Companion Animal Health Market Size & Industry Outlook

The global companion animal health market size reached US$ 25.38 Billion in 2024 from US$ 23.37 Billion in 2023 and is expected to reach US$ 56.60 Billion by 2033, growing at a CAGR of 9.4% during the forecast period 2025-2033. The market is expanding steadily, driven by rising pet ownership, increasing humanization of pets, and growing demand for advanced healthcare solutions. The sector covers pharmaceuticals, vaccines, diagnostics, and veterinary services, with dogs accounting for the largest share of healthcare spending. North America leads due to high insurance penetration and clinic density, while Asia-Pacific is the fastest-growing region as urbanization and disposable incomes boost pet adoption. Key players such as Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, IDEXX, and Ceva dominate the landscape, with innovations in parasiticides, oncology treatments, and point-of-care diagnostics shaping future growth.

Key Market Trends & Insights

Key trends in the market include the surge in pet humanization, where owners seek advanced medical care similar to human healthcare, fueling demand for premium therapeutics and specialty diets. The market is also witnessing rapid adoption of point-of-care diagnostics and digital health tools, enabling faster disease detection and chronic condition monitoring in clinics and at home.

Growing e-commerce and online pharmacy platforms are reshaping distribution, with players expanding veterinary services and prescription delivery. Additionally, the rise in pet insurance coverage is making costly treatments such as oncology, cardiology, and advanced surgeries more accessible, boosting overall healthcare expenditure.

North America dominates the companion animal health market with the largest revenue share of 44.07% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 9.1% over the forecast period.

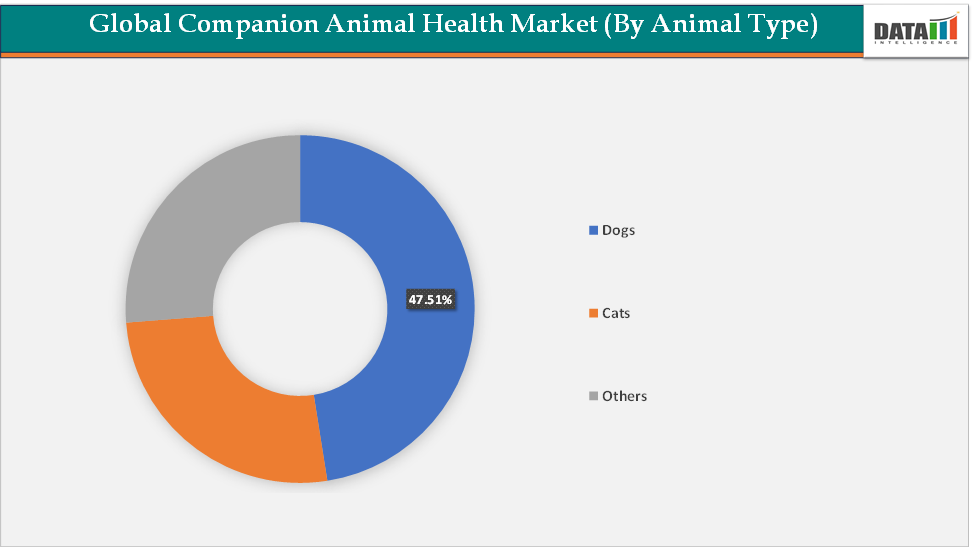

Based on animal type, the dogs segment led the market with the largest revenue share of 47.51% in 2024.

The major market players in the companion animal health market are Merck & Co., Inc., Boehringer Ingelheim International GmbH, Agrolabo Spa, Ceva, Elanco, Indian Immunologicals Ltd., Norbrook, Vetoquinol, Zoetis Services LLC, and IDEXX among others

Market Size & Forecast

2024 Market Size: US$ 25.38 Billion

2033 Projected Market Size: US$ 56.60 Billion

CAGR (2025–2033): 9.4%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

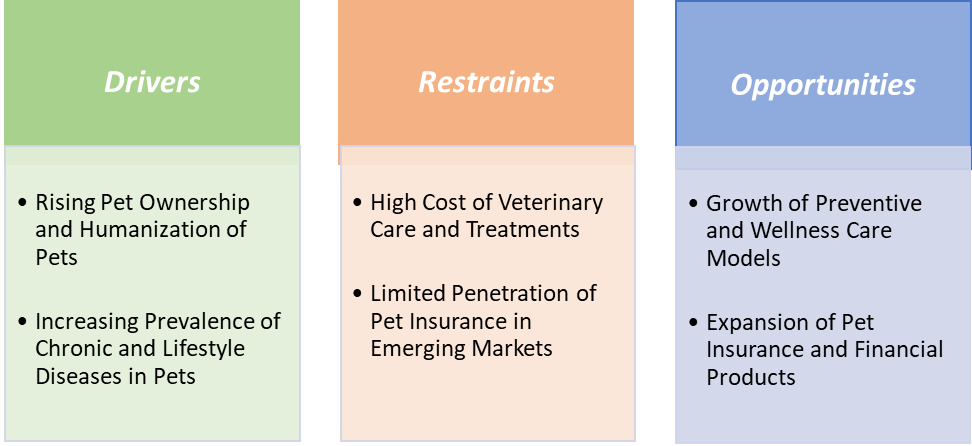

Market Dynamics

Drivers: Rising pet ownership and humanization of pets are significantly driving the companion animal health market growth

Rising pet ownership and the humanization of pets are two of the strongest forces driving the growth of the market, fundamentally reshaping both demand patterns and product innovation. According to the World Animal Foundation, 5.8 million animals entered US animal shelters in 2024, 4.1 million cats and dogs were adopted annually, 2,856,000 dogs entered shelters from community sources in 2024, and 25% of the dogs in the shelters are purebreds. Similar growth is visible in Europe and Asia-Pacific, where urbanization and smaller household sizes have encouraged families and young professionals to adopt companion animals as emotional companions. This cultural shift toward viewing pets as family members, often referred to as the “fur baby” phenomenon, has translated into a willingness to spend more on premium veterinary care, pharmaceuticals, and diagnostics.

Humanization also drives demand for innovative products like monoclonal antibody therapies for osteoarthritis (Zoetis’ Librela and Solensia), advanced point-of-care diagnostic analyzers (IDEXX’s Catalyst One), and nutraceuticals or functional diets that improve long-term health. In addition, owners are spending more on non-core vaccines, parasiticides, oncology treatments, and pain management drugs, reflecting a shift from treating pets as property to investing in their quality of life. This trend is not limited to developed regions, emerging markets such as China and India are seeing rising disposable incomes and urban pet adoption, fueling demand for affordable vaccines, anti-parasitics, and basic diagnostics.

The combination of higher adoption rates, an aging pet population, and increased emotional attachment ensures that healthcare expenditures per pet continue to rise. Ultimately, rising ownership and humanization are not just boosting the volume of patients but also expanding the scope of treatments demanded, from preventive to highly specialized care, making them the cornerstone growth drivers of the industry.

Restraints: The high cost of veterinary care and treatments is hampering the growth of the companion animal health market

The high cost of veterinary care and treatments is a major restraint on the growth of the companion animal health market, as it limits access and adoption of advanced healthcare solutions. Veterinary expenditures have been rising steadily, with the American Pet Products Association (APPA) estimating that over USD 157 billion is projected to be spent on pet industry expenditures in 2025, up significantly from previous years. While this demonstrates strong demand, it also highlights the financial burden placed on owners, especially when specialized treatments are required.

Moreover, rising veterinary fees in mature markets such as the U.S. and Europe have drawn criticism from pet owners, with some delaying or forgoing essential care due to financial concerns. For instance, the average cost in the US for a routine vet visit can range from $70 to $174 (dogs) and $53 to $124 (cats). The total cost will vary based on the location of the clinic, type of practice (specialty, emergency vet and/or general practice), required vaccines or tests, pet’s age and health, additional treatments (like flea prevention) and any supplementary procedures (like nail trimming or dental care). While premium treatments fuel innovation, affordability gaps risk slowing market penetration and widening inequality in access to pet healthcare globally. Thus, without broader insurance coverage or cost-effective alternatives, the high expense of veterinary products and services will continue to temper the otherwise strong growth trajectory of the companion animal health industry.

For more details on this report – Request for Sample

Segmentation Analysis

The global companion animal health market is segmented based on animal type, product type, distribution channel, and region.

Animal Type: The dogs segment is dominating the companion animal health market with a 47.51% share in 2024

The dogs segment dominates the market, holding the largest revenue share due to their high global ownership rates, greater healthcare needs, and stronger emotional bonds with owners compared to other pets. Globally, dogs are the most popular companion animal, with the American Veterinary Medical Association (AVMA) reporting that nearly 45.5% of U.S. households own a dog, compared to about 32.1% that own cats, with 59.8 million dogs and 42.2 million cats. This ownership gap translates into higher veterinary visits, more frequent preventive care, and greater spending on pharmaceuticals and diagnostics.

Dogs are more prone to conditions such as arthritis, obesity, cardiovascular diseases, skin infections, and parasitic infestations, driving sustained demand for vaccines, parasiticides, pain management drugs, and specialty therapeutics. For instance, Zoetis’ blockbuster monoclonal antibody therapy Librela, used for canine osteoarthritis pain, highlights the willingness of dog owners to invest in advanced, premium treatments. Preventive products such as spot-on and chewable parasiticides (NexGard, Simparica, Bravecto) are also predominantly marketed for dogs, making this category a consistent revenue driver.

Furthermore, dogs require more frequent core and non-core vaccinations (rabies, distemper, parvovirus, leptospirosis, Lyme disease) than cats in most geographies, strengthening their contribution to the vaccine segment. In emerging markets, rising middle-class ownership of dogs as status symbols and family companions is also fueling demand for basic vaccines and anti-parasitic treatments, expanding market reach. Overall, the dog segment not only accounts for the largest revenue share in global companion animal health but also drives innovation, as most new drugs, diagnostics, and digital health solutions are first launched for canine use before expanding to other species.

Geographical Analysis

North America is expected to dominate the global companion animal health market with a 44.07% in 2024

North America is the dominant region, largely due to its high pet ownership rates, advanced veterinary infrastructure, and widespread adoption of premium healthcare solutions. The American Pet Products Association (APPA) estimates that over USD 157 billion is projected to be spent on pet industry expenditures in 2025, reflecting the region’s substantial contribution to global revenues. Pet ownership is particularly high in the U.S., with about 70% of households owning a pet, and dogs representing the majority, creating consistent demand for vaccines, pharmaceuticals, diagnostics, and specialty treatments.

North America also has the highest penetration of pet insurance globally, which enables owners to afford costly procedures such as orthopedic surgeries, oncology treatments, and advanced diagnostics. Companies like Zoetis, Merck Animal Health, Elanco, and IDEXX are headquartered or have significant operations in the U.S., making the region a hub for innovation in parasiticides, monoclonal antibody therapies (Librela, Solensia), and point-of-care diagnostic analyzers. Together, these factors position North America as the leading revenue-generating region, accounting for the largest share of the global market, and set the standard for technological adoption and service models that are gradually being replicated in other geographies.

The Asia Pacific region is the fastest-growing region in the global companion animal health market, with a CAGR of 9.1% in 2024

The Asia-Pacific region is the fastest-growing region, driven by rising pet adoption, increasing disposable incomes, and rapid urbanization. Pet ownership has surged in major economies such as China, India, and Japan, where dogs and cats are increasingly viewed as family members, fueling demand for both basic and advanced healthcare. In China, the total pet population in urban areas increased by 2.1 percent to 124.11 million in 2024, with spending on pet healthcare growing at double-digit rates annually. India is witnessing a similar trend, with an estimated 6 million pets added annually, creating a rapidly expanding customer base for vaccines, anti-parasitics, and nutrition products.

The growing middle class in these countries is willing to invest in preventive care and specialty treatments, while multinational players like Zoetis, Elanco, and Boehringer Ingelheim are expanding their presence through partnerships and localized product offerings. Preventive products such as flea and tick treatments, core vaccines (rabies, parvovirus), and chewable parasiticides are among the fastest-growing categories, supported by rising awareness of zoonotic diseases. Additionally, pet insurance adoption is beginning to emerge in markets like China and Japan, which could significantly boost demand for costly treatments such as orthopedic surgeries, oncology care, and diagnostic services.

Veterinary infrastructure is also improving, with new clinics and specialty hospitals opening in urban centers, expanding access to advanced procedures and diagnostics such as point-of-care blood analyzers and imaging tools. Unlike mature markets, APAC still has significant untapped potential, as pet care spending per animal remains lower but is rising rapidly. This combination of a large population base, cultural shifts toward pet humanization, and improving healthcare infrastructure positions Asia-Pacific as the fastest-growing regional market, with CAGR projections consistently outpacing North America and Europe.

Competitive Landscape

Top companies in the companion animal health market include Merck & Co., Inc., Boehringer Ingelheim International GmbH, Agrolabo Spa, Ceva, Elanco, Indian Immunologicals Ltd., Norbrook, Vetoquinol, Zoetis Services LLC, and IDEXX, among others.

Recent Developments

In July 2025, Neuberg Pulse Diagnostics, one of India’s fastest-growing diagnostic chains, launched its first State-of-the-Art integrated diagnostics centre in Ranchi, bringing the city’s first upgraded PET-CT scanner. Neuberg Diagnostics entered into a joint venture with Kolkata-based Pulse Diagnostics to strengthen its footprint across the eastern region, including West Bengal, Odisha, Bihar, Jharkhand, and the North Eastern states.

In May 2025, Mars introduced a suite of artificial intelligence-powered digital tools aimed at helping pet owners monitor their pets’ health, starting with a new smartphone-based dental check for dogs. The launch is part of Mars’ $1 billion investment in digital innovation within its Pet Nutrition segment. The first tool in the portfolio, GREENIES Canine Dental Check, is now available in the U.S. It uses AI trained on more than 53,000 images to analyze photos of dogs’ teeth and gums, helping detect signs of tartar buildup and gum irritation.

In May 2025, Mars, the leading pet care business behind brands pets and pet owners love, including ROYAL CANIN, WHISKAS, CESAR, BANFIELD, BLUEPEARL, VCA and ANTECH, is partnering with Calm, a leading mental health company, to spotlight the well-being potential of pets. Together, they are helping people recognize the role everyday interactions with pets play in supporting relaxation, life balance and overall mental wellbeing.

In February 2025, Elanco Animal Health Incorporated announced the launch of Pet Protect, a line of veterinarian-formulated supplements for dogs and cats. With the pet supplement market experiencing rapid growth and increasing relevance, Pet Protect emerges as a modernized, science-backed supplement line specifically designed to cater to the diverse health needs of pets.

Market Scope

Metrics | Details | |

CAGR | 9.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Animal Type | Dogs, Cats, and Others |

Product Type | Vaccines, Pharmaceuticals, Feed Additives, Diagnostics, Supplements, and Others | |

Distribution Channel | Hospital Pharmacies, E-Commerce, Retail, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global companion animal health market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more veterinary health-related reports, please click here