Dry Ramming Mass Market Size

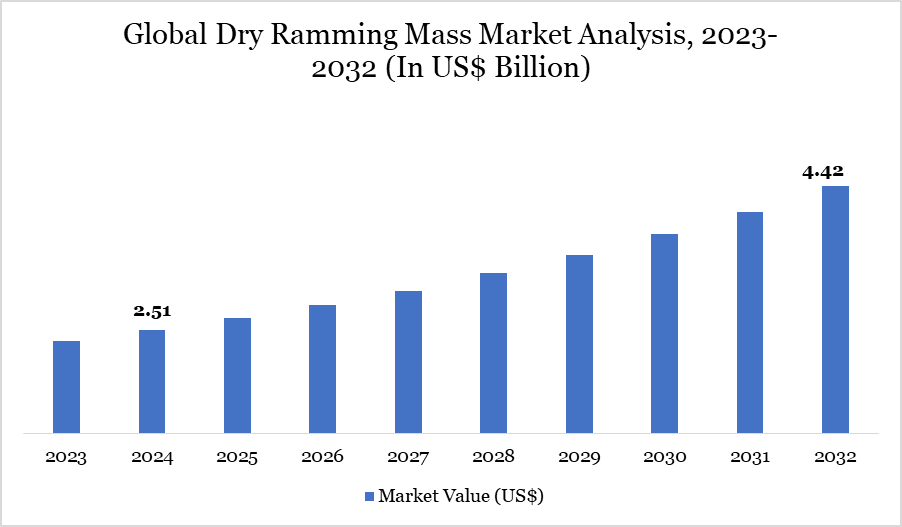

Dry Ramming Mass Market size reached US$ 2.51 billion in 2024 and is expected to reach US$ 4.42 billion by 2032, growing with a CAGR of 7.32% during the forecast period 2025-2032.

Dry ramming mass, a pre-mixed refractory substance consisting of granular pebbles, powders, and binding agents, is seeing increased demand owing to its essential function in the maintenance and construction of high-temperature processing facilities. The increase in industrialization with extensive infrastructure construction has propelled the demand for steel and metal, industries where dry ramming mass is extensively utilized.

The World Steel Association reports that global crude steel output increased from 1,879 million tons in 2020 to 1,951 million tons in 2021, indicating a significant year-over-year growth. This rise is directly associated with heightened requirements for furnace linings, hence enhancing the utilization of dry ramming material.

Government-sponsored megaprojects, including a US$ 1.5 trillion infrastructure initiative including over 7,400 development projects, are enhancing the need for metals and refractory solutions. The material's exceptional thermal efficiency, ease of application, and minimized downtime render it essential in high-temperature industrial operations, positioning it as a vital element in industrial sustainability and productivity.

Dry Ramming Mass Market Trend

A significant factor influencing the dry ramming mass market is the transition towards environmentally sustainable refractory methods. As enterprises face pressure to diminish emissions and comply with regulatory requirements, dry ramming mass is becoming a favored substitute for traditional refractory materials.

The benefits, such as diminished emissions, less waste production, and the possibility of incorporating recycled materials, are becoming increasingly appealing to industrial customers seeking to enhance environmental performance. The advantages are especially notable in steelmaking, power generating, and chemical processing, where refractory materials are crucial yet frequently exacerbate carbon footprints.

Advancements in ramming mass compositions, including those that improve recyclability or decrease energy consumption during installation, highlight the industry's dedication to sustainable development. This increasing awareness is promoting elevated adoption rates, particularly among organizations aiming to align with Environmental, Social, and Governance objectives. As eco-efficiency emerges as a competitive differentiator, the global need for green refractory solutions, such as dry ramming mass, is anticipated to increase.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Type | Alumina Ramming Mass, Silica Ramming Mass, Magnesia-based Ramming Mass, Others |

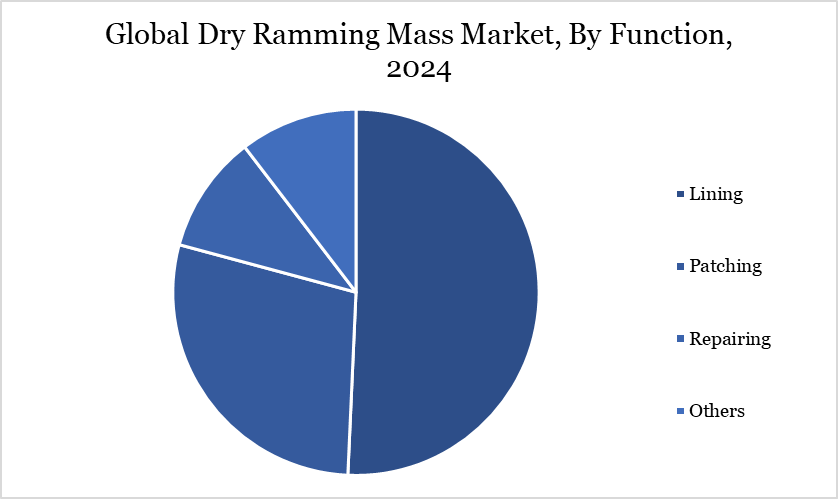

| By Function | Lining, Patching, Repairing, Others |

| By Application | Foundries, Steel, Electric Arc Furnace, Blast Furnace, Non-steel, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dry Ramming Mass Market Dynamics

Increased Demand from the Power and Metallurgical Sectors

A significant non-generic growth stimulus for the dry ramming mass market is its increasing utilization in power generation and metallurgy, where performance under harsh conditions is critical. Dry ramming mass is preferred because to its exceptional temperature stability, corrosion resistance, and minimal maintenance needs.

In the energy sector, it is commonly employed to insulate boilers and furnaces, promoting energy efficiency and minimizing thermal losses. In metallurgy, particularly in steel and aluminum production, dry ramming mass improves furnace longevity and minimizes operating downtime, resulting in economic benefits. The increase in global steel production and infrastructure projects, including trains, highways, and renewable energy installations, has directly enhanced its utilization.

India's US$1.5 trillion National Infrastructure Pipeline has stimulated demand for metal-intensive components, thereby augmenting the usage of dry ramming material in foundries and induction furnaces. The functional adaptability of dry ramming mass across energy and industrial sectors establishes it as a crucial facilitator of high-temperature activities.

High Entry Costs Hindering Wider Adoption

The substantial initial expenditure required for dry ramming mass is a considerable obstacle to market entry, especially for small-scale manufacturers and end users, despite its operating advantages. The cost premium arises from various aspects, including high-quality raw materials, specialized binders, meticulous production methods, and the necessity for skilled workers and application equipment. This renders the material costlier in comparison to conventional refractory alternatives such as castables or bricks. For budget-constrained operations, such as small foundries or independent power producers, the capital expenditure may deter adoption.

Moreover, fluctuating raw material costs, influenced by supply chain disruptions or geopolitical instability, can intensify pricing uncertainty, affecting procurement decisions. Despite the material's expedited drying time and durability suggesting long-term savings, these advantages may not be readily available to all market stakeholders. Thus, the substantial initial expenditure becomes a structural barrier, hindering market penetration and benefiting larger entities capable of absorbing and rationalizing the heightened upfront expenses.

Dry Ramming Mass Market Segment Analysis

The global dry ramming mass market is segmented based on source, type, function, application and region.

Industrial Longevity Fueled by Advanced Lining Solutions

The lining segment dominates the global dry ramming mass market by function, primarily due to its critical role in preserving structural integrity and efficiency in high-temperature industrial processes. Refractory linings offer essential resistance to severe temperatures, mechanical abrasion, and corrosive conditions, rendering them vital in industries such as steel production, energy generation, cement fabrication, and petrochemical processing.

The adaptability of dry ramming mass, a pre-mixed refractory substance, enables its widespread use in lining furnaces, ladles, boilers, and containment vessels. The swift curing time markedly minimizes downtime, facilitating a more immediate return to operations and enhancing overall production. The increasing demand for sophisticated and high-performance refractory linings, fueled by continuous advancements in material science, further stimulates this sector. The extensive use in sectors such as cement, glass, non-ferrous metals, and petroleum strengthens the market position of lining materials, affirming their supremacy in the dry ramming mass market.

Dry Ramming Mass Market Geographical Share

Infrastructure and Industrial Expansion Driving Refractory Demand in Asia-Pacific

The Asia-Pacific area is witnessing substantial demand increase for dry ramming mass, propelled by extensive infrastructural expansion and swift industrialization. Extensive construction initiatives and the development of new industrial facilities in countries such as India, China, and the Philippines are driving the demand for resilient refractory materials that can endure elevated thermal stress.

The region's varied manufacturing sector comprising automotive, electronics, and heavy machinery production depends significantly on furnaces and other high-temperature apparatus, requiring durable refractory linings like dry ramming mass. Government efforts further bolster market expansion.

In 2021, the Philippines budgeted a budget of US$ 6.5 billion to the Department of Public Works and Highways, emphasizing bridges, flood control, and transportation infrastructure as components of an economic recovery strategy. These activities underscore the strategic focus on construction and industrial resilience, bolstering the long-term prospects for dry ramming mass in the Asia-Pacific region.

Sustainability Analysis

The drive for sustainability in refractory materials is increasingly becoming a pivotal concern across all industries. With the tightening of environmental rules and heightened awareness of ecological impact, there is an increasing trend towards the adoption of sustainable solutions. Dry ramming mass has arisen as a sustainable substitute for conventional refractory materials, presenting numerous environmental benefits.

It facilitates diminished emissions and waste production while integrating recycled raw materials into its composition. Furthermore, its utilization augments energy efficiency in high-temperature industrial processes by enhancing thermal insulation and minimizing heat loss. Current research is advancing the creation of environmentally sustainable alternatives, with the objective of reducing the ecological impact linked to refractory manufacturing methods.

These developments correspond with global sustainability objectives and strengthen the industry's shift towards environmentally friendly operations. The demand for dry ramming mass is increasing in industries focused on minimizing their environmental footprint while ensuring operational efficiency and regulatory adherence.

Dry Ramming Mass Market Major Players

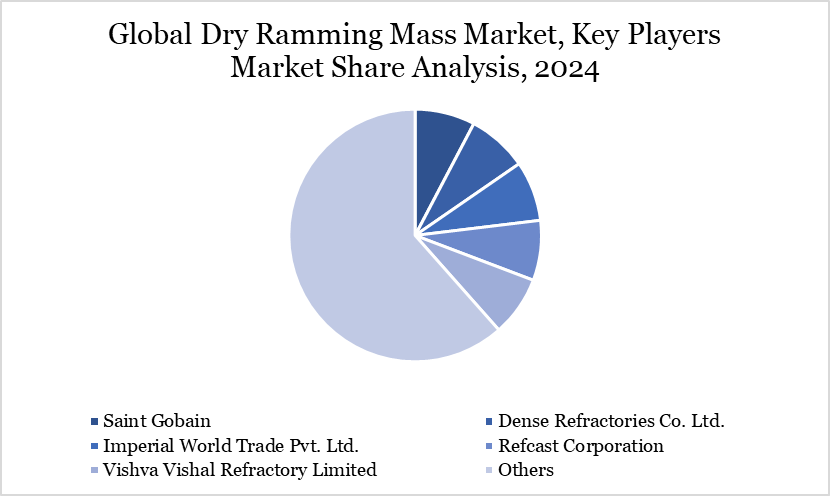

The major global players in the market include Saint Gobain, Dense Refractories Co. Ltd., Imperial World Trade Pvt. Ltd., Refcast Corporation, Vishva Vishal Refractory Limited, Casco Specialty Products, Inc., Gita Refractories Private Limited, Shenghe Refractories, RHI Magnesita N.V. and Henan Xinmi Changxing Refractory Material Co., Ltd.

Key Developments

In 2022, Saint-Gobain, a global leader in building materials and construction solutions, announced a collaboration with Imerys to develop next-generation refractory materials, including dry ramming mass, for the steelmaking industry. This collaboration aims to leverage the expertise of both companies to develop innovative and sustainable refractory solutions.

In 2022, Imerys, a global leader in mineral-based solutions, acquired Kerneos, a French manufacturer of refractory products, including dry ramming mass. This acquisition strengthened Imerys' position in the refractory market and expanded its product portfolio to include a wider range of dry ramming mass solutions.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies