVID-19 Impact on Market

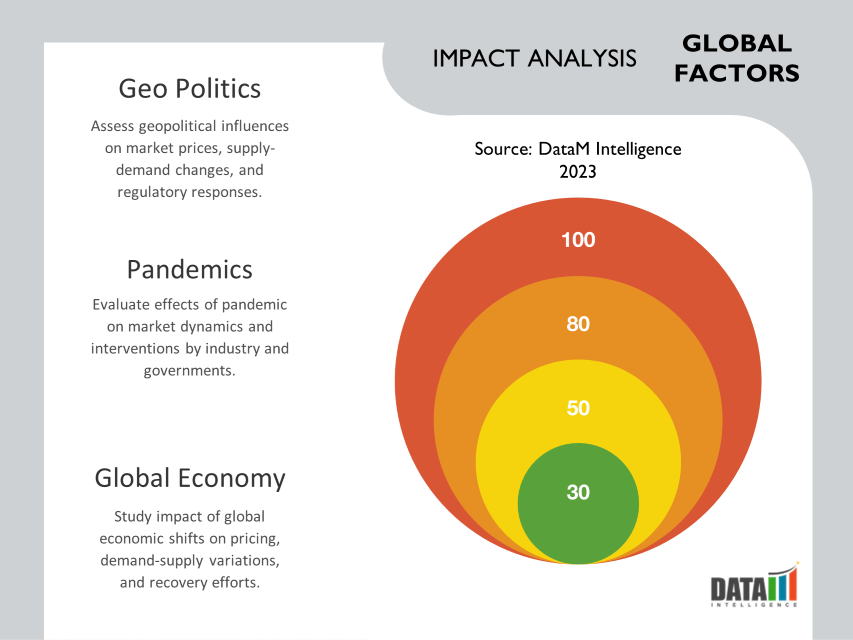

The UNESCO statistics on school closures caused by COVID-19 demonstrate the pandemic's massive impact on education around the world. National educational institution shutdown impacted over 91% of the global student population at their peak, in early April 2020. In total numbers, it means that school closures impacted almost 1,6 billion students in up to 194 nations.

EdTech spending has seen a short-term surge as a result of COVID-19 and is likely to shift to a long-term integration of digital technology and a greater implantation of online education over the next decade. A significant portion of this evolution is directly related to the old and obsolete digital infrastructure in the majority of the public and educational sectors; additionally, educational technologies are becoming more sophisticated and affordable to the majority of institutions.

AI Impact

AI tools have arisen in the sphere of education, resulting in drastic changes and affecting future perspectives. One such development was the introduction of artificial intelligence in education. All schools were shut due to the pandemic. The transition to a remote environment was initially tough not only for children, but also for parents, teachers and educational institutions.

AI analyzes students' learning styles, amount of knowledge and learning speed, finds mistakes and interests, sets smaller goals and guides them step by step toward their ultimate goal. AI analyzes their weaknesses and helps them in converting them into strengths. As students complete small goals, dopamine is produced and they will become continuous learners.

Russia- Ukraine War Impact

Ukraine has about 76,000 foreign students in 2020, according to government statistics. International students have been seeking to return to their home nations since Russia's invasion in February. The few international flights out of Russia and Ukraine are a barrier for many international students. It is made worse by the fact that some students cannot afford to leave the country right away. Though the conflict is taking place on Russian and Ukrainian land, its effects are being felt around the world.

Several universities cut off relations with institutions in Russia. The Massachusetts Institute of Technology has ended its relationship with the Skolkovo Institute of Science and Technology in Moscow due to the Russian government's "unacceptable military actions against Ukraine." Study abroad programs in Russia and Ukraine, as well as in neighboring countries such as Poland, have been discontinued. Current students and scholars may have their research initiatives and education affected as a result of the discontinued ties.

Key Developments

- In March 2022, ViewSonic Corporation, an international provider of communication and electronics, has created myViewBoard, a cloud-based platform that uses AI to help students participate in the classroom. Furthermore, it assesses human posture and environmental factors that may influence students' focus to identify whether or not they are paying attention.

- In January 2022, MyClassCampus (Teachmint Technologies Pvt. Ltd), an ERP platform for educational enterprises, has been acquired by Teachmint Technologies Pvt. Ltd, an online software for students and teachers. Teachmint will be able to increase its offerings in schools and other educational institutions as a result of the acquisition by merging its learning management system (LMS) with the ERP software.

- In June 2021, BYJU, an EdTech online tuition company, partnered with Google LLC to increase the consistency of online learning for students as well as teachers. The partnership will enable educational institutions to provide a customised digital platform for classroom management.

Why Purchase the Report?

- To visualize the global education technology (EdTech) market segmentation based on type, sector, deployment, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of education technology (EdTech) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global education technology (EdTech) market report would provide approximately 69 tables, 67 figures and 203 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies