Deep Brain Stimulation Devices Market Size

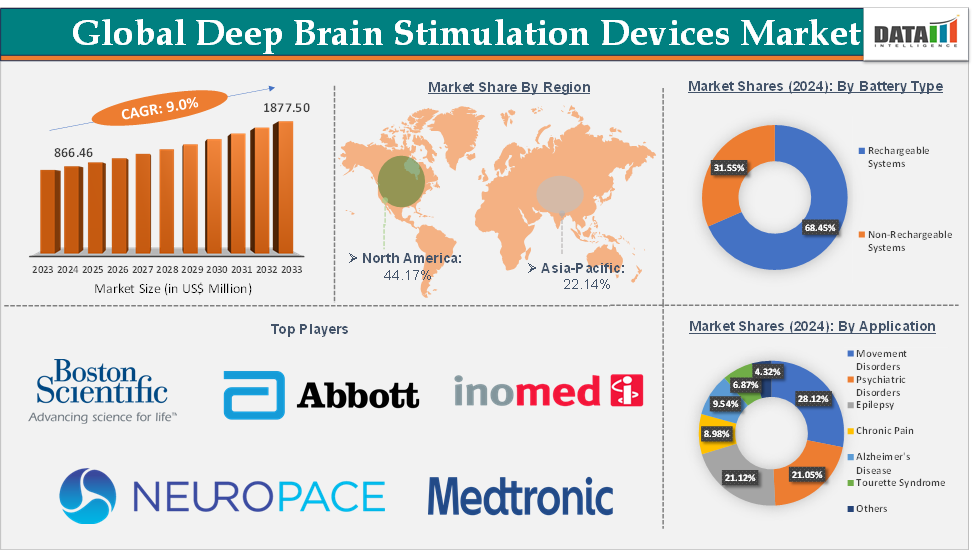

Deep Brain Stimulation Devices Market Size reached US$ 866.46 Million in 2024 and is expected to reach US$ 1,877.50 Million by 2033, growing at a CAGR of 9.0% during the forecast period 2025-2033.

Deep Brain Stimulation Devices Market Overview

The deep brain stimulation devices market is experiencing steady and significant growth driven by the global rise in neurological disorders, technological innovation, and expanding healthcare infrastructure. Deep brain stimulation devices are surgically implanted neurostimulators that deliver electrical impulses to specific targets in the brain, primarily used for treating movement disorders such as Parkinson’s disease, essential tremor, and dystonia, as well as psychiatric conditions like OCD and depression.

Technological advancements are playing a pivotal role in market expansion. Innovations such as MRI-compatible devices, directional leads, closed-loop systems, and rechargeable batteries are enhancing treatment precision, reducing surgical risks, and improving patient comfort and compliance. Integration of wireless and Bluetooth technologies for device monitoring is also becoming more prevalent. Stakeholders that invest in innovation, patient education, and market penetration strategies, especially in underserved regions, are likely to see significant returns in the coming years.

Executive Summary

For more details on this report – Request for Sample

Deep Brain Stimulation Devices Market Dynamics: Drivers & Restraints

Rising technological advancements in DBS devices are significantly driving the market growth

Earlier DBS systems posed safety concerns during MRI scans, which are critical for long-term neurological monitoring. Modern systems like Medtronic’s Percept PC and Boston Scientific’s Vercise Genus are MRI-conditional, enabling safe imaging and thus greater adoption among clinicians and patients. The rising advancements by major market players in these devices are boosting their adoption, which is further driving the market growth.

For instance, in February 2025, Medtronic plc announced U.S. Food and Drug Administration (FDA) approval of BrainSense Adaptive deep brain stimulation (aDBS) and BrainSense Electrode Identifier (EI). Medtronic has enhanced its Percept DBS neurostimulators with exclusive BrainSense Adaptive technology, introducing a DBS for people living with Parkinson's. This feature personalizes therapy based on a patient's brain activity in real time, both in clinical settings and in daily life. It provides enhanced therapy personalization for symptom control that automatically adjusts, minimizing the need for patients to manually adjust stimulation.

Traditional DBS leads deliver current in all directions, potentially stimulating unintended brain areas and causing side effects. Advanced systems like Abbott’s Infinity DBS System feature directional leads, allowing physicians to steer the current more precisely to target regions. This leads to better outcomes and fewer complications, especially in complex conditions like dystonia or tremor. Companies are increasingly exploring AI-based analytics to personalize DBS therapy further. Data collected by sensing-enabled devices can be analyzed to optimize stimulation patterns, improving long-term outcomes and enhancing clinical decision-making.

High procedural and device cost is hampering the deep brain stimulation devices market

The high cost of deep brain stimulation devices and procedures is a significant factor that hampers market growth by limiting access and affordability for a large segment of potential patients. This financial barrier affects adoption rates, particularly in low- and middle-income regions, and impacts both healthcare providers and patients.

For instance, according to the National Institute of Health, 2024, the inflation and currency-adjusted mean cost of the DBS device was USD 21,496.07 ± USD 8,944.16, the cost of surgery alone was USD 14,685.22 ± USD 8,479.66, the total cost of surgery was USD 40,942.85 ± USD 17,987.43 and the total cost of treatment until 1 year of follow-up was USD 47,632.27 ± USD 23,067.08.

Given the high costs, some patients may opt for less effective but more affordable treatments, even if they do not provide the same symptom relief as deep brain stimulation. Non-surgical options, such as medication, physical therapy, or non-invasive brain stimulation techniques, are generally much less expensive than DBS. This preference for more affordable alternatives further constrains the DBS market, particularly among those who prioritize cost over treatment efficacy.

Deep Brain Stimulation Devices Market Segment Analysis

The global deep brain stimulation devices market is segmented based on product type, battery type, stimulation type, application, end-user, and region.

The movement disorders from the application segment are expected to hold 28.12% of the market share in 2024 in the deep brain stimulation devices market

Deep brain stimulation is particularly effective in managing symptoms associated with conditions like Parkinson's disease, essential tremor, and dystonia, where it has become an established treatment option due to its ability to provide significant, sustained symptom relief. These effective benefits associated with deep brain stimulation for movement disorders encourage manufacturers to launch DBS systems with advanced features.

For instance, in January 2024, Abbott received approval from the U.S. Food and Drug Administration (FDA) to launch the Liberta RC deep brain stimulation system, the world's smallest rechargeable deep brain stimulation (DBS) device with remote programming, to treat people living with movement disorders. The Liberta RC DBS system also requires the fewest recharges of any FDA-approved DBS system, needing only 10 recharge sessions a year for most people.

Parkinson's disease is one of the most prevalent movement disorders, affecting more than 10 million people worldwide, with approximately 90,000 new cases diagnosed each year in the United States alone, according to the Parkinson's Foundation. The prevalence is anticipated to rise significantly as the global population ages. This large and growing patient base has made Parkinson's disease the primary condition treated with deep brain stimulation.

Deep Brain Stimulation Devices Market Geographical Analysis

North America is expected to dominate the global deep brain stimulation devices market with a 44.17% share in 2024

The North America region is expected to hold the largest market share over the forecast period, owing to the technological advancements and high rate of adoption of deep brain stimulation devices and procedures. For instance, according to Orlando Neurosurgery, approximately 12,000 DBS procedures occur in the United States each year.

North American companies are at the forefront of introducing next-generation DBS devices that offer improved efficacy and patient comfort. Innovations such as rechargeable batteries, remote programming, and adaptive deep brain stimulation are gaining traction and are widely adopted in the region, especially in the United States. These advancements not only improve patient outcomes but also make deep brain stimulation more appealing to a broader patient base.

There is a rising prevalence of various movement and psychiatric disorders in North America, especially in the United States, further increasing the demand for deep brain stimulation devices and procedures in the region. For instance, according to the Parkinson's Foundation, nearly one million people in the U.S. are living with Parkinson's disease (PD). This number is expected to rise to 1.2 million by 2030. Nearly 90,000 people in the U.S. are diagnosed with PD each year.

Deep Brain Stimulation Devices Market Top Companies

Top companies in the deep brain stimulation devices market include Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Aleva Neurotherapeutics, NeuroPace, Inc., SceneRay Co., Ltd., PINS Medical, Renishaw plc., BrainsWay Ltd., and inomed Medizintechnik GmbH, among others.

Key Developments

In February 2025, Medtronic plc announced U.S. Food and Drug Administration (FDA) approval of BrainSense Adaptive deep brain stimulation (aDBS) and BrainSense Electrode Identifier (EI). Medtronic has enhanced its Percept DBS neurostimulators with exclusive BrainSense Adaptive technology, introducing a DBS for people living with Parkinson's. This feature personalizes therapy based on a patient's brain activity in real time, both in clinical settings and in daily life. It provides enhanced therapy personalization for symptom control that automatically adjusts, minimizing the need for patients to manually adjust stimulation.

In April 2024, Medtronic India launched its NeuroSmartTM Portable Micro Electrode Recording (MER) Navigation system for Deep Brain Stimulation (DBS) to treat Parkinson’s disease. The NeuroSmartTM Portable MER Navigation system, developed by Alpha Omega Engineering, features advanced neurophysiological navigation mapping and enables accurate electrode placement while recording neural activity. Its advanced capabilities for enhanced target localization, based on HaGuide automatic navigation, help identify the most effective target for the patient, ensuring optimum symptom relief.

In August 2024, Medtronic plc received U.S. Food and Drug Administration (FDA) approval for Asleep Deep Brain Stimulation (DBS) surgery for people with Parkinson’s and people with essential tremors. Medtronic is the first and only company to receive FDA approval to offer DBS surgery while a patient is asleep (under general anesthesia) or awake.

In September 2024, Abbott launched a pivotal clinical trial to see if its deep brain stimulation approach can make headway against treatment-resistant depression. The company previously collected green lights for brain neuromodulation systems that help treat the movement symptoms that come with Parkinson’s disease and essential tremor, as well as for implants that focus on the spinal cord to aid in cases of chronic pain. The devices send small electrical pulses to spur tissue activity, not unlike a pacemaker.

Market Scope

Metrics | Details | |

CAGR | 9.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Single-Channel Systems and Dual-Channel Systems |

Battery Type | Rechargeable Systems and Non-Rechargeable Systems | |

Stimulation Type | Constant Current Devices and Voltage-Controlled Devices | |

Application | Movement Disorders, Psychiatric Disorders, Epilepsy, Chronic Pain, Alzheimer's Disease, Tourette Syndrome, and Others | |

End-User | Hospitals and Clinics, Neurological Centers, Ambulatory Surgical Centers, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global deep brain stimulation devices market report delivers a detailed analysis with 78 key tables, more than 74 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.